The rise of artificial intelligence (AI) has significantly transformed various industries, and futures trading is no exception. From the earliest days of manually shouting orders on bustling trading floors to today’s sophisticated, algorithm-driven systems, the futures markets have undergone a seismic shift. Understanding this evolution sheds light on the advantages and disadvantages of automated and manual trading, while also highlighting why institutions like Cannon Trading Company remain pivotal for traders navigating these dynamic landscapes.

The Early Days of Futures Trading

Before the advent of AI, futures trading relied heavily on manual processes. Traders on the floor of exchanges like the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX) engaged in open outcry trading. Brokers shouted and used hand signals to execute trades in pits, creating a high-energy environment driven by human intuition, relationships, and rapid decision-making.

Manual trading in this era required a deep understanding of market fundamentals, technical analysis, and quick reflexes. For example, during the 1980s, crude oil futures saw dramatic price fluctuations driven by geopolitical tensions. Brokers had to assess global news, client positions, and technical charts almost instantaneously to execute profitable trades. The experience of a seasoned futures trader often made the difference between substantial gains and significant losses.

However, the manual system had its drawbacks. Human error, emotional decision-making, and inefficiencies in communication often resulted in missed opportunities or costly mistakes. As technology advanced, these limitations became apparent, paving the way for more sophisticated methods.

The Advent of Automated Futures Trading

The introduction of computers in the late 20th century marked the beginning of a new era for futures trading. Algorithms capable of processing vast amounts of data at incredible speeds began to replace manual processes. This evolution took a giant leap forward with the advent of AI and machine learning in the 21st century.

AI-driven futures trading systems leverage historical data, real-time market information, and predictive analytics to make split-second decisions. For example, in 2010, high-frequency trading (HFT) accounted for over 60% of all U.S. equity trading volume. These AI algorithms identify patterns and execute trades faster than any human trader could manage.

One notable anecdote involves the 2010 “Flash Crash,” where the Dow Jones Industrial Average plummeted nearly 1,000 points in minutes before quickly rebounding. AI algorithms played a significant role in this event. While their speed and efficiency can create liquidity, their interactions can also exacerbate market volatility. This dual-edged nature of AI trading underscores the importance of regulatory oversight and robust system design.

Advantages of AI in Futures Trading

AI futures trading offers numerous benefits:

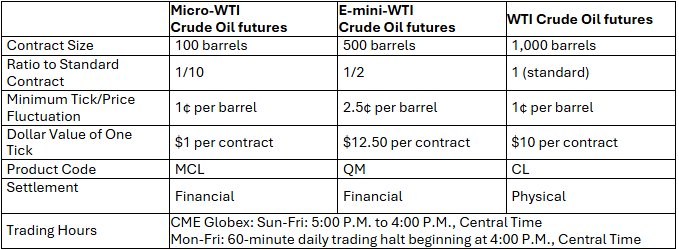

- Speed and Efficiency: AI algorithms process data and execute trades in milliseconds, providing a competitive edge in fast-moving markets. For instance, a futures trader using AI can capitalize on microsecond price discrepancies in commodities like gold or crude oil.

- Data-Driven Decisions: AI systems analyze vast datasets, identifying trends and patterns that might be invisible to human traders. This ability allows for more informed decision-making.

- Emotion-Free Trading: Unlike human traders, AI systems are immune to fear, greed, or panic, ensuring objective decisions even during volatile market conditions.

- Scalability: AI can monitor and execute trades across multiple markets and instruments simultaneously, something no human can achieve.

Case Study: Renaissance Technologies, a hedge fund founded by mathematician James Simons, has consistently delivered high returns using AI-driven strategies. Their Medallion Fund, which employs machine learning algorithms, is one of the most successful trading funds in history, generating average annual returns of 39% before fees.

Disadvantages of Automated Trading

Despite its advantages, AI futures trading has its challenges:

- Over-Reliance on Technology: Traders relying solely on AI risk significant losses if systems fail or encounter unforeseen market conditions.

- Black Box Problem: Many AI algorithms operate as “black boxes,” meaning their decision-making processes are opaque. This lack of transparency can be problematic, especially during unexpected market events.

- Market Volatility: The speed and volume of AI-driven trades can amplify market fluctuations, as evidenced by events like the “Flash Crash.”

- High Development Costs: Building and maintaining AI systems require substantial investment in technology, data, and expertise.

Hypothetical Scenario: Imagine an AI system designed to trade soybean futures based on weather data. A sudden, unprecedented weather anomaly—not included in the training data—leads to erroneous predictions and significant losses. This scenario highlights the importance of continuous monitoring and improvement of AI systems.

Manual Trading: Strengths and Weaknesses

While AI dominates modern futures trading, manual trading still has its place. Human traders bring intuition, experience, and the ability to adapt to unique market conditions. For example, during the COVID-19 pandemic, some experienced futures brokers successfully navigated unprecedented market turmoil by relying on their deep understanding of fundamentals and client needs.

Advantages of manual trading include:

- Flexibility: Human traders can quickly adapt strategies based on evolving market conditions or unexpected events.

- Relationship Building: Successful futures brokers often cultivate strong relationships with clients, providing personalized advice and support.

- Intuitive Decision-Making: Experienced traders can make judgment calls that AI systems might miss.

However, manual trading also has drawbacks:

- Emotional Bias: Fear, greed, and other emotions can cloud judgment, leading to poor decisions.

- Slower Execution: Human traders cannot match the speed of AI systems, particularly in high-frequency trading environments.

- Limited Scalability: Managing multiple markets and instruments simultaneously is challenging for even the most skilled traders.

Why Cannon Trading Company Excels in Futures Trading

For traders seeking the best of both worlds, Cannon Trading Company stands out as an ideal partner. Here’s why:

- Wide Selection of Platforms: Cannon offers access to top-performing trading platforms, catering to both manual and automated trading preferences. Their platforms support advanced charting, algorithm integration, and real-time market data.

- Trust and Reputation: With a 5-star rating on TrustPilot and decades of experience, Cannon Trading Company has earned the trust of its clients. Their exemplary reputation with regulatory bodies ensures that traders can operate with confidence.

- Expertise Across Experience Levels: Whether you’re a seasoned futures trader or a novice exploring the markets, Cannon’s team of experienced futures brokers provides personalized guidance and support.

- Regulatory Compliance: Cannon adheres to stringent National Futures Association (NFA) guidelines, ensuring transparency and ethical practices in futures contract trading.

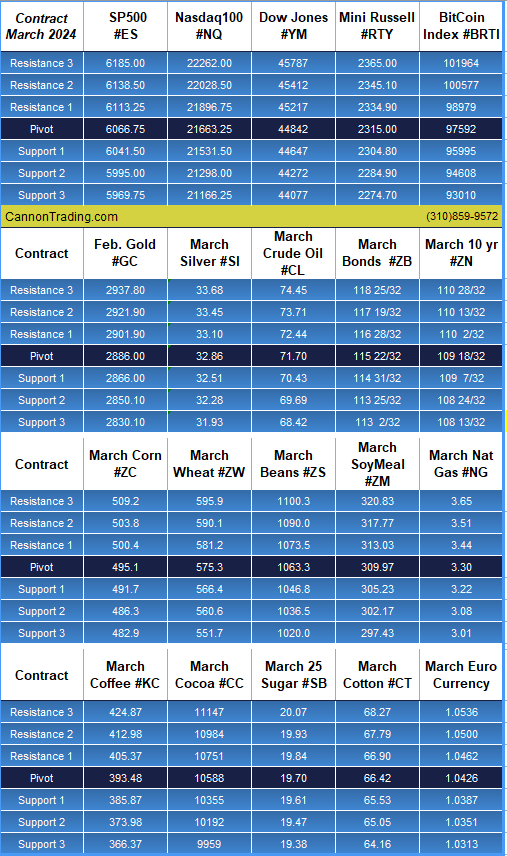

Case Study: A client of Cannon Trading Company reported transitioning from manual trading to a hybrid approach using AI-driven platforms. With Cannon’s support, they successfully implemented an algorithm to trade E-mini S&P 500 futures, achieving consistent returns while retaining the ability to override trades based on market insights.

The Future of AI in Futures Trading

Looking ahead, the integration of AI in futures trading will only deepen. Innovations like natural language processing (NLP) and reinforcement learning will enable systems to interpret news articles, social media sentiment, and even geopolitical developments to inform trading decisions.

For instance, an AI system analyzing weather patterns and crop reports might predict a supply shortage in wheat, prompting traders to enter long futures contracts. Alternatively, advances in quantum computing could revolutionize the speed and accuracy of predictive models, giving traders an unprecedented edge.

However, as AI continues to evolve, ethical and regulatory considerations will remain critical. Ensuring fairness, transparency, and accountability in AI-driven markets will be paramount to maintaining trust and stability.

The evolution of AI futures trading has revolutionized the industry, offering unparalleled speed, efficiency, and data-driven insights. While automated systems have their advantages, the human touch remains invaluable, particularly in navigating complex or unprecedented market scenarios.

For traders of all experience levels, choosing the right partner is essential. Cannon Trading Company’s combination of advanced platforms, stellar reputation, and personalized support makes it an ideal choice for anyone engaged in futures trading. Whether you’re leveraging cutting-edge AI or relying on the expertise of seasoned futures brokers, Cannon provides the tools and guidance needed to succeed in today’s dynamic markets.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading