FOMC Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the rapidly evolving world of futures trading, having access to a cutting-edge futures trading platform is critical. One such platform making waves in the trading community is Bookmap—an innovative tool designed to bring transparency and precision to trading decisions. With its unique visual approach, Bookmap trading enables both novice and professional traders to see beyond the basic charts and deeply understand market behavior in real time.

As the demand for advanced platforms increases, so does the need for reliable brokers. That’s where Cannon Trading Company shines. As one of the most respected firms in the industry, Cannon Trading has been helping traders navigate the complex world of online futures trading platforms for decades.

This article explores the most important features of Bookmap for futures trading, details how to access Bookmap download and pricing, and explains why Cannon Trading Company is an outstanding partner for using this platform.

Bookmap is a high-performance futures trading platform that displays full-depth market data in an intuitive heatmap format. Unlike conventional charting tools, Bookmap trading enables you to see market liquidity and order flow with unprecedented clarity.

With Bookmap Web and Bookmap TradingView integration, users now have the flexibility to analyze markets on various devices and charting systems. This accessibility is enhanced by Bookmap free features that allow traders to try out the platform before committing financially.

The availability of granular market data is one of the core strengths of Bookmap. It visualizes market dynamics by showing historical order book activity and real-time transactions, enabling traders to spot opportunities before they appear on standard charts.

Understanding Bookmap pricing is key before diving in. There are several tiers based on your needs:

Each tier offers flexibility depending on whether you’re new to Bookmap trading or a seasoned professional. Importantly, Bookmap download is straightforward, and the platform supports both Windows and macOS.

With Bookmap Web, you can even access your trading dashboard from any browser, making it ideal for traders on the go.

When it comes to online futures trading platforms, broker selection is just as important as the platform itself. Cannon Trading Company stands out as an industry leader and is a perfect partner for anyone using Bookmap.

Combining the sophisticated features of Bookmap with the unmatched service of Cannon Trading Company creates a powerhouse for futures traders. Whether you’re leveraging the real-time heatmap for scalping or conducting detailed order flow analysis, Cannon Trading’s infrastructure and experience enhance your performance.

From Bookmap pricing transparency to expert help with Bookmap data feeds, Cannon ensures that your trading experience is as seamless and successful as possible.

The Bookmap Futures Trading Platform is revolutionizing how traders view and interact with the market. Its innovative visualization tools, integration with Bookmap TradingView, browser-based Bookmap Web, and robust Bookmap free version make it a go-to solution for serious traders. When combined with a top-tier brokerage like Cannon Trading Company, which offers industry experience, stellar reputation, regulatory compliance, and multiple futures trading platform options—including Bookmap—you have a winning formula for success.

Whether you’re exploring Bookmap download for the first time or looking to deepen your expertise in Bookmap trading, partnering with Cannon Trading will elevate your performance and confidence.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In the dynamic world of online futures trading platforms, few names stand out as boldly as MotiveWave. As technology continues to evolve, traders demand more robust, analytical, and user-friendly tools. The MotiveWave Futures Trading Platform meets these demands head-on, delivering a comprehensive suite of features that elevate the trading experience for both novice and professional futures traders alike.

This article provides a deep dive into the MotiveWave trading environment, highlights key features that make it a premier choice for futures trading, and explores why Cannon Trading Company is the ultimate partner for leveraging MotiveWave’s power.

What is MotiveWave?

MotiveWave is a professional-grade futures trading platform known for its advanced charting tools, algorithmic trading capabilities, and comprehensive market analysis features. Initially gaining traction among forex and equity traders, MotiveWave has carved a prominent space within the online futures trading platform sector due to its reliability and feature-rich design.

Whether you’re focused on short-term scalping or long-term market trend analysis, MotiveWave trading tools are tailored to adapt to your trading style. From MotiveWave mobile access to full desktop integration via MotiveWave download, the platform ensures seamless continuity for traders on the move. Additionally, it supports custom workspaces and scripting with Java-based extensions, further enhancing the functionality for sophisticated trading needs.

Most Important Features for Futures Trading on MotiveWave

Accessing your trading environment is easy with the MotiveWave login process. The interface is secured with two-factor authentication, ensuring your data and trading activities are protected. Users can customize their workspace upon login, allowing for a personalized experience that matches individual trading preferences.

The MotiveWave download is available directly from the official website. Installation is straightforward, with support available for Windows, macOS, and Linux operating systems. Regular updates ensure the platform remains secure and compatible with the latest system features.

A common query among new users is: Is MotiveWave free? While MotiveWave offers a free trial version, its full capabilities are unlocked through tiered pricing plans. This freemium model allows users to test the interface and decide on the best plan that suits their trading needs. Considering its robust toolset, the MotiveWave price offers excellent value compared to competitors.

There are also occasional promotions through partners like Cannon Trading, which may include extended trial periods or discounted subscriptions. This makes testing the MotiveWave trading experience even more accessible.

Choosing the right brokerage is as crucial as selecting the right futures trading platform. Cannon Trading Company excels in this regard. Here’s why:

MotiveWave Review Summary

The feedback from users paints a highly favorable MotiveWave review. Traders cite the platform’s depth of analysis, customizability, and professional-grade tools as reasons for their loyalty. Whether evaluating MotiveWave software for the first time or switching from another futures trading platform, users consistently highlight its seamless performance and insightful analytics.

Professional traders appreciate how MotiveWave trading aligns with institutional tools, while new users benefit from the clear documentation and visual guides. This inclusivity ensures a smoother learning curve, especially when paired with educational materials from Cannon Trading.

Furthermore, the synergy between MotiveWave and Cannon Trading amplifies the platform’s benefits. Combining advanced technology with decades of industry expertise creates a powerful trading environment that is both innovative and secure.

The MotiveWave Futures Trading Platform stands out in a crowded marketplace by offering unparalleled features, powerful analytical tools, and wide-ranging compatibility. The repeated queries of MotiveWave login, MotiveWave price, and MotiveWave download are justified by the platform’s capabilities and reliability. While MotiveWave mobile ensures traders are never disconnected, the question “Is MotiveWave free” is best answered by its generous trial options and value-packed pricing tiers.

When partnered with a top-tier brokerage like Cannon Trading Company, traders gain access to world-class tools, unbeatable service, and a trusted advisor in their futures trading journey. If you’re looking to elevate your futures trading game, MotiveWave combined with Cannon Trading is a combination worth serious consideration.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Platinum futures remain one of the most compelling precious metals contracts for traders looking to hedge risk, speculate on price movements, or diversify their portfolios. As 2025 unfolds, futures traders must equip themselves with the right knowledge, reports, and strategies to navigate the evolving market landscape. In this comprehensive guide, we will explore the key factors influencing platinum futures, historical trends, and why Cannon Trading Company is an ideal futures trading broker for traders of all experience levels.

Platinum futures are expected to be influenced by multiple key factors in 2025:

Meanwhile, corn futures are expected to experience volatility driven by:

When assessing potential platinum futures trades, traders should monitor the following reports:

Platinum has a unique history in the commodities market. Unlike gold and silver, which are primarily monetary metals, platinum has a more industrial focus. Some notable historical trends include:

Gold and silver futures have historically been more stable but still follow macroeconomic and geopolitical trends. Traders should compare these metals to platinum futures to identify relative value opportunities.

For traders looking for a reliable futures broker, Cannon Trading Company stands out for several reasons:

If you’re serious about trading platinum futures, choosing a seasoned futures trading broker like Cannon Trading Company ensures you have the best tools, support, and expertise at your disposal.

Trading platinum futures in 2025 requires a deep understanding of market fundamentals, technical strategies, and macroeconomic influences. By following key reports, monitoring industrial demand, and leveraging expert futures brokers like Cannon Trading Company, traders can position themselves for success in the evolving futures trading landscape.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

The rise of artificial intelligence (AI) has significantly transformed various industries, and futures trading is no exception. From the earliest days of manually shouting orders on bustling trading floors to today’s sophisticated, algorithm-driven systems, the futures markets have undergone a seismic shift. Understanding this evolution sheds light on the advantages and disadvantages of automated and manual trading, while also highlighting why institutions like Cannon Trading Company remain pivotal for traders navigating these dynamic landscapes.

Before the advent of AI, futures trading relied heavily on manual processes. Traders on the floor of exchanges like the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX) engaged in open outcry trading. Brokers shouted and used hand signals to execute trades in pits, creating a high-energy environment driven by human intuition, relationships, and rapid decision-making.

Manual trading in this era required a deep understanding of market fundamentals, technical analysis, and quick reflexes. For example, during the 1980s, crude oil futures saw dramatic price fluctuations driven by geopolitical tensions. Brokers had to assess global news, client positions, and technical charts almost instantaneously to execute profitable trades. The experience of a seasoned futures trader often made the difference between substantial gains and significant losses.

However, the manual system had its drawbacks. Human error, emotional decision-making, and inefficiencies in communication often resulted in missed opportunities or costly mistakes. As technology advanced, these limitations became apparent, paving the way for more sophisticated methods.

The introduction of computers in the late 20th century marked the beginning of a new era for futures trading. Algorithms capable of processing vast amounts of data at incredible speeds began to replace manual processes. This evolution took a giant leap forward with the advent of AI and machine learning in the 21st century.

AI-driven futures trading systems leverage historical data, real-time market information, and predictive analytics to make split-second decisions. For example, in 2010, high-frequency trading (HFT) accounted for over 60% of all U.S. equity trading volume. These AI algorithms identify patterns and execute trades faster than any human trader could manage.

One notable anecdote involves the 2010 “Flash Crash,” where the Dow Jones Industrial Average plummeted nearly 1,000 points in minutes before quickly rebounding. AI algorithms played a significant role in this event. While their speed and efficiency can create liquidity, their interactions can also exacerbate market volatility. This dual-edged nature of AI trading underscores the importance of regulatory oversight and robust system design.

AI futures trading offers numerous benefits:

Case Study: Renaissance Technologies, a hedge fund founded by mathematician James Simons, has consistently delivered high returns using AI-driven strategies. Their Medallion Fund, which employs machine learning algorithms, is one of the most successful trading funds in history, generating average annual returns of 39% before fees.

Despite its advantages, AI futures trading has its challenges:

Hypothetical Scenario: Imagine an AI system designed to trade soybean futures based on weather data. A sudden, unprecedented weather anomaly—not included in the training data—leads to erroneous predictions and significant losses. This scenario highlights the importance of continuous monitoring and improvement of AI systems.

While AI dominates modern futures trading, manual trading still has its place. Human traders bring intuition, experience, and the ability to adapt to unique market conditions. For example, during the COVID-19 pandemic, some experienced futures brokers successfully navigated unprecedented market turmoil by relying on their deep understanding of fundamentals and client needs.

Advantages of manual trading include:

However, manual trading also has drawbacks:

For traders seeking the best of both worlds, Cannon Trading Company stands out as an ideal partner. Here’s why:

Case Study: A client of Cannon Trading Company reported transitioning from manual trading to a hybrid approach using AI-driven platforms. With Cannon’s support, they successfully implemented an algorithm to trade E-mini S&P 500 futures, achieving consistent returns while retaining the ability to override trades based on market insights.

Looking ahead, the integration of AI in futures trading will only deepen. Innovations like natural language processing (NLP) and reinforcement learning will enable systems to interpret news articles, social media sentiment, and even geopolitical developments to inform trading decisions.

For instance, an AI system analyzing weather patterns and crop reports might predict a supply shortage in wheat, prompting traders to enter long futures contracts. Alternatively, advances in quantum computing could revolutionize the speed and accuracy of predictive models, giving traders an unprecedented edge.

However, as AI continues to evolve, ethical and regulatory considerations will remain critical. Ensuring fairness, transparency, and accountability in AI-driven markets will be paramount to maintaining trust and stability.

The evolution of AI futures trading has revolutionized the industry, offering unparalleled speed, efficiency, and data-driven insights. While automated systems have their advantages, the human touch remains invaluable, particularly in navigating complex or unprecedented market scenarios.

For traders of all experience levels, choosing the right partner is essential. Cannon Trading Company’s combination of advanced platforms, stellar reputation, and personalized support makes it an ideal choice for anyone engaged in futures trading. Whether you’re leveraging cutting-edge AI or relying on the expertise of seasoned futures brokers, Cannon provides the tools and guidance needed to succeed in today’s dynamic markets.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

Listen to our Market Recap Podcasts on Apple Podcasts

CPI numbers, Natural gas numbers, 30 year auction and more on a busy day tomorrow!

Ask a Broker: What is Day Trading Futures? watch below!

November Crude Oil

November crude oil completed its first upside PriceCount objective to the $78 area and is correcting with a reversal trade. IF the chart can resume its rally with new sustained highs, the second count would project a possible run to the 82.76 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

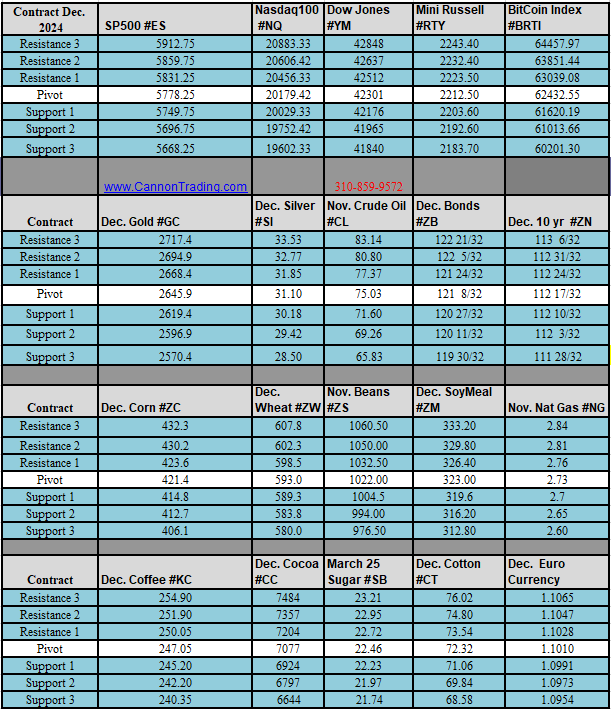

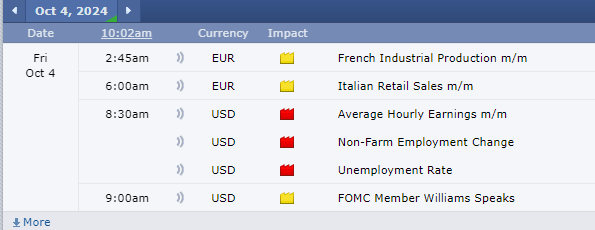

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading. #Equities, #Consolidation phase, #Interest rates, #Precious metals, #Gold, #Silver, #US Dollar, #Crude oil prices, #HurricaneHelene, #Middle East tensions, #Chinese stimulus, #Redbook US Retail Sales, #Case Schiller US Metro-Area Home Prices, #Richmond Fed Manufacturing Index, #Service Sector Index, #Consumer Confidence, #New Home Sales, #Micron Technology

Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

Listen to our Market Recap Podcasts on Apple Podcasts

Movers and Shakers

By John Thorpe, Senior Broker

With Equities quietly trading in a consolidation phase since September 19th, Interest rates following, the precious metals ,once again surprised many traders with their mid-day selloff after last week’s Highest weekly Silver close since May of this year Silver down $1.30 or $6500.00 from yesterdays close per contract.

Gold lower by $33.00 @ 2634.00,

The US Dollar continuing to firm up after it’s end of Q3 Low, trading over 2 cents higher at 1.0227 ending it’s 2.5 month long slide after flirting with 14 month lows of 99.22. .

The Energy complex Dropping significantly today Crude off 4.25 %, the products off 3.5 to 4 % as the menace that’s called Milton is racing East toward the Florida Gulf Coast,

Atlanta Fed Pres. Bostic was quoted “ Hurricanes have significant potential implications for US economy over the next couple quarters”

So, with the Fed Funds, Interest rate markets and Equities range bound waiting for tomorrows FOMC Minutes @ 11:00 am CDT, and the looming Cat 5 potential Catastrophe, In addition to Heightened middle east tensions, Vigilance is the word and may be an opportunity to use options to enhance or protect your trading portfolio. Here is a fresh take by the EIA on short term price expectations in the winter months for the entire energy complex, freshly produced today! Take a look!. https://www.eia.gov/outlooks/steo/report/perspectives/2024/10-winterfuels/article.php

FOMC Minutes tomorrow as well as Crude Oil Inventories

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading. #Equities, #Consolidation phase, #Interest rates, #Precious metals, #Gold, #Silver, #US Dollar, #Crude oil prices, #HurricaneHelene, #Middle East tensions, #Chinese stimulus, #Redbook US Retail Sales, #Case Schiller US Metro-Area Home Prices, #Richmond Fed Manufacturing Index, #Service Sector Index, #Consumer Confidence, #New Home Sales, #Micron Technology

Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

Listen to our Market Recap Podcasts on Apple Podcasts

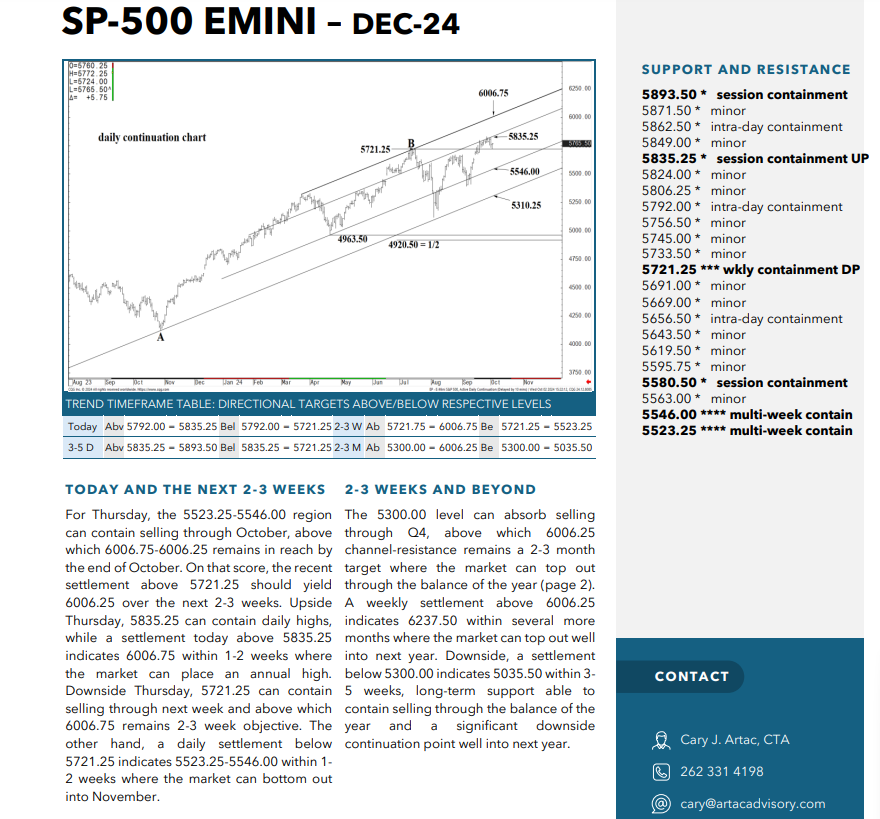

Market is going up but so is the 10-year yield

7 October 2024

Market is going up but so is the 10-year yield***

Advancing shares outnumbered declining ones by three-to-one this week through midday Friday, and seven of 11 S&Psectors trade with 80% or more of their components above their 50-day moving averages. This wide breadth indicates the cyclical trade into sectors beyond mega caps remains intact and markets aren’t moving toward defensive trades at the equity level.

On a technical basis, the SPXheld it’s ground this week above the prior all-time closing high from July despite geopolitical uncertainty . The uptrend remains intact, and the bulls still appear to be in control.

Less bullish note, the SPX now trades at a nearly 22 price-to-earnings (P/E) ratio, historically high. This might damper investor enthusiasm for now, though solid earnings growth could help ease valuations.

Unfortunately for anyone banking on improved earnings growth, analysts keep backing up the truck. The average third quarter S&P 500 earnings per share estimate slipped to 4.2% today from 4.6% a week ago, according to research firm FactSet. That’s down from 7.8% at the end of June.

The FED is easing, and the path of least resistance is intact. The S&P 500 is less than 1% below all-time highs, following September’s strong Nonfarm Payrolls report.

Federal Reserve Chair Jerome Powell said, the U.S. economy is in solid shape and the Federal Reserve intends to keep it that way, Consumer household debt is very high. If the economy performs as expected, that would mean a total of 50 basis points of cuts for the remainder of this year, Powell said.

Stronger-than-expected September jobs data by the Bureau of Labor Statistics on Friday added fuel to arguments in favor of a soft landing, inflation closing in on the Federal Reserve’s 2% target. A gain of 254,000 nonfarm jobs last month paired with easing unemployment, it signals that the labor market remains on solid footing. And should help reduce calls for another big rate cut. Fed officials, however, will also have a couple more inflation readings to review before the meeting, as well as weekly jobless claims data and consumer spending updates. All of that could shift the economic outlook in the coming weeks.

The market now expects 25-basis-point interest rate cuts at the Fed’s November and December meetings following September’s 50-basis-point cut. That would equal 100 basis points, or 1 percentage point, worth of rate cuts before year-end. measured, methodical rate cuts. The U.S. economy is based on services, and we want consumers to stay robust as the Fed brings borrowing costs down.

Friday’s jump in the 10-year Treasury yield on the jobs report. Home loans loosely follow the 10-year and rates on a 30-year fixed jumped Friday morning to 6.53%, according to Mortgage News Daily.

While the port strike ended, labor strikes have become more common, which likely translates into higher wages (wage gains from Fridays nonfarm payrolls report were +0.4% vs. +0.3% expected. For now, inflation data has been trending toward the Fed’s target.

Analysts are saying this is Goldilocks scenario for the markets. Others are saying we might see some upside for inflation, crude prices are up 10% due to Middle East tensions. Wage inflation can play a role. The election can be a risk. But good news is good news. The positive forces should propel the market higher.

Any money manager that’s been bearish this year is behind the index if they were in cash and now, they have to jump in. Who wants to sell now and have tax gains. Nine months into the year and we’re up 20%. plus, money that comes out of the declining money-market funds and expiring U.S. government bonds should make its way into equities,

NOTE: The commodities futures trader report last week shows that large speculators and leveraged funds have the largest net short position in the 10 year treasury futures. they see long term interest rate going up.

Why aren’t small caps rallying? Small caps and value trade together and value started to outperform growth, perhaps small caps will play catch up. typically, you see small caps outperform a year after the first cut.

Next week we’ve got several potential market moving catalysts, highlighted by monthly Inflation data: The September consumer price index (CPI) report is out Thursday. Economists are expecting a 2.2% year-over-year increase at the headline level, and a 3.1% year-over-year increase at the core level, which strips out volatile food and energy prices. watch the CPI’s shelter index, which has been a key underlying source of overall inflation. slowing of year-over-year price increases in shelter would be welcome.September producer price index (PPI) is out Friday. While the Fed is more concerned about consumer prices, the PPI is still important because if wholesale prices go up more than expected it might mean higher retail prices down the line as companies look to protect their margins. These inflation numbers will certainly figure into the Fed’s calculations concerning future rate cuts.

We also have the Robotaxi event for Tesla and Advanced Micro Devices holds an important artificial intelligence event.

Look out for next Friday’s big bank earnings reports (JPM, WFC, BK).

FactSet is currently forecasting Q3 earnings growth for the S&P 500 to be up a healthy 4.6%, down from the 7.8% at the start of the quarter.

Sectors worth watching; tech, cyclical, Housing, cybersecurity, aviation, power & grid.

Summary: The intermediate technicals are bullish, but near-term price action has been choppy to sideways over the past few weeks. Geopolitical risk remains high, and the Fed may not be as accommodative as previously expected, the stronger than expected U.S. economic data appears to be the primary driver of the near-term direction for stocks, and that direction is higher for now. any upside surprises in the CPI report may cause for a correction. Earnings should help navigate market direction.

The outlook contained in this article are of opinion only and do not guarantee any profits. Futures trading is risky and suitable for everyone.

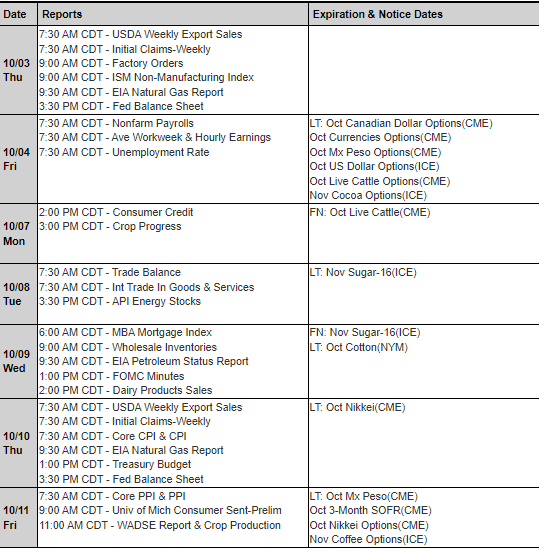

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading. #Equities, #Consolidation phase, #Interest rates, #Precious metals, #Gold, #Silver, #US Dollar, #Crude oil prices, #HurricaneHelene, #Middle East tensions, #Chinese stimulus, #Redbook US Retail Sales, #Case Schiller US Metro-Area Home Prices, #Richmond Fed Manufacturing Index, #Service Sector Index, #Consumer Confidence, #New Home Sales, #Micron Technology

Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

In this issue:

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

Earnings season begins in earnest. Major Inflation indicators. FOMC Minutes. 17 Fed Speeches by all 12 Fed Governors. So, we have a little bit of everything, in what is expected to be a huge week, adding to the current Middle East volatility.

Prominent Earnings this Week:

FOMC Minutes Wednesday. 1:00PM Central

FED SPEECHES:

Big Economic Data week:

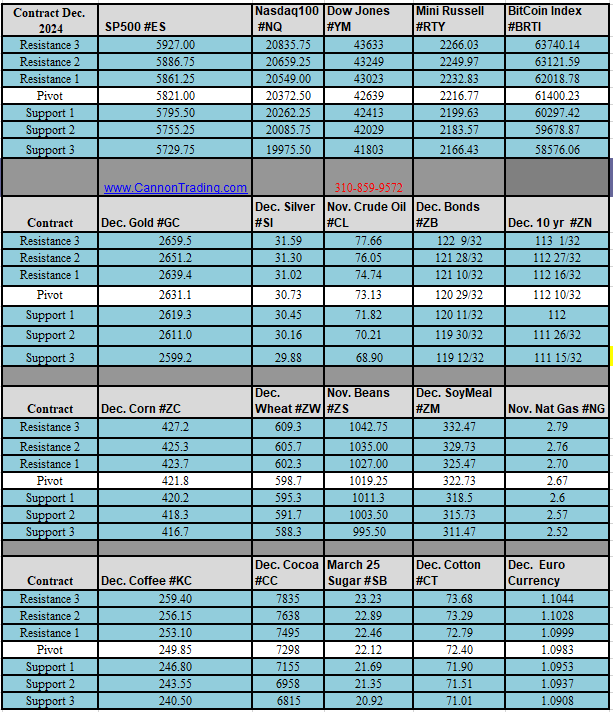

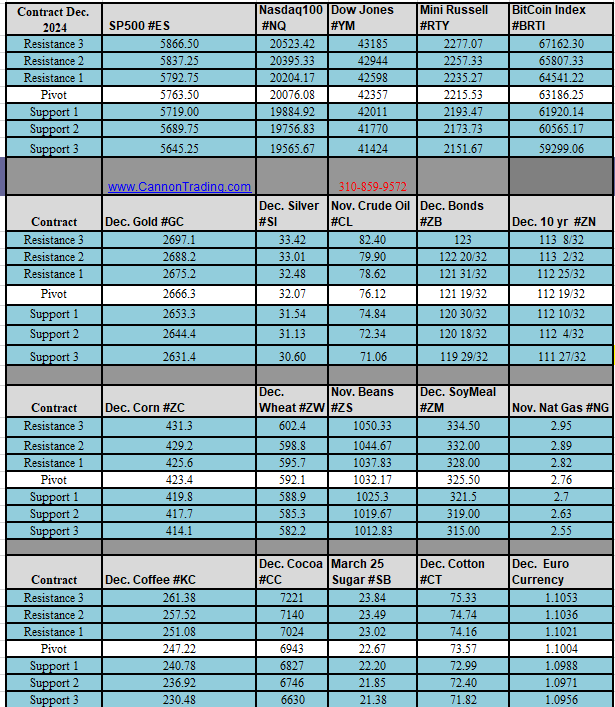

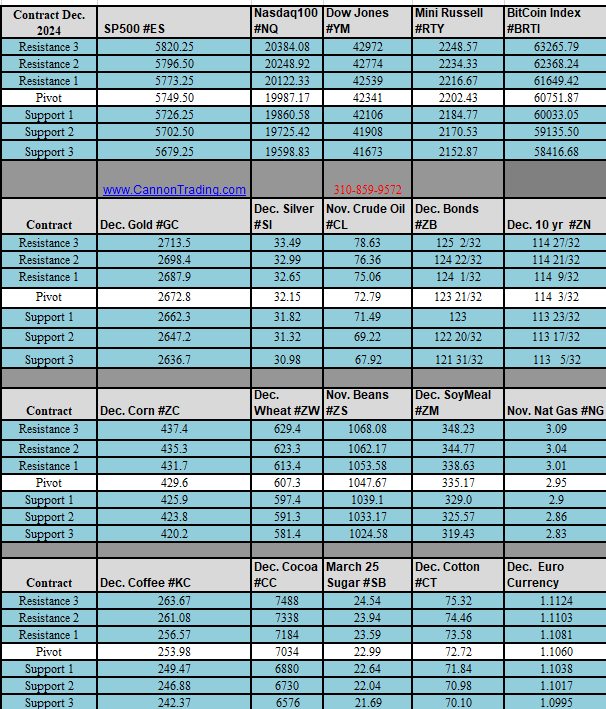

Click Image Below for Larger View

Would you like to have access to research like shown above and MORE?

Here is what you will receive DAILY:

To sign up and get two weeks FULL access, start by requesting the free trial below.

Questions? We are happy to help!

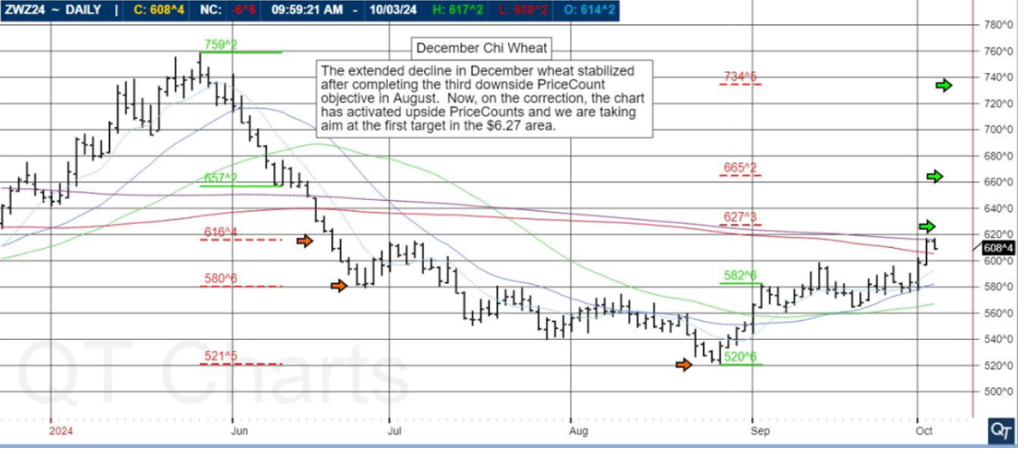

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Wheat

The extended decline in December wheat stabilized after completing the third downside PriceCount objective in August. Now, on the correction, the chart has activated upside PriceCounts and we are taking aim at the first target in the $6.27 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

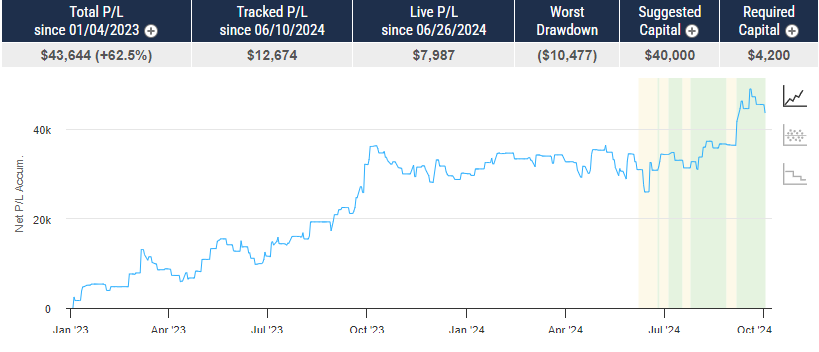

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

SI – Silver

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$25,000

COST

USD 115 / monthly

Recommended Cannon Trading Starting Capital

$25,000.00

COST

USD 150 / monthly

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data. Please read full disclaimer HERE.

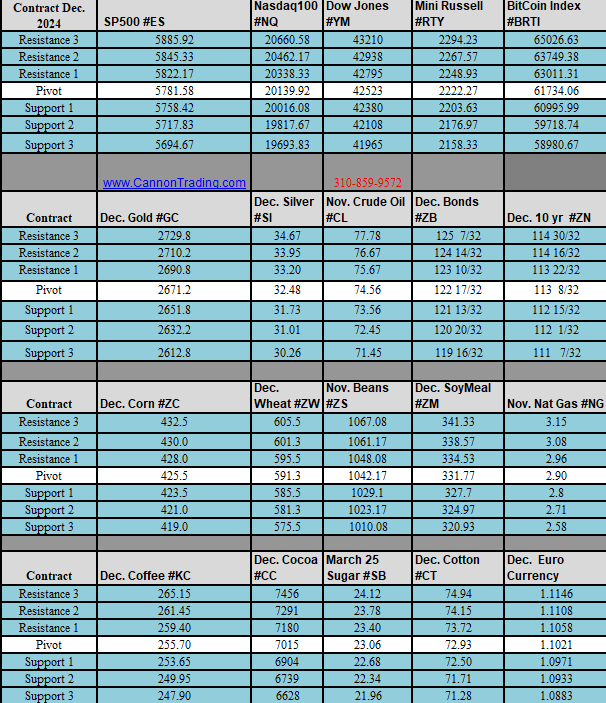

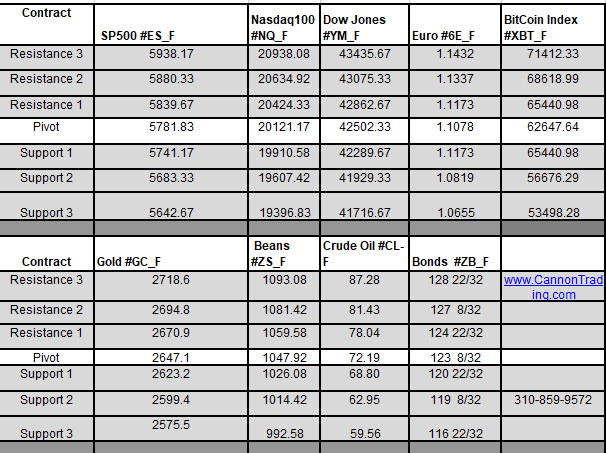

| Would you like to receive daily support & resistance levels? |

| Yes Select |

| No Select |

Trading Reports for Next Week

Trading Reports for Next Week

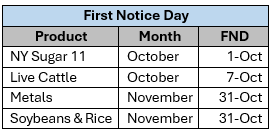

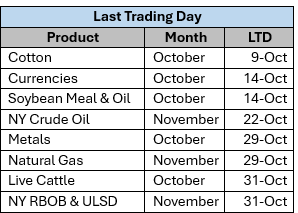

First Notice (FN), Last trading (LT) Days for the Week:

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

Listen to our Market Recap Podcasts on Apple Podcasts

NFP tomorrow at 7:30 AM Central time! Non Farm Payrolls is a market moving event that takes place the first Friday of every month. Be aware and understand this report can impact market behavior.

Below are the contracts entering First Notice or Last Trading Day for the upcoming month. Be advised that for contracts that are deliverable, it is requested that all LONG positions be exited two days prior to First Notice and ALL positions be exited the day prior to Last Trading Day. If you have any questions, please contact your broker.

|

|

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading. #Equities, #Consolidation phase, #Interest rates, #Precious metals, #Gold, #Silver, #US Dollar, #Crude oil prices, #HurricaneHelene, #Middle East tensions, #Chinese stimulus, #Redbook US Retail Sales, #Case Schiller US Metro-Area Home Prices, #Richmond Fed Manufacturing Index, #Service Sector Index, #Consumer Confidence, #New Home Sales, #Micron Technology