Get Real Time updates and more on our private FB group!

Cross Currents to Fuel Volatility Even Higher

By John Thorpe, Senior Broker

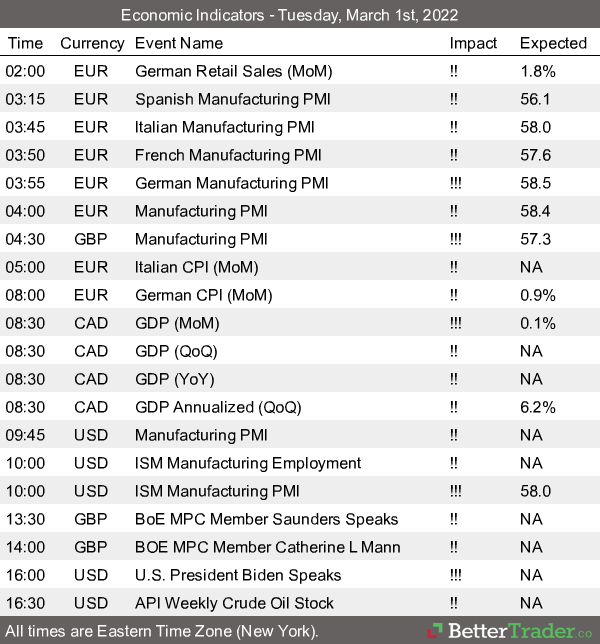

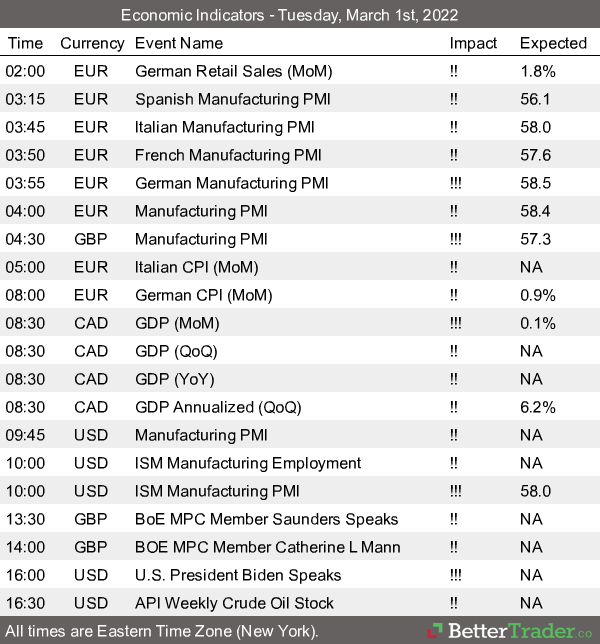

It’s clear the market has been reacting to the minute by minute changes from the international communities responses to the Russian Invasion into another sovereign country. These currents have been pushing markets violently the past week and are expected to continue to do so for days and weeks to come. However , we can’t lose sight of 3 very important domestic issues that could have far reaching global impacts as well. Here in the U.S. , on Tuesday night President Joe Biden is scheduled to give his first “State of the Union” address to the American citizens and world. Without a doubt, the futures markets will be reacting during our evening session Tuesday night March 1st 9:00 P.M. EST. Wednesday Morning 10:00 A.M. ending Thursday afternoon, Fed Chair Jerome Powell presents his report—called the Monetary Policy Report—that is submitted semiannually to the Senate Committee on Banking, Housing, and Urban

Affairs and to the House Committee on Financial Services, along with

testimony from the Federal Reserve Board Chair., this will be the first time Fed Chair will be answering questions directly related to the Russia/Ukraine conflict since the conflict began.

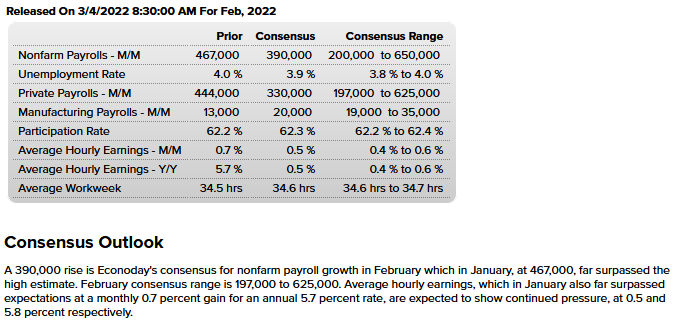

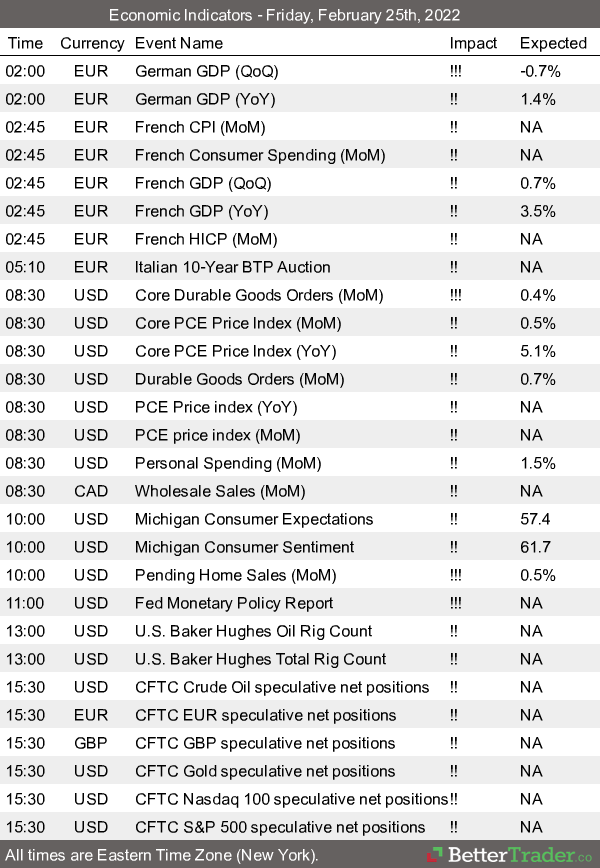

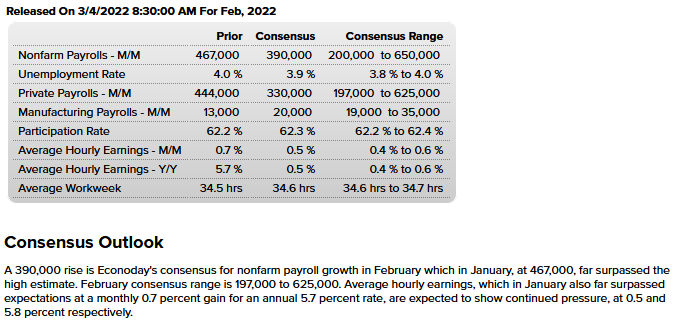

On Friday Morning at 8;30 a.m. EST the most watched labor department number is released: Nonfarm Payrolls (NFP) also known as the Employment situation report. Here are this months expectations from Econoday.com

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

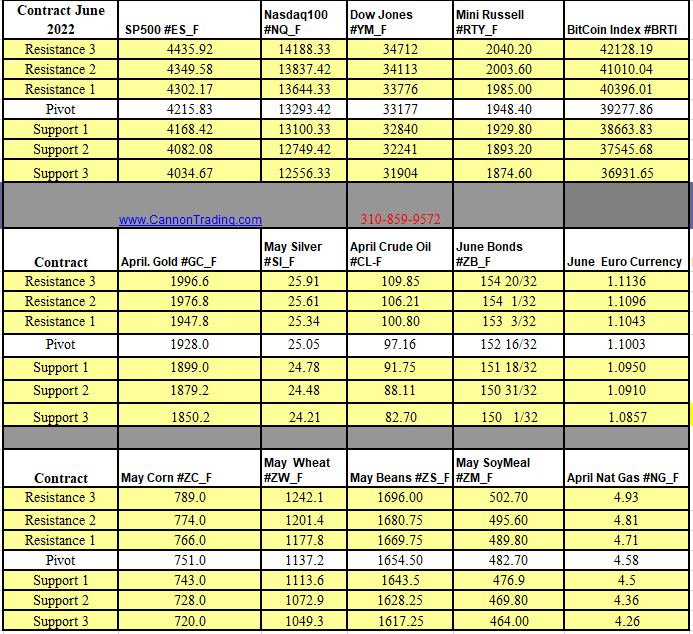

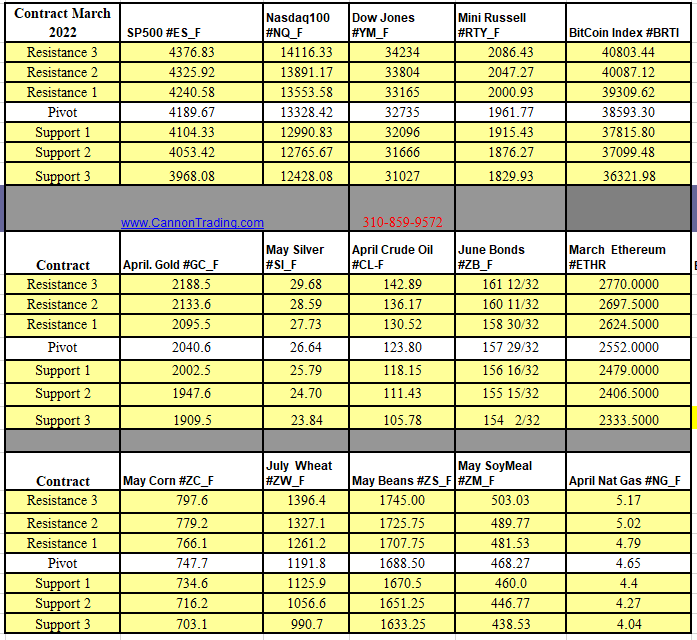

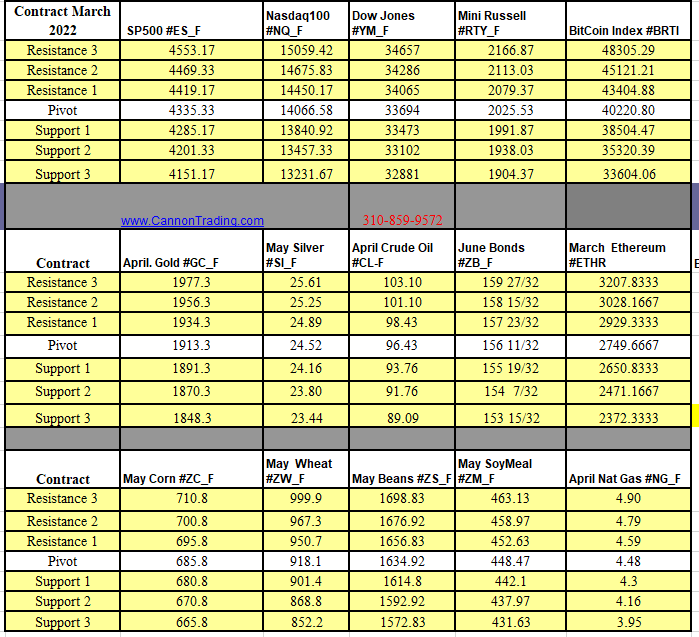

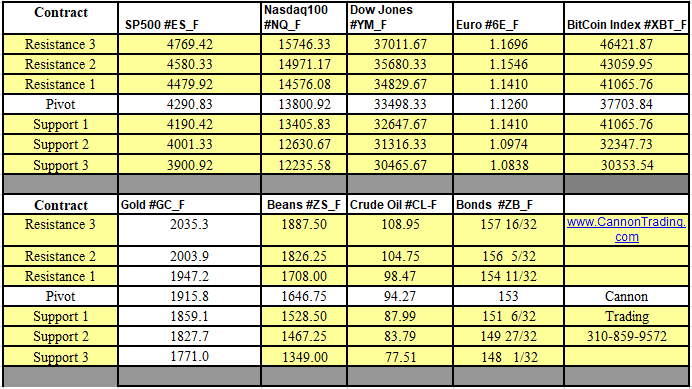

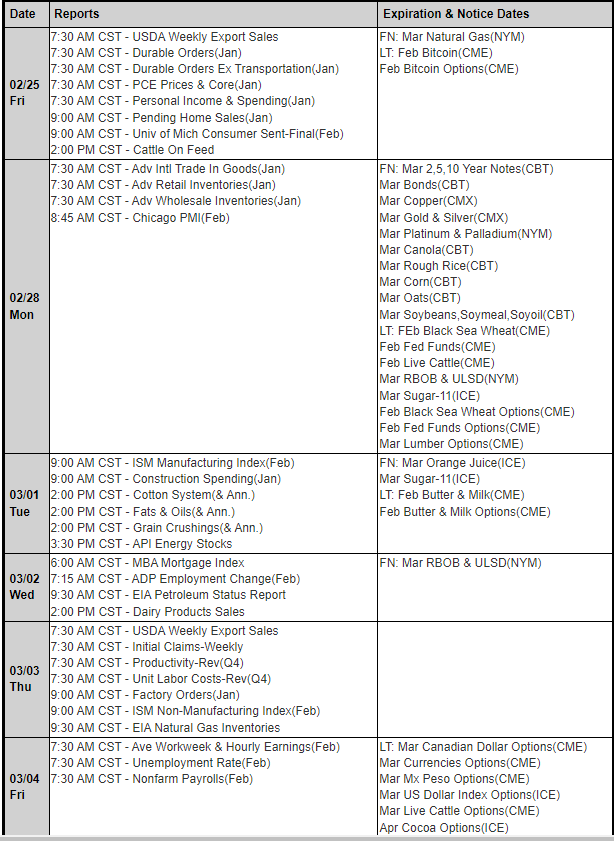

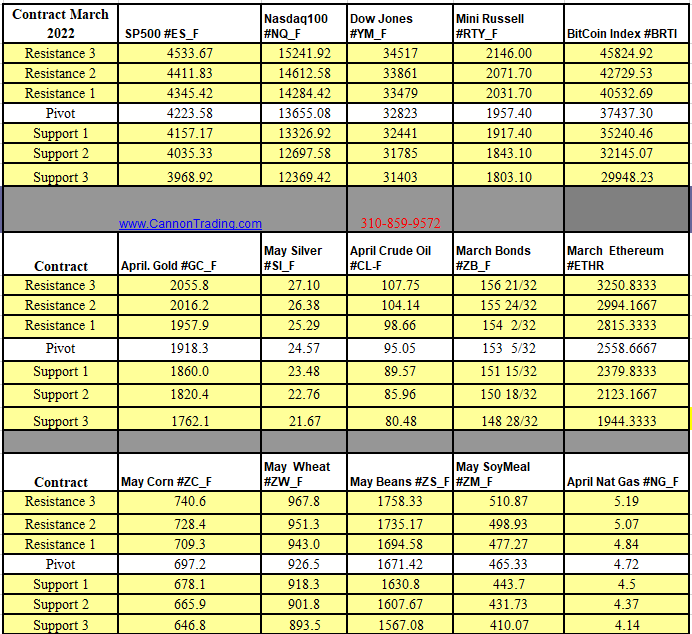

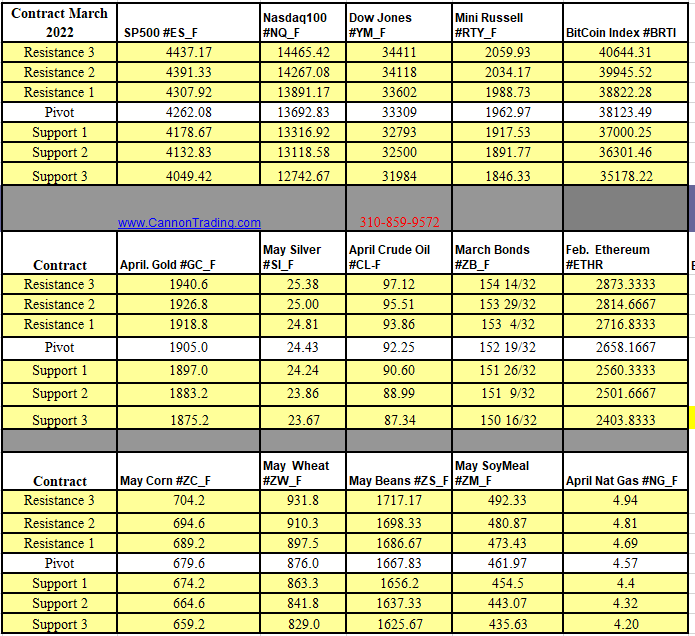

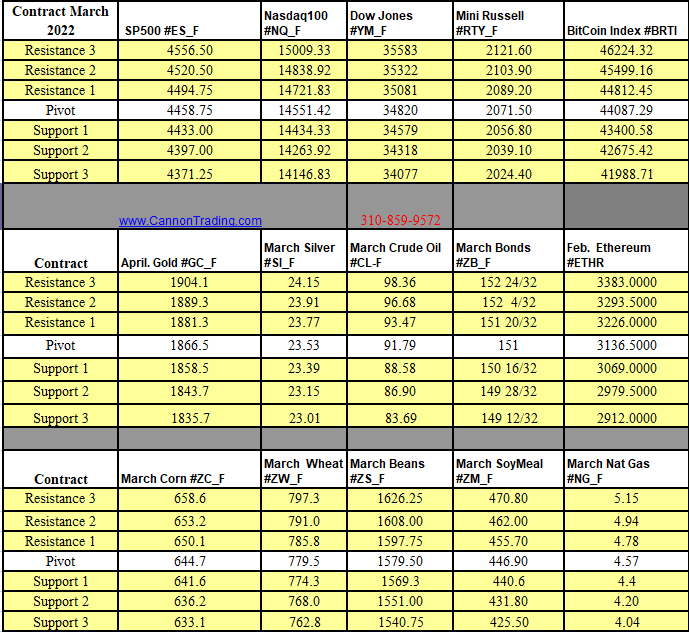

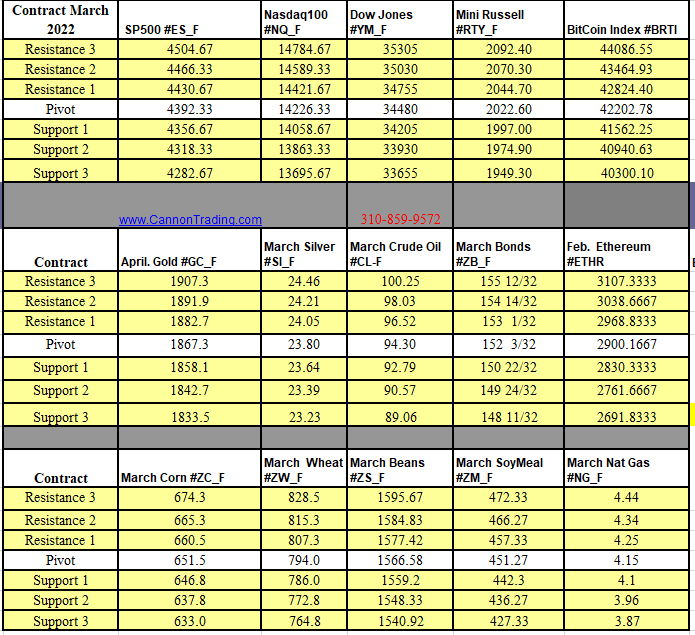

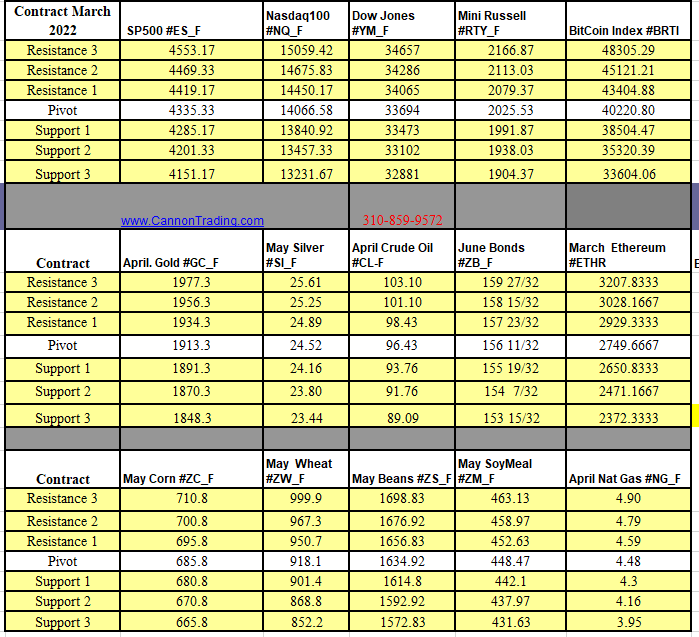

Futures Trading Levels

03-01-2022

Improve Your Trading Skills

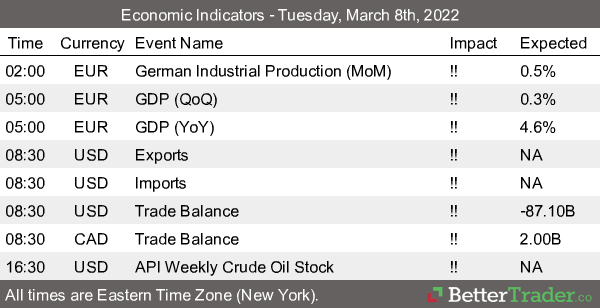

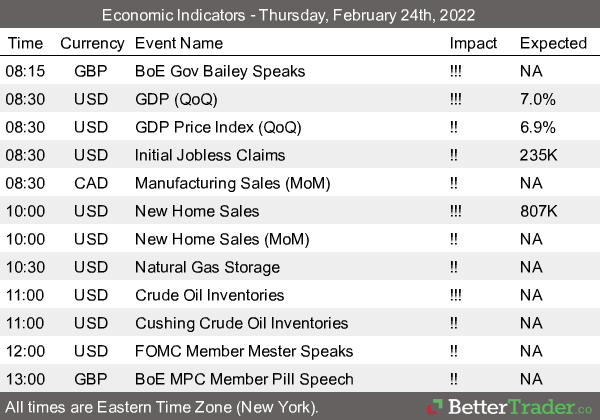

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.