Around the Clock Crypto Futures Trading Ahead

By Mark O’Brien, Senior Broker

|

|

General: Crypto Trading Round-The-Clock

Big news. CME Group, the world’s largest derivatives marketplace, plans to offer customers round-the-clock trading for its cryptocurrency products next year.

The timetable anticipates 24/7 trading of futures and options starting in early 2026. Currently this will cover the CME Group’s main offerings in Bitcoin and Ethereum, but starting Oct. 13, they will be joined by Solana and XRP derivatives.

Trading in cryptocurrency derivatives has been growing steadily since CME first offered Bitcoin futures in 2017. Notional open interest, which represents the outstanding value of contracts, reached a record $39 billion in mid-September.

All-hours access lets investors respond to price swings in real time, which could add additional legitimacy and liquidity to these digital assets.

Stock Index Futures:

The Dec. E-mini S&P 500 and E-mini Nasdaq futures contracts traded to new all-time record highs intraday today. Volume has tended to be lighter on this the sixth day of the U.S. government shutdown.

Traders have been negligibly on edge at these highs with some uncertainty about the U.S. shutdown, the state of the jobs market and the delay of scheduled releases of U.S. government economic reports.

Looking elsewhere for clues on the U.S. jobs front, last week a report from global outplacement firm Challenger, Gray & Christmas indicated U.S. employers announced fewer layoffs in September but hiring plans so far this year were the lowest since 2009. It came a day after a weaker-than-expected ADP National Employment Report.

Metals:

Dec. gold futures rose to new all-time highs for the sixth of seven trading sessions today, barreling through yesterday’s first move through $4,000 per ounce to trade intraday up to $4,081 per ounce, a $76.6 per ounce follow-through move.

Gold and silver futures have surged roughly 55% and 65% year to date, respectively, as expectations of Federal Reserve rate cuts have boosted the appeal of metals, which tend to perform better when interest rates are lower.

Energies:

Despite today’s report that U.S. crude oil inventories rose more than expected last week, crude oil futures oil futures staged a modest recovery today after last week’s decline to a 16-week low as the U.S. government shutdown fed worries about the global economy, while traders expected more oil supply to come on the market with the planned output boost announced by OPEC+ over the weekend.

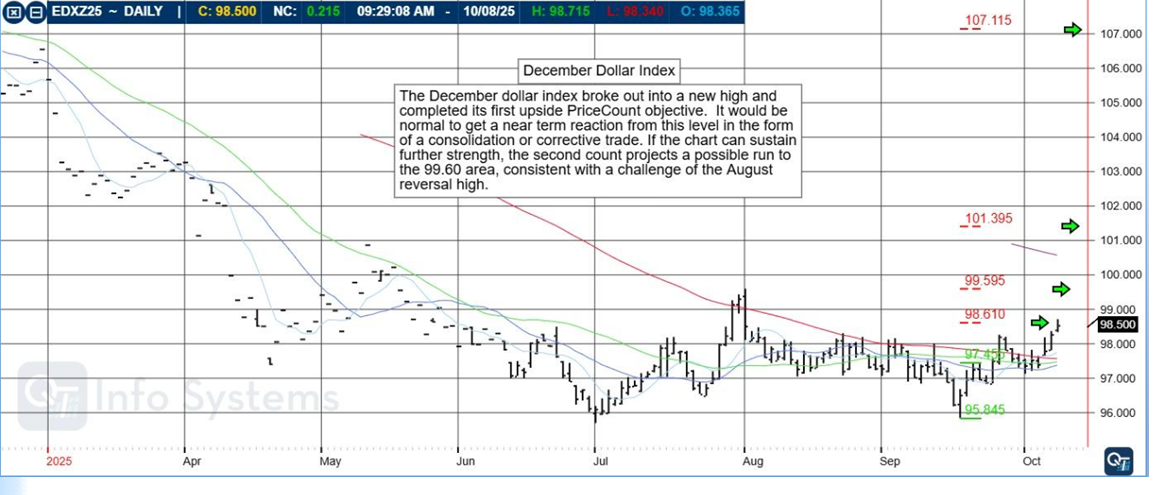

December Dollar Index

The December dollar index broke out into a new high and completed its first upside PriceCount objective. It would be normal to get a near term reaction from this level in the form of a consolidation or corrective trade. If the chart can sustain further strength, the second count projects a possible run to the 99.60 area, consistent with a challenge of the August reversal high. |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

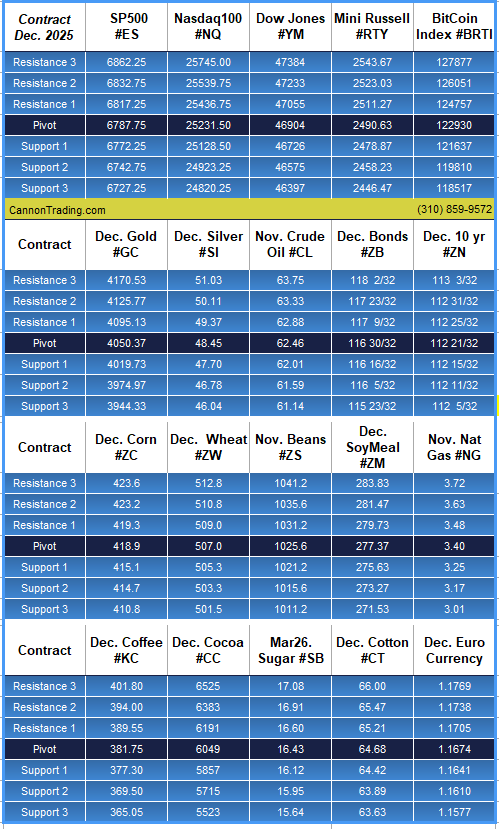

Daily Levels for Oct. 9th, 2025

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

|

|

Economic Reports

U.S. government data may be impacted by the shutdown. ‘Tentative’ events are subject to delay, revision, or cancellation

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|