|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (309)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,162)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures trade copier (1)

- Futures Trading (1,268)

- futures trading education (446)

- Gold Futures (113)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (144)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (432)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Category: Metal Futures

Trading metal futures? If you are planning to, then it is important to know that in this kind of trading you always have to come prepared. Do your homework and track the indices daily. Take out time and check how metals are doing in different parts of the world.

Take a look at the Eastward market every day. The first markets to open are the Asian ones. Begin your tracking of indices from here. Apart from this you will also have to be regular with reading the business reports. There is much work for you to do before you put your money in metals futures.

Because trading requires one to take out a considerable amount of time for studying and analyzing, and because a lot of people have everything but time, there are traders and brokers. We at Cannon Trading can assist you with trading. If you want to trade yourself, we give you the advice. In short, we are there to help you with whatever you have got. Here we have a category archive that lists some informative blogs on metal futures and trading. Go through these valuable posts to increase your knowledge of metal futures.

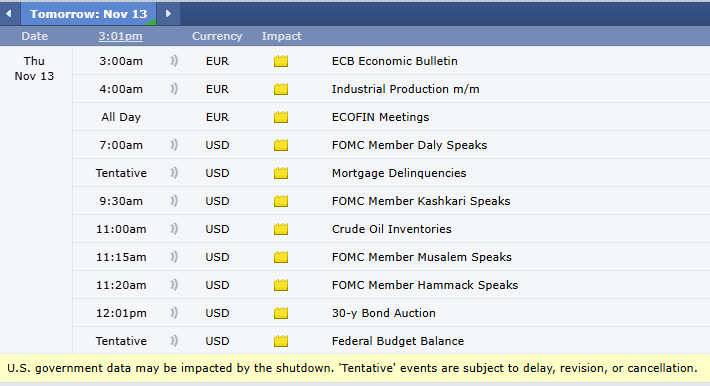

End of the Longest Shutdown? PLUS: Metals, Energies, Natural Gas; Nov. 26 Soybeans, Levels; Your 6 Important Can’t-Miss Updates for Futures Trading on November 13th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

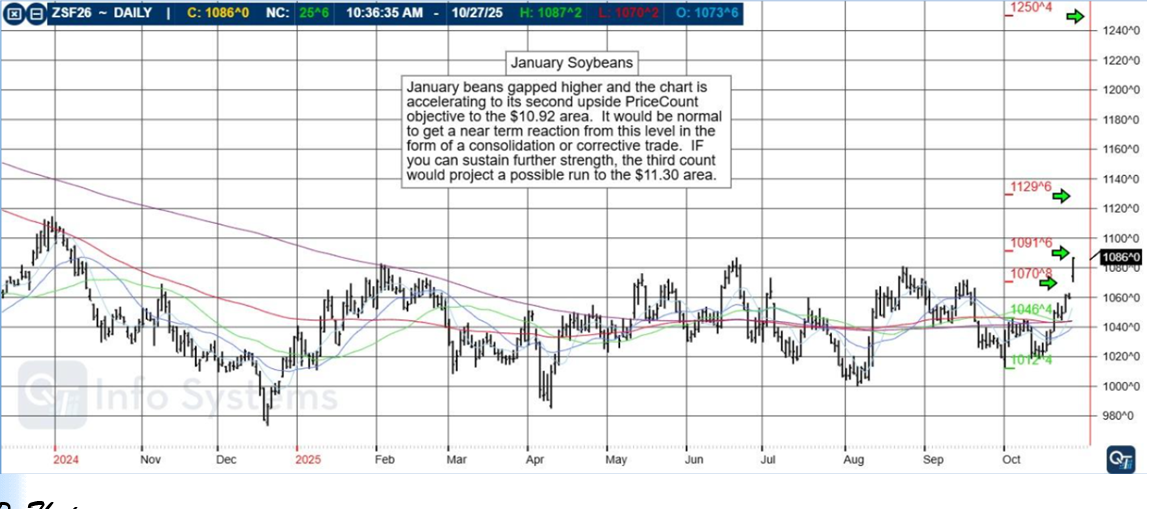

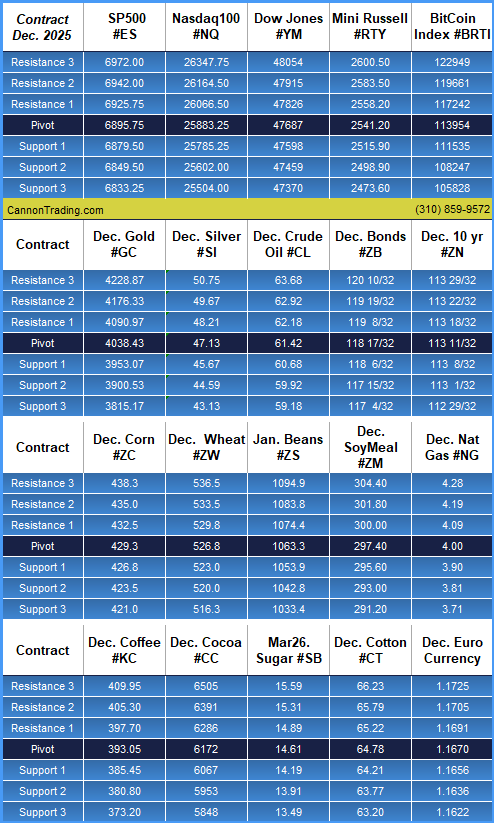

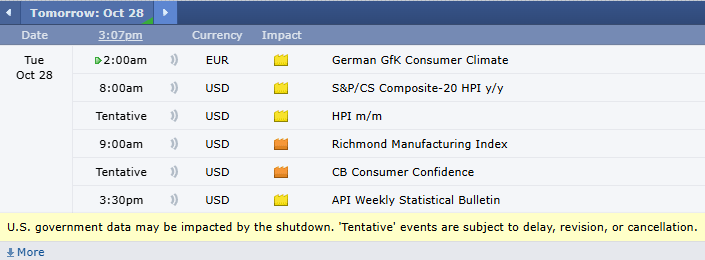

January Beans, Why Many Traders Lose Money Trading Futures (WITH CAN’T MISS VIDEO!!!!), Levels, Reports; Your 4 Need-To-Knows for Trading Futures on October 28th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

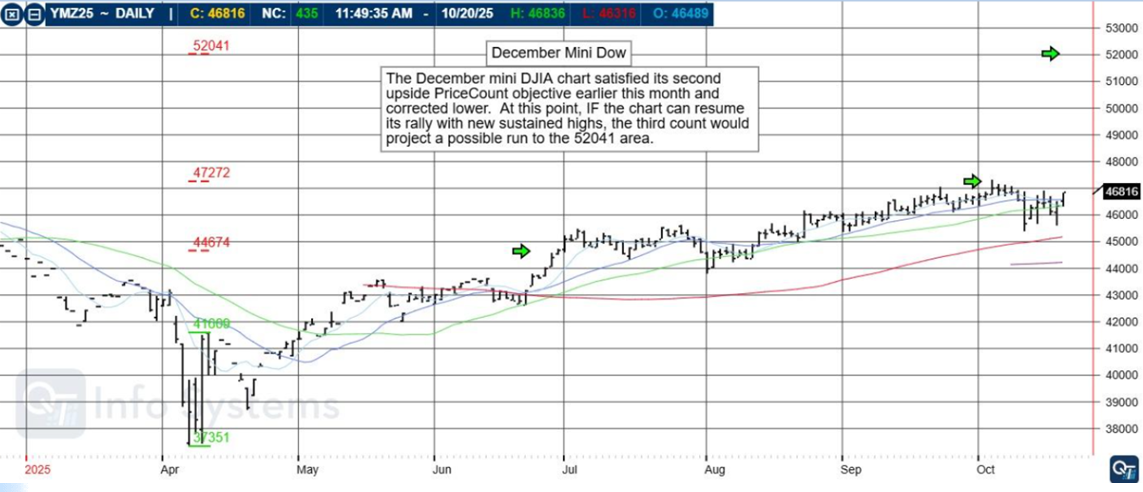

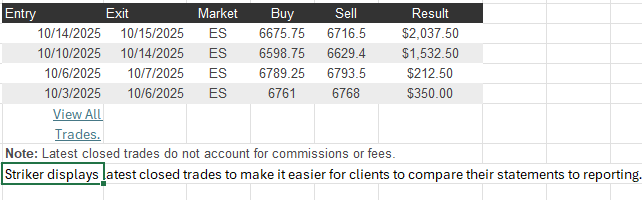

Overnight Edge, December Mini Dow, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 21st, 2025

|

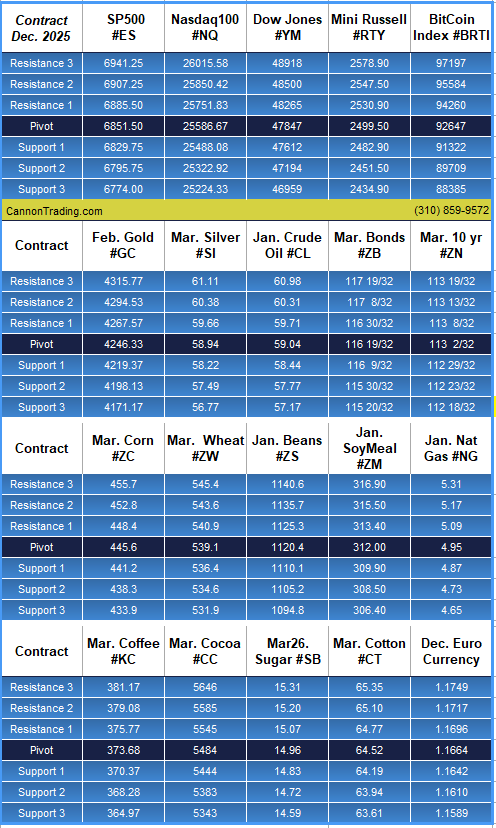

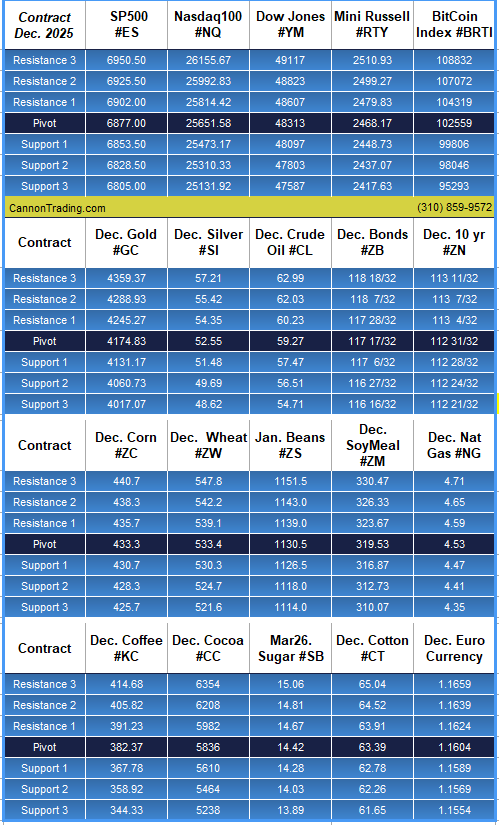

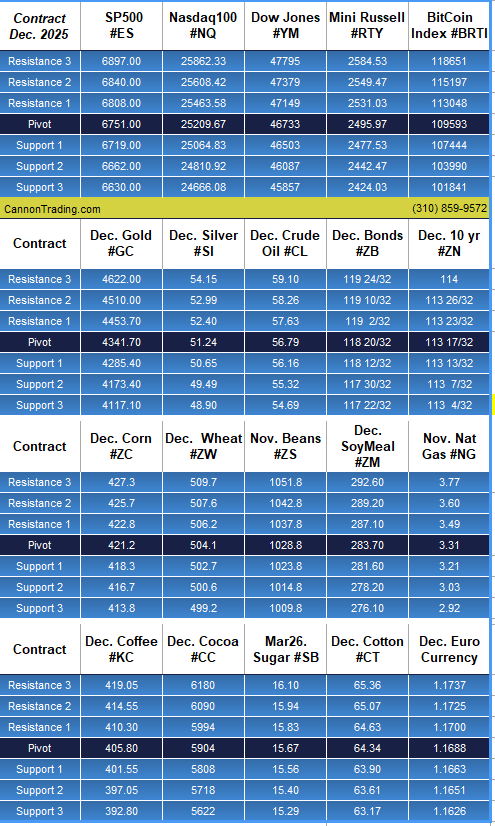

At-a-Glance Levels

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

| Gold (GC) — Dec (GCZ5) | 4173.40 | 4285.40 | 4341.70 | 4453.70 | 4510.00 | ||

| Silver (SI) — Dec (SIZ5) | 49.49 | 50.65 | 51.24 | 52.40 | 52.99 | ||

| Crude Oil (CL) — Nov (CLX5) | 55.32 | 56.16 | 56.79 | 57.63 | 58.26 | ||

| Dow Jones (YM) — Dec 2025 | 46087 | 46503 | 46733 | 47149 | 47379 |

Over the past few months, and especially in recent weeks, we’ve seen unusually large overnight moves. Some moves appear random, others reverse quickly, and some are driven by headlines such as tariff news. These dynamics have increased gap risk, reduced overnight liquidity, and produced frequent open-time dislocations.

Common question

Where is the edge?

Short answer

- Trade the first 30 minutes and focus on short-term gap-fill or rejection setups.

- Use same-day options when you expect a large directional move to limit tail risk and avoid being stopped out only to see the market move in your favor.

- Trade spreads when relative strength diverges across instruments (for example, gold vs silver or mini-Dow vs ES).

Extended answer

I want to focus on the practical elements of trading like pre-market context, move behavior, market news correlation, liquidity, options limits, and whether to use mean reversion or momentum. I’ll also want to highlight key parts like risk management, stop placement, and position sizing. Planning should be direct with a simple checklist and no more than six sections. I should also consider using a relevant citation about tariff-related movements, but just one, and make sure it’s only placed where necessary. No framing or extra explanations.

Futures day-trading edge

You find edge by matching a repeatable hypothesis to the current market regime, then executing it with strict risk and execution rules.

Regime diagnosis (what the market is doing now)

- Volatility regime: large overnight gaps and erratic premarket prints mean the market is in a news-driven, headline-sensitive volatility regime.

- Catalyst profile: moves are often tied to macro headlines and tariff noise; those headlines create directional gaps that either persist into the session or sharply reverse at the open.

- Liquidity profile: overnight liquidity is thin and fragmented, increasing slippage and fake outs at the open.

Reliable, tradeable edges you can use

- Pre-open directional bias with size filter. Trade opens when overnight gap exceeds a threshold (e.g., 0.5% or X ticks) and pre-market order flow confirms (sustained prints, not one-off sweep).

- Use reduced size and wider stops for gaps caused by headline noise.

- Fade headline gap into first 30 minutes when structure is weakIf gap lacks follow-through volume and price fails to make a clean microstructure breakout, favor mean reversion to the first-tail or VWAP.

- Trend-follow breakouts in high conviction regimeWhen overnight move is accompanied by aligned macro flow (rates, FX, commodities) and volume ramps into the open, follow momentum with a continuation plan.

- Volatility arbitrage playsUse options or calendar spreads where available to sell realized volatility after spikes and buy protection around known headline windows.

- Session-timing edgeTrade smaller and tighter in the first 15–30 minutes after the open; increase size after the market establishes structure (first clean high/low and confirmation).

- Microstructure edge: limit vs market tacticsUse passive limit entries near structural levels and aggressive exits into liquidity. Avoid market entries into thin pre-open auction prints.

Concrete execution rules (checklist)

- Pre-market checklist: identify gap size, top 3 headlines, correlated markets (bonds, FX, oil), and pre-open volume trend.

- Entry rules: require either structural confirmation (higher high / lower low) or a mean-reversion setup with defined edge-to-risk ratio ≥ 2:1.

- Sizing: reduce notional by 25–50% on headline-driven nights; increase only after two clean consecutive edges are realized.

- Stops and targets: place stop where edge invalidates (clearly definable price level); scale out at predefined targets; never trade without a stop.

- Slippage buffer: add tick buffer to stops and profit targets during thin liquidity opens.

How to test and keep the edge

- Backtest regime-specific rules: label historical sessions by overnight gap size and headline events, test mean-reversion vs momentum rules separately.

- Forward-test with small capital: run a two-week rolling simulator and log slippage, win rate, and expectancy.

- Adaptive rules: codify a volatility threshold that switches you between momentum and fade strategies automatically.

Brief trade plan template

- Hypothesis: (e.g., “Overnight tariff headline caused a 0.7% gap that lacks confirmatory volume; first 20 minutes will mean-revert to VWAP.”)

- Entry: limit at VWAP + X ticks or on 1-minute reversal candle.

- Stop: invalidation beyond the overnight high/low + slippage buffer.

- Target: partial at VWAP, final at first structure level.

- Size: 50% normal when gap driver = headline; full size only when macro alignment confirmed.

Be systematic: diagnose regime, pick the strategy that historically wins in that regime, enforce execution and risk rules, and iterate from measured data.

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this blog are of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future results.

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||

|

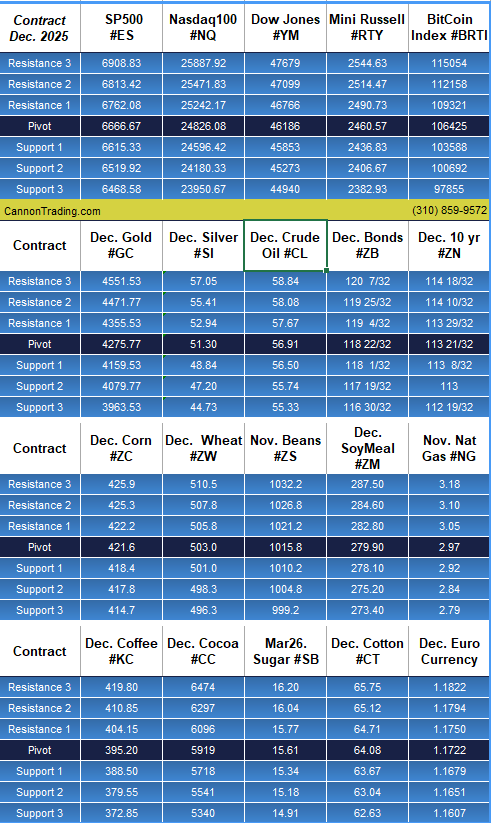

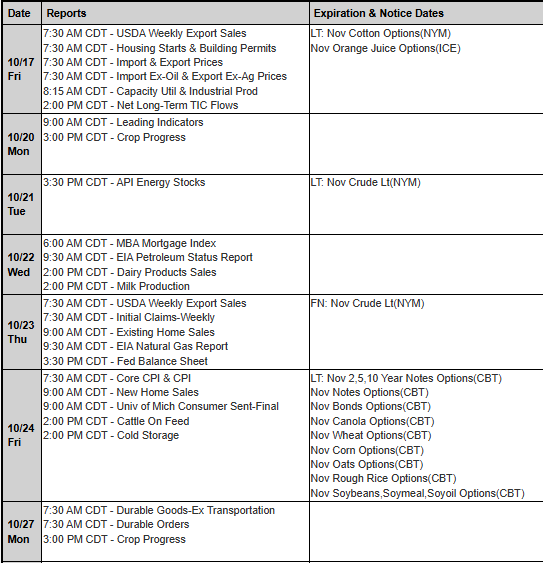

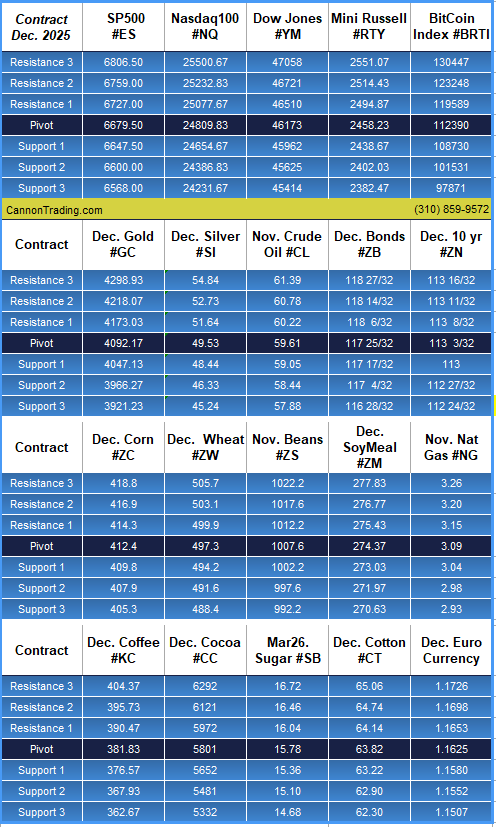

Less Data amidst Gov’t Shutdown, NEW WEBINAR, Dec. Crude Oil, Levels, Reports; Your 5 Important Must-Knows for Trading Futures the Week of October 20th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

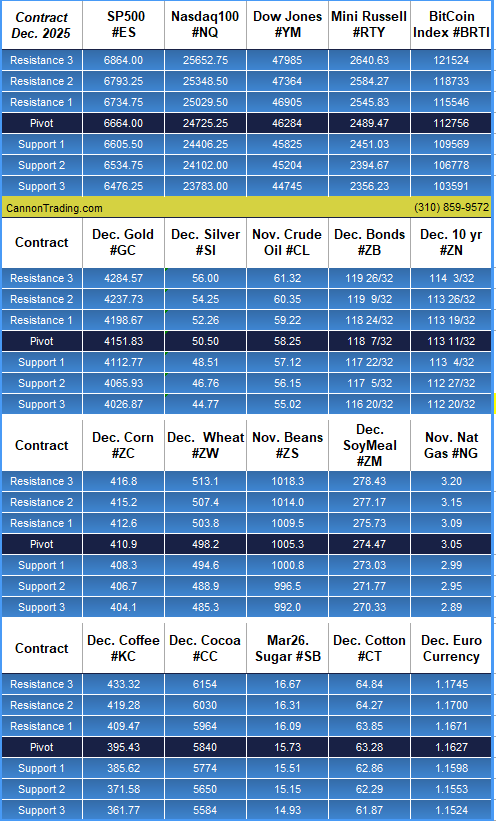

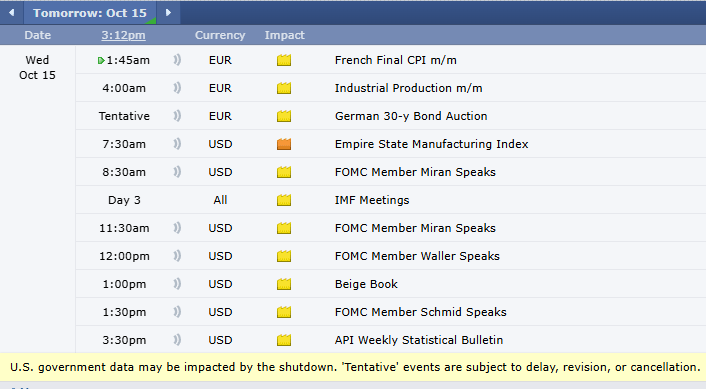

Options Trading, All Time Highs for Gold/Silver, Spread Trading Webinar TOMORROW, Levels, Reports; Your 5 Important Must-Knows for Trading Futures on October 15th, 2025

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

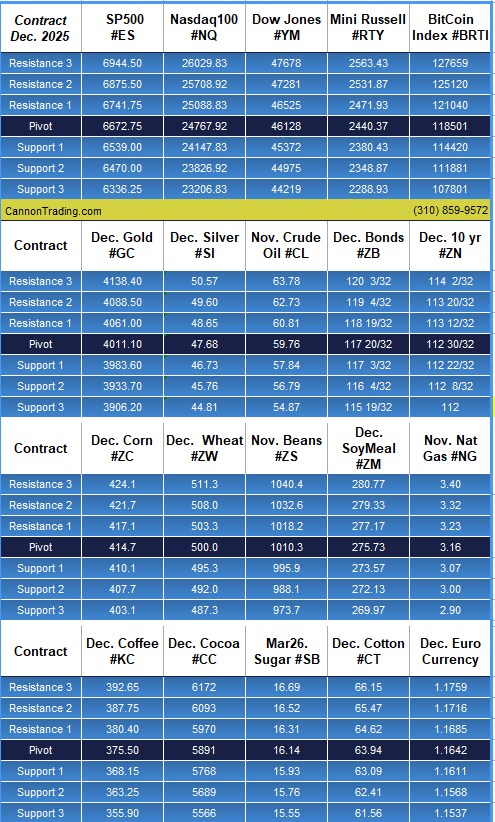

Volatility Tuesday! All-time Highs on Gold, December Cocoa, Levels, Reports; Your 5 Important Must-Knows for Trading Futures on October 14th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

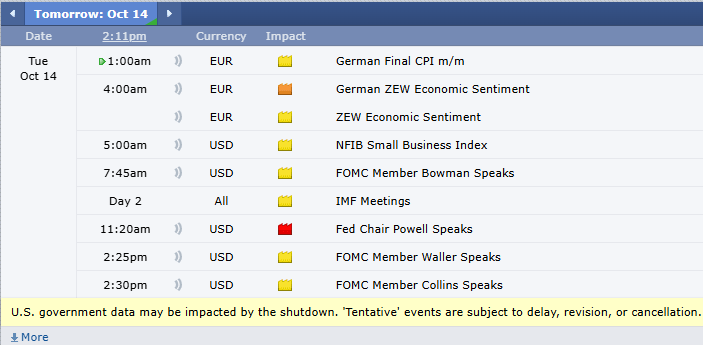

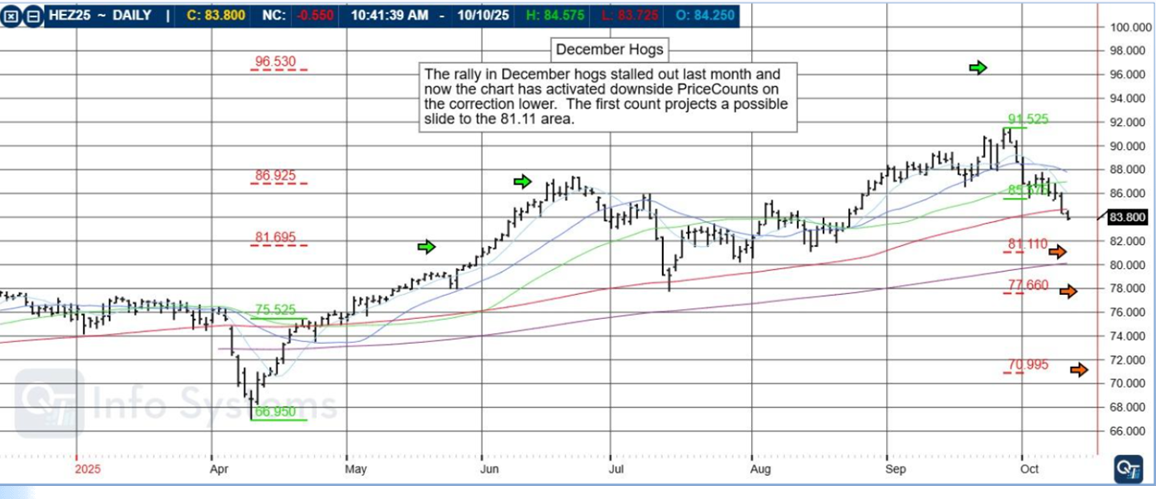

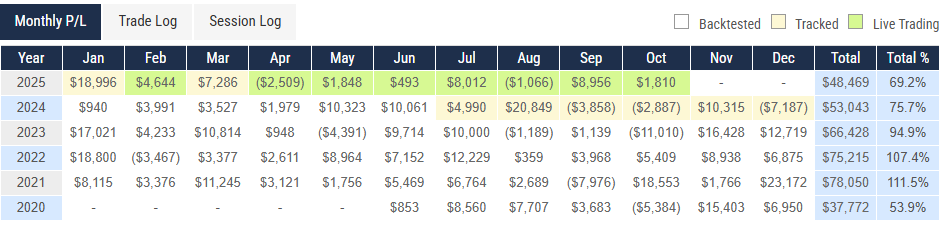

Day Trading Week! Fed Speakers, December Hogs, Swing Trading, Levels, Reports; Your 6 Important Need-To-Knows for Trading Futures the Week of October 13th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

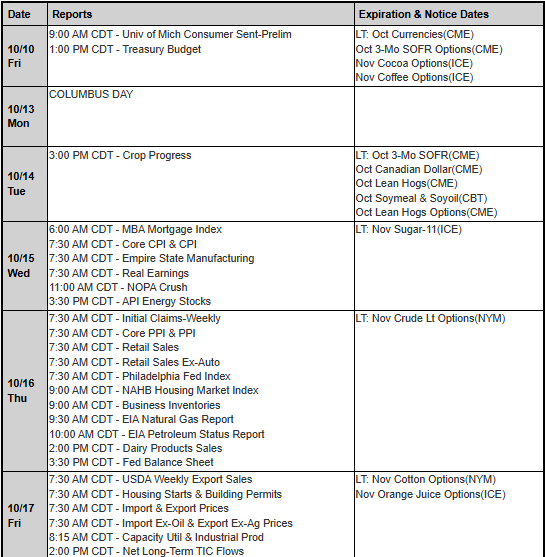

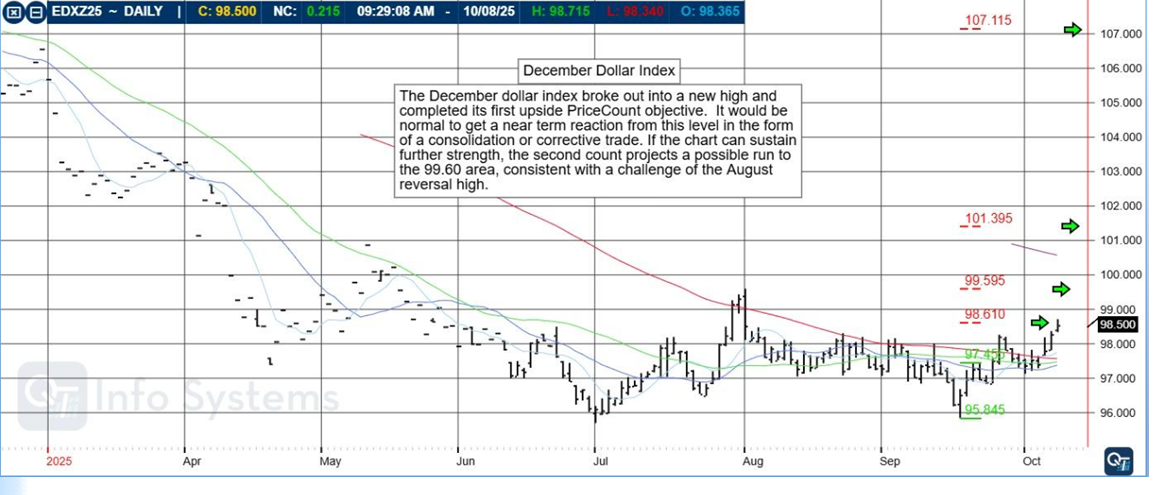

Crypto Trading, December Dollar Index, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 9th, 2025

|

|

General: Crypto Trading Round-The-Clock

Big news. CME Group, the world’s largest derivatives marketplace, plans to offer customers round-the-clock trading for its cryptocurrency products next year.

The timetable anticipates 24/7 trading of futures and options starting in early 2026. Currently this will cover the CME Group’s main offerings in Bitcoin and Ethereum, but starting Oct. 13, they will be joined by Solana and XRP derivatives.

Trading in cryptocurrency derivatives has been growing steadily since CME first offered Bitcoin futures in 2017. Notional open interest, which represents the outstanding value of contracts, reached a record $39 billion in mid-September.

All-hours access lets investors respond to price swings in real time, which could add additional legitimacy and liquidity to these digital assets.

Stock Index Futures:

The Dec. E-mini S&P 500 and E-mini Nasdaq futures contracts traded to new all-time record highs intraday today. Volume has tended to be lighter on this the sixth day of the U.S. government shutdown.

Traders have been negligibly on edge at these highs with some uncertainty about the U.S. shutdown, the state of the jobs market and the delay of scheduled releases of U.S. government economic reports.

Looking elsewhere for clues on the U.S. jobs front, last week a report from global outplacement firm Challenger, Gray & Christmas indicated U.S. employers announced fewer layoffs in September but hiring plans so far this year were the lowest since 2009. It came a day after a weaker-than-expected ADP National Employment Report.

Metals:

Dec. gold futures rose to new all-time highs for the sixth of seven trading sessions today, barreling through yesterday’s first move through $4,000 per ounce to trade intraday up to $4,081 per ounce, a $76.6 per ounce follow-through move.

Gold and silver futures have surged roughly 55% and 65% year to date, respectively, as expectations of Federal Reserve rate cuts have boosted the appeal of metals, which tend to perform better when interest rates are lower.

Energies:

Despite today’s report that U.S. crude oil inventories rose more than expected last week, crude oil futures oil futures staged a modest recovery today after last week’s decline to a 16-week low as the U.S. government shutdown fed worries about the global economy, while traders expected more oil supply to come on the market with the planned output boost announced by OPEC+ over the weekend.

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||

|

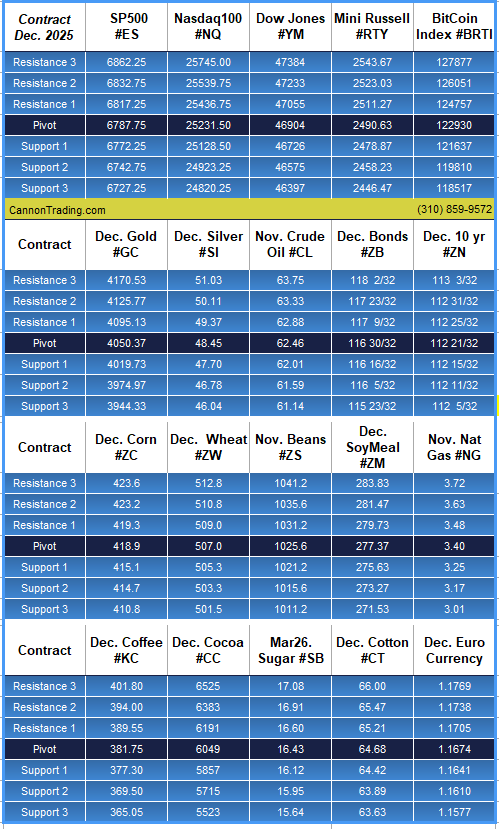

Trading Resources, December Silver, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 8th, 2025

|

|

|

|

|

|

|

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

Click here for quick and easy instructions.

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010