|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Different grains are traded on the Index, as commodities. Wheat, corn, soybeans, canola and soybean meal are just a few examples. They can be either a short-hedge or a long-hedge. One of the most traded grain futures is corn.

Basically, buying or selling these forms of futures enables the buyers and sellers to lock in prices of the specified grain today for the items that are to be delivered in the future. Therefore, all those who are interested in grains futures must track the performance of the grain on the demand and supply graph as well as its performance on the index. Though it is not tough to understand grains futures, the calculation of risk and returns is something that an average person may leave for an expert to do.

We at Cannon Trading are there to help you to not just understand the markets well, but to act as your personal advisors when it comes to trading futures. And, that’s something that applies for grain futures as well. However, information and awareness come before anything else. That is why, we want you to read through all of these blogs and articles carefully before you decide whether you want to trade grain futures or not.

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading futures is a dynamic and high-stakes endeavor, attracting traders with the promise of leveraged profits and diverse opportunities across commodities, financial indices, currencies, and more. In futures trading, participants buy or sell standardized contracts that speculate on the future price of an asset, allowing them to profit from correct market predictions. This arena is not only about speculation; it also serves a critical role in risk management—many investors and businesses use trading futures contracts to hedge against price fluctuations in raw materials, interest rates, or stock markets. The combination of potential for rapid gains, global market access, and hedging utility has made futures trading a popular pursuit for both individual traders and institutions.

However, succeeding in this competitive field requires more than just enthusiasm. Modern futures traders rely on a blend of proven techniques, disciplined daily routines, and the support of a reliable futures broker to navigate volatility. The most successful traders deploy a range of strategies—from technical chart analysis to fundamental market research—to make informed decisions each day. Equally important is partnering with the right brokerage; the best futures broker will provide quality trade execution and support that can make or break a trading strategy. In this comprehensive paper, we explore the most widely practiced techniques in futures trading today and how traders can implement these methods in their day-to-day trading routines. We also shine a spotlight on Cannon Trading Company, a futures broker with decades of industry leadership. Cannon Trading Company’s historical and ongoing contributions—reflected in its stellar reputation, 5-star client ratings, regulatory compliance, and cutting-edge trading platforms—underscore what it means to have an industry-leading partner in the futures market.

Traders in the futures markets have developed a variety of approaches to profit from price movements. Below are some of the most popular futures trading techniques practiced today, each with its own style and implementation:

Having a solid strategy is one thing, but consistent success in trading futures comes from diligent day-to-day execution. Effective traders turn their chosen techniques into structured daily habits. Below is an example of how a futures trader can implement these strategies through a typical trading day:

Among futures brokers, Cannon Trading Company stands out as a firm that has consistently set a high standard for service and expertise. Established in 1988, Cannon Trading has spent decades honing its reputation and is widely regarded as a trusted future broker for traders around the world. Over the years, the company has contributed significantly to the futures industry—being one of the early adopters of online trading technology, sharing market insights through educational resources, and exemplifying best practices in client service. Cannon’s longevity in the competitive futures brokerage field speaks to its adaptability and unwavering commitment to clients’ success. Today, it is not just a brokerage but a partner in its clients’ trading journeys, distinguished by qualities that few others can match. Below are key aspects that highlight Cannon Trading Company’s leadership in the futures trading arena:

With these strengths, Cannon Trading Company has firmly established itself as a leader in the futures trading community. The combination of top-tier customer satisfaction, unimpeachable trustworthiness, deep industry experience, and technological excellence makes Cannon a one-stop destination for traders seeking the best futures broker to support their trading journey. The firm’s historical and ongoing contributions—be it through pioneering trading solutions, guiding traders with expert knowledge, or simply being a dependable partner—have left an indelible mark on the industry. In an era where traders have many choices, Cannon continues to differentiate itself by blending old-school integrity with modern innovation. For anyone serious about trading futures, Cannon Trading Company represents the gold standard of what a futures brokerage should be.

The world of trading futures offers immense potential for those equipped with knowledge, discipline, and the right support. By mastering popular trading techniques—whether it’s a quick scalp on an index future or a carefully hedged commodity spread—and integrating them into a consistent daily routine, traders can approach the futures markets with confidence. Equally important is having a strong partner in your corner. As we’ve seen, a seasoned and reliable futures broker can provide the technology, guidance, and security that elevate a trading experience. When traders combine well-honed strategies with the resources offered by the best futures broker, the results can be truly powerful. Cannon Trading Company exemplifies this synergy: its decades of expertise and client-focused services empower traders to apply their skills effectively in the market. In essence, success in futures trading comes down to preparation and partnership. With sound strategies, steadfast risk management, and a brokerage like Cannon Trading Company supporting your goals, you can navigate the futures landscape with greater clarity and purpose. As the futures industry continues to evolve, those who stay educated, disciplined, and well-supported will be best positioned to thrive in the exciting opportunities that lie ahead.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572(International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

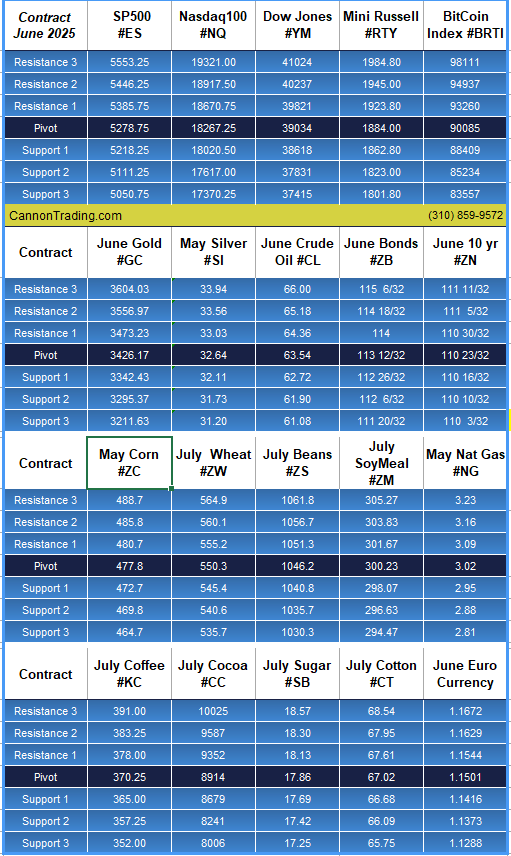

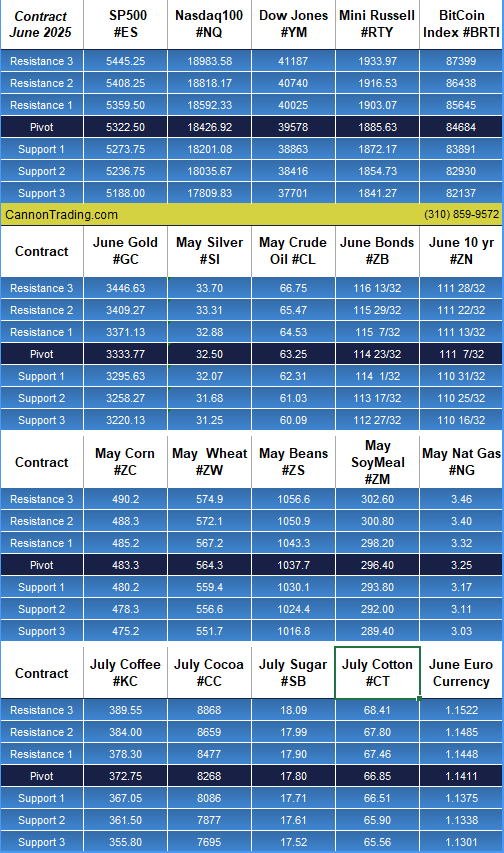

However, with volatility, you need to double check the status daily at:

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

BRACKET ORDERS VIDEO

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

By John Thorpe, Senior Broker

|

|

|

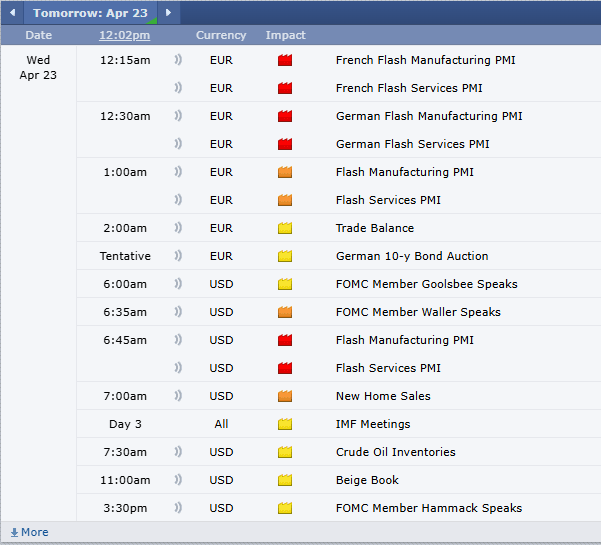

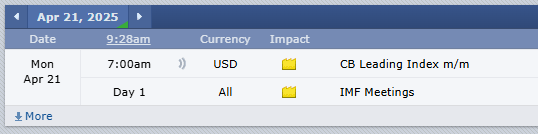

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

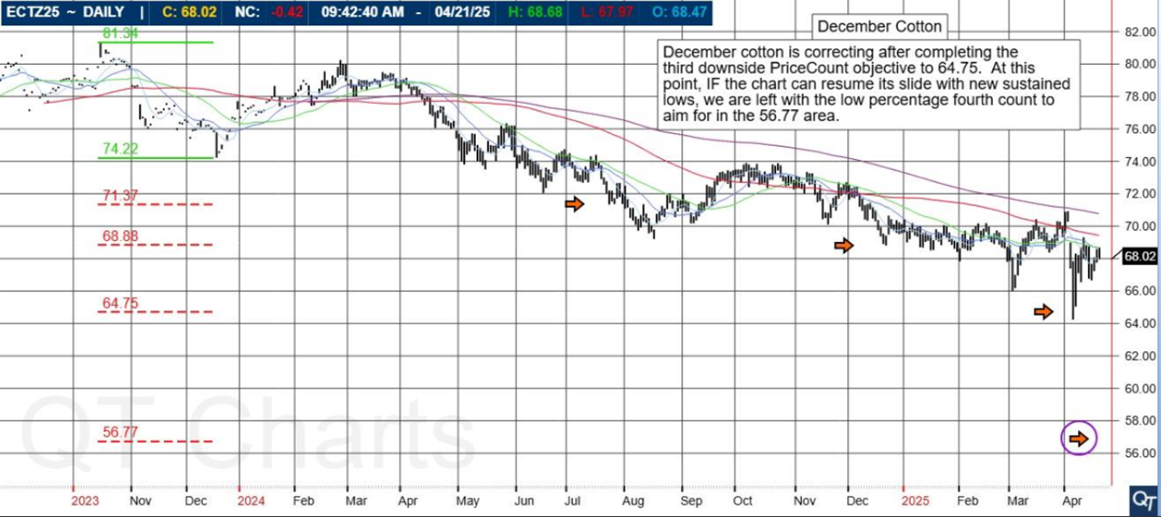

December cotton is correcting after completing the third downside PriceCount objective to 64.75. At this point, IF the chart can resume its slide with new sustained lows, we are left with the low percentage fourth count to aim for in the 56.77 area.

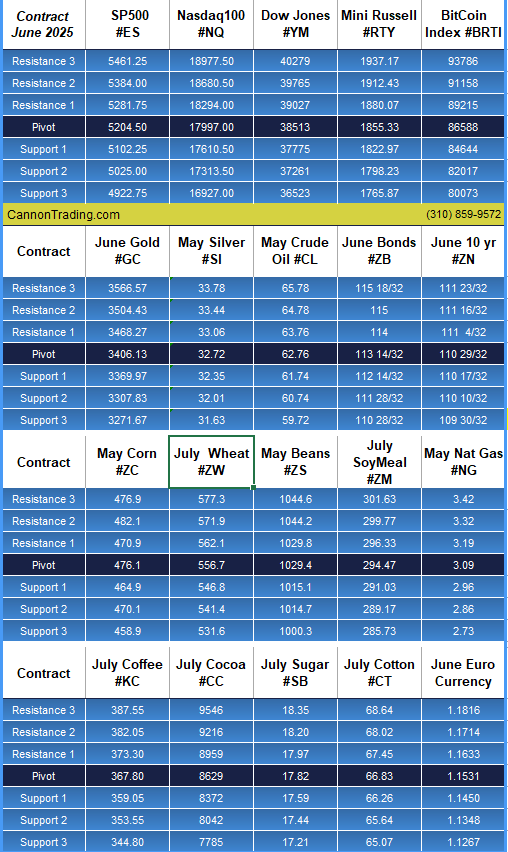

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

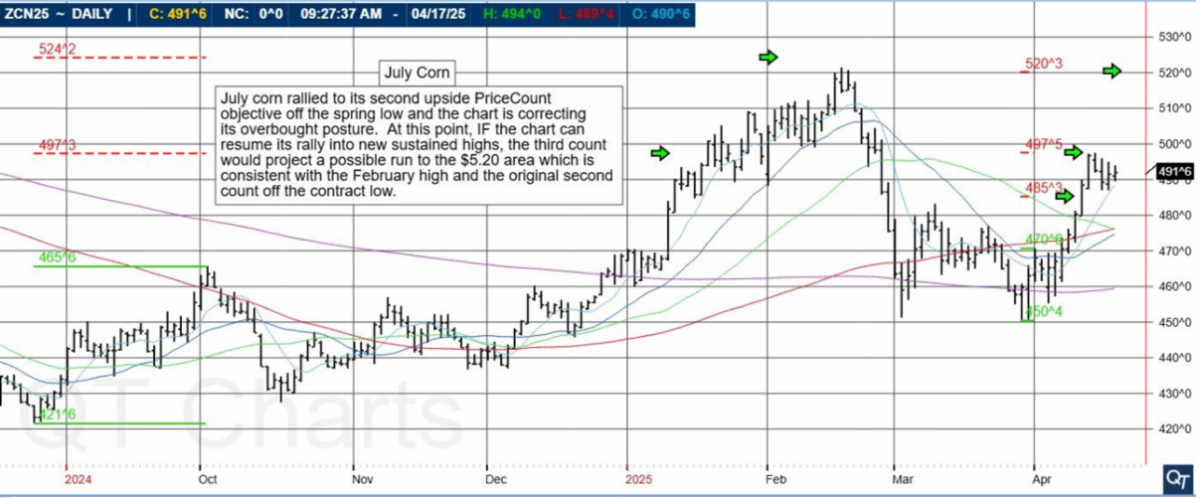

July corn rallied to its second upside PriceCount objective off the spring low and the chart is correcting its overbought posture. At this point, IF the chart can resume its rally into new sustained highs, the third count would project a possible run to the $5.20 area which is consistent with the February high and the original second count off the contract low.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

In the fast-paced, high-stakes world of futures trading, where precision, timing, and insight spell the difference between profit and peril, the role of a qualified futures broker is not only instrumental—it is indispensable. For seasoned traders and novices alike, the guidance of an experienced, trustworthy broker can determine not just individual trade outcomes but also the overall trajectory of one’s trading career. As trading becomes more technologically advanced and globally interconnected, the need for human expertise, personalized guidance, and reliable support becomes even more essential.

This comprehensive article will delve deep into the inherent, undeniable values of commissioning a qualified, reliable futures broker, outline the key characteristics of successful professionals in this field, evaluate the risks and benefits clients face depending on their broker selection, and spotlight why Cannon Trading Company has become synonymous with trust, longevity, and client-first service in the futures trading industry.

A futures broker plays a multifaceted role in facilitating and optimizing the futures trading experience. Unlike automated trading systems or impersonal platforms, a qualified futures broker provides individualized insights, robust risk management strategies, technical expertise, and access to essential trading tools.

Futures trading involves contracts based on the anticipated future value of commodities, indices, currencies, interest rates, and more. Each contract type comes with its own rules, liquidity profiles, margin requirements, and risk profiles. A competent futures broker is trained to understand these nuances and can help traders make informed decisions.

A futures broker can offer traders a strategic advantage by evaluating market conditions, identifying opportunities, and guiding clients toward actionable trades. Importantly, brokers can help tailor risk management strategies to each client’s tolerance and goals—be it through stop-loss placement, diversification, or hedging techniques. This personalized risk governance is invaluable, especially when trading leveraged instruments like futures contracts.

The best futures brokers bring real-time insights to the table, staying abreast of economic data, geopolitical developments, and technical signals that could impact markets. Their expertise can be the linchpin between capitalizing on a trend or suffering an avoidable loss. They also ensure that orders are executed swiftly and precisely—critical in volatile markets where every tick counts.

While many claim to offer trading services, only a select few are consistently recognized as top-tier futures brokers. Here are the most common characteristics found in highly reviewed professionals:

Every trader seeks an edge, and partnering with a top-notch futures broker offers precisely that. Here’s how these inherent values translate into direct benefits:

By gaining access to timely market insights, analytical support, and strategic guidance, traders can enhance their trading. A great futures broker serves as both a mentor and a partner in profit.

Proper risk controls are a hallmark of professional trading. Reliable brokers ensure that each trade aligns with a client’s risk appetite and financial goals. They can help prevent catastrophic losses through sound advice and oversight.

Knowing that a trusted expert is monitoring your trades, is available for consultation, and is proactively looking out for your interests; these facets can bring peace of mind—a crucial psychological advantage in a high-pressure environment.

For new traders, a qualified futures broker can dramatically shorten the learning curve. Their insights, explanations, and mentorship help build foundational knowledge and avoid rookie mistakes.

As beneficial as it is to have a reliable futures broker, the inverse is equally true. Choosing the wrong broker introduces significant risks:

Therefore, careful vetting of any futures broker is essential before committing capital.

With over 35 years of excellence, Cannon Trading Company has established itself as one of the best futures brokers in the industry. The firm has successfully managed to uphold a legacy of trust, performance, and unwavering client commitment.

In a time when many firms route clients through layers of automated menus and chatbots, Cannon Trading remains proudly personal. Every client has direct access to seasoned brokers—some with over 25 years of individual experience. No automated answering service stands between a trader and expert advice. This model isn’t just old-school—it’s best-in-class.

The company boasts a pristine reputation with industry regulators, including the NFA and CFTC. This reflects their rigorous adherence to ethical practices, secure fund management, and transparent dealings. Their numerous 5 out of 5-star TrustPilot rankings further attest to their stellar service and client satisfaction.

Cannon Trading empowers traders with a wide selection of FREE, top-performing trading platforms. Whether a trader prefers advanced analytical tools, fast execution speeds, mobile access, or intuitive interfaces, there’s a platform tailored to meet their needs. Their lineup includes platforms like SierraChart, TradingView, CQG, and others—each chosen for reliability and performance.

From commodities and indices to currencies and interest rate products, Cannon Trading enables clients to access virtually all futures trading markets. This breadth allows clients to diversify and hedge their portfolios efficiently, with expert support for every asset class.

Cannon’s culture emphasizes education, empowerment, and long-term relationships. They offer free consultations, educational webinars, market newsletters, and timely updates to help traders remain informed and proactive. This holistic support system makes them a favorite among both retail and institutional clients.

How has Cannon Trading Company not only survived but thrived in a notoriously competitive industry? Several key factors account for their enduring success:

Founded by industry veterans who recognized the importance of client trust and market expertise, Cannon Trading has always prioritized ethical conduct and innovation. Their forward-thinking approach has kept them ahead of the curve.

While staying true to their core values, Cannon has continually evolved technologically. They’ve integrated new platforms, leveraged real-time data feeds, and offered cloud-based solutions to ensure clients have the most advanced tools at their disposal.

Cannon Trading invests heavily in client education. From beginner tutorials to advanced trading techniques, they provide a treasure trove of resources to foster client success. This not only builds loyalty but also enhances trading outcomes.

Many brokers at Cannon have remained with the company for decades. This stability ensures that clients receive guidance from experts who have weathered numerous market cycles and who understand long-term trading dynamics.

Futures trading offers enormous potential—but also significant complexity and risk. In this high-stakes arena, the value of partnering with a qualified, experienced, and client-focused futures broker cannot be overstated. Such professionals are strategic allies, risk managers, educators, and gatekeepers to success.

Among the many choices available, Cannon Trading Company stands out as one of the best futures brokers due to its client-first approach, stellar regulatory record, long-serving staff, top-rated customer satisfaction, and commitment to trading excellence. Their unmatched combination of human touch, technological savvy, and institutional integrity makes them a benchmark in the world of futures trading.

Whether you are a new trader taking your first steps or a seasoned professional seeking a partner for sophisticated strategies, Cannon Trading offers a rare blend of tradition and innovation—a partnership built to last in the dynamic world of trading futures.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

5 Critical Pitfalls to Avoid When Choosing a Futures Trading Platform

In today’s fast-paced financial world, traders and investors alike are constantly seeking the most effective and feature-rich tools to gain an edge in the market. Among the most vital tools is the best futures trading platform, which can make or break a trader’s ability to succeed. With numerous options available for both retail and institutional traders, identifying the best trading platform futures can be overwhelming. This comprehensive paper explores what features define the best platforms for futures trading, how traders can leverage these features to choose the right fit for their needs, and why CannonX, developed by Cannon Trading Company, is the top contender in the space.

We will also explore the broader offering of Cannon Trading Company, from its professional-grade institutional trading platform support to their exceptional customer service, making it not just about CannonX, but about a complete ecosystem for futures online trading platform excellence.

The term best futures trading platform encompasses a wide range of features and criteria that traders look for to meet their unique goals. Some of these features include:

Each of these features plays a significant role in defining the best trading platform futures users seek, especially those engaging in futures contract trading where timing, information, and execution precision are paramount.

Speed is a critical factor when trading futures contracts. A delay of even a fraction of a second can mean the difference between profit and loss.

Charting capabilities help traders visualize market patterns and execute trades based on technical indicators.

Access to real-time futures quotes is crucial to ensure traders are making decisions based on current market conditions.

A customizable layout allows traders to organize their screens for optimal workflow.

Modern trading requires the ability to act from anywhere. A robust mobile app platform allows traders to manage positions on the go.

DOM provides insights into market liquidity and potential price movement.

Risk tools such as stop-loss, take-profit, and margin alerts are essential for responsible trading.

Traders using automated strategies need access to open APIs.

Platform integrity relies heavily on strong cybersecurity and compliance with financial regulations.

Customer Service and Broker Access

Direct access to experienced brokers provides a huge edge.

CannonX embodies every single one of the features outlined above. Here’s how it stands out as the best trading platform futures solution today:

It is not simply a tool, but a complete ecosystem that caters to both retail and institutional needs, making CannonX the undisputed best futures trading platform.

While CannonX is the flagship futures online trading platform, Cannon Trading Company delivers far beyond a single product. Here’s what makes them a superior brokerage:

When choosing a futures online trading platform, consider the following:

By cross-referencing these factors with what CannonX and Cannon Trading Company offer, it becomes evident why they provide one of the best platforms for futures trading.

In a crowded landscape of trading platforms, the best futures trading platform isn’t just about having the most buttons and indicators. It’s about synergy—how all these features work together to support your trading goals. CannonX exemplifies this synergy with its seamless blend of speed, depth, control, and mobility. When paired with Cannon Trading Company’s unmatched brokerage support, you get not only the best trading platform futures traders can ask for but also the most reliable and empowering trading experience in the industry.

From real-time futures quotes to high-end institutional trading platform tools and unbeatable customer support, Cannon Trading Company has earned its reputation as the top choice for futures contract trading. Whether you’re a day trader looking for a responsive futures app, or a fund manager needing precision and compliance, this is where you find your trading home.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading