Dow-Jones In Real Time

Providing exposure to 30 of the largest companies in the U.S., the Dow-Jones futures market is directly correlated to the value of the Dow-Jones Industrial Average. Among the most liquid contracts on the exchange, the Dow futures are a favorite for all types of traders. Whether you are a scalper live streaming online, or you’re a position trader placing phone orders, the Dow futures are a diverse landscape with traders participating from all over the world.

Real time quotes are widely available across media outlets, trading platforms, and brokerages. The E-Mini Dow futures(YM) trade on the CBOT as part of the CME Group. Minimum tick size is one point with a value of $5.00 per point, per contract. The notional value of the E-Mini Dow contract can be calculated using the value of the Dow Jones Industrial Average times $5. A smaller alternative, the E-Micro Dow(MYM) contract trades at one-tenth the format of the former, or $0.50 per tick.

The Dow-Jones Advantage

Dow-Jones futures offer competitive margin requirements and leverage, allowing responsible investors and traders the opportunity to hedge larger positions with less capital. For U.S. Traders, the IRS classifies broad based index futures such as the Dow Futures under the 60/40 rule which allows trading profits to be taxed at 60% the more favorable capital gains rate, and only 40% as ordinary income (Check with a CPA before trading.)

As an investment device, the Dow-Jones futures provide real time leveraged exposure to the index value, which promotes capital efficiency for investors and traders. This means that skilled risk managers, like yourself, will no doubt find competitive and creative solutions to manage risk.

The Dow Jones Futures market is a competitive market for tools and platforms to trade with. Hence, a plethora of options are available to both retail and professional traders. The Dow-Jones Futures are traded on by many brokerages, software, and platforms, with access to real time data quotes being provided from the exchange through several different data providers.

Dow Jones Futures Live Stream

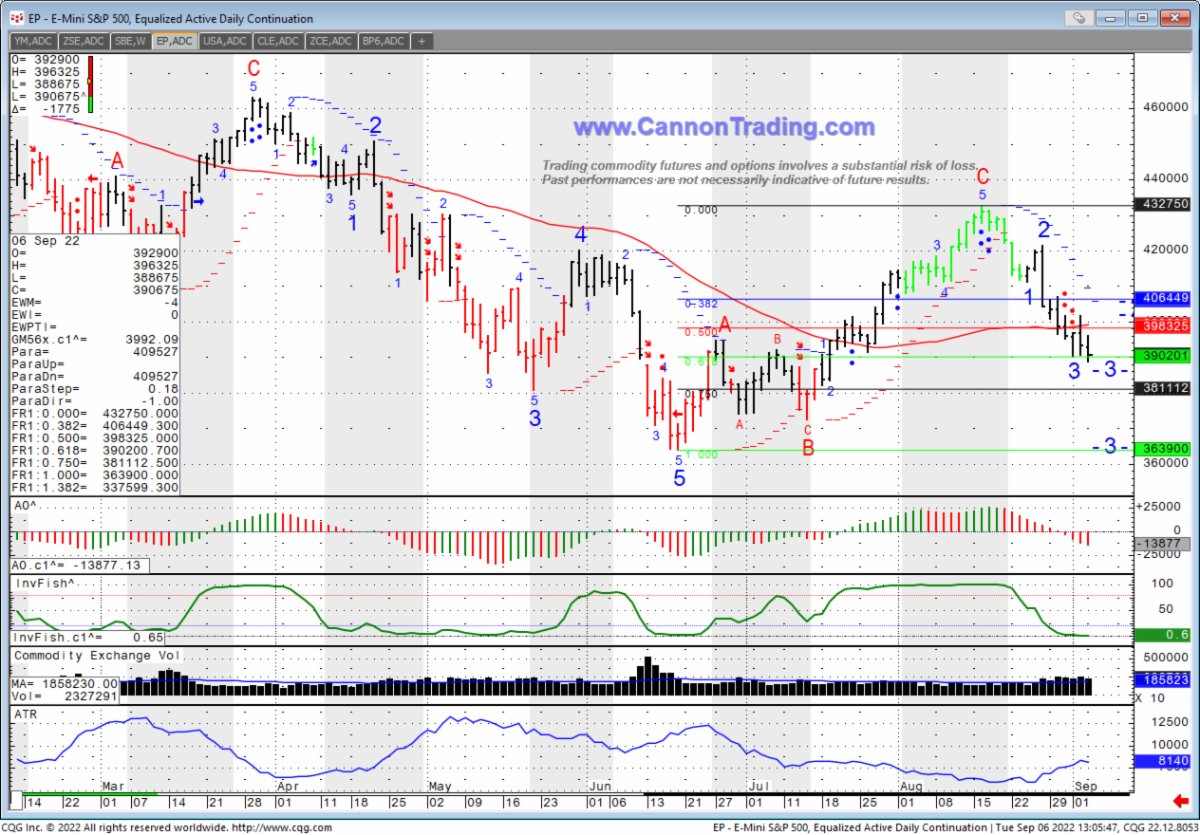

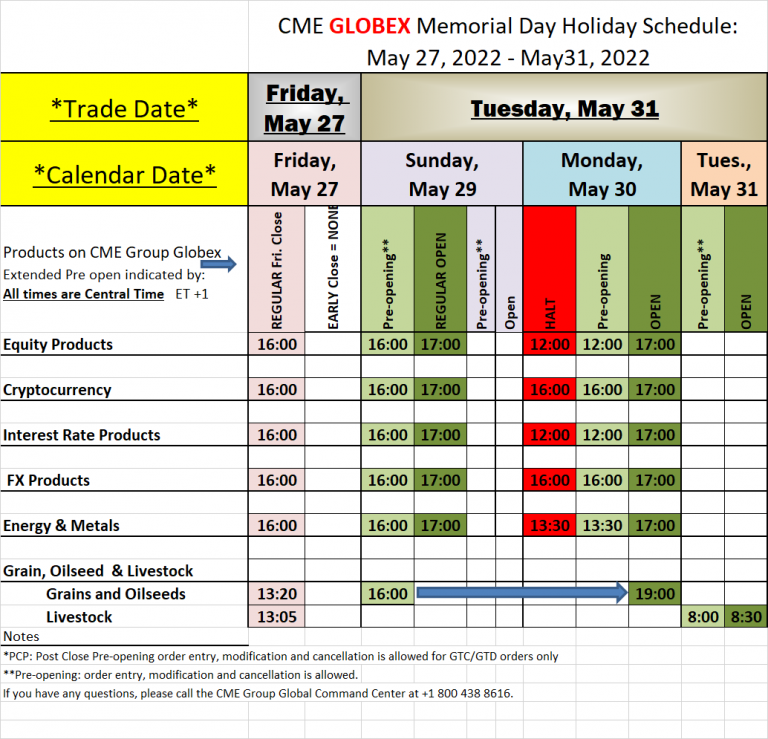

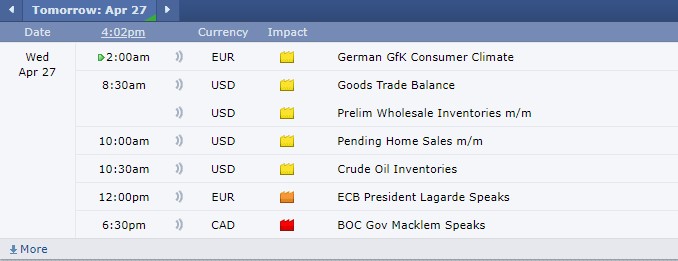

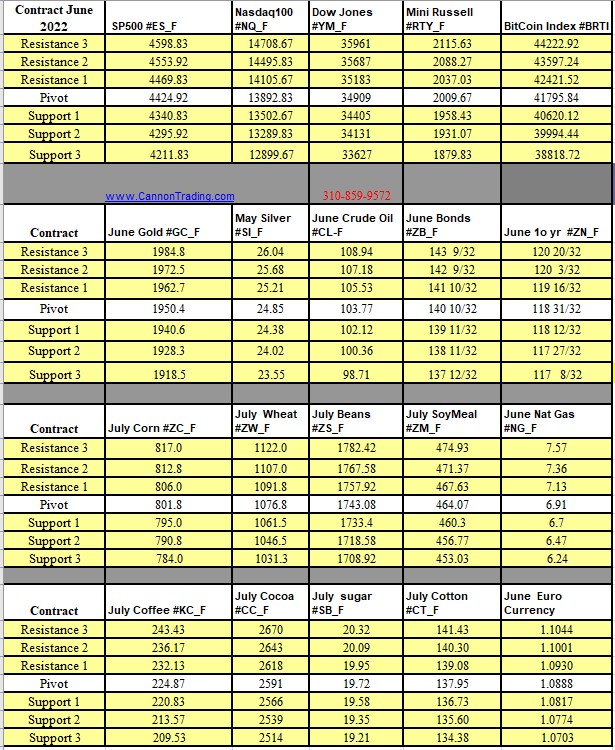

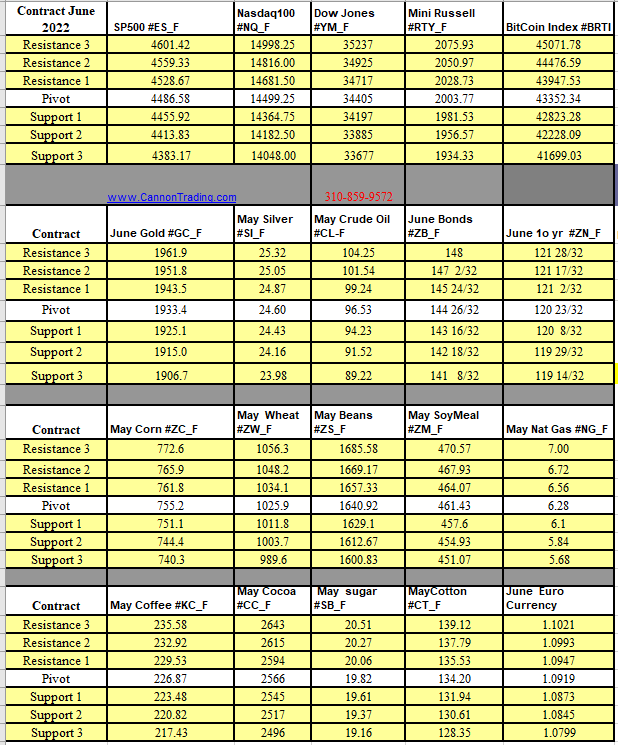

The Dow-Jones futures market shares a strong correlation to the other U.S. Index futures such as the Nasdaq 100, S&P500, and Russell 2000 contracts. This means that the U.S. markets tend to reflect the movement of one another with additional correlations to the bond markets, currencies, and many other commodities such as gold, silver, etc. Notably, the futures trade nearly 24 hours a day through the week, from Sunday evening until Friday. It’s arguable that if you consider the ease of shorting, capital efficiency, etc. it makes futures a much more valuable tool than ETF’s. Additionally, also available are the Dow Futures Options contracts which expire monthly. Be sure to understand your risks, and consult with your broker before trading.

Key Points of the Dow-Jones Futures Market

- Dow-Jones Futures provide leveraged exposure to the DJIA for traders and investors. Take caution when you are approaching a leveraged environment, as the risks can be substantial.

- Multiple Contract Sizes for different sized investors, traders, and strategies

- E-Mini(YM) – $5 per point

- E-Micro(MYM) – $10 per point

- Profits are taxed more favorably at the 60/40 rate.

- Trade nearly 24 hours a day, 6 days a week.

You can download one of our trading platforms with live data and the options board here

E-Futures International | Futures Trading Platform & Broker Demo Account (cannontrading.com).

We will be happy to screen share with you and answer any questions you may have about futures related inquiries.

Author: Josh Meyers, Broker at Cannon Trading Company

Important: Trading commodity futures and options involves a substantial risk of loss. Therefore, recommendations contained in this letter are of opinion only and do not guarantee any profits. There is not an actual account trading these recommendations and past performances are not necessarily indicative of future results.