Futures trading is a complex and dynamic sector of the financial markets, requiring traders to navigate volatility, leverage, and strategic execution. While many traders master the basics, advanced futures traders often encounter unexpected challenges. In this article, we explore ten uncommon problems in trading futures and provide detailed, risk-assessed solutions. We will also examine why futures trading has been a cornerstone of global financial markets and how Cannon Trading Company, a legacy commodity brokerage firm based in Los Angeles since 1988, has successfully weathered decades of market innovation.

-

Latency Arbitrage Risks in High-Frequency Trading

Problem: Even sophisticated futures traders underestimate how milliseconds of latency can impact execution in high-frequency trading (HFT). Certain firms exploit minor discrepancies in price feeds, engaging in latency arbitrage against slower participants.

Solution: Traders should utilize direct market access (DMA) with co-located servers near exchanges to reduce execution time.

Risk Assessment: While co-location fees can be high, the alternative—being consistently front-run by faster traders—can lead to significantly larger financial losses over time.

Why This Solution? Compared to conventional retail brokerage solutions, DMA provides superior execution speeds and minimizes the risk of adversarial HFT strategies exploiting slower market orders.

-

Over-Optimization in Algorithmic Trading

Problem: Traders using algorithmic strategies often curve-fit their models to historical data, leading to poor real-world performance.

Solution: Implement walk-forward analysis and Monte Carlo simulations to test robustness against unseen market conditions.

Risk Assessment: Over-reliance on historical data increases drawdown risk. Diversifying strategy inputs can mitigate failures in live markets.

Why This Solution? Unlike standard backtesting, walk-forward analysis accounts for evolving market structures, reducing reliance on outdated data patterns.

-

Misinterpreting Order Flow in Thin Markets

Problem: Many futures traders misjudge liquidity in thinly traded contracts, leading to unexpected price slippage.

Solution: Use iceberg orders and volume-weighted average price (VWAP) algorithms to execute large positions more efficiently.

Risk Assessment: While VWAP orders can prevent market impact, improper execution timing can still lead to adverse selection.

Why This Solution? Compared to manual execution, VWAP minimizes slippage in illiquid futures markets, ensuring better entry and exit efficiency.

-

Neglecting Cross-Exchange Settlement Risks

Problem: Traders using multiple futures trading brokers across exchanges sometimes fail to account for cross-exchange margin calls.

Solution: Consolidate accounts with a prime futures broker that offers centralized risk assessment.

Risk Assessment: Single brokerage consolidation increases counterparty risk, but decentralized positions create exposure to conflicting margin policies.

Why This Solution? Prime brokerage mitigates liquidity fragmentation, reducing inefficiencies associated with collateral management.

-

Hidden Costs in E-Mini Futures Trading

Problem: Advanced traders often overlook exchange fees, data costs, and hidden liquidity provider markups when trading e-mini futures.

Solution: Utilize a cost-analysis dashboard from a futures trading broker that provides transparency on fees.

Risk Assessment: A trader might reduce cost-per-trade but risk losing access to critical order execution tools from premium platforms.

Why This Solution? Full cost visibility allows better strategy refinement, optimizing profitability over time.

-

The Fallacy of Static Hedging Strategies

Problem: Many futures traders assume static hedging (e.g., long S&P 500 futures against short crude oil futures) will always perform consistently.

Solution: Utilize dynamic delta hedging to adjust exposure as volatility fluctuates.

Risk Assessment: Dynamic hedging requires frequent adjustments, increasing transaction costs.

Why This Solution? Unlike static hedging, dynamic approaches account for changing market correlations, preventing unexpected losses.

-

Unexpected Margin Call Liquidity Gaps

Problem: Traders sometimes find themselves liquidated at extreme prices due to margin calls during low-liquidity periods.

Solution: Implement preemptive margin buffer strategies and monitor overnight funding conditions.

Risk Assessment: Holding excess capital reduces leverage efficiency but prevents forced liquidation at unfavorable prices.

Why This Solution? Unlike reactive capital injections, preemptive margin buffers safeguard against adverse execution.

-

Algorithmic Spoofing and Market Manipulation Risks

Problem: Spoofing—placing fake orders to manipulate prices—can create deceptive liquidity illusions.

Solution: Use proprietary spoof-detection indicators and confirm trades with time-and-sales analysis.

Risk Assessment: False positives can lead to over-cautious trading, reducing profit opportunities.

Why This Solution? Unlike conventional volume analysis, spoof-detection tools actively filter out manipulative activity.

-

Execution Disruptions from Exchange Halts

Problem: Circuit breakers and exchange halts can trap traders in highly leveraged positions.

Solution: Diversify execution venues and employ hedge orders in correlated markets.

Risk Assessment: Spreading orders across exchanges increases counterparty exposure, requiring careful counterparty risk management.

Why This Solution? A multi-venue approach ensures continued execution flexibility, reducing exposure to exchange-specific disruptions.

-

The Illusion of Automated Trading Autonomy

Problem: Traders often assume once an algorithm is deployed, it requires little oversight.

Solution: Employ real-time risk monitoring with automated trade kill-switch mechanisms.

Risk Assessment: Kill-switches may occasionally halt profitable trades, but they prevent catastrophic automation failures.

Why This Solution? Unlike passive oversight, active monitoring ensures rogue algorithms don’t cause unchecked losses.

Why Futures Trading Has Thrived for Centuries

Futures trading has been a fundamental part of global financial markets because it provides essential functions—price discovery, hedging, and liquidity. From the early rice futures exchanges in 18th-century Japan to modern electronic markets, futures have enabled risk transfer between producers, speculators, and hedgers. Despite technological advances, the core principles of futures trading remain intact: efficient risk management and speculative opportunities.

Cannon Trading Company: A Legacy Futures Brokerage

Established in 1988, Cannon Trading Company has endured decades of market evolution through innovation and deep market expertise. As one of the longest-standing futures trading brokers in Los Angeles, Cannon Trading provides advanced trading tools, superior risk management solutions, and comprehensive brokerage services. By adapting to technological advancements while maintaining a strong client focus, Cannon Trading has remained a reliable partner for professional traders navigating the ever-changing landscape of futures trading.

Understanding and mitigating uncommon trading challenges can significantly enhance a futures trader’s success. By implementing advanced solutions tailored to each issue, traders can optimize performance and reduce risk. As evidenced by firms like Cannon Trading Company, longevity in the futures trading industry is achieved through adaptability, transparency, and an unwavering commitment to innovation.

For more information, click here.

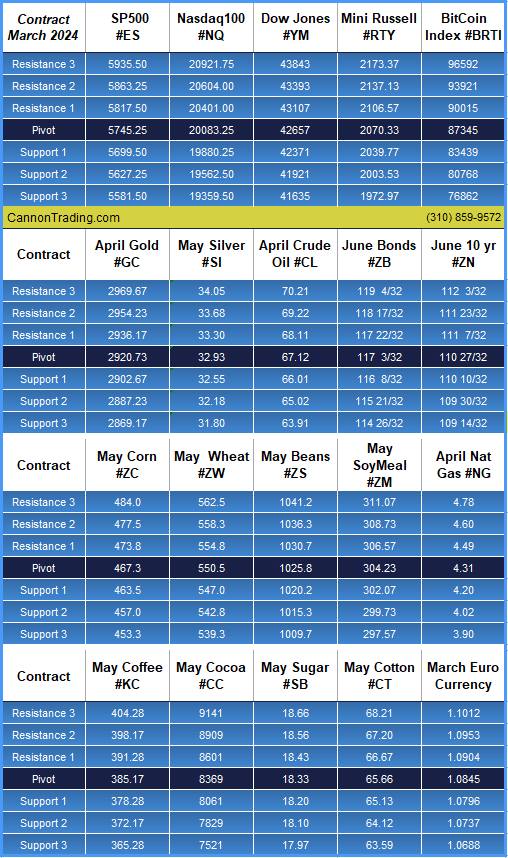

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading