USDA prospective plantings report tomorrow at 11 AM Central Time

From our friends at Hightower Report

For the USDA prospective plantings report on Friday, the average trade expectation for US soybean plantings is

88.3 million acres, with a range of expectations from 87.4 to 89.6 million. This would be up from 87.5 million last

year. The USDA Outlook Forum had planted area at 87.5 million acres as well.

For the Quarterly Grain Stocks report, US March 1 soybean stocks are expected to come in around 1.728 billion bushels (range 1.600-1.910 billion) versus 1.932 billion last year. Brazil may need to supply up to half of the soybeans that Argentina will import after the worst drought in 100 years devastated its fields and cut 2023 output nearly in half.

Argentina may need to import up to 10 million tonnes of soybeans. For the weekly export sales report, traders see soybean sales near 100,000-600,000 tonnes for old crop and another 50,000-300,000 tonnes for new crop. Meal sales are expected near 75,000-250,000 tonnes and oil sales are expected near zero-20,000 tonnes.

TODAY’S MARKET IDEAS:

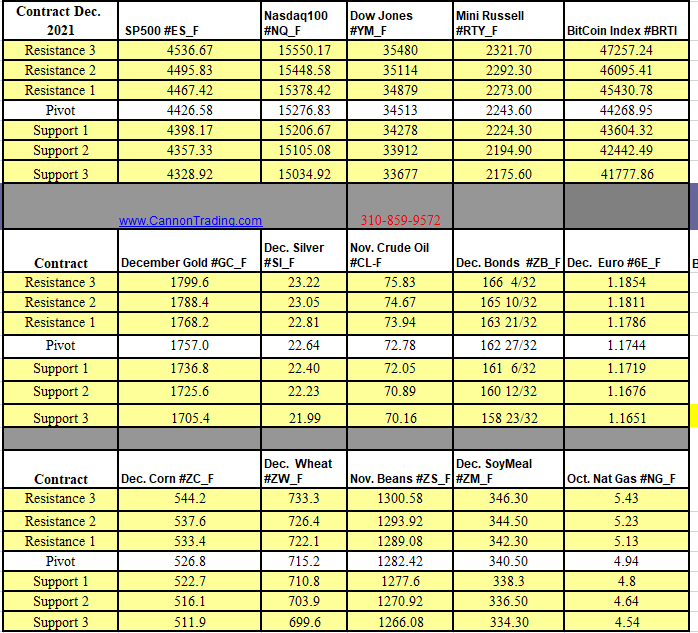

Look for support in November Soybeans at 1291 3/4, with 1316 and then 1337 1/2 as key resistance. July Soybean support is at 1443, with 1464 3/4 as next key resistance. July Soybean Meal support is at 447.30, with 459.10 and 465.70 as resistance.

For the USDA planted acreage report on Friday, traders see US corn plantings near 90.9 million acres, 87.7-92.1 range, as compared with 91 million acres from the USDA Outlook forum and from 88.6 million last year. We lean to the higher end of estimates.

Traders see March 1 corn stocks at 7.474 billion bushels which would be the lowest since 2014. The range of estimates is 7.240-7.830, as compared with 7.758 billion last year. For the weekly export sales report, traders see corn sales near 600,000-1.8 million tonnes for old crop and 50,000-300,000 tonnes for new crop.

For the USDA planted acreage report on Friday, traders see all wheat planted area at 48.9 million acres, 45.7-50.0 range, as compared with 49.5 million acres from the USDA Outlook Forum. Spring wheat planted area is expected near 10.9 million acres, 9.8-12.0 range, as compared with 10.8 million acres last year. Winter wheat plantings are expected near 36.3 million acres from 33.3 million in 2022. Traders see wheat stocks as of March 1 at 929 million bushels, 875-1.020 billion range, as compared with stocks last March at 1.029 billion bushels last year. For the weekly export sales report, traders see wheat sales near 125,000-300,000 tons for old crop and 0-150,000 tons for new crop.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

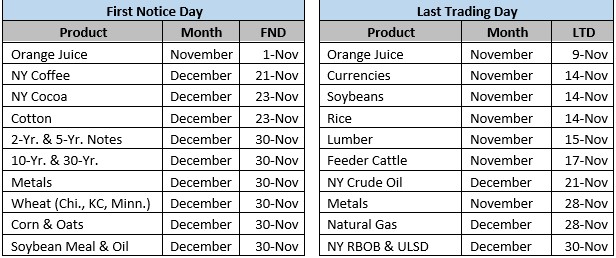

Futures Trading Levels

for 03-31-2023

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.