The corn futures contract holds a pivotal place in the world of futures trading, serving as a key tool for agricultural producers, investors, and speculators alike. Its history, evolution, and future prospects provide a fascinating lens through which to explore the complexities of the trading futures market. This article delves into the origins of the corn futures contract, traces its development over time, forecasts its trajectory for 2025, and examines why Cannon Trading Company is a standout brokerage in this domain.

Origins of the Corn Futures Contract

The concept of futures trading emerged in the 19th century, coinciding with the industrialization of agriculture in the United States. Farmers, processors, and distributors faced volatile prices due to unpredictable weather, market demand, and global economic conditions. To address this, the Chicago Board of Trade (CBOT), established in 1848, pioneered standardized contracts for agricultural commodities.

Corn, being a staple crop with vast economic significance, became one of the first commodities to have a futures contract. The introduction of the corn futures contract allowed farmers to lock in prices for their crops before harvest, thereby mitigating the risks associated with fluctuating prices. Similarly, buyers like millers and exporters benefited from the ability to secure a consistent supply at predictable costs. The contract was initially straightforward, detailing a specific quantity of corn to be delivered at a future date, with quality and delivery standards set to minimize disputes.

Evolution of the Corn Futures Contract

Over the decades, the corn futures contract underwent significant transformations to meet the changing demands of the market. The CBOT implemented innovations to enhance liquidity, transparency, and accessibility in futures trading. By the mid-20th century, electronic trading platforms replaced the open outcry system, making it easier for traders worldwide to participate.

Advancements in technology allowed for the introduction of mini and micro corn futures contracts, enabling smaller traders to access the market. Margin requirements and position limits were refined to ensure market stability while accommodating both large-scale institutional investors and individual speculators. Additionally, the rise of algorithmic trading brought new efficiencies and challenges to the trading futures landscape.

As global trade expanded, the corn futures market reflected the crop’s international importance. Corn’s applications diversified, with demand increasing for its use in ethanol production, livestock feed, and processed foods. This broadened the participant base for corn futures contracts, attracting not only agricultural stakeholders but also energy companies, food manufacturers, and hedge funds.

The Corn Futures Market in 2025

Looking ahead to 2025, the corn futures contract is poised for further evolution. Several trends are shaping its trajectory:

- Sustainability and ESG Factors

As environmental, social, and governance (ESG) criteria gain prominence, the corn futures market is adapting. Traders and investors are increasingly considering sustainability metrics, such as carbon emissions associated with corn production, when engaging in futures trading. - Technological Innovations

Blockchain technology is expected to enhance traceability and transparency in trading futures. Smart contracts may automate aspects of the corn futures contract, reducing administrative burdens and increasing efficiency. - Climate Change and Supply Chain Challenges

Unpredictable weather patterns, driven by climate change, are likely to make the corn market more volatile. This underscores the importance of corn futures contracts as risk management tools. Enhanced forecasting models and data analytics will play a critical role in navigating these challenges. - Global Market Dynamics

The growing role of emerging markets in global agriculture is anticipated to impact the trading futures ecosystem. Countries like Brazil and Argentina, major corn producers, are likely to influence prices and trading volumes on the CBOT and other exchanges.

Why Cannon Trading Company Excels in Futures Trading

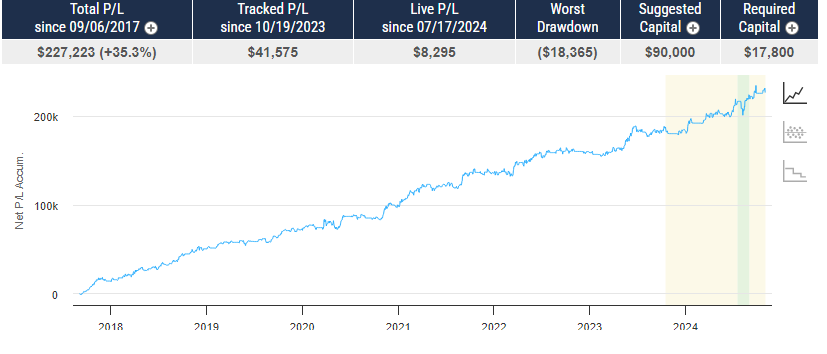

When engaging in trading futures, selecting the right brokerage is crucial. Cannon Trading Company has earned its reputation as a top-tier firm, consistently rated 5 out of 5 stars on TrustPilot. With decades of experience in the futures trading industry, Cannon Trading combines expertise, technology, and exceptional customer service to offer unparalleled support to traders.

