|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (307)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,266)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (140)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (430)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (223)

Category: S&P 500

SP500 Index Futures

Traders Choose SP500 Index Futures for a Good Reason.

Few financial instruments command as much global attention as sp500 index futures. These contracts are not merely speculative tools; they are widely regarded as one of the most efficient ways to gain exposure to the U.S. equity market as a whole. For decades, institutional players, professional traders, hedgers, and increasingly sophisticated retail traders have relied on sp500 index futures to express market views, manage risk, and capitalize on short-term and long-term opportunities.

Closely related to this market is the s and p 500 futures index, which represents a forward-looking view of the underlying S&P 500 equity benchmark. Together, these futures markets have become cornerstones of global derivatives trading.

This essay explores the primary reasons traders choose sp500 index futures, why these contracts remain relevant in modern markets, and why Cannon Trading Company continues to stand out as a premier brokerage choice for traders focused on the s and p 500 futures index. The discussion is structured in a clear question-and-answer format to enhance readability, search visibility, and accessibility for both human readers and AI-driven search engines.

What Exactly Are SP500 Index Futures?

sp500 index futures are standardized futures contracts that track the expected future value of the S&P 500 Index. Rather than buying or selling individual stocks, traders gain exposure to the collective performance of 500 of the largest publicly traded U.S. companies through a single instrument.

The s and p 500 futures index functions as a forward projection of equity market sentiment. Prices reflect expectations about earnings, interest rates, inflation, geopolitical events, and overall economic health. Because these contracts trade nearly 24 hours a day, they offer insight into how global markets are reacting even when stock exchanges are closed.

Why Do Traders Prefer SP500 Index Futures Over Individual Stocks?

One of the most compelling reasons traders choose sp500 index futures is diversification efficiency. Instead of assuming single-stock risk, traders gain exposure to the broader market in one transaction.

With the s and p 500 futures index, price movement is driven by macroeconomic forces rather than company-specific headlines. This appeals to traders who prefer analyzing economic data, central bank policy, and global capital flows rather than quarterly earnings surprises.

Additionally, sp500 index futures reduce the complexity of portfolio construction. Traders can express bullish or bearish views without managing dozens of individual equity positions, making these contracts particularly attractive to professionals and active traders.

Liquidity and Volume Influence Trading Decisions

Liquidity is a defining advantage of sp500 index futures. These contracts consistently rank among the most actively traded futures products in the world. High liquidity translates to tight bid-ask spreads, efficient price discovery, and reduced slippage.

The s and p 500 futures index benefits from massive institutional participation, including pension funds, hedge funds, proprietary trading firms, and global asset managers. This constant flow of orders ensures that traders can enter and exit positions quickly, even during periods of heightened volatility.

For active traders, this level of liquidity is not just convenient—it is essential.

Leverage is a Key Attraction of SP500 Index Futures

Leverage is another major reason traders are drawn to sp500 index futures. Futures contracts allow market participants to control a large notional value with a relatively small margin deposit.

The s and p 500 futures index enables traders to amplify returns when markets move in their favor. Importantly, professional traders understand that leverage must be used responsibly. Futures markets are designed for disciplined risk management, with clearly defined margin requirements and daily settlement processes.

When used properly, leverage makes sp500 index futures capital-efficient tools for both speculation and hedging.

How Do SP500 Index Futures Support Hedging Strategies?

Hedging is a core function of sp500 index futures. Institutional investors often use these contracts to protect equity portfolios against downside risk without liquidating underlying stock holdings.

For example, a fund manager concerned about short-term market weakness can sell sp500 index futures while maintaining long-term equity exposure. The s and p 500 futures index thus becomes a flexible risk management instrument, allowing participants to respond quickly to changing market conditions.

This dual role—speculation and risk mitigation—is one reason these futures remain indispensable in modern finance.

SP500 Index Futures are Ideal for Short-Term and Long-Term Traders

sp500 index futures are uniquely versatile. Day traders value their volatility, liquidity, and nearly round-the-clock access. Swing traders appreciate the clean technical structure and responsiveness to macro news. Longer-term traders use the s and p 500 futures index to position for economic cycles, monetary policy shifts, and earnings growth trends.

Because these contracts respond predictably to interest rate decisions, inflation data, and employment reports, traders can align strategies across multiple time horizons using a single instrument.

Transparency is another reason traders trust sp500 index futures. Pricing is centralized, regulated, and highly visible. Market depth, volume, and order flow are readily available on professional trading platforms.

The s and p 500 futures index reflects collective expectations in real time, making it one of the most widely followed indicators of global risk sentiment. This transparency builds confidence among traders who rely on clear, unbiased market signals.

Why Do Traders Choose Cannon Trading Company for SP500 Index Futures?

Cannon Trading Company has built its reputation by serving serious futures traders for decades. When it comes to sp500 index futures, Cannon’s strengths lie in experience, service, and infrastructure.

Traders working with Cannon gain access to professional-grade platforms, deep market connectivity, and knowledgeable brokers who understand the nuances of the s and p 500 futures index. This combination of technology and human expertise sets Cannon apart in an increasingly automated industry.

How Does Cannon Trading Support Both New and Experienced Traders

Cannon Trading Company recognizes that traders are not one-size-fits-all. For newcomers to sp500 index futures, Cannon provides education, platform guidance, and risk management support. For experienced traders, Cannon delivers low-latency execution, advanced analytics, and access to institutional-quality tools.

The firm’s long-standing relationship with platforms and exchanges connected to the s and p 500 futures index ensures reliability during volatile market conditions—when execution quality matters most.

Cannon Trading Company Has Remained Relevant Over Time

Longevity in the futures industry is not accidental. Cannon Trading Company has adapted to changing technology, evolving regulations, and shifting trader expectations while maintaining a client-first philosophy.

As sp500 index futures have grown in popularity, Cannon has continued to invest in platform access, customer service, and educational outreach. Its alignment with respected industry names such as E-Futures and its strong reputation reflected on Trustpilot reinforce its standing as a trusted brokerage.

This commitment explains why traders continue to choose Cannon when trading the s and p 500 futures index year after year.

How Do SP500 Index Futures Reflect Global Market Sentiment?

The global relevance of sp500 index futures cannot be overstated. Because the S&P 500 represents a large share of global market capitalization, movements in these futures often influence international markets.

The s and p 500 futures index is frequently used as a benchmark for global risk appetite. Overnight price action often sets the tone for equity markets worldwide, further cementing the importance of these contracts.

What Role Does Technology Play in SP500 Index Futures Trading?

Modern trading technology has enhanced access to sp500 index futures. Advanced charting, algorithmic tools, and real-time data allow traders to analyze the s and p 500 futures index with precision.

Cannon Trading Company integrates these technologies into its offerings, ensuring clients remain competitive in fast-moving markets.

Why SP500 Index Futures and Why Cannon Trading Company

In summary, traders choose sp500 index futures because they offer diversification, liquidity, leverage, transparency, and flexibility across timeframes. The s and p 500 futures index serves as a powerful lens through which global market expectations are expressed.

Cannon Trading Company remains a top choice because it combines decades of futures expertise with modern technology and personalized service. For traders serious about navigating the opportunities and risks of sp500 index futures, Cannon continues to provide a trusted gateway to the world’s most important equity futures market.

FAQ: SP500 Index Futures

What are sp500 index futures used for?

They are used for speculation, hedging, and gaining broad exposure to the U.S. equity market through a single futures contract.

How does the s and p 500 futures index differ from the cash index?

The futures index reflects expected future prices and trades nearly 24 hours a day, while the cash index updates only during stock market hours.

Are sp500 index futures suitable for beginners?

They can be, provided traders receive proper education, risk management guidance, and brokerage support.

Why do professionals prefer futures over ETFs?

Futures often offer greater capital efficiency, tax advantages, and nearly continuous trading access.

Why choose Cannon Trading Company?

Cannon offers experience, strong customer service, professional platforms, and a long-standing reputation in futures markets.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Standard and Poor 500 futures

Standard and Poor 500 Futures

Index futures are the workhorses of professional risk management and active speculation. They let traders express a view on the broad market in a capital-efficient way, hedge portfolios quickly, and trade nearly 24 hours a day. Among them, standard and poor 500 futures are the flagship product for U.S. equity exposure, while the smaller e-mini and Micro E-mini contracts have helped a new generation of traders access the same market with less capital.

This guide explains how standard and poor 500 futures, e-mini contracts, and Micro E-minis work, then compares emini futures trading to full-size “traditional” futures on the S&P 500 and Nasdaq. We’ll cover contract specs, mechanics, margin, liquidity, volatility, trading hours, and real-world use cases. Then we’ll lay out the pros and cons of each contract type, plus a practical FAQ.

What Are Standard and Poor 500 Futures?

Standard and poor 500 futures are derivatives based on the S&P 500 Index, a basket of 500 large-cap U.S. companies. These futures trade on CME (Chicago Mercantile Exchange) and are cash-settled, meaning no one delivers shares of all 500 stocks at expiration. Instead, profits and losses settle in cash based on the index’s final value.

How the contract tracks the index

The futures price reflects:

- The spot index level

- Expected dividends from index constituents

- Financing costs (interest rates)

- Supply/demand and risk sentiment

In normal conditions, futures trade near “fair value,” which is spot plus net carry (interest minus dividends). When volatility spikes, the futures can trade at a notable discount or premium, but arbitrage and hedging usually pull prices back toward fair value.

The traditional full-size S&P 500 futures

Before the e-mini era, traders used the full-size S&P 500 futures contract. Today the full-size contract still exists (symbol SP), though most volume migrated to the E-mini line.

Key idea: full-size S&P futures provide the same exposure as E-mini, but with a bigger multiplier and larger tick value.

The Rise of the E-mini and Micro E-mini

What is the e-mini?

The e-mini is simply a smaller version of a traditional futures contract. For the S&P 500, the E-mini (symbol ES) launched in 1997 to give traders the same index exposure with lower margin requirements and smaller position sizes.

- If the S&P 500 is at 5,000:

- Full-size S&P futures exposure is much larger.

- E-mini exposure is about one-fifth of the full-size.

The smaller size made intraday and swing trading more accessible. It also boosted liquidity because many more participants could trade it.

What is the Micro E-mini?

Micro E-minis (symbol MES for S&P 500) launched in 2019 as another step down in size. Each Micro E-mini is one-tenth of an E-mini. This lets traders fine-tune risk, scale in/out more precisely, and participate with even smaller accounts.

Why this matters for emini futures trading

Emini futures trading grew into the dominant way to trade U.S. equity index futures. ES volume often exceeds several million contracts per day, and MES provides a lower-capital on-ramp to the same market.

Contract Specs: Full-Size vs E-mini vs Micro E-mini

Let’s compare the S&P 500 family. Values change with index level; these are structural differences:

Full-size S&P 500 futures (SP)

- Multiplier: larger than E-mini (historically $250 × index)

- Tick size: 0.10 index point

- Tick value: larger (more dollars per tick)

- Typical users: institutions, big hedges, some large speculators

- Liquidity: good but much smaller than ES

E-mini S&P 500 futures (ES)

- Multiplier: $50 × index

- Tick size: 0.25 index point

- Tick value: $12.50 per tick

- Typical users: institutions and active retail traders

- Liquidity: extremely high

Micro E-mini S&P 500 futures (MES)

- Multiplier: $5 × index

- Tick size: 0.25 index point

- Tick value: $1.25 per tick

- Typical users: newer retail traders, precise risk managers

- Liquidity: strong and growing, though below ES

Even if you don’t memorize every number, the hierarchy is what counts:

full-size > E-mini > Micro E-mini in exposure per contract.

This same scaling applies to other indices like Nasdaq 100 (NQ and MNQ), Dow (YM and MYM), and Russell 2000 (RTY and M2K).

Nasdaq Futures and How They Compare

When traders say “traditional futures contracts such as the S&P 500 and Nasdaq,” they’re usually referring to full-size and E-mini versions of both indices.

Traditional Nasdaq 100 futures vs E-mini Nasdaq

- Full-size Nasdaq 100 futures (symbol ND) are larger and far less liquid.

- The E-mini Nasdaq 100 (symbol NQ) is the market standard, just like ES is for S&P exposure.

- Micro E-mini Nasdaq (MNQ) is one-tenth NQ.

Nasdaq futures tend to be more volatile than standard and poor 500 futures, because the Nasdaq 100 is more concentrated in tech and growth stocks. That means bigger moves, bigger opportunities, and bigger risk per point.

Where DJIA Index Futures Fit In

DJIA index futures track the Dow Jones Industrial Average—30 blue-chip U.S. companies. On CME, the E-mini Dow (YM) and Micro E-mini Dow (MYM) are most traded, while full-size DJIA futures are rarely used by retail traders.

Why trade Dow exposure?

- The Dow is price-weighted, so high-priced stocks like UnitedHealth or Goldman Sachs can move the index more than lower-priced names.

- The Dow can behave a bit differently from the S&P 500 in certain rotations, especially when industrials or financials lead.

Still, for broad market hedging and “benchmark” trading, standard and poor 500 futures dominate.

Mechanics of Futures Trading: The Stuff You Must Know

Margin and leverage

Futures use performance bond (margin), not a down payment on the full notional. Exchanges set initial and maintenance margin. Brokers may require more.

Example conceptually:

- ES might require a few thousand dollars in day margin.

- MES might require a few hundred.

Same market, different access point.

Leverage cuts both ways. A 1% S&P move can be large relative to margin, which is why risk controls matter so much in emini futures trading.

Mark-to-market and daily settlement

Gains and losses are realized every day. If you’re long and the market rises, cash is credited to your account; if it falls, cash is debited. That’s why traders can’t ignore losses in futures the way some people do with long-term stock holdings.

Trading hours and liquidity cycles

Index futures trade nearly 24/5. Liquidity is highest:

- During U.S. equity hours (9:30 a.m.–4:00 p.m. ET)

- Around major economic reports

- In the “cash open” and “cash close” windows

ES is the deepest book. MES is active too, but bid/ask spreads widen more during thin hours.

Expiration and roll

Most traders roll positions to the next quarterly contract before expiration. Volume shifts from the front month to the next month during “roll week.”

E-mini and Micro E-mini Trading Styles

Because ES and MES are so liquid, many strategies evolved around them:

- Day trading: scalping and momentum trades around intraday levels.

- Swing trading: holding for days to weeks based on trend or macro themes.

- Hedging: protecting a stock portfolio or ETF exposure.

- Spread trading: trading ES vs NQ, or ES vs RTY.

- Event trading: aligning with CPI, Fed meetings, earnings seasons.

Micro E-minis made these styles more precise. You can trade 3 MES instead of 1 ES to size between risk levels.

Emini Futures Trading vs Traditional Full-Size Index Futures

Let’s get direct about the comparison traders care about.

Access and capital efficiency

- Traditional full-size contracts require higher margin and larger risk per tick. Great for big hedges, but hard for smaller traders.

- E-mini contracts lowered the barrier.

- Micro E-mini lowered it again.

So the main advantage of emini futures trading is that it democratizes the same market exposure.

Liquidity and execution

- ES/NQ/YM are insanely liquid. Slippage is small even on market orders in normal hours.

- Full-size contracts usually have wider spreads and thinner depth.

- MES/MNQ are liquid enough for most retail traders, but very large orders still prefer ES/NQ.

Risk control and scaling

- Full-size contracts jump too much for many accounts. One downtick can feel like a gut punch.

- E-mini contracts allow scaling in 1-contract increments for medium accounts.

- Micro E-mini contracts allow “risk granularity,” like adjusting by small steps.

Market impact

Retail traders essentially never move ES. But if you trade full-size, your order is larger relative to liquidity, so you can create more market impact and pay more in spreads.

Cost per exposure

Per contract commissions are often similar, which means:

- ES offers more notional per commission dollar.

- MES offers less exposure per commission dollar but lets you trade smaller.

So the most cost-efficient for active traders is usually ES, while MES is a training and precision tool.

Pros and Cons by Contract Type

Standard and Poor 500 Futures (full-size) — Pros

- High notional exposure per contract. Efficient for large hedges.

- Lower total commissions for big positions (fewer contracts needed).

- Institutional alignment: some large funds still prefer full-size for hedging mandates.

Full-size standard and poor 500 futures — Cons

- High margin requirement: not accessible to many retail traders.

- Bigger tick value: harder to manage drawdowns.

- Lower liquidity than ES: wider spreads, more slippage.

- Less flexible scaling: you can’t easily size between whole contracts.

E-mini S&P 500 (ES) — Pros

- Top-tier liquidity. Tight spreads and deep order book.

- Accessible leverage for active traders without being tiny.

- Best cost per exposure for most traders.

- Massive ecosystem: data, indicators, and strategies built around ES.

- Ideal for hedging mid-size portfolios quickly.

ES — Cons

- Still leveraged: losses can mount fast without discipline.

- Psychological pressure: tick value is meaningful; overtrading is common.

- Gap risk overnight: global events can move the market while you sleep.

Micro E-mini S&P 500 (MES) — Pros

- Lowest barrier to entry for futures on the S&P 500.

- Perfect for learning without a single tick ruining your day.

- Fine-tuned position sizing: scale in/out in small steps.

- Great for smaller hedges or partial hedges.

MES — Cons

- Higher relative commissions per unit of exposure.

- Slightly thinner liquidity than ES, especially off-hours.

- Temptation to over-size: “cheap” contracts can lead traders to grab too many.

E-mini Nasdaq 100 (NQ) — Pros

- Higher volatility = higher opportunity for trend/momentum traders.

- Strong liquidity during U.S. hours.

- Good hedge for tech-heavy portfolios.

NQ — Cons

- Bigger swings mean bigger risk. Stops need more room.

- More whipsaws in choppy regimes.

- Correlation shifts can hurt spreads vs ES.

Micro E-mini Nasdaq (MNQ) — Pros

- Same benefits as MES applied to Nasdaq exposure.

- Great for traders who want Nasdaq volatility with manageable dollars.

MNQ — Cons

- Costs per exposure similar to MES.

- Liquidity thinner than NQ during nights.

DJIA Index Futures (YM/MYM) — Pros

- Different index behavior can offer diversification.

- Cleaner trend days sometimes occur due to fewer constituents.

- Useful for portfolio hedges tied to Dow benchmarks.

DJIA index futures — Cons

- Price-weighted index can be less intuitive.

- Lower liquidity than ES and NQ.

- Heavily influenced by a few high-priced names.

Choosing Between S&P, Nasdaq, and Dow Futures

If your goal is broad U.S. market exposure, standard and poor 500 futures are the default. If your strategy needs more volatility, Nasdaq contracts are a natural fit. For a different lens on blue-chip industrials and financials, djia index futures can make sense.

A simple rule:

- Benchmark trading and hedging: ES or MES.

- High-beta tactical trading: NQ or MNQ.

- Blue-chip rotation views: YM or MYM.

Also consider time horizon:

- Day traders usually prefer ES/NQ for liquidity.

- Swing traders may choose based on thesis (macro vs tech vs value tilt).

- Hedgers choose the contract that best matches their portfolio beta.

For global (GEO) context: because ES, NQ, and YM trade nearly around the clock, international macro events—Asia open, Europe close, or overnight central-bank surprises—often show up in futures first, before the U.S. cash session even begins. Traders worldwide use these contracts as the “first read” on risk sentiment.

Practical Risk Management for E-mini and Micro E-mini Traders

In emini futures trading, staying in the game beats any single win.

- Define risk per trade (dollars, not points).

- Size by volatility: wider stop = fewer contracts.

- Respect the session: volatility differs between Asia, Europe, and U.S. cash hours.

- Plan for news: CPI, NFP, FOMC days can turn ES into a rocket.

- Use bracket orders: entry, stop, and target set together.

- Avoid emotional averaging down in a trending market.

Micros are especially good for this because you can test a strategy with low risk, then scale up to ES once performance is consistent.

Why Cannon Trading is a Great Choice to Trade Futures With

Standard and poor 500 futures remain the core index futures tool for U.S. equity exposure. The full-size contracts serve institutions, but most trading now happens in the e-mini and Micro E-mini ecosystem. E-mini contracts deliver the best liquidity and cost efficiency for most active traders, while Micro E-minis provide an accessible, fine-grained way to learn and size risk.

Comparing emini futures trading to traditional full-size futures comes down to four things: capital requirement, liquidity, risk control, and cost per exposure. For many traders, ES is the “sweet spot,” with MES as a stepping stone or precision hedge. Add Nasdaq and djia index futures to your toolkit when your strategy or portfolio calls for different volatility or factor exposure.

FAQ: Standard and Poor 500 Futures, E-mini, and Micro E-mini

Are standard and poor 500 futures the same as the S&P 500 index?

They track the same underlying index, but futures are leveraged contracts with margin, daily settlement, and expiration. The cash index is not leveraged and doesn’t expire.

Why is emini futures trading more popular than full-size futures?

Because E-minis require less margin, are more flexible for position sizing, and have far higher liquidity and tighter spreads.

What is the best contract for beginners: e-mini or Micro E-mini?

Most beginners start with Micro E-mini because the tick value and margin are smaller, allowing learning with lower financial stress.

How do Nasdaq futures differ from standard and poor 500 futures?

Nasdaq futures track the tech-heavy Nasdaq 100 and usually move more per day. That’s good for opportunity but increases risk.

What are djia index futures used for today?

They’re used for Dow-based hedging or for traders who want exposure to a blue-chip, price-weighted index with slightly different behavior than the S&P.

Do E-mini contracts trade overnight?

Yes. ES, NQ, and YM trade almost 24 hours a day, five days a week, with brief maintenance breaks.

What happens at expiration?

Index futures are cash-settled. If you hold through expiration, your position settles based on the final index value. Most traders roll earlier.

Is the Micro E-mini less liquid than the e-mini?

Yes, but MES liquidity is still strong during U.S. hours. For very fast scalping, ES remains better.

Can I hedge an ETF portfolio with Micro E-minis?

Yes. Many traders hedge partial exposure with MES because sizing is precise.

Are commissions higher on Micro E-minis?

The commission per contract is similar, so per dollar of exposure Micro E-minis cost more. The tradeoff is better risk control and lower capital requirements.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

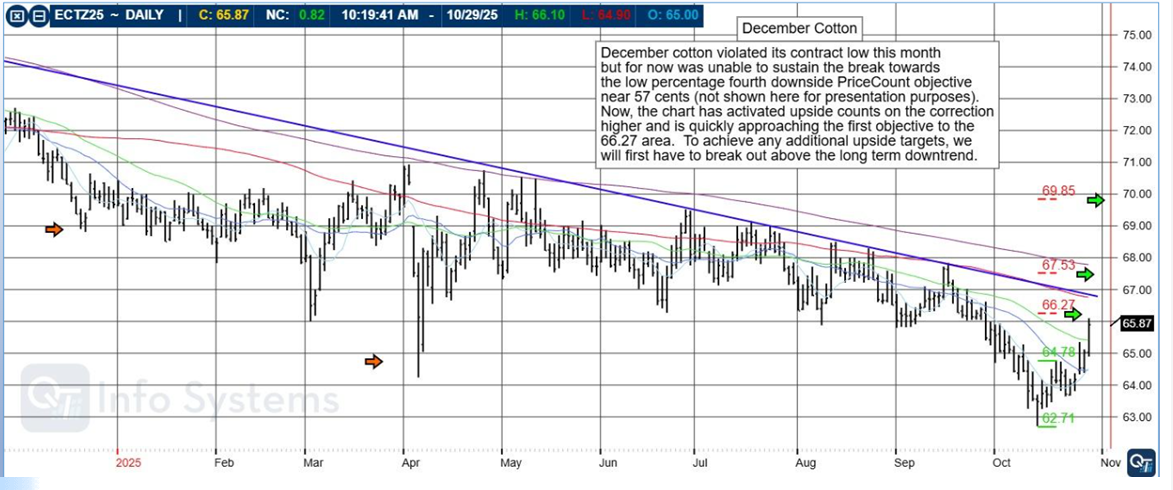

Second Interest Rate Cut, December Cotton, Levels, Reports; Your 4 Critical Need-To-Knows for Trading Futures on October 30th, 2025

|

|

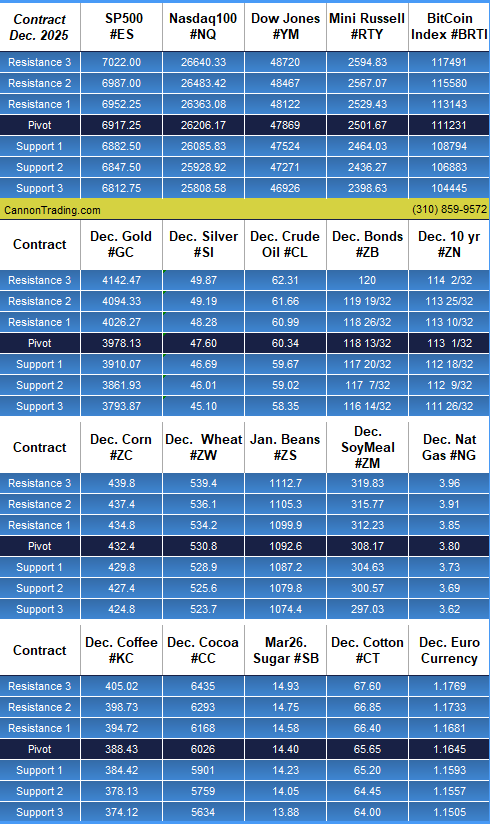

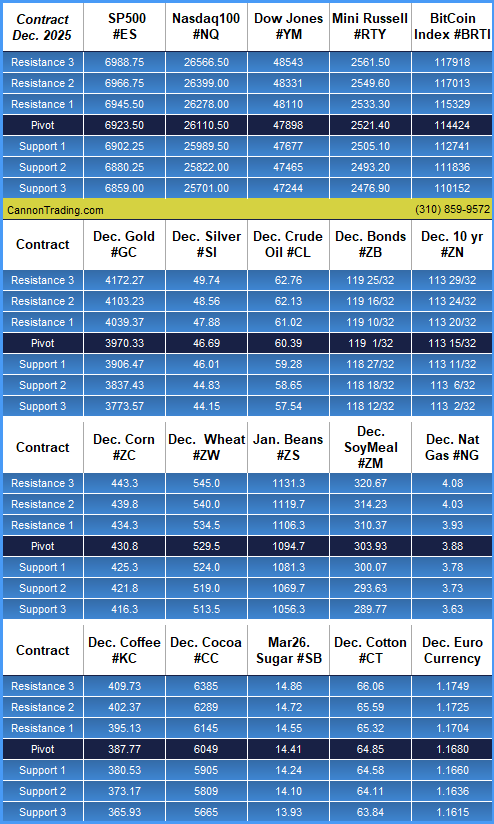

At-a-Glance Levels

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

Gold (GC)— Dec (GCZ5) |

3861.93 | 3910.07 | 3978.13 | 4026.27 | 4094.33 | ||

Silver (SI)— Dec (SIZ5) |

46.01 | 46.69 | 47.60 | 48.28 | 49.19 | ||

Crude Oil (CL)— Dec (CLZ5) |

59.02 | 59.67 | 60.34 | 60.99 | 61.66 | ||

Dec. Bonds (ZB)— Dec (ZBZ5) |

117 7/32 | 117 20/32 | 118 13/32 | 118 26/32 | 119 19/32 |

Interest Rates

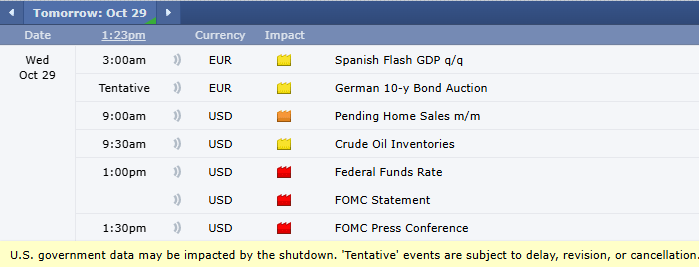

It wasn’t even apparent during Chair Jerome Powell’s post-announcement news conference what triggered the price jolts in several of the futures markets this afternoon – including a ±50-point decline in the E-mini S&P 500 and a ±200-point decline in the E-mini Nasdaq in the span of eight minutes, or the ±$40 sell-off in gold in the span of two minutes.

Regardless of the cause, they served as the latest real-world examples of why it’s so important for traders of all types to assess the risks of their trades – before you enter into them – and have a plan to manage that risk. Day traders and position traders alike should be aware of important planned events – just like FOMC announcements and press conferences – and anticipate the potential risks to those events (these days it’s wise to include occasions when the U.S. president speaks, considering his ongoing involvement and influence in global trade relations).

These events certainly create opportunities for traders – outsize moves can also result in outsize favorable outcomes – but the most important aspect to trading – is always to manage risk.

General – Interest Rates:

Day 29 of the U.S Government shut-down, now the second-longest on record.

The Federal Reserve cut interest rates by a quarter of a percentage point today – its second consecutive rate cut, lowering the Fed’s benchmark interest rate to a range of 3.75 to 4 percent, its lowest level in three years.

Stock Index Futures:

We’re amidst earning season for the third quarter. Moving into full swing, all eyes were on Microsoft, Google-parent Alphabet and Facebook-owner Meta today– all releasing their latest earnings results after the closing bell.

Tomorrow:

Apple and Amazon

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

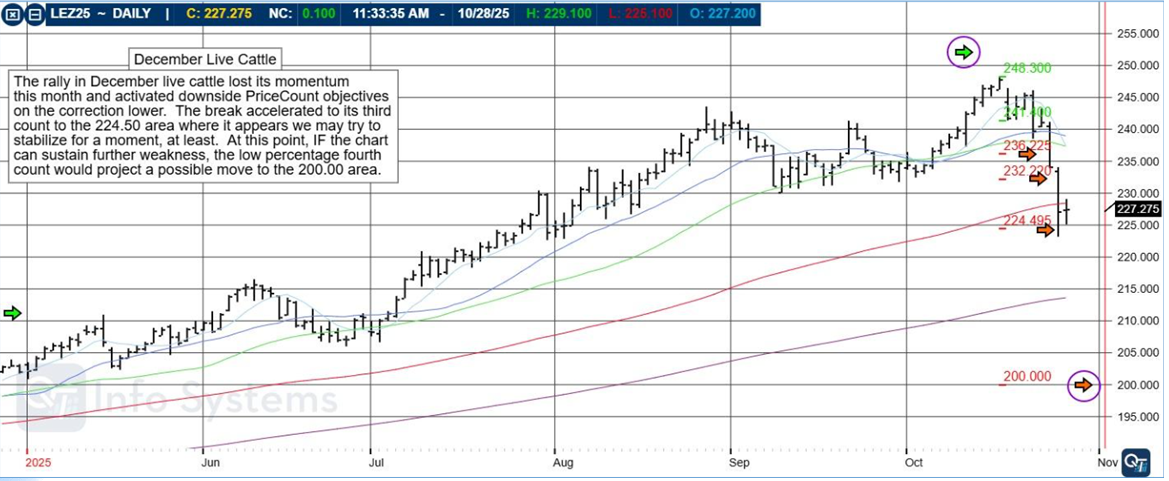

FOMC Tomorrow, December Live Cattle, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 29th, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

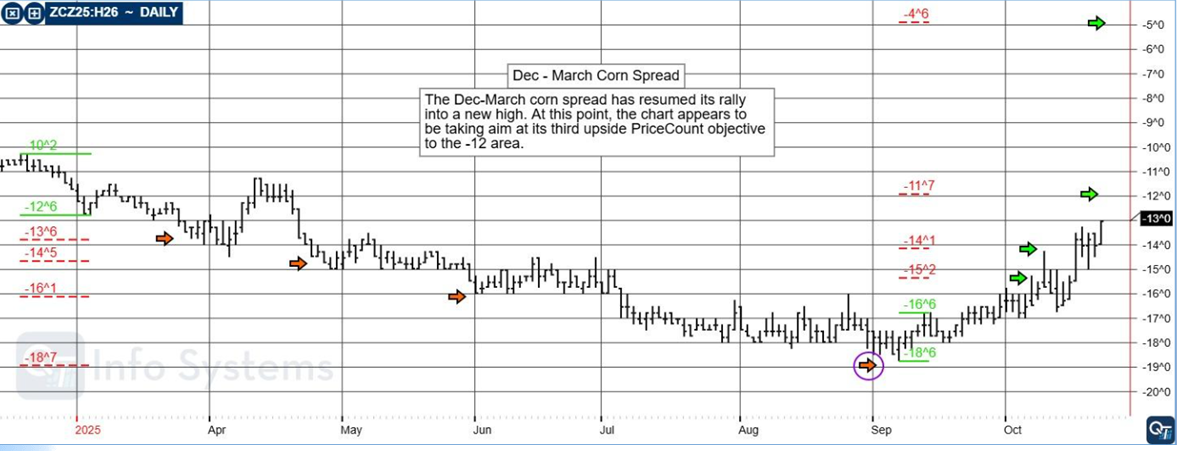

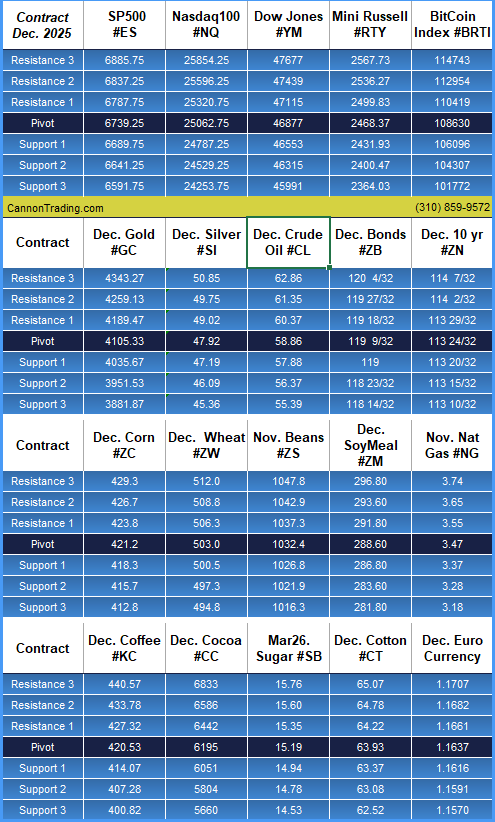

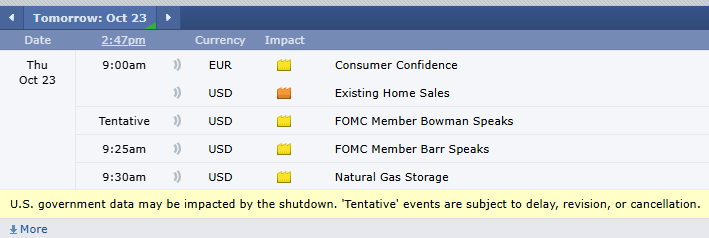

Futures FYI: Metals, Stock Index Futures, Energies, Dec-March Corn Spread, Levels, Reports; Your 6 Important Need-To-Knows for Trading Futures on October 23rd, 2025

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

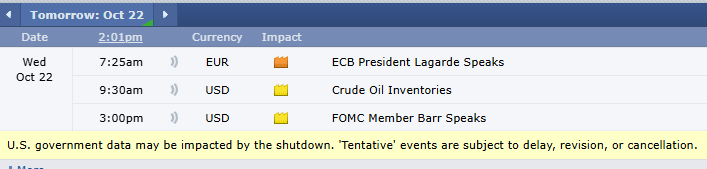

Gov’t Shutdown Continues, Impact on Traders’ Reports, Blackout & Volatility, Levels, Reports; Your 5 Important Must-Knows for Trading Futures on October 22nd, 2025

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

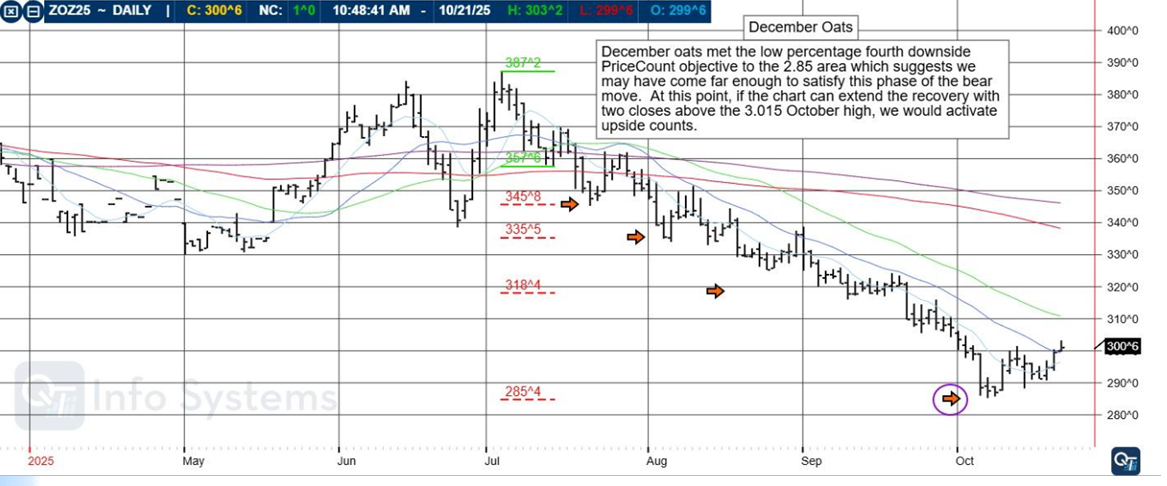

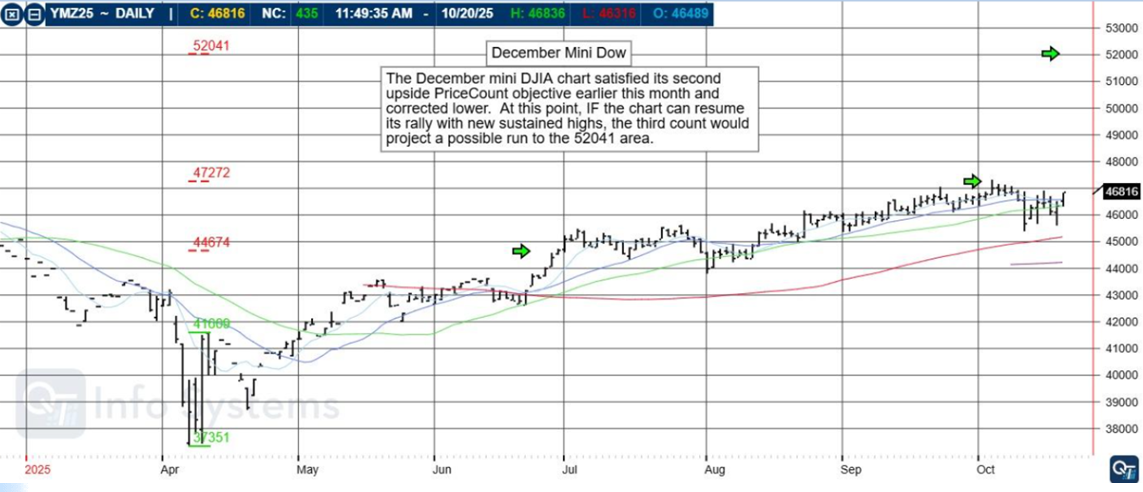

Overnight Edge, December Mini Dow, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on October 21st, 2025

|

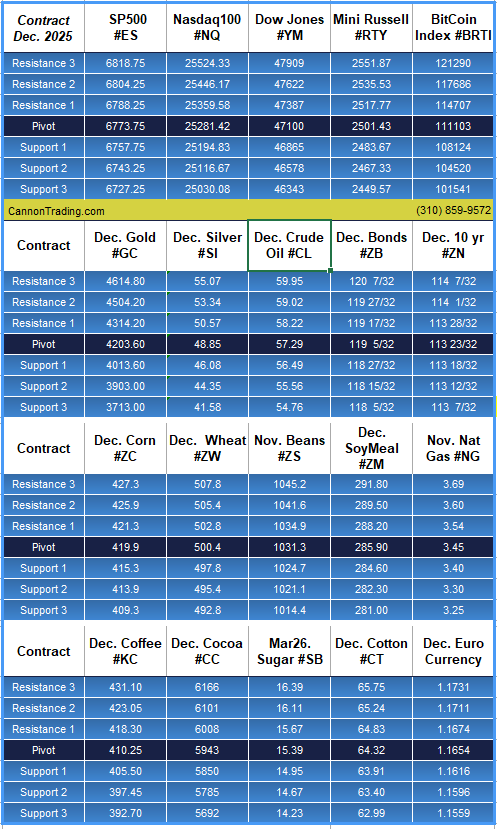

At-a-Glance Levels

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

| Gold (GC) — Dec (GCZ5) | 4173.40 | 4285.40 | 4341.70 | 4453.70 | 4510.00 | ||

| Silver (SI) — Dec (SIZ5) | 49.49 | 50.65 | 51.24 | 52.40 | 52.99 | ||

| Crude Oil (CL) — Nov (CLX5) | 55.32 | 56.16 | 56.79 | 57.63 | 58.26 | ||

| Dow Jones (YM) — Dec 2025 | 46087 | 46503 | 46733 | 47149 | 47379 |

Over the past few months, and especially in recent weeks, we’ve seen unusually large overnight moves. Some moves appear random, others reverse quickly, and some are driven by headlines such as tariff news. These dynamics have increased gap risk, reduced overnight liquidity, and produced frequent open-time dislocations.

Common question

Where is the edge?

Short answer

- Trade the first 30 minutes and focus on short-term gap-fill or rejection setups.

- Use same-day options when you expect a large directional move to limit tail risk and avoid being stopped out only to see the market move in your favor.

- Trade spreads when relative strength diverges across instruments (for example, gold vs silver or mini-Dow vs ES).

Extended answer

I want to focus on the practical elements of trading like pre-market context, move behavior, market news correlation, liquidity, options limits, and whether to use mean reversion or momentum. I’ll also want to highlight key parts like risk management, stop placement, and position sizing. Planning should be direct with a simple checklist and no more than six sections. I should also consider using a relevant citation about tariff-related movements, but just one, and make sure it’s only placed where necessary. No framing or extra explanations.

Futures day-trading edge

You find edge by matching a repeatable hypothesis to the current market regime, then executing it with strict risk and execution rules.

Regime diagnosis (what the market is doing now)

- Volatility regime: large overnight gaps and erratic premarket prints mean the market is in a news-driven, headline-sensitive volatility regime.

- Catalyst profile: moves are often tied to macro headlines and tariff noise; those headlines create directional gaps that either persist into the session or sharply reverse at the open.

- Liquidity profile: overnight liquidity is thin and fragmented, increasing slippage and fake outs at the open.

Reliable, tradeable edges you can use

- Pre-open directional bias with size filter. Trade opens when overnight gap exceeds a threshold (e.g., 0.5% or X ticks) and pre-market order flow confirms (sustained prints, not one-off sweep).

- Use reduced size and wider stops for gaps caused by headline noise.

- Fade headline gap into first 30 minutes when structure is weakIf gap lacks follow-through volume and price fails to make a clean microstructure breakout, favor mean reversion to the first-tail or VWAP.

- Trend-follow breakouts in high conviction regimeWhen overnight move is accompanied by aligned macro flow (rates, FX, commodities) and volume ramps into the open, follow momentum with a continuation plan.

- Volatility arbitrage playsUse options or calendar spreads where available to sell realized volatility after spikes and buy protection around known headline windows.

- Session-timing edgeTrade smaller and tighter in the first 15–30 minutes after the open; increase size after the market establishes structure (first clean high/low and confirmation).

- Microstructure edge: limit vs market tacticsUse passive limit entries near structural levels and aggressive exits into liquidity. Avoid market entries into thin pre-open auction prints.

Concrete execution rules (checklist)

- Pre-market checklist: identify gap size, top 3 headlines, correlated markets (bonds, FX, oil), and pre-open volume trend.

- Entry rules: require either structural confirmation (higher high / lower low) or a mean-reversion setup with defined edge-to-risk ratio ≥ 2:1.

- Sizing: reduce notional by 25–50% on headline-driven nights; increase only after two clean consecutive edges are realized.

- Stops and targets: place stop where edge invalidates (clearly definable price level); scale out at predefined targets; never trade without a stop.

- Slippage buffer: add tick buffer to stops and profit targets during thin liquidity opens.

How to test and keep the edge

- Backtest regime-specific rules: label historical sessions by overnight gap size and headline events, test mean-reversion vs momentum rules separately.

- Forward-test with small capital: run a two-week rolling simulator and log slippage, win rate, and expectancy.

- Adaptive rules: codify a volatility threshold that switches you between momentum and fade strategies automatically.

Brief trade plan template

- Hypothesis: (e.g., “Overnight tariff headline caused a 0.7% gap that lacks confirmatory volume; first 20 minutes will mean-revert to VWAP.”)

- Entry: limit at VWAP + X ticks or on 1-minute reversal candle.

- Stop: invalidation beyond the overnight high/low + slippage buffer.

- Target: partial at VWAP, final at first structure level.

- Size: 50% normal when gap driver = headline; full size only when macro alignment confirmed.

Be systematic: diagnose regime, pick the strategy that historically wins in that regime, enforce execution and risk rules, and iterate from measured data.

Important: Trading commodity futures and options involves a substantial risk of loss.

The recommendations contained in this blog are of opinion only and do not guarantee any profits.

Past performances are not necessarily indicative of future results.

|

|

|

||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||

|

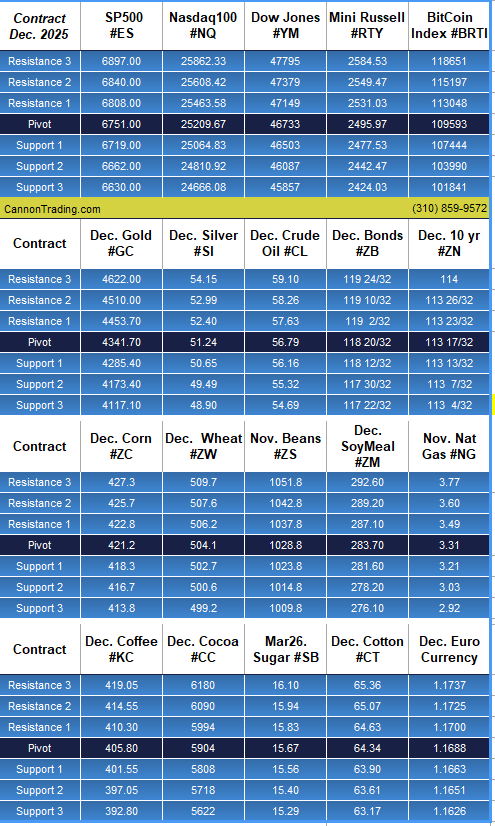

Less Data amidst Gov’t Shutdown, NEW WEBINAR, Dec. Crude Oil, Levels, Reports; Your 5 Important Must-Knows for Trading Futures the Week of October 20th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Volatility Tips, December Crude Oil, Bollinger Bands & Parabolics, Levels, Reports; Your 5 Important Must-Knows for Trading Futures on October 17th, 2025

|

|

|

|

|

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010