Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

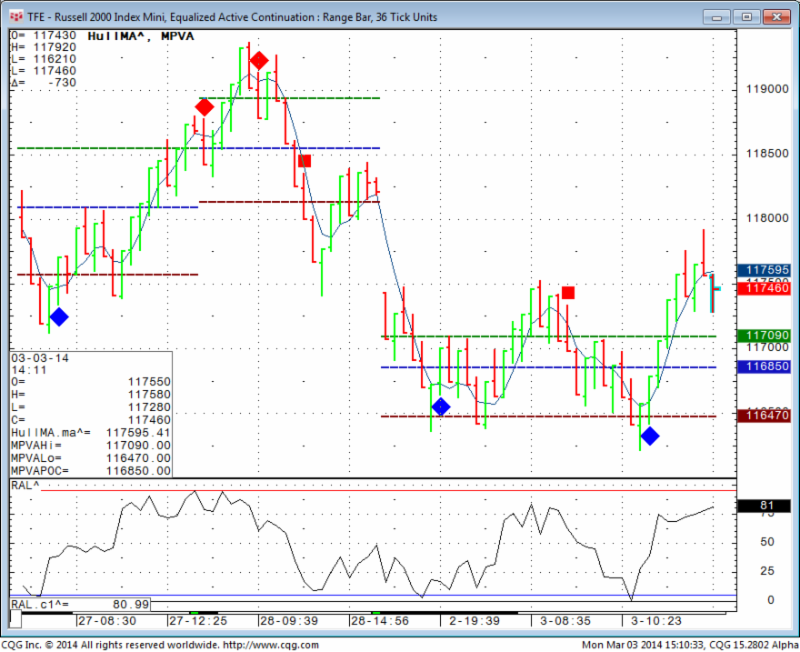

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Friday March 14, 2014

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Rollover Notice for Stock Index Futures

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones, the “Big” pit-traded S&P 500, etc., it is extremely important to remember that tomorrow, Thursday, March13th, is rollover day.

Starting March13th, the June 2014 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the June 2014 contract as of March 13th. Volume in the March 2014 contracts will begin to drop off until its expiration on Friday March 21st.

The month code for June is M4.

Traders with electronic trading software should make sure that defaults reflect the proper contract as of Thursday morning.

| Please close any open March Currency positions by the close on Friday the 14th.Should you have any further question please contact your broker. |

So June started being the LEAD or FRONT month with a statement as the market dropped pretty hard.

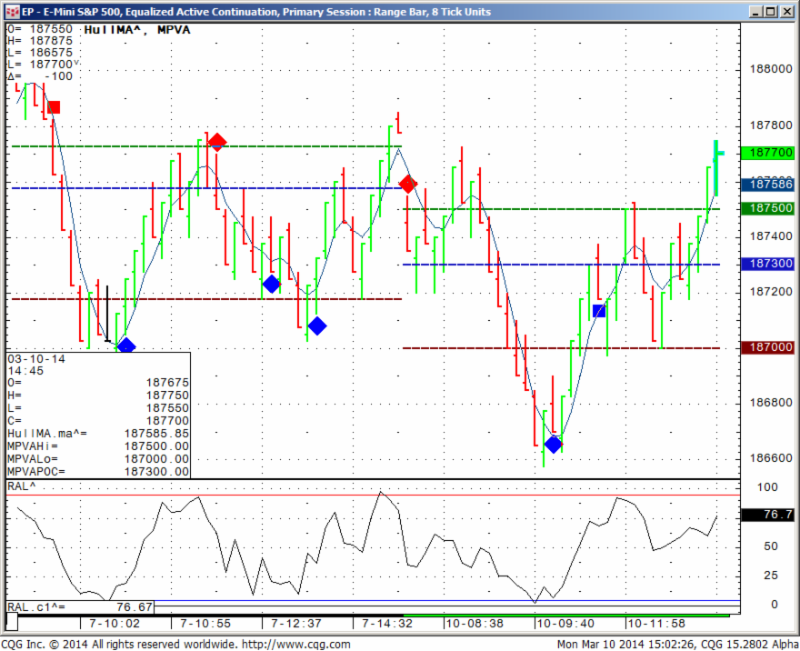

Here is what June mini SP daily chart looks like:

Continue reading “Rollover + Mini S&P Chart, Futures Levels & Economic Reports 3.14.2014”