Trump Speaks Tomorrow

During Market Hours!

+

Treasury Notes, Micro Grains

Tomorrow should be another volatile day!

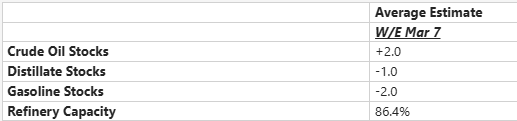

With Trump speaking, Fed speaker, ADP weekly claims and crude oil inventories – we suspect the current volatility will continue.

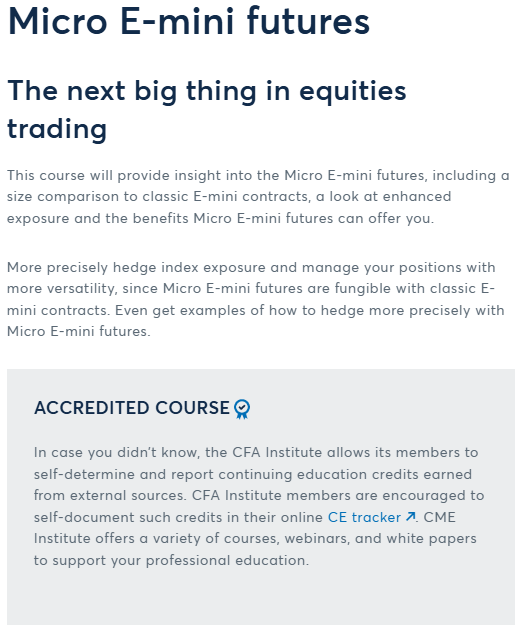

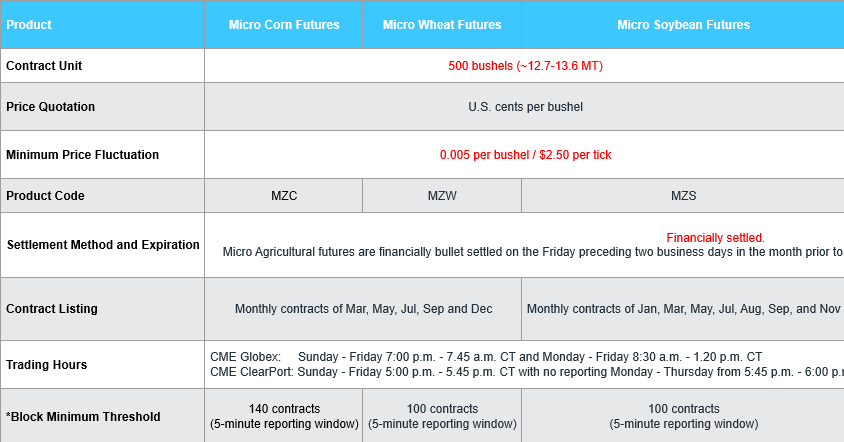

On a different note – MICRO GRAINS are available

MICRO GRAINS

After the first three weeks of trading, we are approaching just under a half million Micro Grains contracts traded for Micro Corn, Micro Soybean, Micro Soybean Oil, Micro Soybean Meal, and Micro Wheat, as well as some other quick hits below.

Try MICRO Grains, grain futures and many other futures with our REALTIME state of the art FREE platform!

FREE DEMO HERE

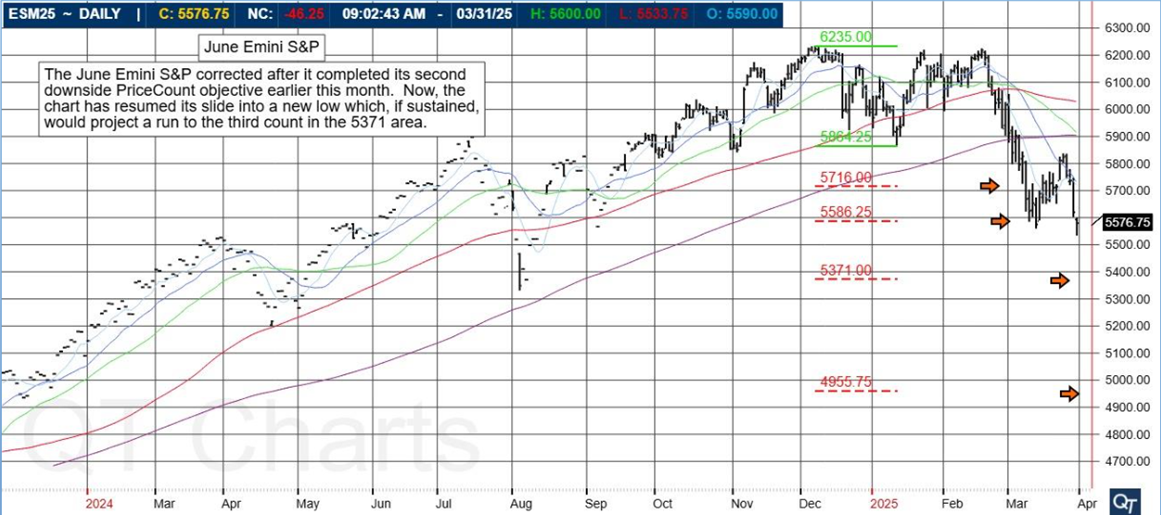

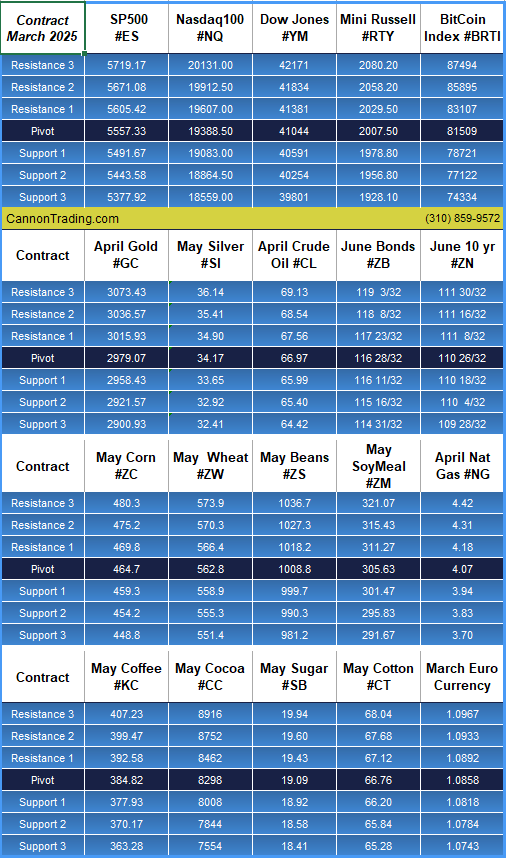

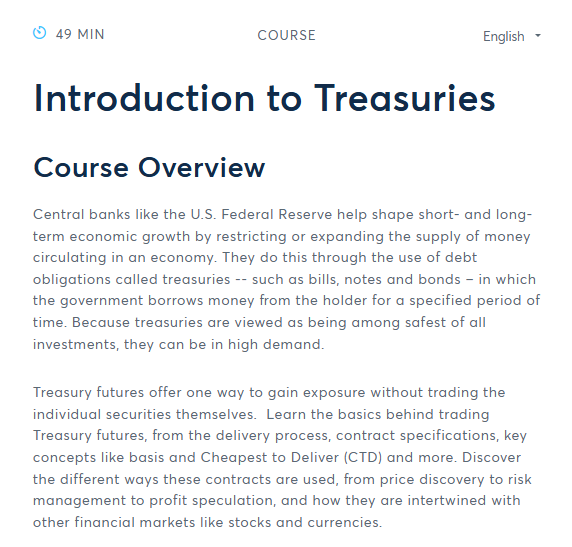

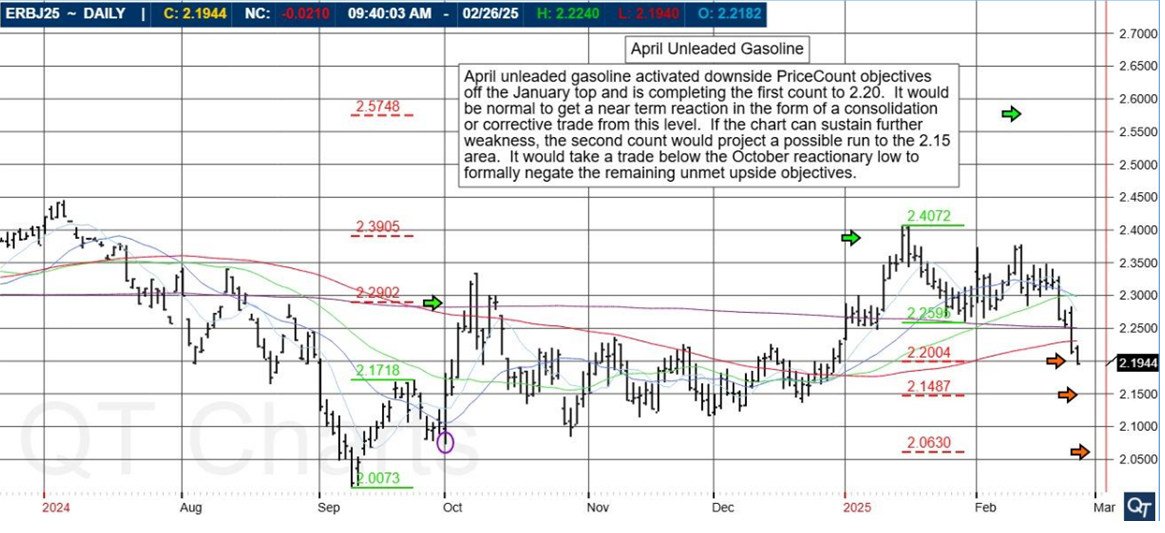

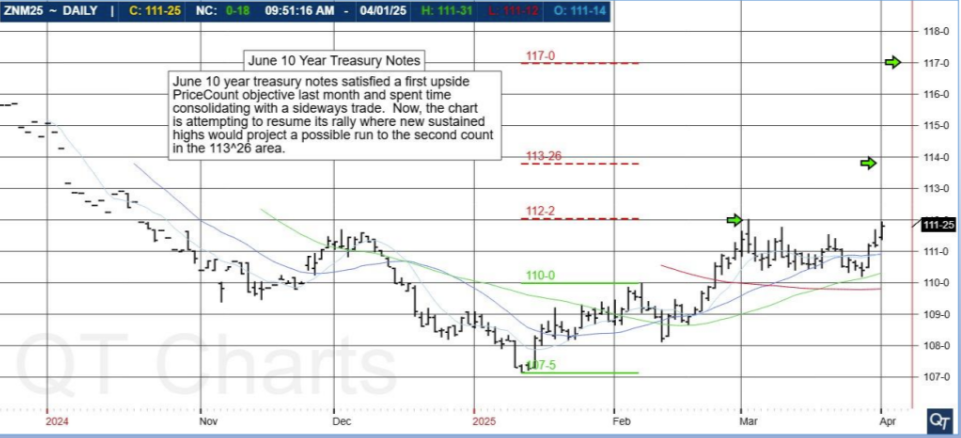

June 10 Year Treasury Notes

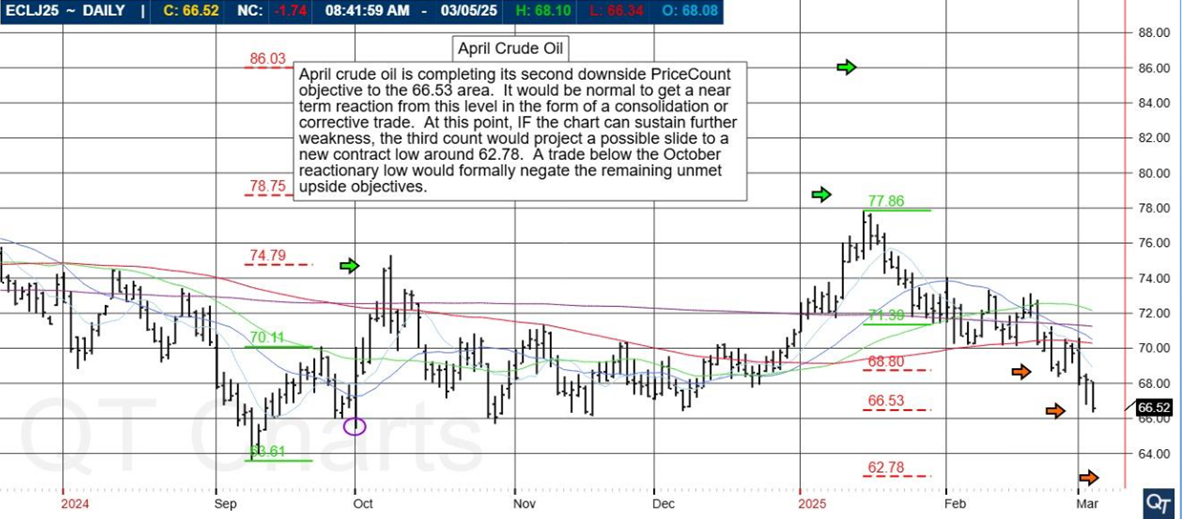

June 10 year treasury notes satisfied a first upside PriceCount objective last month and spent time consolidating with a sideways trade. Now, the chart is attempting to resume its rally where new sustained highs would project a possible run to the second count in the 113^26 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

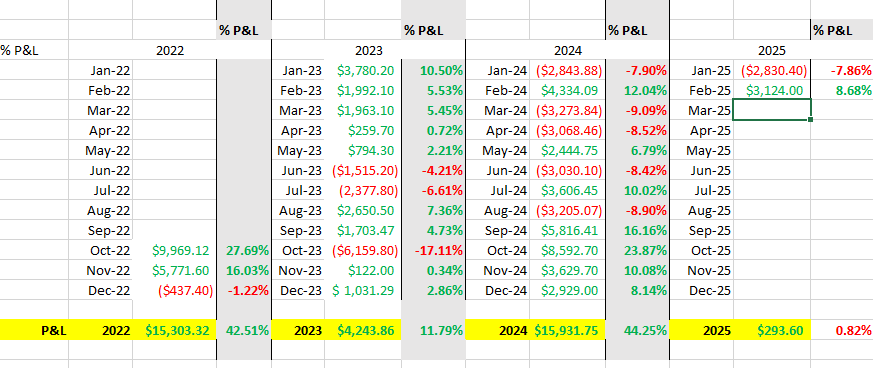

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

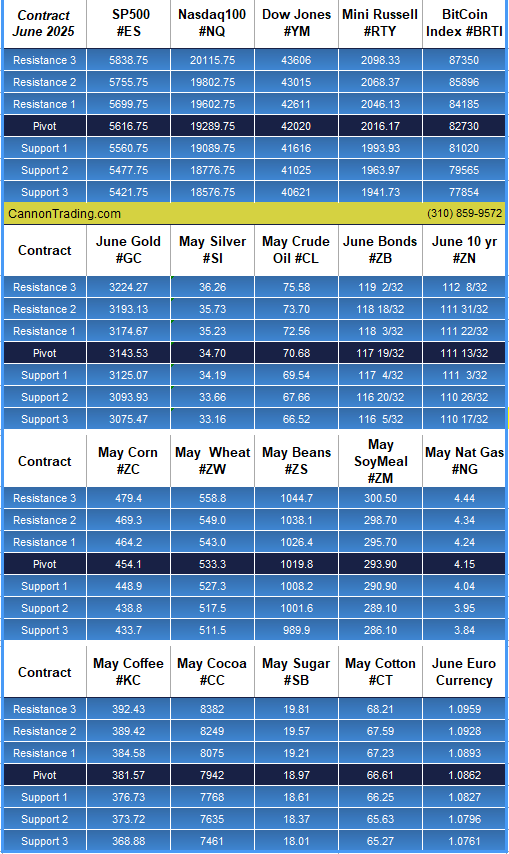

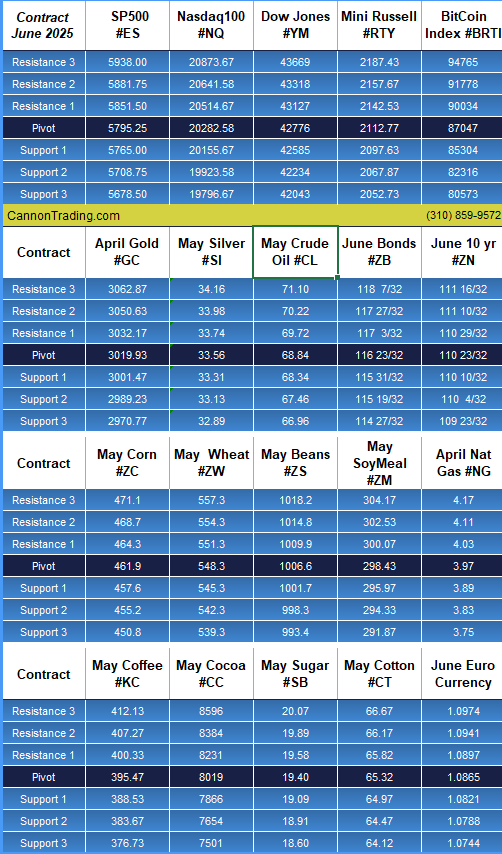

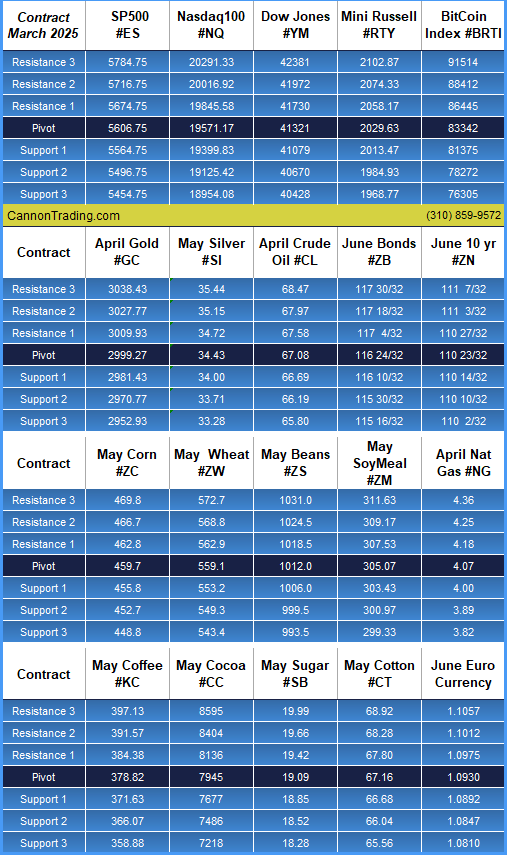

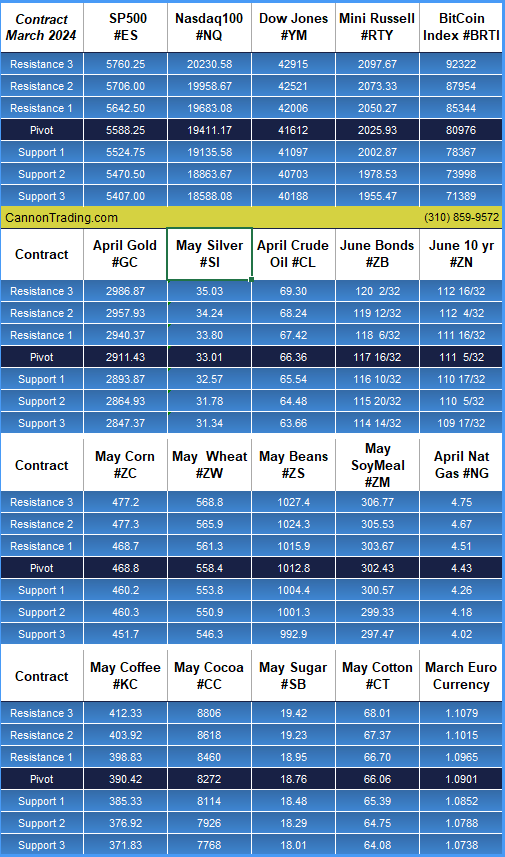

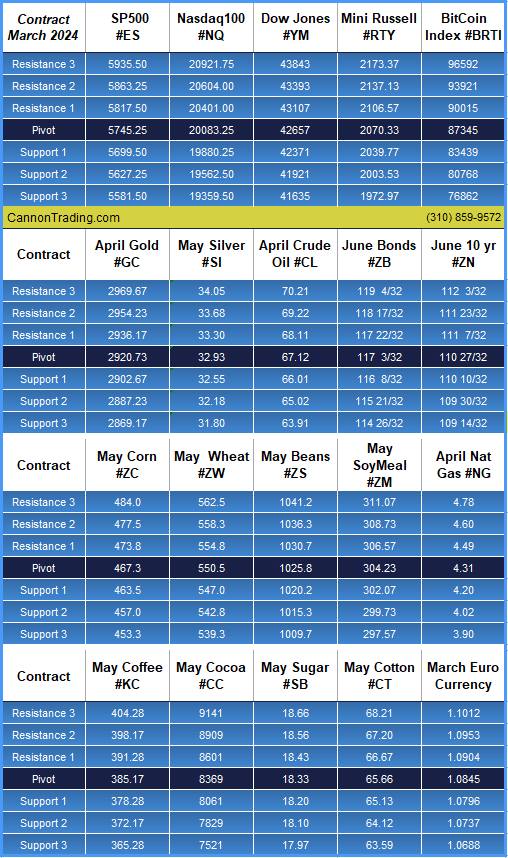

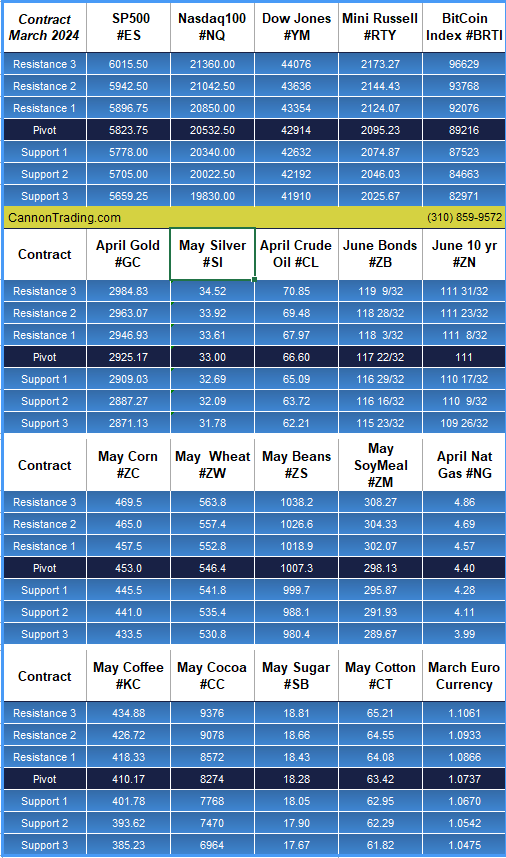

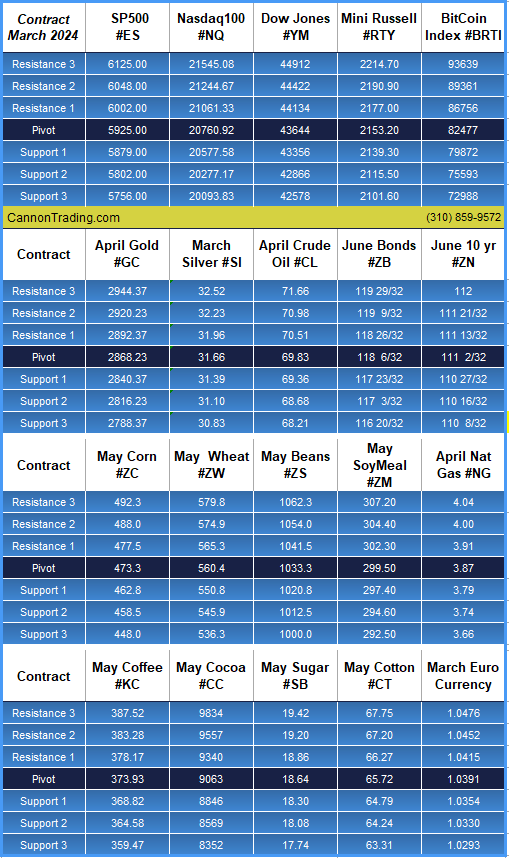