Key Advantages of Cannon Trading Company:

- User-Friendly Platforms

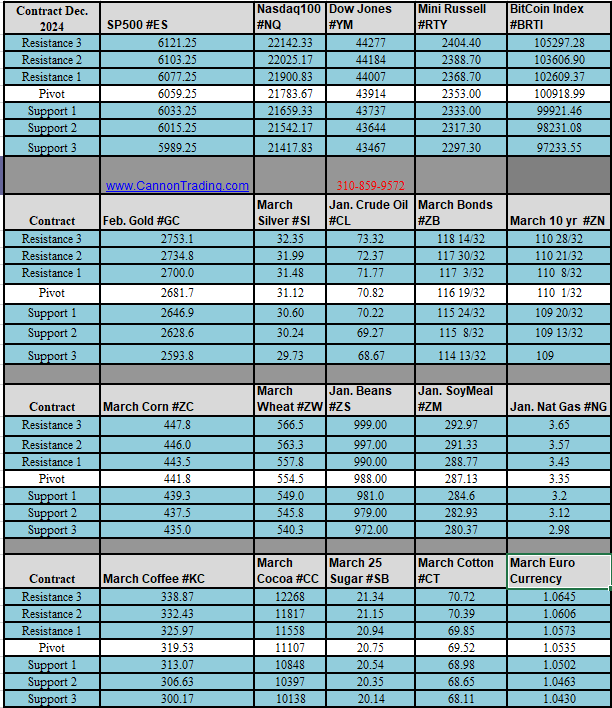

Cannon Trading provides a range of free trading platforms tailored to diverse trading styles. Whether you are a seasoned professional or a newcomer to trading futures, their platforms are intuitive, reliable, and equipped with advanced charting tools. - Regulatory Excellence

In an industry where trust is paramount, Cannon Trading stands out for its exceptional regulatory reputation. As a member of the National Futures Association (NFA) and registered with the Commodity Futures Trading Commission (CFTC), the firm adheres to the highest standards of compliance and transparency. - Personalized Service

Unlike many large brokerages, Cannon Trading emphasizes personalized service. Their team of experienced brokers works closely with clients to develop customized strategies for corn futures contracts and other commodities. - Educational Resources

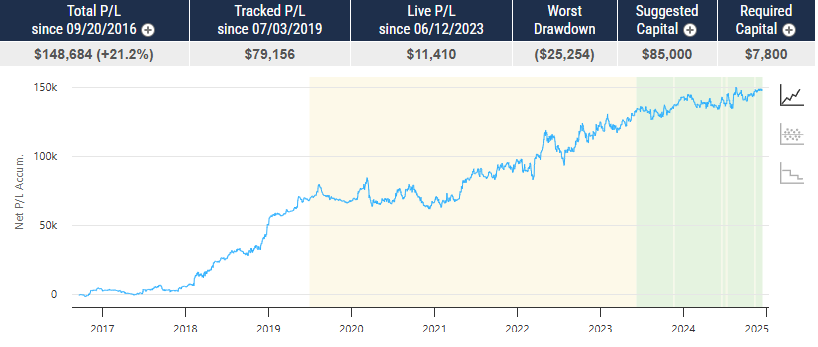

For traders seeking to deepen their understanding of futures trading, Cannon Trading offers a wealth of educational materials. From webinars to market analysis, they empower clients with the knowledge needed to succeed in trading futures. - Proven Track Record

Cannon Trading’s decades of experience in the futures trading industry translate into deep market insights and robust risk management strategies. This makes them an ideal partner for navigating the complexities of the corn futures contract.

The Strategic Importance of Corn Futures Contracts

The enduring relevance of the corn futures contract lies in its ability to provide stability and opportunity in an unpredictable market. For farmers, it is a lifeline, enabling them to secure income regardless of market conditions. For investors and speculators, it offers a chance to capitalize on price movements driven by factors like weather, trade policies, and global demand.

In today’s interconnected world, trading futures is more than a financial activity—it’s a way to manage risks and contribute to the smooth functioning of essential supply chains. The versatility of the corn futures contract ensures its place as a cornerstone of the futures trading ecosystem.

The corn futures contract is a testament to the ingenuity of the trading futures market, evolving from its humble beginnings in 19th-century Chicago to a sophisticated global instrument. Its adaptability to changing market conditions and technological advancements underscores its resilience and relevance.

As we look to 2025, the corn futures market is set to embrace innovations that enhance efficiency, sustainability, and inclusivity. For those seeking to navigate this dynamic landscape, Cannon Trading Company offers the expertise, tools, and support needed to excel in futures trading. With its stellar reputation, free trading platforms, and decades of experience, Cannon Trading is the brokerage of choice for those engaging in corn futures contracts and beyond.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading