Cannon Futures Weekly Newsletter Issue # 1128

Join our private Facebook group for additional insight into trading and the futures markets!

- Important Notices – Make 2023 great!

- Trading Resource of the Week – Trading Around Economic Reports FREE COURSE

- Hot Market of the Week – March Wheat

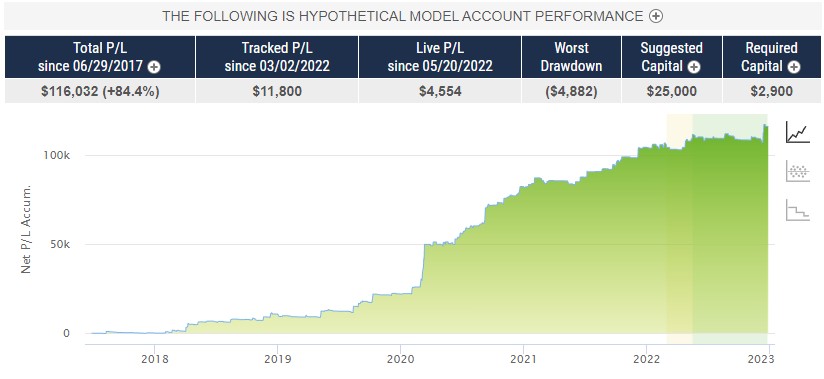

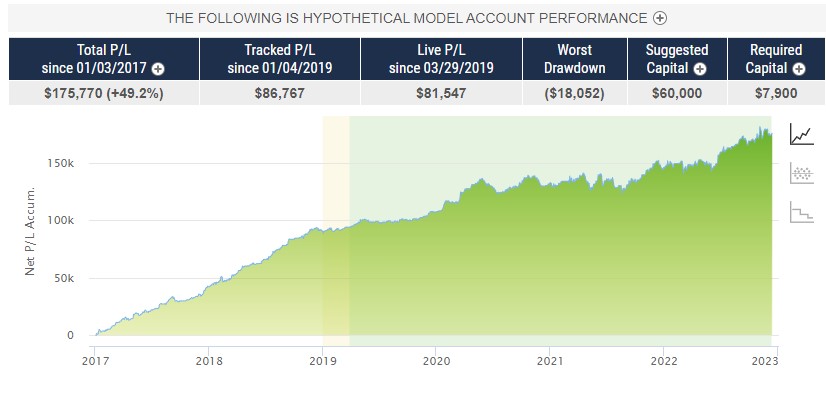

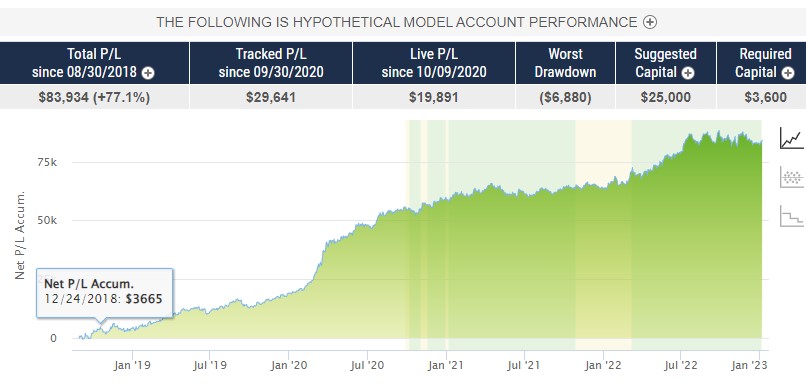

- Broker’s Trading System of the Week – CIRUS ST58 EUROFX KASE

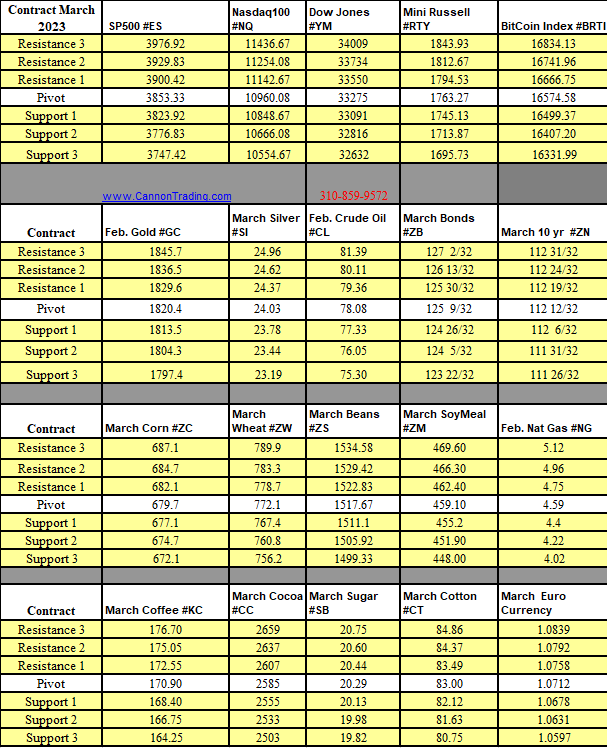

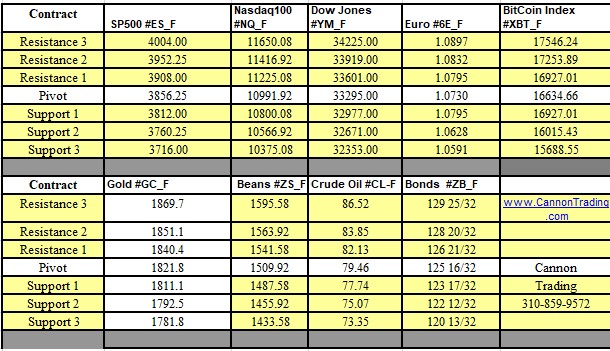

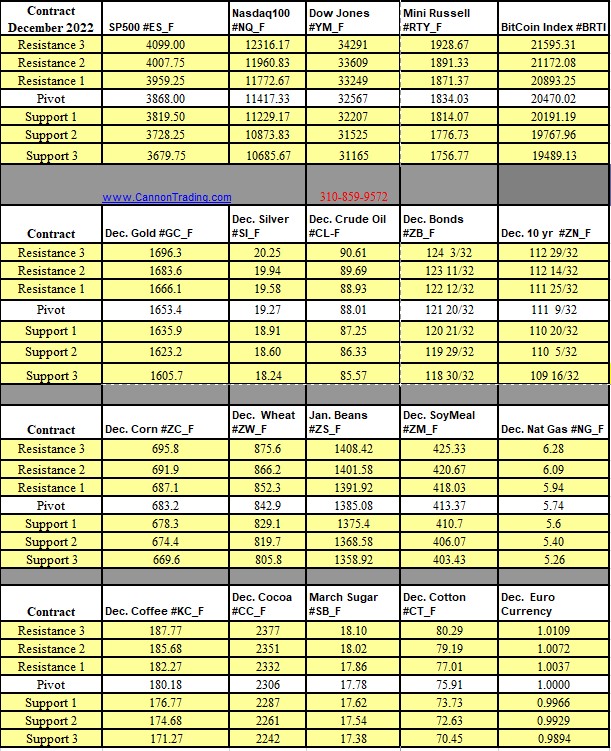

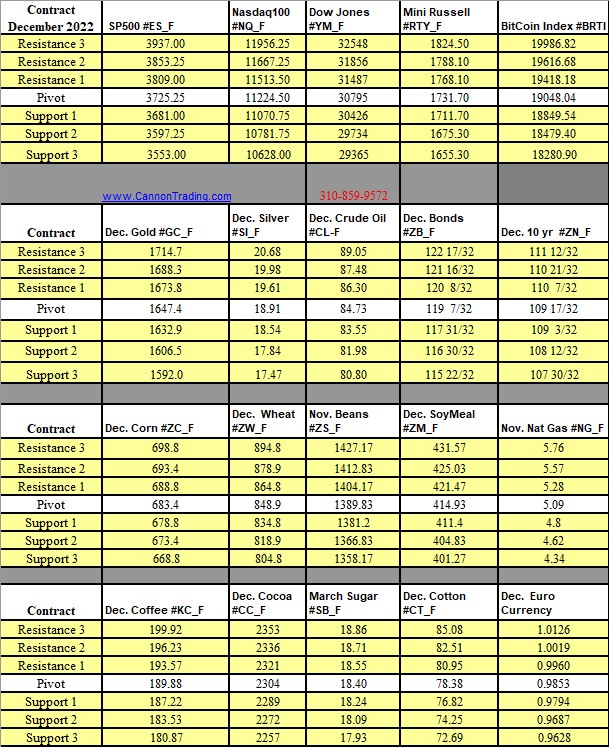

- Trading Levels for Next Week

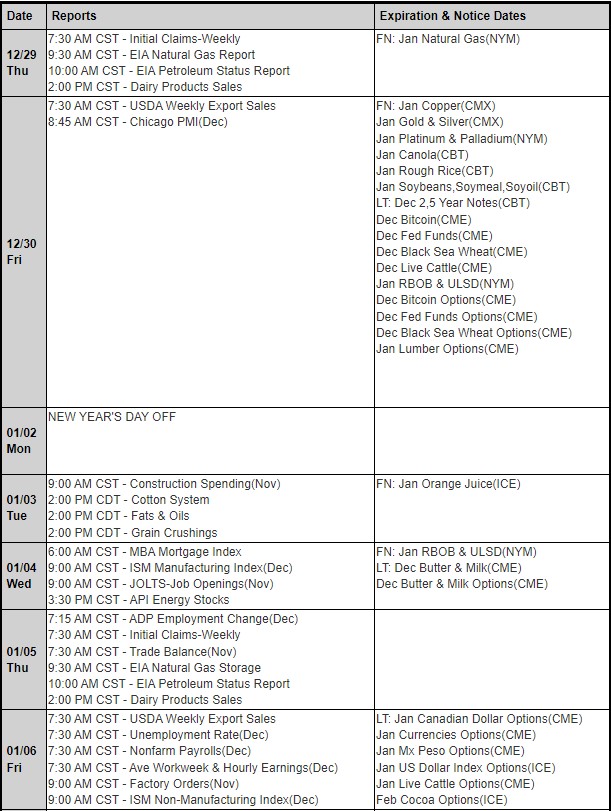

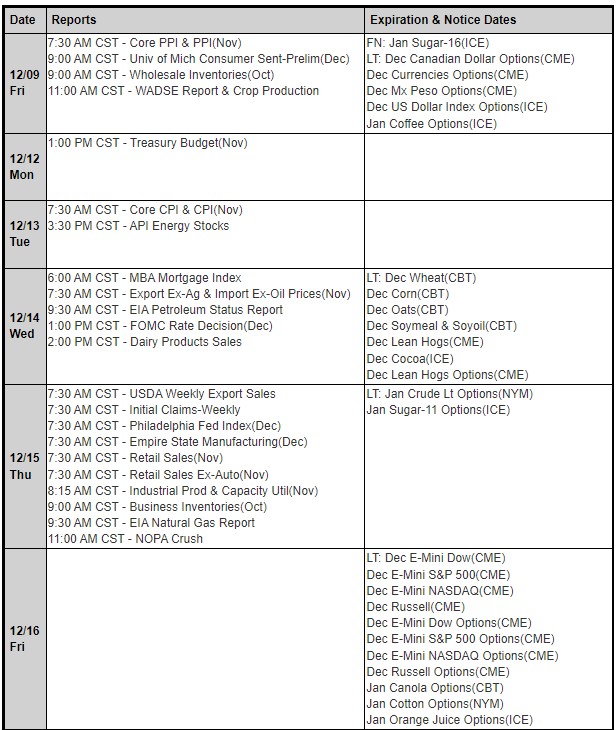

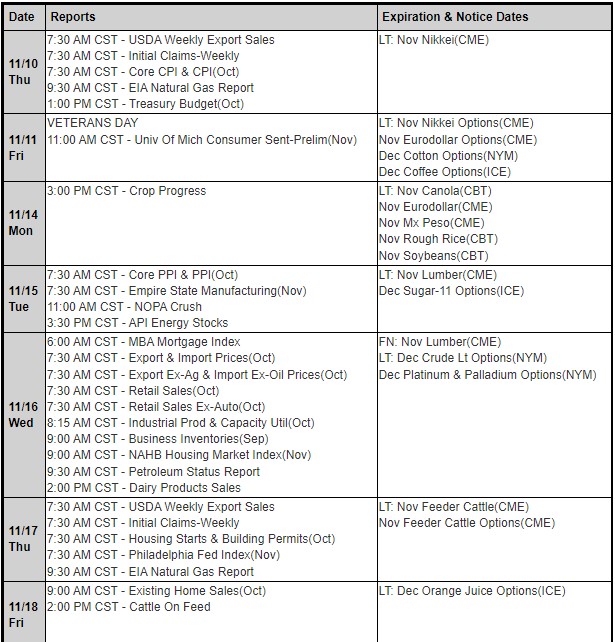

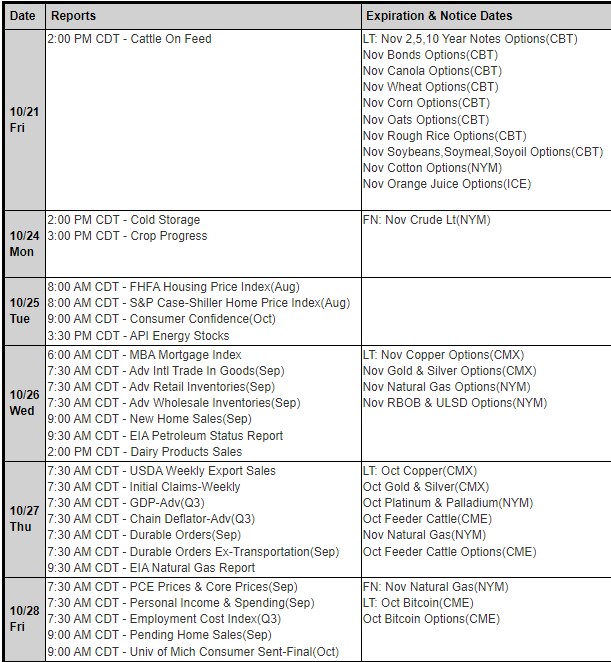

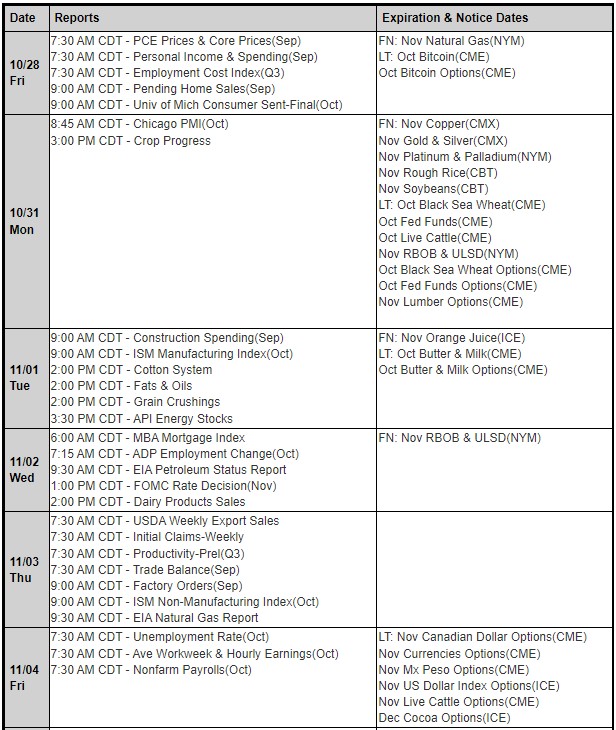

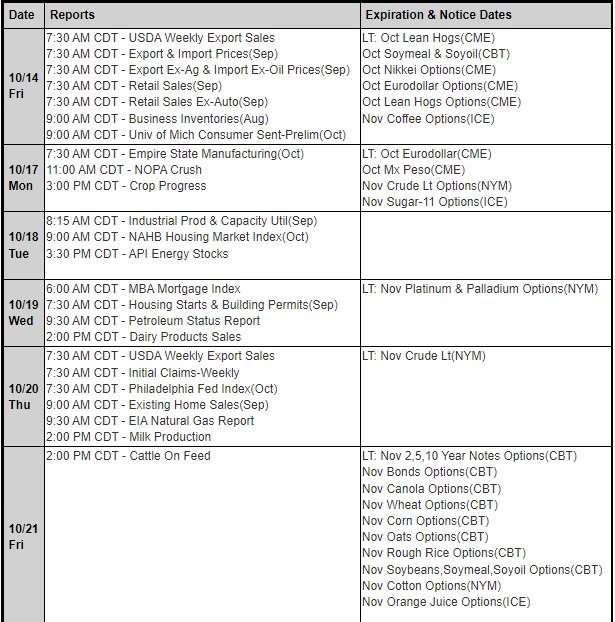

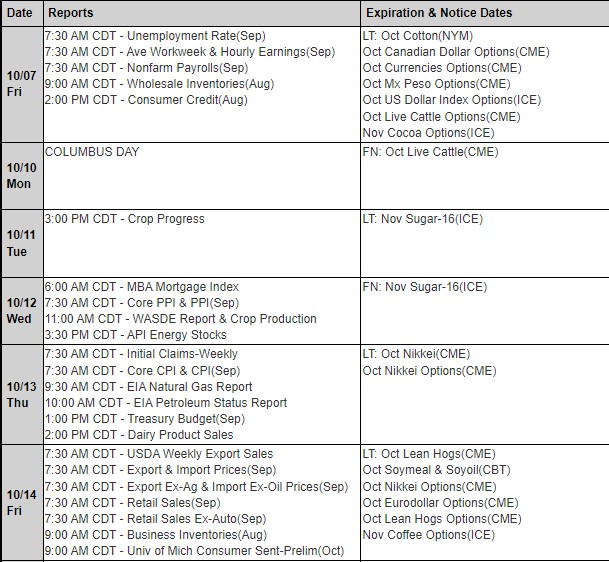

- Trading Reports for Next Week

-

-

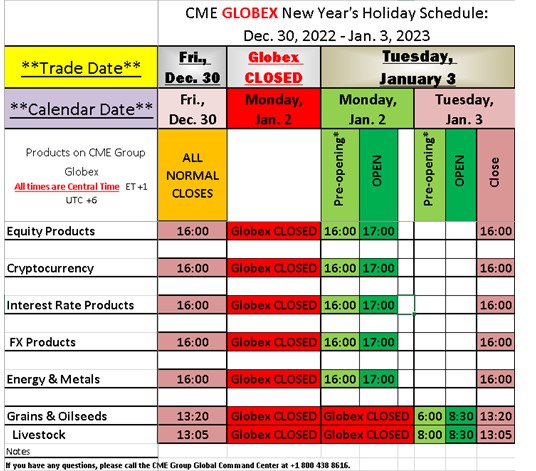

Important Notice – New year’s Trading Schedules

-

- What is GDP?

- About the Retail Sales Report

- What is NFP ( non farm payroll) Report?

- Understanding US housing Data

- FOMC

- Understanding Oil Data Report

- Importance of Consumer Confidence Survey

-

-

-

-

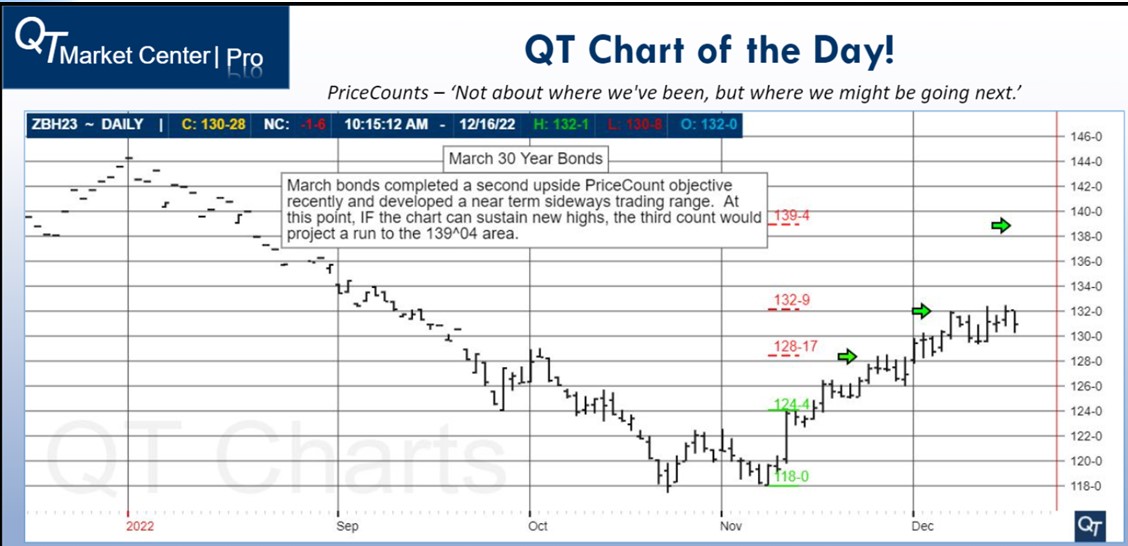

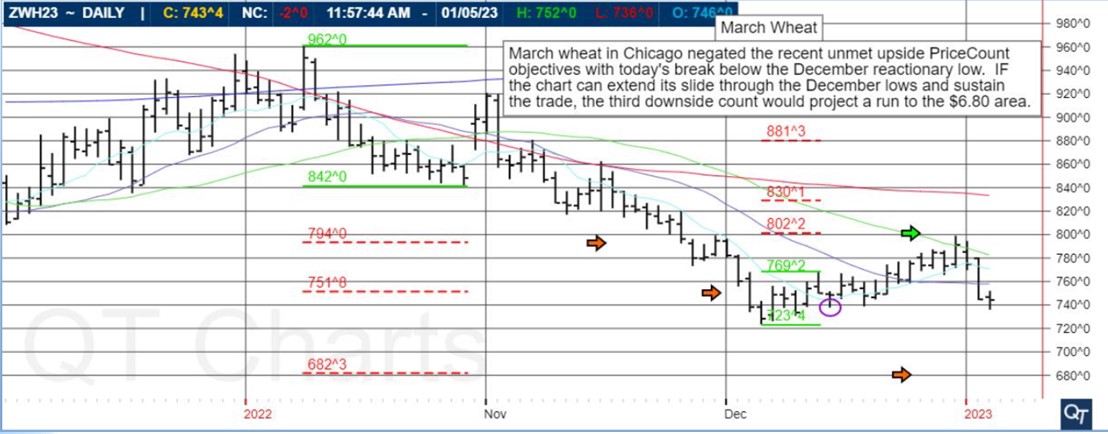

Hot Market of the Week – March Wheat

Hot market of the week is provided by QT Market Center, A swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.PriceCounts – Not about where we’ve been , but where we might be going next! -

-

-

-

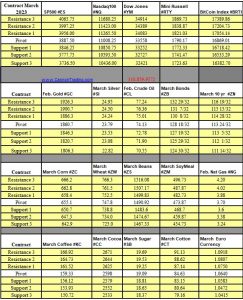

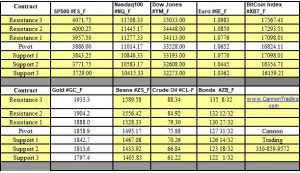

Trading Levels for Next Week

Weekly Levels

-

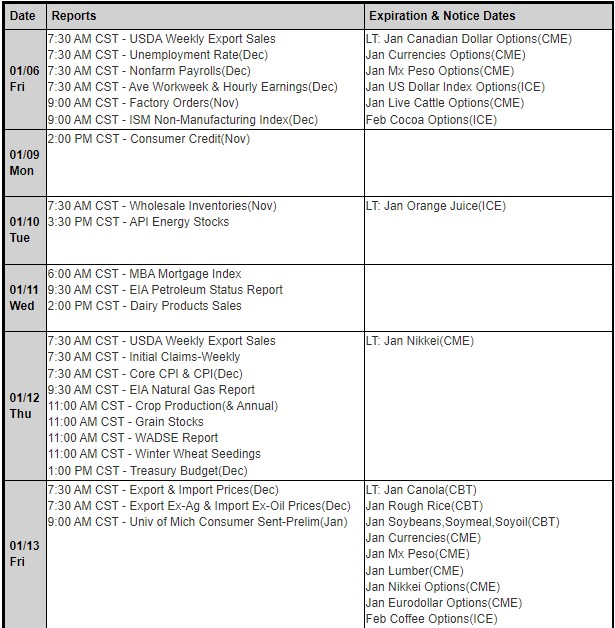

Trading Reports for Next Week

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading