NFP – Non Farm Payrolls Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the rapidly evolving world of futures trading, having access to a cutting-edge futures trading platform is critical. One such platform making waves in the trading community is Bookmap—an innovative tool designed to bring transparency and precision to trading decisions. With its unique visual approach, Bookmap trading enables both novice and professional traders to see beyond the basic charts and deeply understand market behavior in real time.

As the demand for advanced platforms increases, so does the need for reliable brokers. That’s where Cannon Trading Company shines. As one of the most respected firms in the industry, Cannon Trading has been helping traders navigate the complex world of online futures trading platforms for decades.

This article explores the most important features of Bookmap for futures trading, details how to access Bookmap download and pricing, and explains why Cannon Trading Company is an outstanding partner for using this platform.

Bookmap is a high-performance futures trading platform that displays full-depth market data in an intuitive heatmap format. Unlike conventional charting tools, Bookmap trading enables you to see market liquidity and order flow with unprecedented clarity.

With Bookmap Web and Bookmap TradingView integration, users now have the flexibility to analyze markets on various devices and charting systems. This accessibility is enhanced by Bookmap free features that allow traders to try out the platform before committing financially.

The availability of granular market data is one of the core strengths of Bookmap. It visualizes market dynamics by showing historical order book activity and real-time transactions, enabling traders to spot opportunities before they appear on standard charts.

Understanding Bookmap pricing is key before diving in. There are several tiers based on your needs:

Each tier offers flexibility depending on whether you’re new to Bookmap trading or a seasoned professional. Importantly, Bookmap download is straightforward, and the platform supports both Windows and macOS.

With Bookmap Web, you can even access your trading dashboard from any browser, making it ideal for traders on the go.

When it comes to online futures trading platforms, broker selection is just as important as the platform itself. Cannon Trading Company stands out as an industry leader and is a perfect partner for anyone using Bookmap.

Combining the sophisticated features of Bookmap with the unmatched service of Cannon Trading Company creates a powerhouse for futures traders. Whether you’re leveraging the real-time heatmap for scalping or conducting detailed order flow analysis, Cannon Trading’s infrastructure and experience enhance your performance.

From Bookmap pricing transparency to expert help with Bookmap data feeds, Cannon ensures that your trading experience is as seamless and successful as possible.

The Bookmap Futures Trading Platform is revolutionizing how traders view and interact with the market. Its innovative visualization tools, integration with Bookmap TradingView, browser-based Bookmap Web, and robust Bookmap free version make it a go-to solution for serious traders. When combined with a top-tier brokerage like Cannon Trading Company, which offers industry experience, stellar reputation, regulatory compliance, and multiple futures trading platform options—including Bookmap—you have a winning formula for success.

Whether you’re exploring Bookmap download for the first time or looking to deepen your expertise in Bookmap trading, partnering with Cannon Trading will elevate your performance and confidence.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

However, with volatility, you need to double check the status daily at:

We have a full day tomorrow! Reports, earnings and more global news in general.

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

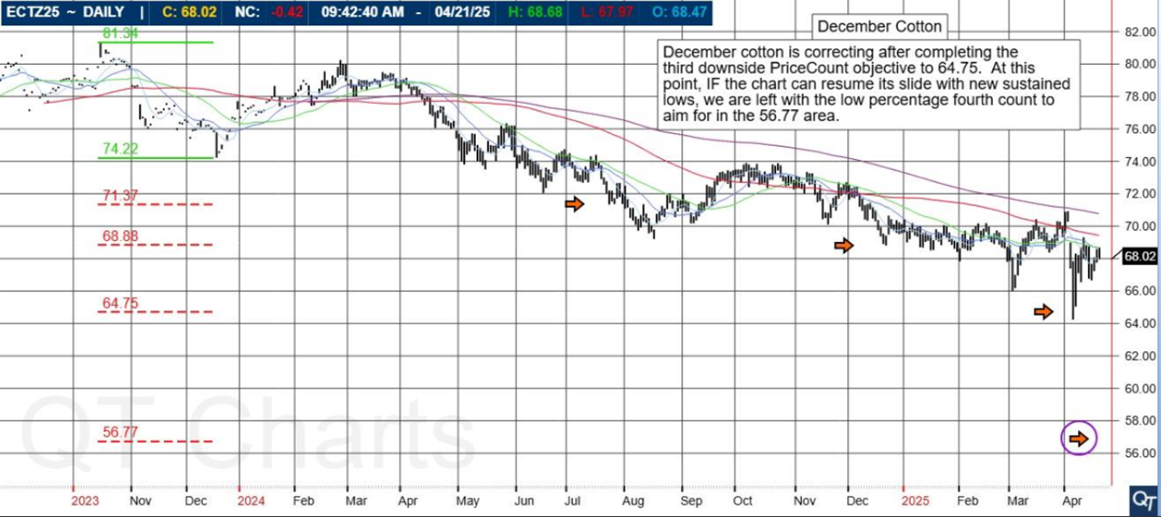

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Day Trading margins are back to normal!

However, with volatility, you need to double check the status daily at:

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

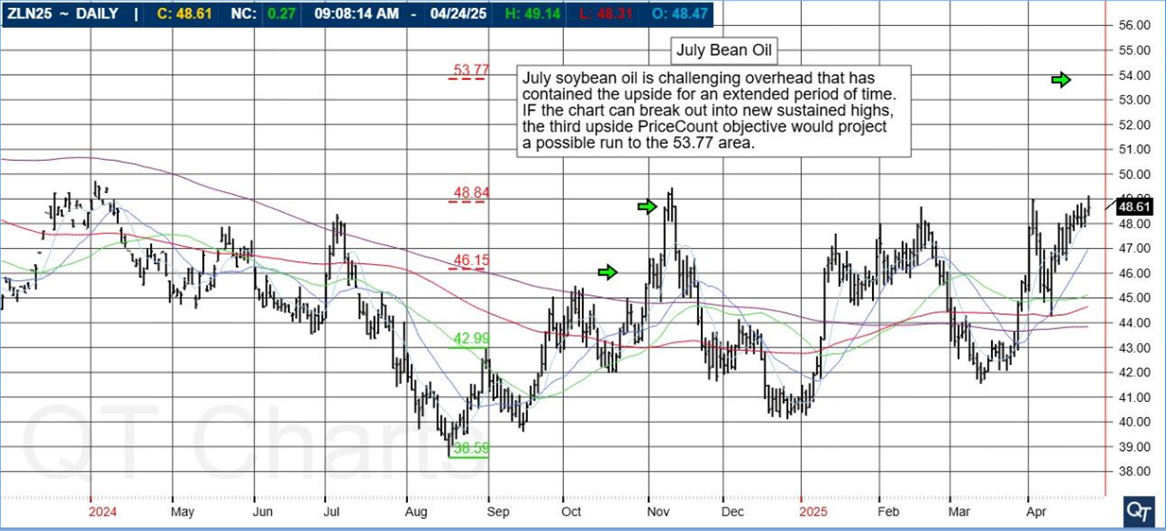

July soybean oil is challenging overhead that has contained the upside for an extended period of time. IF the chart can break out into new sustained highs, the third upside PriceCount objective would project a possible run to the 53.77 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

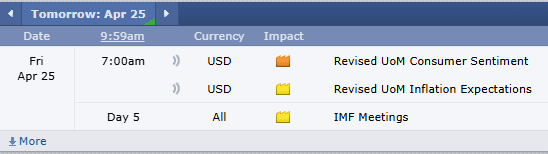

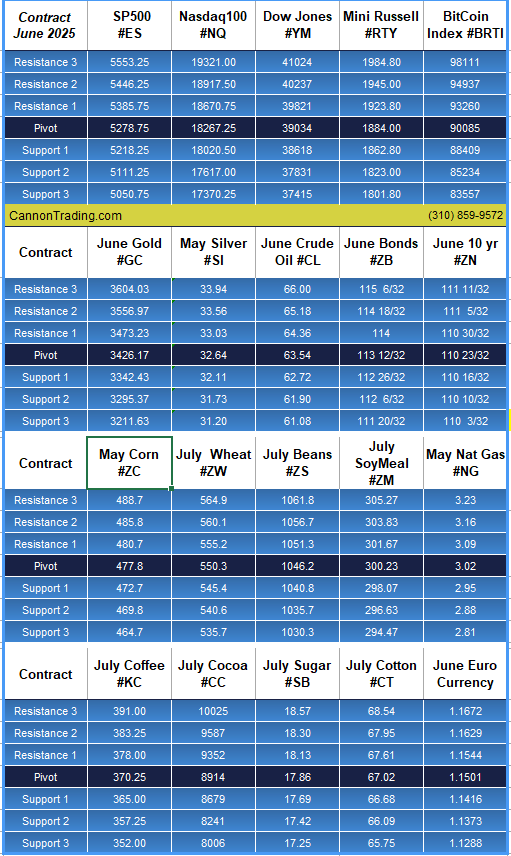

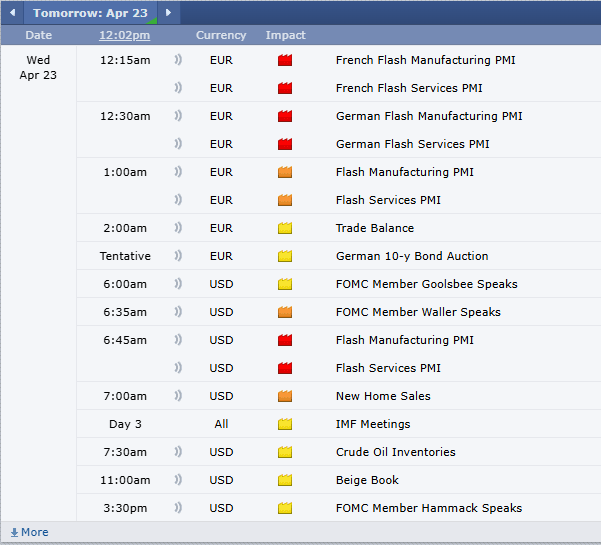

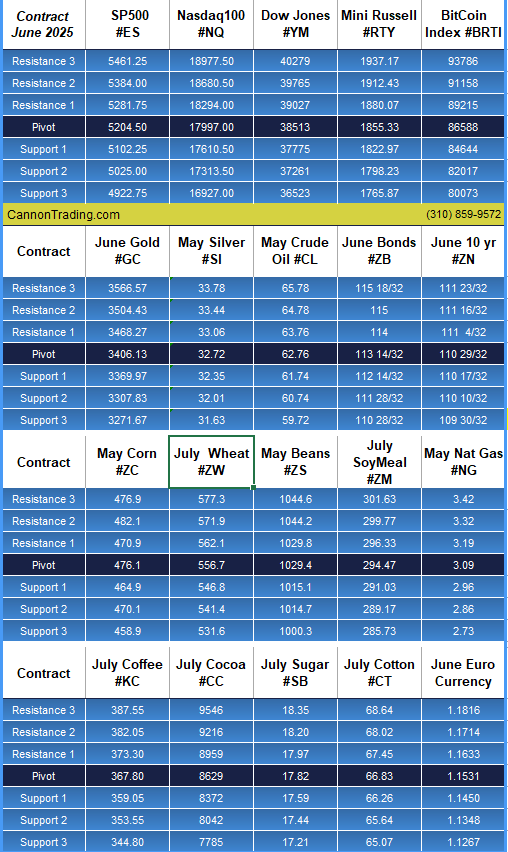

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

By John Thorpe, Senior Broker

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

December cotton is correcting after completing the third downside PriceCount objective to 64.75. At this point, IF the chart can resume its slide with new sustained lows, we are left with the low percentage fourth count to aim for in the 56.77 area.

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|