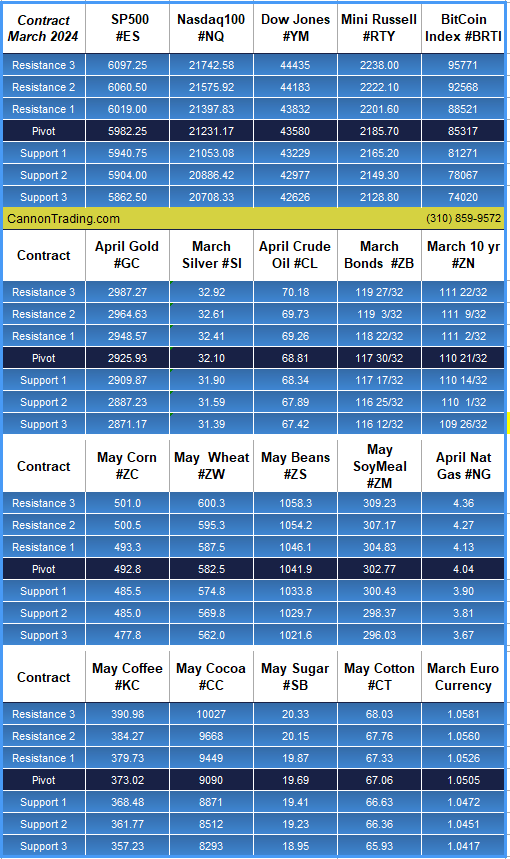

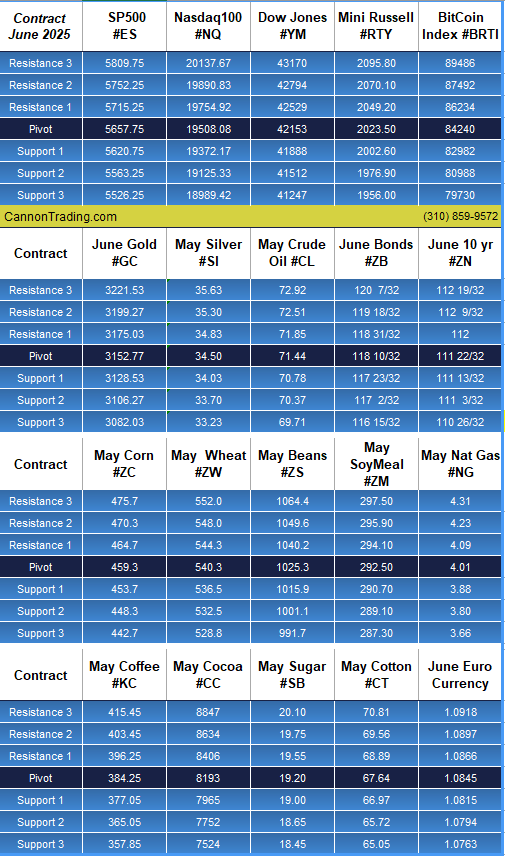

Daily Levels for April 2nd, 2025

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

Click here for quick and easy instructions.

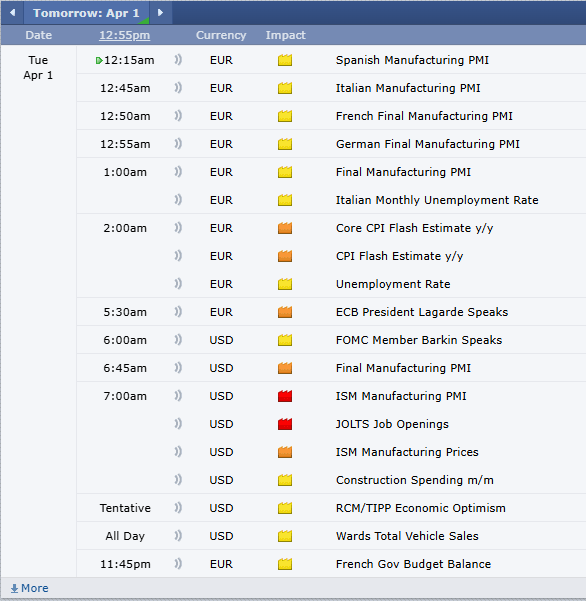

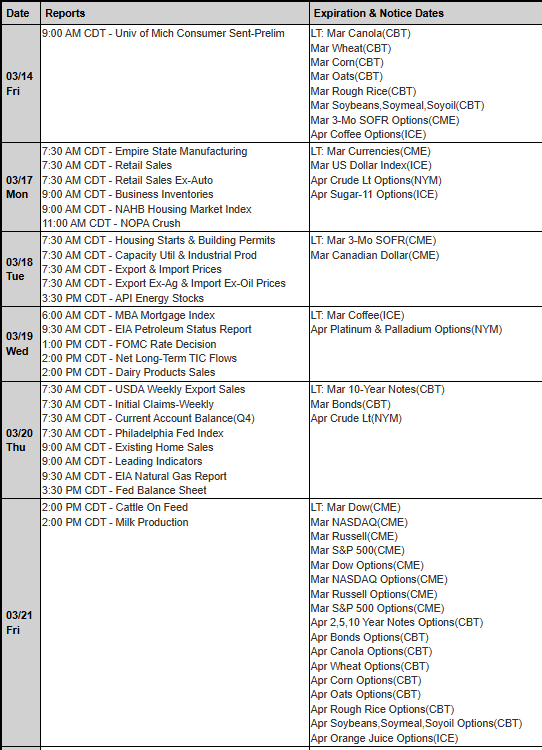

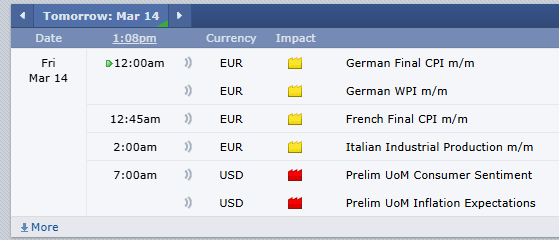

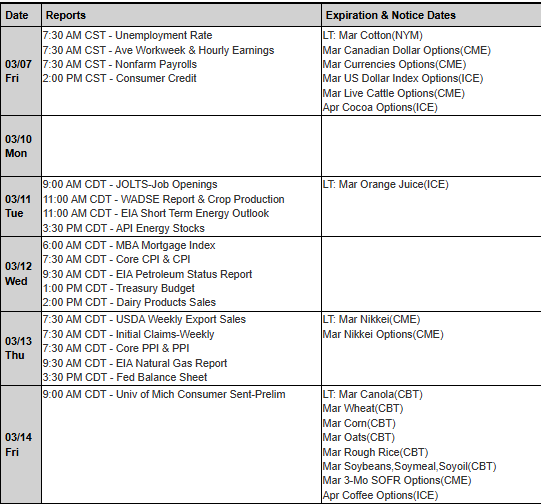

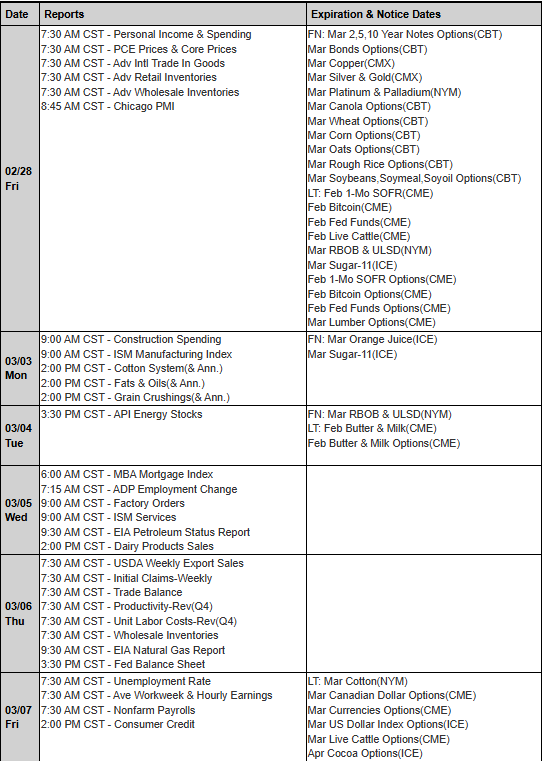

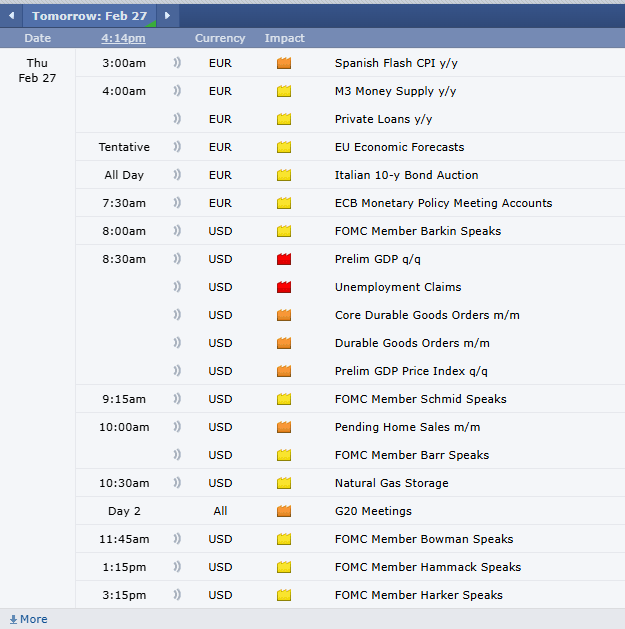

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|