Futures trading has grown from humble beginnings into a cornerstone of modern global finance. What started centuries ago as simple agreements for future delivery of goods has evolved into a sophisticated marketplace where traders can speculate and hedge on everything from wheat and oil to stock indexes and cryptocurrencies. The practice of trading futures today involves advanced techniques, powerful electronic platforms, and a deep understanding of market dynamics. This comprehensive exploration covers the origins of futures trading and speculation, how these instruments became integrated into financial markets, and the evolution of the science of trading futures over time. Along the way, we will also highlight how one futures broker in particular – Cannon Trading Company – exemplifies innovation and excellence in this field. The goal is to inform beginners, institutional investors, and financial students alike about the rich history, key developments, and best practices in futures trading.

Futures Trading and Speculation

The concept of futures trading traces back to the need for farmers and merchants to manage price risk. Centuries ago, producers of crops and buyers would agree on a price for a commodity to be delivered at a future date. These early forward contracts allowed both parties to secure a deal in advance, bringing stability in the face of unpredictable supply, demand, and weather. For example, records from 17th century Japan show that rice merchants used contracts to lock in future rice prices – a practice that led to the establishment of the Dojima Rice Exchange in Osaka in 1730, often cited as the world’s first organized futures market. Likewise, in Europe, traders during the Dutch Golden Age sometimes engaged in forward contracts (notoriously during the tulip bulb mania of the 1630s) to speculate on future prices.

As these practices took root, formal exchanges emerged to standardize and regulate the trading of such agreements. In the United States, the Chicago Board of Trade (CBOT) was founded in 1848, providing a centralized place for trading contracts on grains like corn and wheat. By the 1850s and 1860s, the CBOT was evolving the forward contract concept into standardized futures contracts – agreements that specified the quality, quantity, and delivery timing of a commodity. Standardization made it easier for contracts to be traded among participants, which in turn attracted more traders. This included not just farmers and grain merchants but also speculators drawn by the profit opportunities in price fluctuations. Speculation became an integral part of trading futures almost from the start. While farmers used futures to hedge against crop price drops and buyers used them to secure supply, speculators provided vital liquidity by taking on the risk with the hope of financial gain. Early on, some viewed speculative futures trading as gambling, but it became clear that these speculators helped make the markets more efficient by matching buyers and sellers and contributing to price discovery.

Throughout the late 19th and early 20th centuries, futures markets expanded to other commodities. Exchanges were established for cotton in New York (the New York Cotton Exchange in 1870), for coffee and sugar, and later for products like cattle, metals, and more. These markets enabled producers and users of commodities across industries to manage price volatility. By the early 20th century, the idea of futures trading was well entrenched: a diverse range of commodities had active futures contracts, and a growing class of professional traders was specializing in trading futures contracts for profit. Regulatory oversight also began to develop – for instance, the United States introduced the Grain Futures Act in 1922 to curb abuses, which eventually led to the Commodity Exchange Act of 1936. These laws laid the groundwork for modern regulation of futures exchanges and helped integrate futures into the broader financial system by ensuring fair practices and building public trust.

Integration of Futures into Financial Markets

Originally conceived for agricultural and commodity markets, futures gradually became integrated into the wider financial markets as their usefulness and appeal broadened. A major turning point came in the 1970s. The collapse of the Bretton Woods system and the end of the gold standard in 1971 introduced significant volatility into currency exchange rates and commodity prices. In response, financial exchanges expanded the futures concept beyond traditional commodities. In 1972, the Chicago Mercantile Exchange (CME) launched the International Monetary Market, which listed the first currency futures contracts. Suddenly, investors and businesses could use futures trading to hedge or speculate on foreign exchange rates in the same way farmers had been using futures on corn or wheat. The integration of futures into the financial realm accelerated from there.

By the late 1970s and early 1980s, new types of futures contracts appeared that tracked financial instruments. The Chicago Board of Trade introduced U.S. Treasury bond futures, allowing traders to manage interest rate risk. Stock index futures were launched, with the first major contract on the S&P 500 index debuting in 1982 at the CME. This innovation meant that portfolio managers and investors could protect or leverage broad stock market positions efficiently through trading futures rather than buying or selling dozens of individual stocks. These developments firmly embedded futures markets into the core of modern finance. Banks, hedge funds, and institutional investors began relying on futures for everything from hedging stock portfolios and interest rate exposures to implementing complex trading strategies. What had started as a tool for commodity producers became an indispensable financial instrument for Wall Street and global markets.

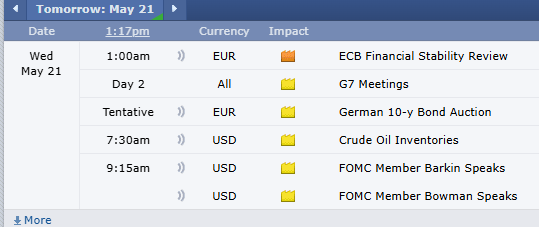

As futures gained prominence, the infrastructure and regulation around them kept pace. In 1974, the U.S. government established the Commodity Futures Trading Commission (CFTC) as a federal regulator specifically to oversee futures and commodity markets, much like the SEC does for securities. Self-regulatory organizations like the National Futures Association (NFA) were formed in 1982 to uphold ethical standards among futures brokers and firms. These steps ensured that as futures became mainstream, there were protections in place for traders and the integrity of the marketplace. During this expansion, working with a skilled future broker became increasingly important for traders venturing into new markets. Such brokers served not just as order executors but also as guides, helping investors navigate the complexities of a rapidly growing futures landscape and adhere to evolving regulations. By the end of the 20th century, virtually every major financial market was linked with a futures market: stock indexes, interest rates, currencies, and even new instruments like weather futures and electricity futures. This integration brought greater liquidity and continuous price discovery across global markets. It also meant that events in one market (for example, a stock market move) could quickly be reflected in related futures (like stock index futures), underscoring how deeply interwoven futures trading and the broader financial system had become.

Historical Timeline: Key Milestones in Futures Trading

To better visualize the development of futures trading through the ages, below is a brief historical timeline highlighting major milestones and innovations:

- 17th Century: Informal forward trading and speculation take place in Europe and Asia. Notably, Dutch merchants during the 1630s tulip mania trade forward contracts on tulip bulbs, and Japanese rice traders develop methods to lock in future rice prices.

- 1730: The Dojima Rice Exchange in Osaka, Japan becomes the first officially recognized futures exchange, where rice futures contracts are traded under the oversight of the Tokugawa shogunate.

- 1848: The Chicago Board of Trade (CBOT) is established in the United States. It provides a central marketplace for grain trade and lays the foundation for standardized futures contracts (with the first standardized grain futures contracts introduced in the 1860s).

- 1870s: Expansion of futures exchanges in the U.S. and Europe. The New York Cotton Exchange opens in 1870, and other commodities like coffee, sugar, and cocoa see futures markets established. Futures trading becomes a common practice for various agricultural products.

- 1920s–1930s: Regulatory frameworks emerge. The Grain Futures Act of 1922 and the Commodity Exchange Act of 1936 in the U.S. introduce federal oversight to reduce manipulation and fraud in commodity futures. Futures trading continues through the Great Depression under stricter rules, reinforcing its role in the economy.

- 1970s: Integration into financial markets accelerates. Currency futures launch in 1972 (CME’s International Monetary Market), followed by interest rate futures (e.g., Treasury bond futures in 1977). The newly formed CFTC (1974) regulates these markets. Oil shocks and economic volatility drive more participants to use futures for hedging.

- 1980s: Stock index futures and global growth. The first stock index futures (such as the S&P 500 futures in 1982) revolutionize equity risk management. Futures exchanges open around the world, and more financial futures (stock indexes, interest rates, currencies) gain popularity. The NFA is established (1982) to govern futures brokers and protect traders.

- 1990s: Electronic trading emerges. Exchanges begin shifting from traditional open-outcry pit trading to electronic systems. The CME launches its Globex electronic trading platform in 1992. Internationally, fully electronic exchanges like Eurex gain prominence. Futures trading volumes grow significantly as access widens.

- 2000s: Technological revolution and new products. Most futures markets complete the transition to electronic trading, increasing speed and efficiency. Mergers create global exchange groups (e.g., CME Group). New futures contracts appear on everything from emissions credits to real estate indexes. Online futures trading becomes accessible to retail traders worldwide via internet-based futures broker platforms.

- 2010s: Diversification and modernization. Futures on cryptocurrencies (like Bitcoin futures in 2017) and volatility indices launch, showing the adaptability of futures to new asset classes. Algorithmic and high-frequency trading become significant in futures markets. Exchanges introduce micro-sized contracts to attract beginning traders. The futures industry enjoys robust growth in participation.

- 2020s: Futures markets today are highly liquid, globally integrated, and served by advanced electronic trading platforms. Nearly all trading is conducted digitally through sophisticated software. Real-time market data, mobile trading apps, and algorithmic strategies are commonplace. Futures brokers continue to innovate in platform offerings and risk management tools, making futures more accessible to both institutional and individual traders.

The Rise of Technical Analysis in Futures Trading

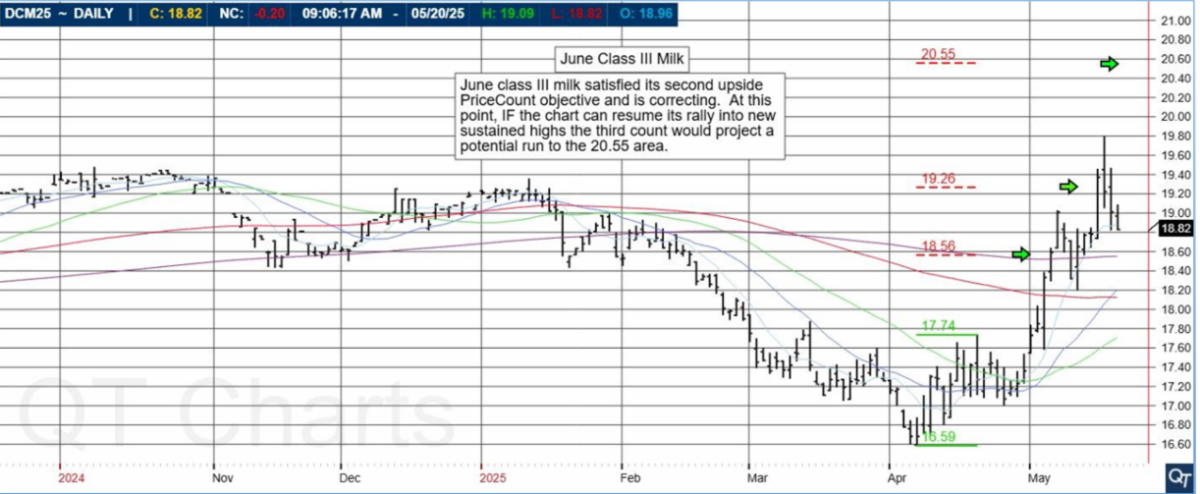

One of the key developments in the science of trading futures has been the rise of technical analysis as a tool for making trading decisions. Technical analysis involves studying price charts, patterns, and indicators to predict future market movements. Its roots in futures trading go back to the very beginning – even in the 18th century, Japanese rice traders were said to use chart patterns (the precursor to modern candlestick charts) to gain an edge in rice markets. However, technical analysis truly flourished in the 20th century as futures markets expanded. Traders found that by analyzing historical price data, they could identify trends and potential turning points in markets ranging from corn to currencies.

By the mid-1900s, technical analysis had become an established discipline, with published theories and methods. Analysts like Charles Dow (originator of Dow Theory in the early 1900s) laid early groundwork suggesting that price trends tend to follow certain patterns. Futures traders eagerly adopted these ideas, since fundamental information (like crop reports or economic data) could be hard to obtain quickly, whereas price charts were readily available and contained the distilled information of all market participants’ expectations. In the 1970s and 1980s, as financial futures emerged, many successful traders and futures brokers relied on technical trading systems. They used tools like moving averages, momentum oscillators, and chart patterns to make trading decisions. Famous trend-following strategies were developed in futures markets – for example, the “Turtle Traders” experiment in the 1980s demonstrated that with some rules based largely on price trends (a technical approach), even novices could potentially trade futures profitably. This era saw an explosion of technical indicators (such as the Relative Strength Index and Moving Average Convergence Divergence (MACD)) applied to futures charts for commodities and financial instruments alike.

The advent of personal computers and electronic trading platforms further propelled technical analysis in futures trading. By the 1990s and into the 2000s, traders could use software to back-test technical strategies on historical data and even automate their analysis. Modern trading futures often involves algorithmic systems that are essentially automated technical analysis models – they scan market data for specific signals and execute trades in milliseconds. Technical analysis is now deeply ingrained in the futures trading culture, used by beginners studying simple chart patterns and by institutional traders running complex quantitative models. While not infallible, technical analysis provides a systematic framework to navigate the fast-moving futures markets, and it pairs well with the leveraged, short-term nature of futures contracts. A skilled futures trader today often combines technical chart analysis with other insights to decide when to enter or exit trades, and many futures broker platforms come equipped with advanced charting tools and technical indicators to support this analytical approach.

Evolution of Risk Management in Futures Trading

As futures trading grew in popularity and scale, the importance of risk management became ever more apparent. Futures are leveraged instruments – a trader only posts a fraction of a contract’s value as margin, which means both potential gains and losses are magnified. Historically, both exchanges and traders have continually improved risk management practices to keep futures markets stable and to protect trading accounts from catastrophic losses.

From the beginning, the structure of futures exchanges was designed to manage risk. Clearinghouses were established as intermediaries between buyers and sellers of futures, guaranteeing the performance of contracts. This eliminated counterparty default risk: even if one side of a trade went bankrupt, the clearinghouse ensured the other side would still be made whole. Exchanges also set rules like daily price limits (maximum moves allowed per day) and margin requirements (the minimum funds a trader must hold) to prevent extreme volatility from destabilizing the market. These measures, introduced over the early and mid-20th century, were crucial in integrating futures into the mainstream financial system as safe and reliable instruments.

For individual traders and futures brokers, managing risk has evolved into a science of its own. A key development was the widespread use of stop-loss orders – instructions to automatically exit a position if the market moves against the trader by a specified amount. By the late 20th century, most experienced traders were using stop-losses or related techniques to cap their downside risk on any given trade. Position sizing strategies also became common: rather than betting the farm on one trade, traders learned to risk only a small percentage of their capital on each futures position. Futures brokers often educate their clients on these principles, emphasizing that successful futures trading is as much about controlling risk as chasing profit.

In the 1990s and 2000s, with the advent of sophisticated software, risk management took another leap forward. Brokers and trading platforms began offering real-time monitoring of portfolio risk, margin calculators, and analytics to simulate “what-if” scenarios. Traders could instantly see how a price change might impact their account or whether adding a new futures position would exceed their risk limits. Institutions trading futures deployed advanced models like Value at Risk (VaR) to quantify potential losses in their portfolios on a daily basis. Meanwhile, regulators also tightened rules – for instance, after episodes of excessive speculation or defaults, margin requirements might be raised to ensure stability. Modern futures brokers provide a suite of risk management tools to clients: from basic stop-loss and limit order capabilities to more complex options like trailing stops (which adjust exit levels as the market moves favorably) and risk dashboards that aggregate exposure across multiple markets.

Perhaps one of the greatest tests of futures risk management came during periods of extreme market stress, such as the 2008 financial crisis or the rapid market swings of 2020. Through these events, the futures markets remained resilient, thanks in part to robust risk controls at exchanges and prudent risk management by traders and brokers. The lesson reinforced over time is clear: while trading futures offers high return potential, managing the risks through careful strategies is absolutely essential. Today, a reputable futures broker will strongly emphasize risk management to clients, knowing that long-term success in futures trading comes from surviving the market’s ups and downs through discipline and protective measures.

Electronic Trading Platforms and Modern Futures Trading

No discussion of the evolution of futures trading would be complete without examining the impact of electronic trading platforms. For most of their history, futures were traded in open-outcry pits – noisy floors where traders literally shouted and signaled orders. This began to change in the late 20th century as exchanges and brokers harnessed new technology to trade faster and reach more participants. Electronic futures trading had modest beginnings in the 1980s and early 1990s, but it triggered a revolution that made trading more accessible and efficient than ever.

One of the first major moves came in 1992 when the CME introduced Globex, an electronic after-hours trading system for futures. Initially, many traders still preferred the face-to-face action of the pits during regular hours, but over the next decade electronic trading gained traction. By the late 1990s, fully electronic futures exchanges like Eurex in Europe were outpacing some traditional exchanges, proving that screen trading could be as liquid and deep as the trading pit. Futures brokers began offering clients software to connect directly to these electronic markets. Cannon Trading Company, for instance, was among the early adopters, providing online access to futures trading in the late 1990s when this technology was still new. Embracing online platforms allowed such futures brokers to serve clients globally with real-time quotes, advanced charting, and instant trade execution – something impossible in the old pit-only days.

The advantages of electronic trading quickly became apparent. Orders that once took minutes (or longer, if you had to call your broker who then relayed it to a pit trader) could now be executed in seconds or milliseconds. Traders could see live price feeds and use internet-based platforms to trade from anywhere, leveling the playing field between institutional and individual market participants. Over the 2000s, nearly all major futures exchanges transitioned to predominantly electronic trading. The open-outcry pits for many commodities and financial futures gradually closed or saw drastically reduced activity (with a few iconic exceptions lasting into the 2010s).

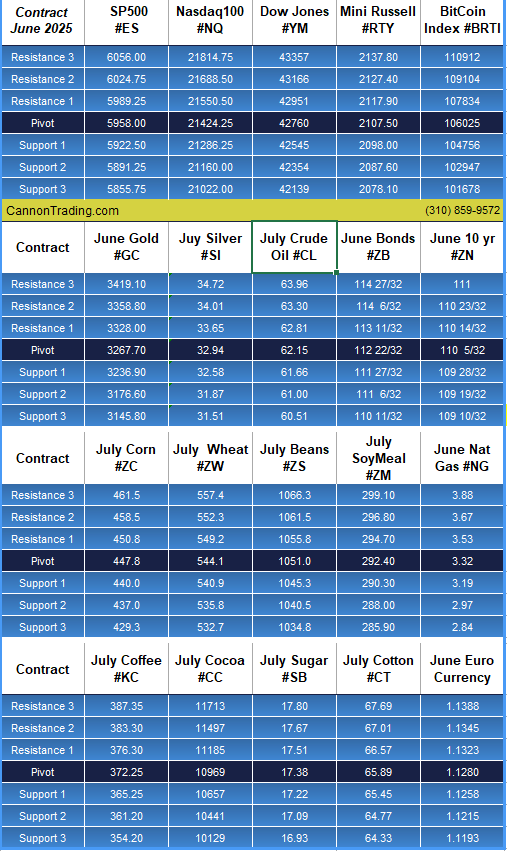

Modern electronic trading platforms offer a rich array of features that have advanced the science of trading futures. These include algorithmic trading capabilities (where a computer program can execute trades based on predefined criteria far faster than any human), advanced charting and technical analysis tools built into the software, and risk management modules that alert traders of margin calls or excessive exposure. Futures brokers differentiate themselves by the quality and variety of trading platforms they provide. Some platforms cater to active day traders with streaming data and custom indicators, while others appeal to long-term traders with advanced order types and strategy automation. The competition has driven innovation: today’s trader can choose from platforms like MetaTrader, TradingView, NinjaTrader, and proprietary systems offered by brokers – each loaded with features that traders decades ago could only dream of. The shift to electronic trading also opened the door to a global 24-hour market; futures on U.S. exchanges can be traded from Asia or Europe with ease, and vice versa, making trading futures a round-the-clock endeavor.

Overall, electronic platforms have made futures markets more efficient and accessible. They have lowered transaction costs and empowered traders with information. At the same time, they require traders to be savvy; with speed and power at one’s fingertips, discipline is key to avoid impulsive moves. The best futures brokers today combine cutting-edge electronic trading technology with strong customer support, ensuring that traders can harness these modern tools effectively and responsibly.

Cannon Trading Company: An Innovative Futures Broker with Decades of Excellence

In the highly competitive world of futures brokerage, a few firms distinguish themselves through longevity, innovation, and client service. One standout example is Cannon Trading Company, which is widely regarded as one of the most innovative futures brokerage firms in the industry. In fact, many traders consider Cannon to be the best futures broker due to its blend of advanced technology and outstanding service. Cannon Trading was established in 1988, giving it decades of experience as a futures broker serving traders across the globe. Over the years, the firm has continually adapted to the changes in futures trading, often leading where others followed. Its blend of traditional brokerage values and forward-thinking technology has earned Cannon a stellar reputation among both retail and institutional traders.

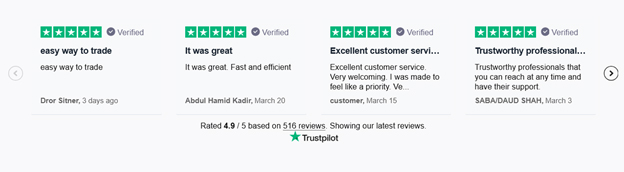

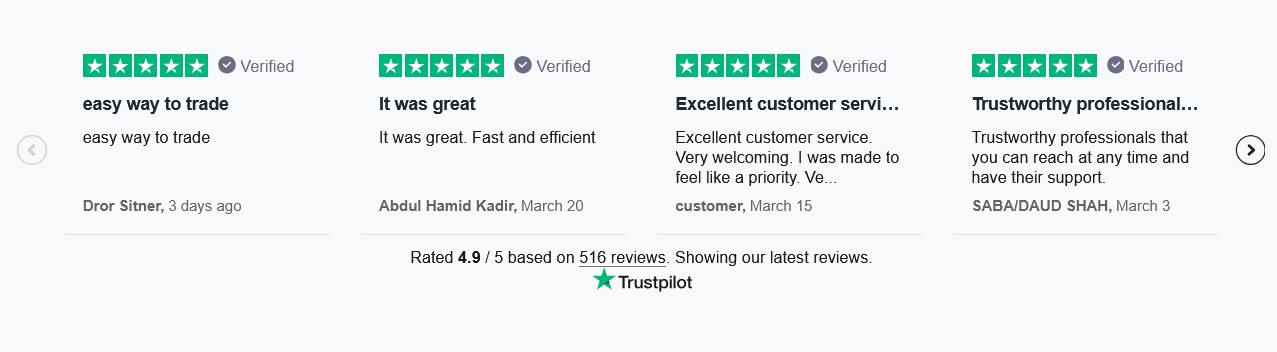

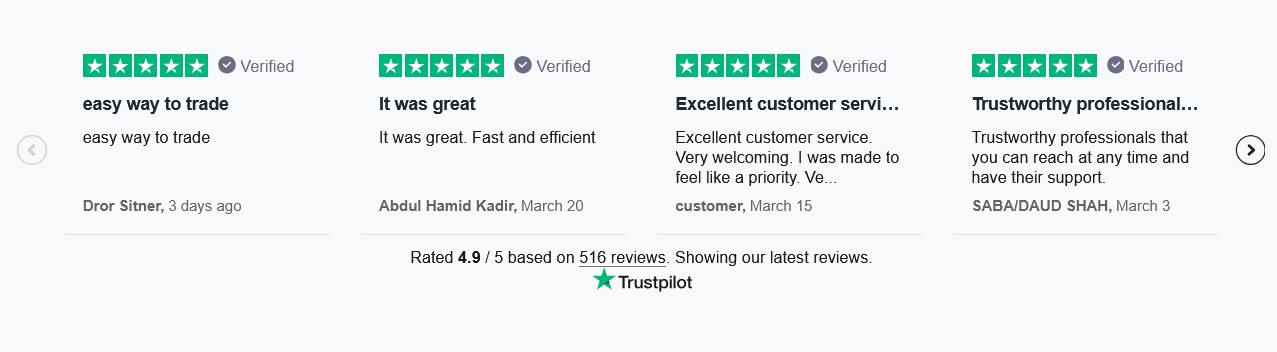

A key indicator of Cannon Trading Company’s success is its consistent 5 out of 5-star client ratings on TrustPilot. In an industry where customer satisfaction can be elusive, Cannon’s near-perfect scores reflect excellence in service, transparency, and reliability. Clients frequently praise the firm’s knowledgeable brokers and attentive support. Having a team of experienced, Series 3 licensed futures brokers available to guide clients sets Cannon apart as more than just a trading portal – they act as partners in the trading journey. This customer-centric approach has solidified Cannon’s status as a trusted future broker for thousands of traders. Testimonials often highlight fast, personalized responses and a genuine commitment to helping clients succeed in futures trading.

Cannon Trading’s dedication to innovation goes hand in hand with a focus on education and risk management. As a top-tier futures broker, Cannon makes sure that clients are not only equipped with technology but also with knowledge. The firm regularly provides educational webinars, market analysis, and trading guides to help traders make informed decisions. They emphasize risk management techniques, offering guidance on using stop-loss orders, managing leverage, and diversifying across markets – critical factors for anyone involved in futures trading. This emphasis on trader education and safety speaks to Cannon’s integrity, and it aligns with their excellent standing with regulatory bodies. Cannon Trading Company is a registered member of the National Futures Association and remains in full compliance with Commodity Futures Trading Commission regulations. Over its long history, the company has maintained an impeccable record, giving clients peace of mind that they are dealing with a reputable and law-abiding future broker.

Another reason Cannon is often cited as one of the best futures brokers is its comprehensive range of products and services. Clients can trade an enormous variety of futures – from classic commodity contracts like grains and metals to modern stock index, interest rate, and currency futures. Cannon facilitates trading on all major U.S. futures exchanges and many international ones. Despite offering such breadth, the firm remains attentive to individual client needs. Whether a trader is a beginner placing their first trade or an institution executing large, complex orders, Cannon’s team provides tailored support. This level of versatility and customer care is rare, and it underscores why Cannon Trading Company has earned numerous industry accolades and unwavering customer loyalty.

Innovation is a cornerstone of Cannon’s identity. The firm was among the first brokers to offer online futures trading and continues to stay at the cutting edge of technology. They provide one of the widest selections of trading platforms in the industry – over twenty different platform options – ensuring every client can find the ideal toolkit. Platforms such as E-Futures International and Sierra Chart are available, along with Cannon’s own proprietary solutions like the CannonX trading platform for spreads and iSystems for automated strategies. This wide array of platforms is complemented by competitive pricing, including low day-trading margins and attractive commission rates, which further solidify Cannon’s standing as a best futures broker choice for traders seeking value and performance.

In summary, Cannon Trading Company exemplifies what a modern futures broker should be: experienced, innovative, and client-focused. Its decades-long presence in the futures industry, unmarred regulatory reputation, top-tier customer satisfaction ratings, and broad selection of platforms and services all combine to make it a leader. For anyone seeking a reliable partner in the futures markets – whether you are a beginner learning the ropes or an institutional investor demanding high performance – Cannon Trading Company stands out as a premier choice among futures brokers.

Futures trading has come a long way from its origins in agricultural trade and simple speculative bets. It has transformed into a sophisticated domain where global financial markets, advanced technology, and skilled analysis converge. We have seen how futures contracts started as a means to stabilize farmers’ incomes and now are used to hedge entire portfolios or gain exposure to markets with precision and leverage. The science and art of trading futures have progressed through innovations like technical analysis, which gives traders roadmaps of market sentiment, and through rigorous risk management practices that protect participants in a highly leveraged environment. The move to electronic trading platforms has broken down barriers, making futures markets accessible to anyone with an internet connection and a trading account, while vastly increasing speed and efficiency.

Throughout this evolution, the role of the futures broker remains as crucial as ever. Brokers serve as the gateway to the futures exchanges, and the best in the business do much more than execute trades – they educate, provide insights, and equip traders with cutting-edge tools. In today’s competitive landscape, the best futures broker firms distinguish themselves by combining deep market expertise with technology and client service. As highlighted, Cannon Trading Company is a shining example of this balance, with its longstanding dedication to innovation and trader support. For traders at any level, partnering with a reliable future broker can make all the difference in navigating the opportunities and challenges that futures trading presents.

In the end, futures trading remains an exciting and dynamic field. It offers opportunities for profit and portfolio protection alike, but it demands knowledge, discipline, and the right support. By understanding the rich history of futures, appreciating the developments that shape how we trade today, and choosing the right partners and tools, traders and investors can confidently participate in this ever-evolving market. Whether you are a student exploring financial concepts, a new trader taking your first steps, or an institutional investor hedging multi-million dollar exposures, the world of futures trading welcomes you with a promise: the future of trading is what you make of it, especially when you have a top future broker by your side to help turn your strategies into success.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading