Book Map trading has revolutionized how traders visualize market data and execute trades in real time. As the financial markets continue evolving, advanced tools like Book Map—also stylized as Bookmap—have become indispensable. Designed for high-performance futures trading, Book Map is more than just a charting tool. It presents an intricate, live display of order flow, heat maps, liquidity zones, and market depth, enabling professional and novice traders alike to make better-informed decisions.

This detailed article explores how the Book Map futures trading platform serves both traders and brokers. We’ll delve into how brokers can guide responsible trade execution, the platform’s unique features, and why Cannon Trading Company stands out as a premier brokerage partner—recognized as one of the best futures brokers with numerous five-star TrustPilot reviews.

Part I: How Book Map Trading Empowers Traders

Real-Time Order Flow Visualization

One of the standout features of Book Map trading is its ultra-real-time data visualization. Unlike traditional candlestick charts or DOM (Depth of Market) ladders, Book Map gives traders an interactive heat map that represents historical and live liquidity. This allows traders to view the evolution of limit orders over time, helping them anticipate potential reversals or breakouts.

This deep insight into the order book is critical for futures trading, where split-second decisions can define success or failure. With Book Map, traders can read the “pulse” of the market, watching as large buy or sell walls emerge and dissolve, offering a strategic edge in fast-paced trading environments.

Increased Confidence in Execution

Book Map’s visual clarity gives traders enhanced confidence when executing trades. By seeing where major liquidity pools exist and how they behave around key price levels, traders gain insight that traditional tools cannot provide. This edge is particularly crucial for short-term futures contract trading and scalping strategies, where microstructure analysis is essential.

Book Map trading enables users to “see the unseen” by exposing hidden liquidity and spoofing behavior. These insights are invaluable for avoiding false breakouts and making high-probability entries and exits.

A Platform Built for All Skill Levels

Whether you’re new to trading futures or a seasoned algorithmic trader, Book Map accommodates various experience levels. Beginners appreciate the intuitive interface and tutorials, while experienced traders benefit from add-ons like imbalance indicators, volume dots, and the ability to overlay custom algorithms.

The platform’s extensive customization also allows for plug-ins and third-party integrations, making it ideal for developing, testing, and deploying advanced trading strategies. It has become a vital component in the trading toolkit for anyone serious about mastering futures contract trading.

Part II: How Book Map Serves Brokers and Their Clients

Enhanced Client Support Tools

Brokers play a crucial role in helping their clients trade responsibly on Book Map. Through broker-admin dashboards, they can monitor activity, set custom limits, and review trading patterns. This oversight ensures that clients adhere to sound risk management principles, particularly in volatile futures markets.

Many brokers integrate Book Map’s backend analytics to offer proactive support, helping clients avoid overleveraging and impulsive behavior. Features like trade history analysis, session summaries, and daily P&L reviews help brokers maintain transparent and supportive relationships with their clients.

Education and Onboarding Assistance

Brokers often serve as the first point of contact for traders entering the world of Book Map trading. The best futures brokers invest heavily in education—offering webinars, platform walkthroughs, and personalized training sessions.

This educational support helps traders understand how to interpret Book Map’s unique visuals, such as volume dots, heat maps, and iceberg orders. A well-trained trader is a more confident and responsible trader, making it a win-win for both brokers and clients.

Encouraging Risk Management

Responsible trading is built on robust risk management, and brokers can use Book Map to reinforce this. For example, brokers may set predefined trading limits based on client experience and capital or guide traders on how to use Book Map’s volume-based stop-loss and take-profit indicators.

Furthermore, tools like cumulative volume delta and order imbalance detectors assist traders in making rational, data-backed decisions instead of emotional trades. Brokers who actively promote these features help reduce client risk and protect their own reputations as responsible partners in the futures trading ecosystem.

Part III: Unique Features That Set Book Map Apart

Heat Map Visualization of Liquidity

The heat map is arguably Book Map’s crown jewel. It color-codes price levels based on the intensity of limit orders, allowing traders to see where market participants are placing their bets. This level of transparency is unparalleled among futures trading platforms.

This feature turns the invisible into visible—traders can see where support or resistance is likely to form before the price even reacts. No other platform provides this granular level of insight into market microstructure, especially in the context of trading futures.

Volume Dots and Order Book Imbalance

Book Map visualizes each trade with color-coded volume dots that reflect aggressiveness and size. This real-time insight into order flow helps traders detect momentum shifts, buyer/seller exhaustion, and potential reversals.

In addition, Book Map calculates order book imbalance—showing whether buyers or sellers dominate a particular price level. These cues are essential for making precise entries and exits during futures contract trading.

High-Speed Data Processing and API Integration

Book Map supports ultra-low latency data feeds from top data providers, ensuring lightning-fast updates. For algorithmic and high-frequency traders, this speed is non-negotiable.

Book Map also features an open API, enabling tech-savvy traders to create custom indicators, trading bots, or plug-ins. This flexibility makes Book Map not just a trading platform, but an innovation hub for the futures trading community.

Replay Mode for Trade Review

Unlike many platforms that simply log trades, Book Map lets users replay entire market sessions tick by tick. This is invaluable for both self-review and broker-client coaching sessions. By walking through trades in replay mode, traders can better understand what went right—or wrong—and refine their strategies accordingly.

Part IV: Why Cannon Trading Company is a Great Futures Broker for Book Map Users

A Legacy of Excellence in Futures Trading

Cannon Trading Company is no newcomer to the scene. With over 35 years of experience in the futures industry, the firm has cultivated a stellar reputation as a top-tier brokerage. This longevity translates to deep industry knowledge, client trust, and a rich understanding of market dynamics—making Cannon a beacon for traders seeking reliability and innovation.

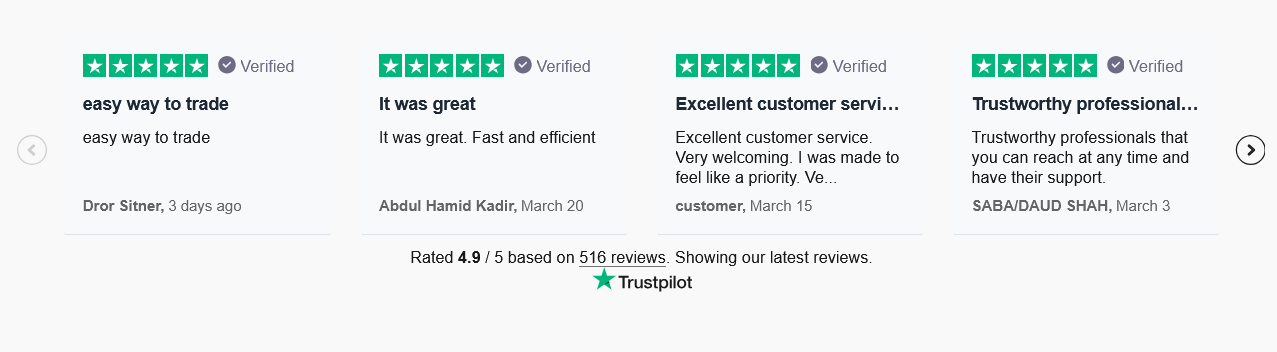

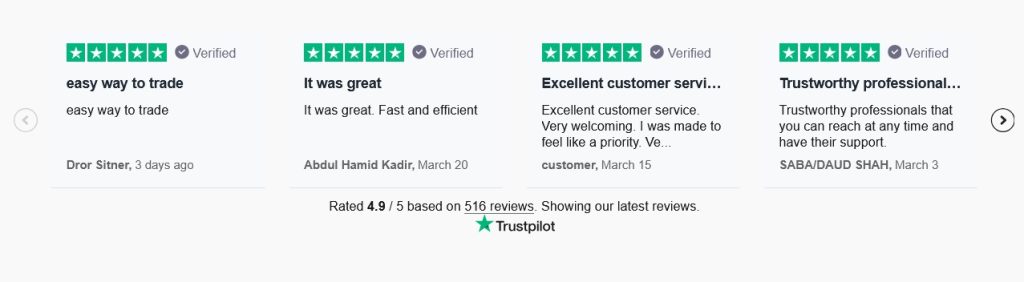

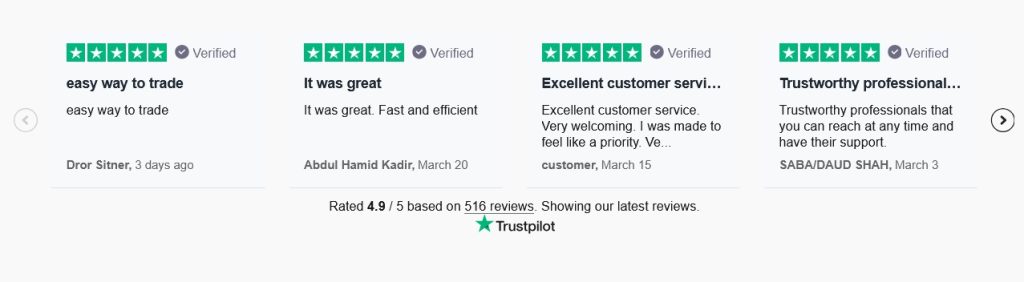

Top Ratings on TrustPilot

Cannon Trading’s track record is reflected in its numerous 5 out of 5-star ratings on TrustPilot, a platform known for honest and rigorous customer feedback. As one of the best futures brokers TrustPilot has consistently praised, Cannon stands out not just for performance, but for transparency and customer service.

These reviews highlight the firm’s dedication to client satisfaction, timely support, platform education, and above all, trustworthiness. In an industry where credibility is everything, Cannon Trading’s TrustPilot reputation is a badge of honor.

Regulatory Integrity and Compliance

Cannon Trading Company maintains a spotless record with both federal regulators and independent futures industry organizations. The firm complies with all CFTC (Commodity Futures Trading Commission) and NFA (National Futures Association) regulations, ensuring that its clients operate within a safe and legal framework.

This compliance framework offers peace of mind to traders and reassures them that they are partnering with a brokerage that values ethics, transparency, and responsibility.

A Broker for All Skill Levels

Whether you’re just starting with Book Map or you’re a seasoned futures trader, Cannon Trading Company offers tailored services that meet you where you are. The firm provides multiple account types, dedicated account managers, and access to a wide selection of futures trading platforms—making it easy to find a perfect fit.

Their educational offerings include platform training, futures market analysis, daily trade ideas, and access to webinars hosted by industry veterans. Such extensive support ensures that every client, regardless of skill level, can thrive in the dynamic world of futures contract trading.

Book Map and Cannon: A Powerful Combination

When you combine Book Map’s cutting-edge technology with Cannon Trading’s brokerage expertise, you get a powerful trading solution. Cannon offers seamless integration with the Book Map trading platform, including data feed compatibility, platform configuration support, and custom onboarding assistance.

This synergy between platform and broker enhances execution quality, risk management, and ultimately, profitability. It’s why so many traders consider Cannon Trading not just a broker, but a long-term trading partner.

Book Map trading represents the cutting edge of data-driven futures trading. Its ability to visualize order flow, track liquidity in real time, and empower traders with actionable insights sets it apart from conventional platforms. But the platform’s potential is only fully realized when paired with the right brokerage.

Cannon Trading Company, recognized as one of the best futures brokers with top TrustPilot ratings, a strong regulatory record, and unmatched experience, is uniquely positioned to help traders maximize the benefits of Book Map. From onboarding and education to trade execution and support, Cannon delivers value at every stage of the trading journey.

In an era of increasingly complex financial markets, tools like Book Map and firms like Cannon Trading ensure that traders don’t just survive—they thrive.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading