Trading futures is a dynamic and high-stakes endeavor, attracting traders with the promise of leveraged profits and diverse opportunities across commodities, financial indices, currencies, and more. In futures trading, participants buy or sell standardized contracts that speculate on the future price of an asset, allowing them to profit from correct market predictions. This arena is not only about speculation; it also serves a critical role in risk management—many investors and businesses use trading futures contracts to hedge against price fluctuations in raw materials, interest rates, or stock markets. The combination of potential for rapid gains, global market access, and hedging utility has made futures trading a popular pursuit for both individual traders and institutions.

However, succeeding in this competitive field requires more than just enthusiasm. Modern futures traders rely on a blend of proven techniques, disciplined daily routines, and the support of a reliable futures broker to navigate volatility. The most successful traders deploy a range of strategies—from technical chart analysis to fundamental market research—to make informed decisions each day. Equally important is partnering with the right brokerage; the best futures broker will provide quality trade execution and support that can make or break a trading strategy. In this comprehensive paper, we explore the most widely practiced techniques in futures trading today and how traders can implement these methods in their day-to-day trading routines. We also shine a spotlight on Cannon Trading Company, a futures broker with decades of industry leadership. Cannon Trading Company’s historical and ongoing contributions—reflected in its stellar reputation, 5-star client ratings, regulatory compliance, and cutting-edge trading platforms—underscore what it means to have an industry-leading partner in the futures market.

Popular Futures Trading Techniques

Traders in the futures markets have developed a variety of approaches to profit from price movements. Below are some of the most popular futures trading techniques practiced today, each with its own style and implementation:

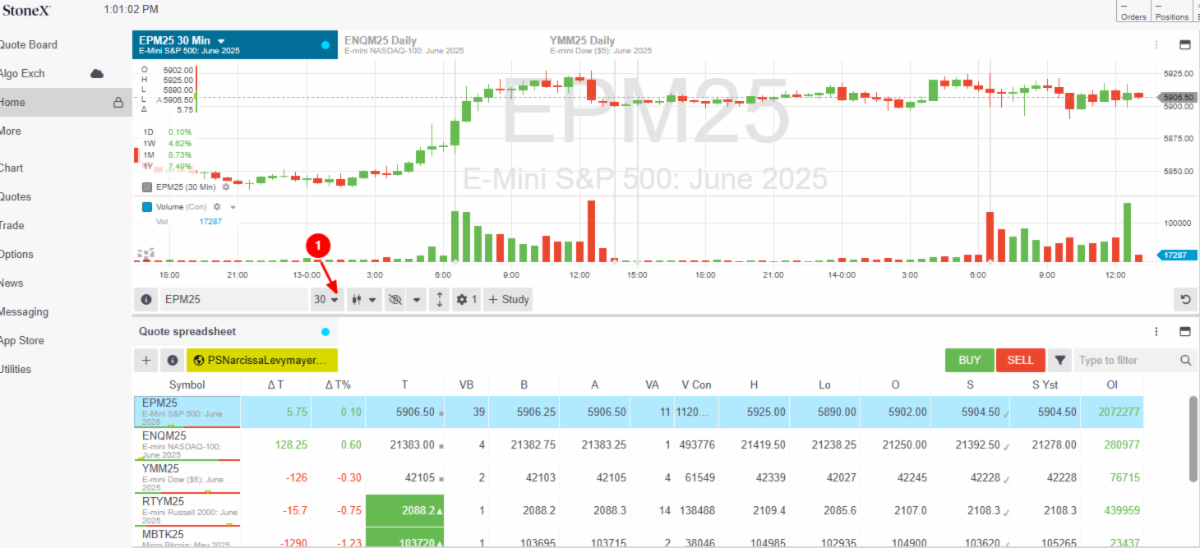

- Day Trading and Scalping: These high-energy strategies involve opening and closing futures positions within the same day (or even within minutes). Day traders and scalpers capitalize on small, frequent price fluctuations, often placing dozens of trades in a session to accumulate profits. They focus on highly liquid futures (such as stock index or crude oil contracts) where tight bid-ask spreads and quick execution allow rapid trading. Discipline and fast decision-making are crucial—traders typically rely on real-time charts, order flow data, and advanced platform tools to enter and exit positions swiftly. Because success can hinge on split-second timing, having the best technology and a reliable futures broker for lightning-fast trade execution is especially important for intraday strategies like scalping.

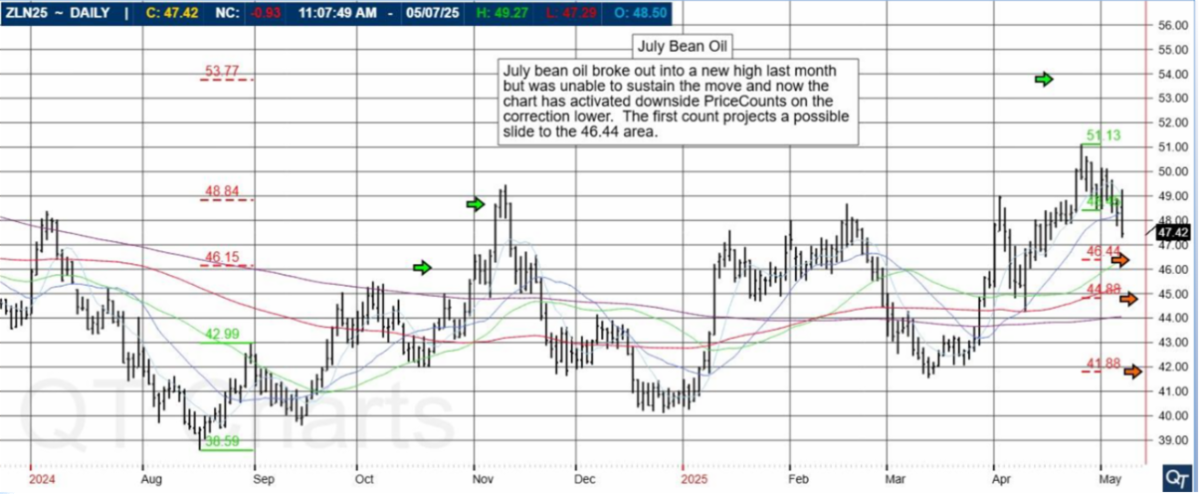

- Swing Trading and Trend Following: Not all futures trading is ultra-short-term. Swing traders hold positions for multiple days or weeks, aiming to capture medium-term market swings or trend movements. Trend followers, similarly, try to ride sustained directional moves in futures prices—up or down—over longer periods. Using daily or weekly price charts, these traders identify patterns such as uptrends (higher highs) or downtrends (lower lows) and employ technical indicators (like moving averages or trendlines) to time their entries. For example, a swing trader might buy a futures contract when they see a bullish breakout from a chart pattern and hold it for several days if the upward trend persists. This technique is widely practiced because many futures markets (from equities to commodities) exhibit clear trends over time. Implementing a swing trade strategy requires patience, risk management to weather short-term volatility, and conviction to let profits run. Unlike rapid day trading, swing trading fits well into a routine where a trader analyzes the market each evening or morning, adjusts stops and targets, and then lets the position unfold according to the broader trend.

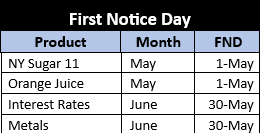

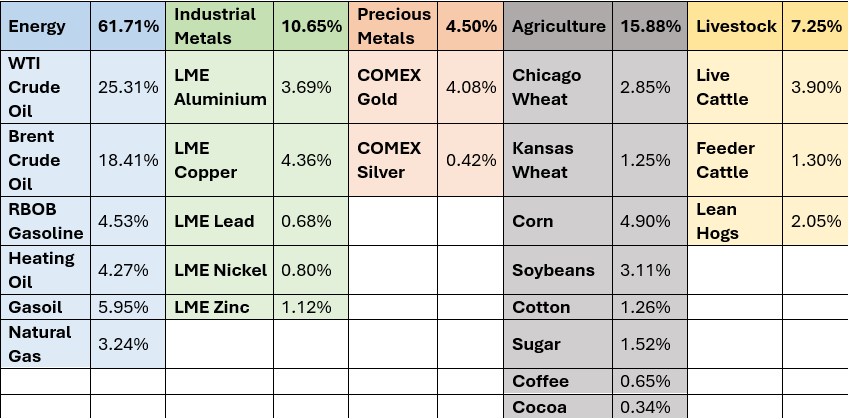

- Spread Trading (Calendar Spreads and Pairs): Spread trading is a popular futures technique that involves taking simultaneous long and short positions in two related contracts, aiming to profit from the price difference between them. One common type is the calendar spread, where a trader buys a futures contract for one expiration month and sells a contract on the same underlying asset for a different month. Another example is trading a pair of related commodities (like gasoline and crude oil, or gold and silver) by going long one and short the other. Spread trades are often considered lower-risk because the positions hedge each other to some degree—if one leg moves against the trader, the other leg may offset some of the loss. For instance, a trader expecting a temporary supply glut in oil might short a near-term oil futures contract while going long a longer-dated oil contract, anticipating the price gap between the two contracts will widen in their favor. Many professional futures traders and hedgers use spreads to exploit pricing inefficiencies or to hedge exposure, and exchanges even offer margin benefits (lower margin requirements) for certain recognized spread positions. To implement spread strategies, a trader must carefully monitor the relationship between the two instruments, often using specialized platform features to track spread charts or placing simultaneous orders. While the profit per spread might be smaller than an outright position, the reduced volatility appeals to those who prefer a steadier, more analytical approach to trading futures.

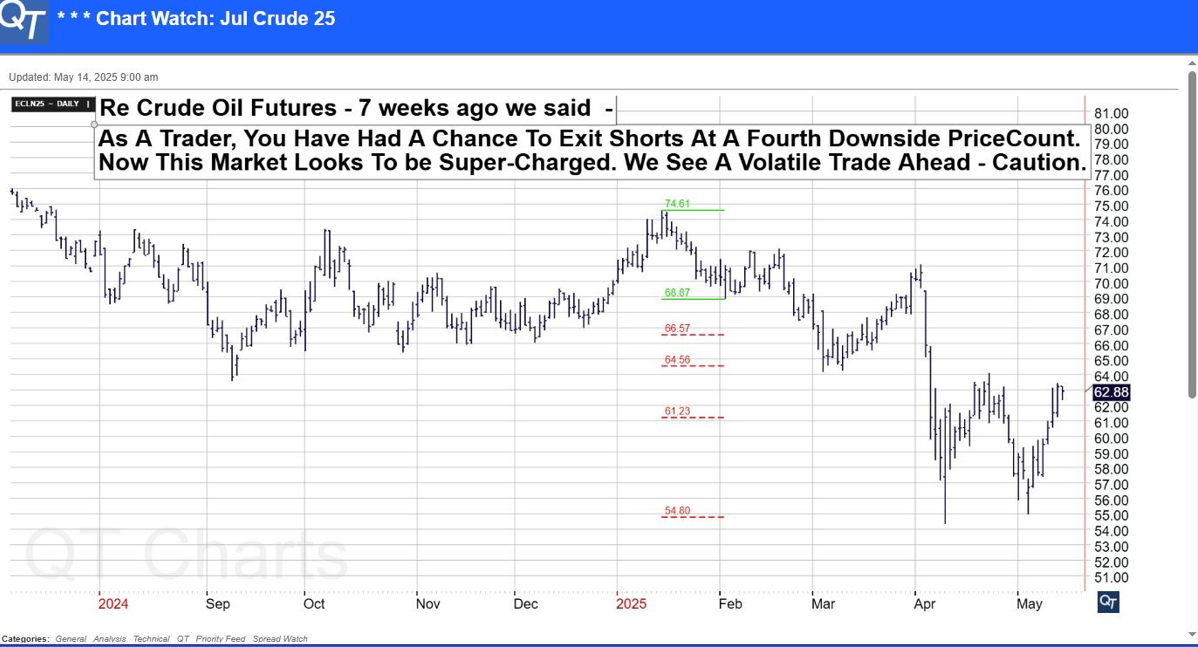

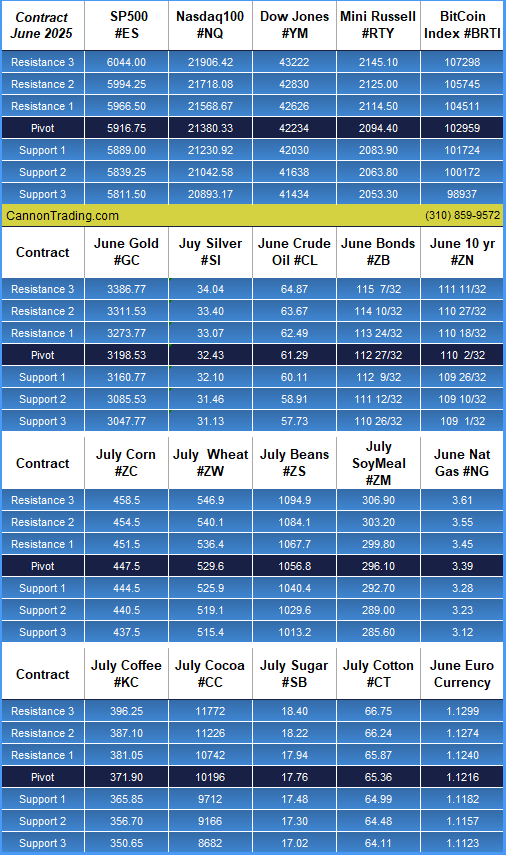

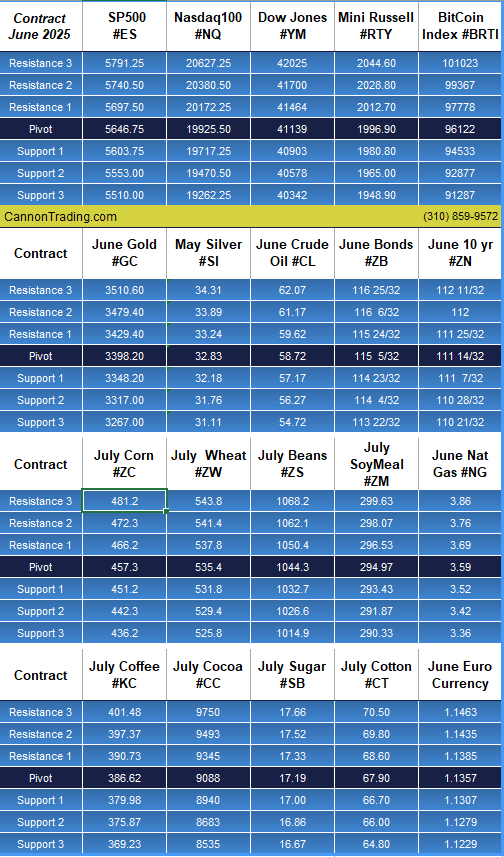

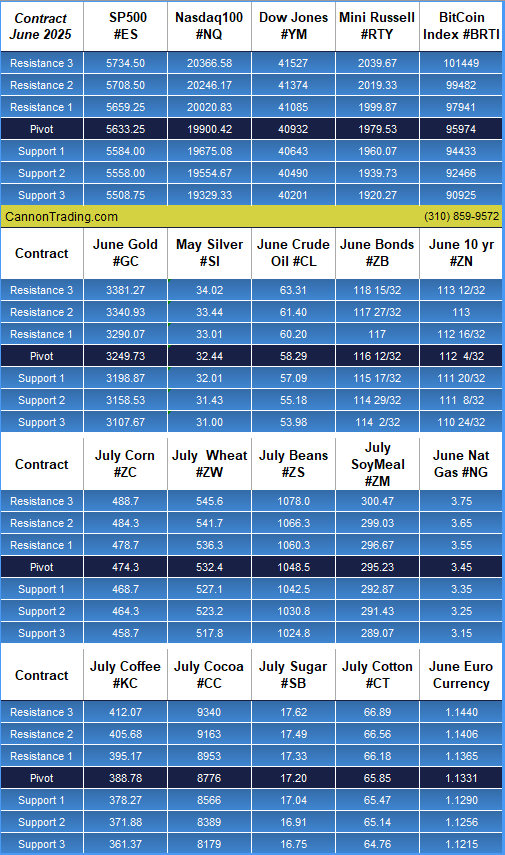

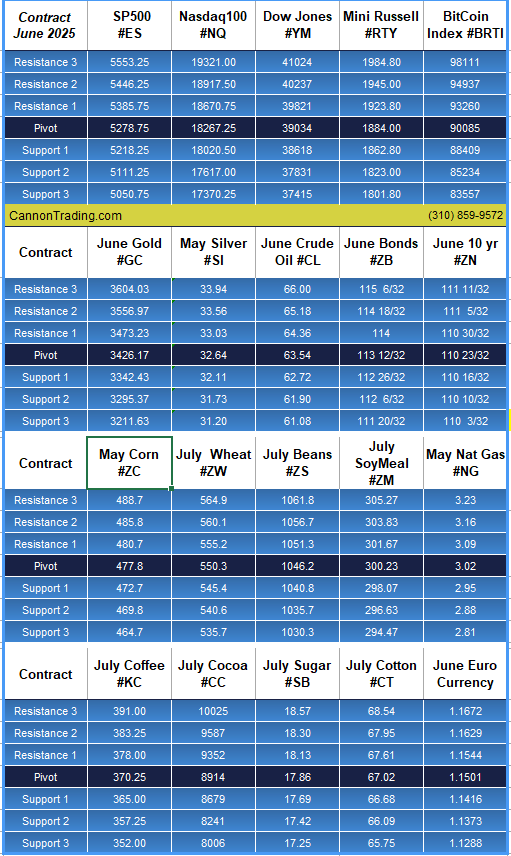

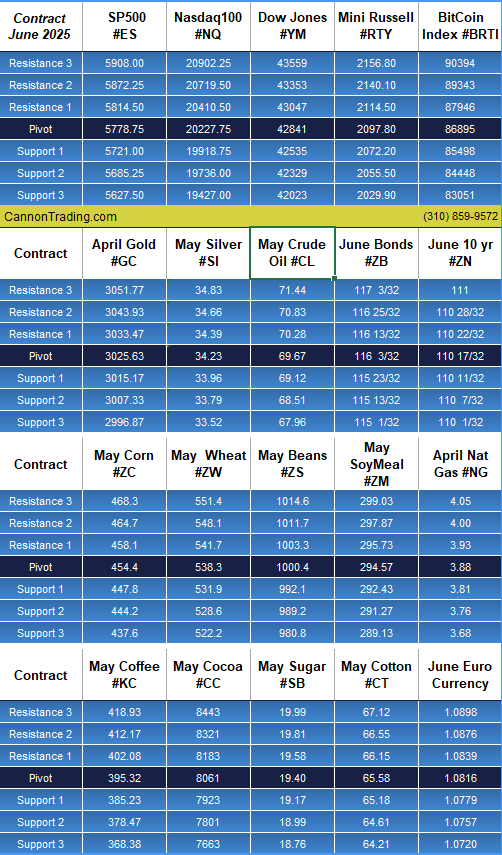

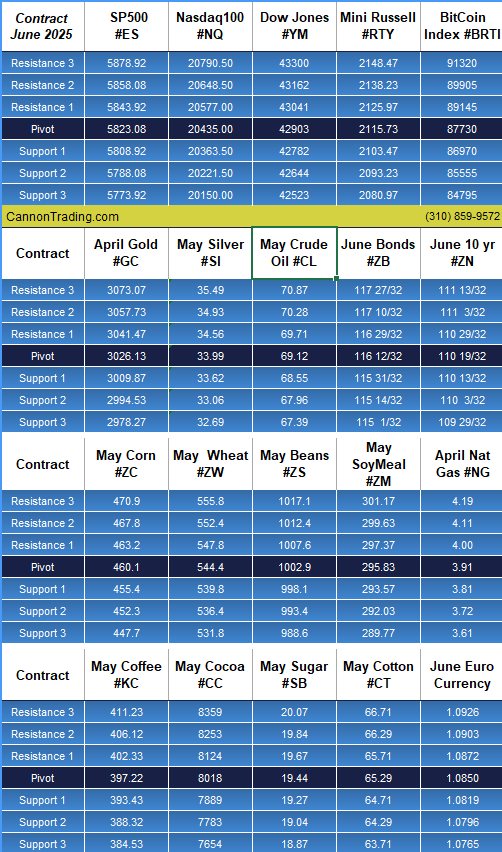

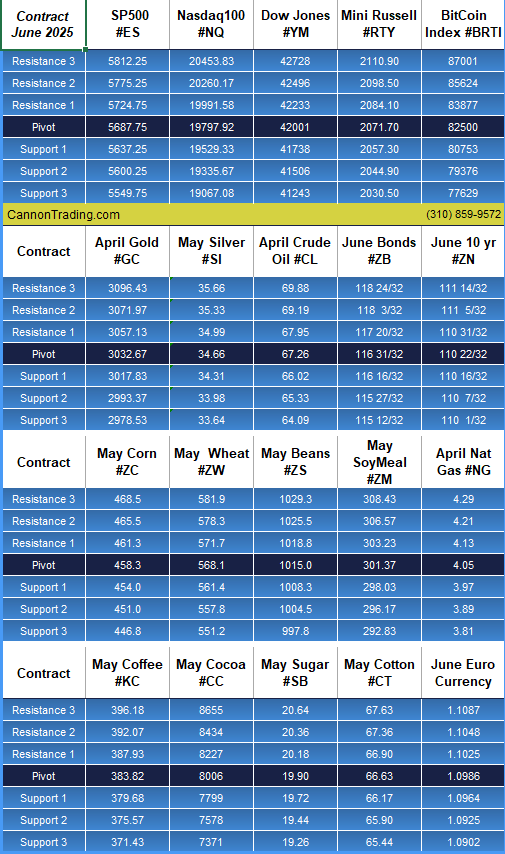

- Technical Analysis Strategies: The majority of short-term futures traders rely heavily on technical analysis—using price charts, patterns, and indicators—to guide their decisions. Techniques under this umbrella include momentum trading, breakout trading, and mean-reversion trading, all of which use historical price and volume data to predict future movements. Traders might use oscillators like RSI or MACD to spot when a market is overbought or oversold, or they may draw support and resistance levels to anticipate where price will reverse or accelerate. Candlestick patterns (such as hammer, engulfing pattern, etc.) are also popular tools to time entry and exit points. Implementing a technical strategy means each day the trader studies chart setups on their chosen futures markets, marks key levels (like the prior day’s high/low, pivot points, etc.), and plans trades accordingly. Many futures trading platforms provide built-in technical indicators and drawing tools, making it convenient to incorporate this analysis into a daily routine. The key to success with technical strategies is consistency and testing—traders often back-test their rules on historical data and stick to a well-defined trading plan. Over time, technical trading techniques have proven widely effective for futures due to the liquidity and trend-driven nature of these markets.

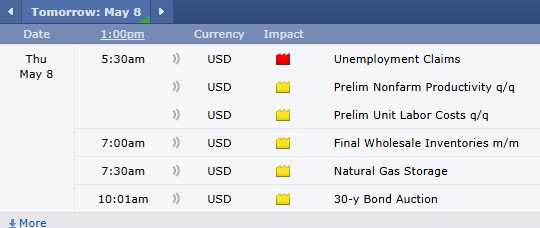

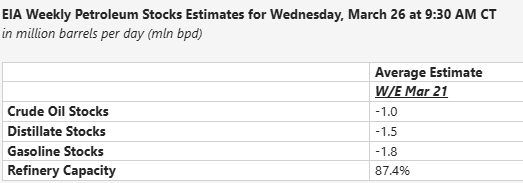

- Fundamental Analysis Strategies: While technicals focus on price action, fundamental strategies involve trading based on economic news, supply-and-demand data, and other underlying factors that affect futures prices. This approach is common among traders and investors who deal in commodities and financial futures where real-world events drive market value. For example, a trader might go long wheat futures ahead of a government crop report if they expect a supply shortage, or trade currency futures based on central bank interest rate announcements. In futures trading, fundamentals can be crucial: energy traders watch OPEC meetings and oil inventory reports; stock index futures traders follow economic indicators and earnings reports; metal traders monitor industrial demand and geopolitical events. Implementing fundamental techniques requires staying informed—many successful futures traders begin their day by reviewing news feeds, economic calendars, and research reports. They may adjust their trading plans to account for scheduled events (like Federal Reserve meetings or employment data releases) that could cause volatility. Often, fundamental traders combine their analysis with technical entry points—a practice called “blending”—for precise timing. For instance, if fundamentals suggest bullish conditions for an asset, a trader might still wait for a technical breakout on the price chart before trading futures contracts. This synergy can improve the reliability of the strategy. Patience is important here; sometimes the market may take time to reflect new fundamental information. Nevertheless, many of the larger trend movements in futures markets over the years have been rooted in fundamentals, making this approach a mainstay, especially for longer-term futures investors and commercial hedgers.

- Algorithmic and Automated Trading: An increasingly prevalent technique in modern futures markets is algorithmic trading—using computer programs to automatically execute trades based on predefined criteria. Algorithmic strategies can range from simple automated execution of orders (for example, entering a trade when a certain price hits) to complex high-frequency trading algorithms that scan multiple futures markets for arbitrage opportunities in microseconds. Traders who use algorithmic methods often develop or utilize trading software that connects to their future broker via API (Application Programming Interface) to place orders without manual input. This approach is popular because it removes human emotion and allows trades to be executed with high speed and precision. For instance, a trader might code a strategy to trade E-mini S&P 500 futures whenever the price moves outside a particular volatility band, letting the program watch the market 24/7 and act instantly. Implementing an automated strategy in daily trading involves setting up the algorithm, testing it thoroughly (paper trading), and then activating it during live market hours while monitoring for any technical issues. Many futures brokers support algorithmic traders by offering robust platforms and stable, low-latency connections, which are essential for this technique to work effectively. It’s not uncommon for even individual traders to rent server space near exchange data centers to minimize order lag. Whether it’s a proprietary algorithm run by a large hedge fund or a retail trader using a pre-built automated system, algorithmic trading has become a widely practiced part of trading futures. It underscores the importance of technology and reliability—traders need confidence that their strategy will execute accurately, making broker selection and platform quality a critical factor for success in this realm.

Implementing Futures Trading Techniques in Your Daily Routine

Having a solid strategy is one thing, but consistent success in trading futures comes from diligent day-to-day execution. Effective traders turn their chosen techniques into structured daily habits. Below is an example of how a futures trader can implement these strategies through a typical trading day:

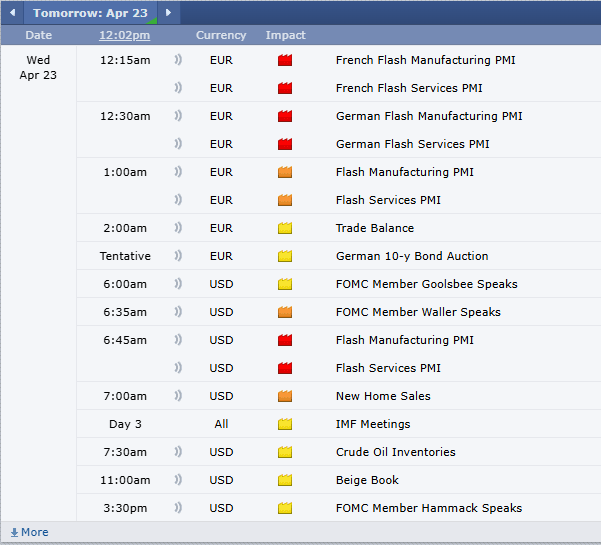

- Morning Market Prep: Every trading day should begin with preparation. Traders review the latest market news and overnight price action to gauge the market’s mood. This step often includes checking global market developments (since futures trade nearly 24 hours), reading any morning briefs or analysis provided by their future broker, and noting important economic events on the calendar for the day. Next, traders analyze the charts of the futures contracts they plan to trade, identifying key levels of support and resistance, trend directions, or any technical signal relevant to their strategy. For instance, a trend-following trader might verify that an upward trend is intact on the daily chart, while a day trader could mark pre-market highs and lows as potential breakout points. By the end of this prep phase, a trader has a game plan: which techniques to apply (e.g., “If the S&P 500 futures break above resistance, I’ll employ a breakout trade strategy”) and clear criteria for entering or avoiding trades.

- Trade Execution and Management: When the market is open and active, traders execute their plans, following the rules of their chosen futures trading techniques. During this phase, discipline is paramount—impulsive trades outside the plan are avoided. A day trader, for example, will be monitoring the price ticks on a fast chart and placing orders swiftly through their trading platform when their setup appears. They might use limit orders to buy or sell at specific levels, or market orders if needing instant execution. Modern futures brokers offer various order types and tools (bracket orders, one-cancels-other orders, etc.) to help automate parts of this process. Traders implementing a strategy will also actively manage open positions: adjusting stop-loss orders to lock in profits as a trend goes in their favor, or scaling out of positions (closing portions of the trade) as targets are hit. If the strategy involves multiple positions (such as a spread trade), the trader keeps an eye on both legs simultaneously. It’s during the execution phase that having a responsive and stable trading platform is vital. Any lag or downtime can be costly, so traders value brokers like Cannon Trading that provide reliable connectivity and quick order fills. Throughout the trading session, the focus is on sticking to the strategy’s guidelines—whether it’s a scalp that lasts just a few minutes or a swing trade that might be held through the day, each move is deliberate and according to plan.

- Risk Management Practices: Integrated into the execution process, but worthy of special emphasis, is real-time risk management. Successful futures traders treat risk control as a daily habit. This means sizing each position appropriately (e.g., risking only a small percentage of account capital on any one trade) and always using protective stop-loss orders. For example, if a trader is futures trading crude oil on a volatile day, they will determine in advance that they’ll exit the trade if it goes a certain amount against them—preventing a small loss from snowballing. Many traders also set daily loss limits for themselves; if they hit a predefined maximum loss in a day, they stop trading to avoid emotional decisions. Conversely, profit targets may be used to know when to take money off the table. Another key practice is avoiding over-leverage: since trading futures involves margin, prudent traders continuously monitor their margin usage and equity to ensure they aren’t overextended by having too many contracts open at once. By keeping an eye on metrics like account balance, margin requirements, and open trade equity, a trader can make quick adjustments (such as reducing position size or hedging) to stay within safe risk parameters. Good brokers assist in risk management by providing real-time account metrics and even risk tools that alert traders to large moves. In essence, part of the daily routine is a constant dialogue with oneself about risk: “Is this trade still valid or should I cut it? Has my market outlook changed? Am I comfortable with the dollar risk I have on right now?” This mindset protects the trader’s capital over the long run.

- Evening Review and Continuous Improvement: After the trading day winds down, seasoned traders take time to review and refine. This step transforms daily actions into learning opportunities. Traders will often keep a journal of all trades placed—recording the rationale, entry and exit prices, and outcomes. In the evening or during off-hours, they revisit these trades to evaluate performance: Was the entry according to plan? Did emotion cause any deviations? How did the chosen strategy perform in today’s market conditions? For instance, a swing trader might review whether they adhered to their trend-following rules or exited a position too early. If a particular futures trading strategy yielded poor results, the trader notes if it was due to market anomalies or a flaw in execution. Over time, this review process helps traders tweak their techniques (maybe adjusting an indicator setting or rethinking a trade trigger) and improve. It’s also common to prepare for the next day during this time—updating analysis based on the day’s price movements and setting tentative plans for tomorrow. If needed, this is when a trader might reach out to their broker’s support with any account issues or platform questions that arose during the day, ensuring everything is ready for the next session. By maintaining this disciplined cycle of preparation, execution, risk management, and review, traders can continuously implement their preferred strategies effectively and adapt to changing market conditions.

Cannon Trading Company: A Legacy of Excellence in Futures Trading

Among futures brokers, Cannon Trading Company stands out as a firm that has consistently set a high standard for service and expertise. Established in 1988, Cannon Trading has spent decades honing its reputation and is widely regarded as a trusted future broker for traders around the world. Over the years, the company has contributed significantly to the futures industry—being one of the early adopters of online trading technology, sharing market insights through educational resources, and exemplifying best practices in client service. Cannon’s longevity in the competitive futures brokerage field speaks to its adaptability and unwavering commitment to clients’ success. Today, it is not just a brokerage but a partner in its clients’ trading journeys, distinguished by qualities that few others can match. Below are key aspects that highlight Cannon Trading Company’s leadership in the futures trading arena:

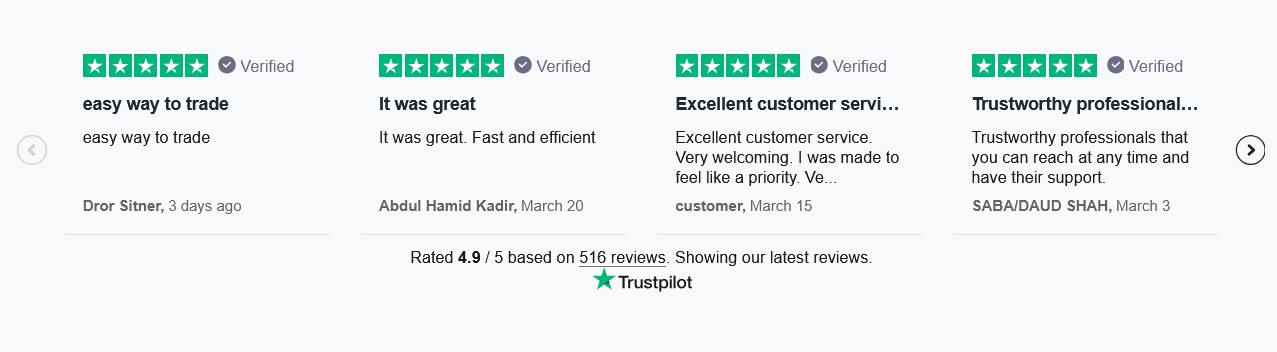

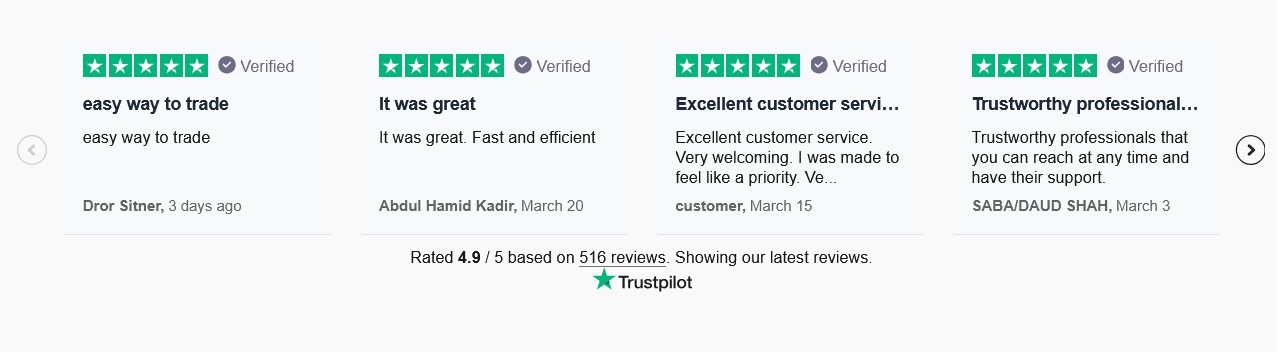

- Stellar 5 out of 5-Star Ratings on TrustPilot: In an industry where reputation is everything, Cannon Trading Company shines with outstanding client reviews. The firm has accumulated numerous 5 out of 5-star ratings on TrustPilot, reflecting the high level of satisfaction among its customer base. In fact, with an average TrustPilot score near 4.9 out of 5, Cannon is one of the highest-rated futures brokers in the United States. Clients consistently praise the company’s reliability, honesty, and responsiveness. Such glowing feedback—entirely from real traders—demonstrates Cannon’s dedication to providing an excellent trading experience. Whether it’s prompt support during volatile market moments or helpful guidance for newcomers, Cannon’s team has earned the trust and loyalty of traders, as evidenced by these public 5-star testimonials.

- Exemplary Reputation with Regulators: Cannon Trading Company has built its business on a foundation of integrity and compliance, resulting in an exemplary reputation with regulatory bodies. The firm is registered with the Commodity Futures Trading Commission (CFTC) and is a long-standing member of the National Futures Association (NFA) in good standing. This means that Cannon operates under strict regulatory standards designed to protect traders. Over its many years of operation, the company has maintained a clean track record, free of major regulatory infractions—an achievement that sets it apart in the brokerage community. For clients, this impeccable compliance history translates into peace of mind: they know their chosen future broker adheres to the highest ethics, financial safeguards, and transparency requirements. In an environment as heavily regulated as futures trading, Cannon’s relationship with regulators exemplifies what it means to put clients’ security first. Traders can be confident that funds are handled properly, communications are clear and truthful, and all business practices are fair. Cannon’s ethical approach has not only earned it the respect of regulators but also solidified its status as a trustworthy name in the futures industry.

- Decades of Experience in the Futures Industry: With over 35 years of experience, Cannon Trading Company is a true veteran in the futures brokerage space. Few futures brokers can claim the depth of knowledge that comes from three-plus decades of hands-on involvement in the markets. Since the late 1980s, Cannon’s team of professionals (including Series 3 licensed brokers and seasoned market strategists) have navigated through countless market cycles, from the pit-trading era to the electronic trading revolution. This long history means that when clients work with Cannon, they benefit from seasoned insights and practical wisdom that newer brokers might lack. The firm has witnessed the evolution of trading technology, regulatory changes, and shifting market trends, and it has continuously adapted to serve traders’ needs through it all. Importantly, Cannon has leveraged its experience to educate and empower its clients: the company often provides market commentary, trading tips, and webinars, sharing lessons learned over decades. This mentorship mindset helps traders avoid common pitfalls and take a more informed approach to futures trading. The ongoing contribution of Cannon’s experience is evident in the success stories of many long-term clients who have grown as traders under the company’s guidance. In an industry where experience can make a crucial difference, Cannon’s extensive background gives its clients a significant advantage.

- Wide Selection of Trading Platforms: One of Cannon Trading Company’s most notable contributions to the modern trader’s experience is its wide array of trading platforms. Understanding that different traders have different styles and needs, Cannon has curated a selection of about ten distinct futures trading platforms for clients to choose from. This is one of the largest platform offerings in the industry, aimed at ensuring every trader finds a perfect fit. Whether a client is a high-speed day trader, a technical chartist, or an algorithmic developer, Cannon has the technology to support them. Popular platforms available through Cannon include NinjaTrader, TradingView, Sierra Chart, CQG, MultiCharts, and more, each known for its robust features. For example, active scalpers and order-flow traders often appreciate the low-latency execution and depth-of-market tools of CQG, while those who favor extensive charting and customization might opt for Sierra Chart or TradingView. By providing access to such a breadth of software, Cannon empowers traders to execute their chosen techniques (be it advanced technical analysis or automated trading) on the platform that best suits their workflow. Importantly, many of these platforms come with free trial periods or demo accounts via Cannon, so clients can test drive them before committing. This flexibility reflects Cannon’s client-first philosophy: rather than a one-size-fits-all solution, the company invests in offering choice. In addition, Cannon ensures that all its supported platforms are backed by reliable data feeds and customer support, so traders have a seamless experience switching between or onboarding onto any system. The sheer range of high-quality tools available is a testament to Cannon Trading Company’s ongoing commitment to equip its clients with cutting-edge resources – a key reason many regard Cannon as the best futures broker for platform selection and technology.

With these strengths, Cannon Trading Company has firmly established itself as a leader in the futures trading community. The combination of top-tier customer satisfaction, unimpeachable trustworthiness, deep industry experience, and technological excellence makes Cannon a one-stop destination for traders seeking the best futures broker to support their trading journey. The firm’s historical and ongoing contributions—be it through pioneering trading solutions, guiding traders with expert knowledge, or simply being a dependable partner—have left an indelible mark on the industry. In an era where traders have many choices, Cannon continues to differentiate itself by blending old-school integrity with modern innovation. For anyone serious about trading futures, Cannon Trading Company represents the gold standard of what a futures brokerage should be.

Empowering Your Futures Trading Journey

The world of trading futures offers immense potential for those equipped with knowledge, discipline, and the right support. By mastering popular trading techniques—whether it’s a quick scalp on an index future or a carefully hedged commodity spread—and integrating them into a consistent daily routine, traders can approach the futures markets with confidence. Equally important is having a strong partner in your corner. As we’ve seen, a seasoned and reliable futures broker can provide the technology, guidance, and security that elevate a trading experience. When traders combine well-honed strategies with the resources offered by the best futures broker, the results can be truly powerful. Cannon Trading Company exemplifies this synergy: its decades of expertise and client-focused services empower traders to apply their skills effectively in the market. In essence, success in futures trading comes down to preparation and partnership. With sound strategies, steadfast risk management, and a brokerage like Cannon Trading Company supporting your goals, you can navigate the futures landscape with greater clarity and purpose. As the futures industry continues to evolve, those who stay educated, disciplined, and well-supported will be best positioned to thrive in the exciting opportunities that lie ahead.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572(International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading