The FED is your friend…..

14 October 2024

By GalTrades.com

The FED is your friend plus the trend is your friend. The Federal Reserve is in an easing cycle which is a positive for the markets. I would like to see that trend continue and there be no change in the Fed’s stance, we don’t want to see economic reports which would hint at inflation creeping back up. Federal Reserve officials debated whether to lower interest rates by a quarter or half of a percentage point last month. Almost all participants agreed that the upside risks to inflation had diminished, and most remarked that the downside risks to employment had increased. Inflation is broadly trending down. Markets had to digest a warmer-than-expected CPI report and a one-year high print in initial claims, rising geopolitical risks, along with higher oil prices and yields, yet stocks have been able to make new highs.

With markets at all-time highs, earnings season can be a boost or a test of lower support zones. All eyes will be on the earnings numbers and what executives have to say about their outlooks. In the week ahead, a number of influential companies are set to report. While the trend in stocks remains bullish, the environment is not without its risks and valuation is full. The forward P/E on the S&P 500 currently stands at roughly 22 versus the 10-year average of 17.7, per FactSet. Elevated valuation is largely driven by expectations for strong earnings growth and easing monetary policy from the Federal Reserve. Therefore, Q3 earnings season, which unofficially kicked off, will likely need to deliver strong results to keep this bull market going. High earnings valuations are fully priced in this growth story, any miss on overall earnings can generate a valuation re-set and a pullback. I would also like to look at Thursday’s Retail Sales report. The last couple of Retail Sales reports have been stronger than expected, so this data point will provide a good read on the state of the U.S. consumer. Friday CNBC/NRF Retail Monitor showed a 0.3% month/month drop in consumer spending, which could suggest a soft Retail Sales report. If so, this could be enough to trigger a profit-taking pullback in stocks.

If NVDA can obtain a new all-time high, or the small cap’s Russell can break out to fresh two-year highs next week, these would likely be near-term bullish catalysts. I would like to see a continuation of the uptrend; However, I am very cautious as any negative news from earnings or the retail’s report can change the momentum until the next catalyst.

S&P fifth straight weekly gain. The market is hitting this level without much help from tech stocks and the Magnificent 7 as the rally broadens out to the financials in response to positive third-quarter numbers from Wells Fargo, JPMorgan, and BlackRock.

Multiples are high and portfolio managers are saying they’re uncomfortable buying at these levels, but there is a lot of money coming in from the sidelines therefore they feel that they have to participate. The index level feels expensive as well, I hear analysts are looking for mid cap size companies.

Banks delivered earnings on Friday and their prices went up, which is a good start for earnings season. Year to date; JPM is up 31%, C 28%, GS 33%, BAC 25%, WFC 24%. That’s higher than the S&P YTD.

Cybersecurity: is making new highs, see ETF – BUG.

Money is coming out of China-related stocks on some disappointment around stimulus. Those dollars are rotating out of China tech names such as Alibaba and moving into the U.S. tech giants.

Bond yields rose this week, primarily driven by the warmer-than-expected inflation data. Two-year Treasury yields increased to 3.955% from 3.923% while 10-year yields tacked on roughly 10 basis points to 4.085% from 3.981%

Earnings & Economic reports this week: Monday, Oct.14: Charles Schwab (SCHW)

Tuesday, Oct. 15: Walgreens Boots Alliance(WBA), UnitedHealth (UNH), Citigroup (C), Bank of America (BAC), Johnson & Johnson (JNJ) and Goldman Sachs (GS) United Airlines (UAL), Interactive Brokers (IBKR) and JB Hunt(JBHT) Interactive Brokers Group Inc. (IBKR), Omnicom Group Inc. (OMC), J.B. Hunt Transport Services (JBHT)

Wednesday, Oct.16: Morgan Stanley (MS), Abbott Labs (ABT), ASML (ASML), US Bancorp (USB), Citizens (CFG) and Prologis (PLD) Alcoa (AA), PPG Industries(PPG), CSX (CSX), Kinder Morgan (KMI), Discover (DFS) and Crown Castle (CCI) Discover Financial Services (DFS), Equifax Inc. (EFX)

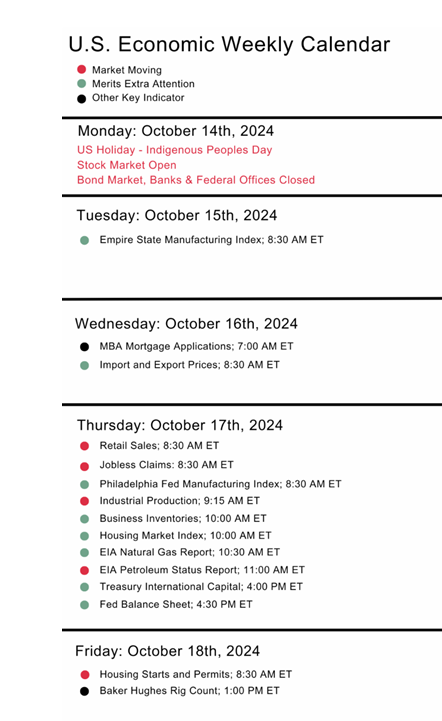

Thursday, Oct. 17: Initial Jobless Claims, Retail Sales, Industrial Production & Capacity Utilization

Taiwan Semi (TSM), Travelers (TRV), Elevance (ELV), Huntington Bancshares (HBAN), Blackstone (BX), Truist (TFC) and KeyCorp(KEY) Netflix (NFLX), Intuitive Surgical (ISRG) and Crown Holdings (CCK) Elevance Health Inc. (ELV), Travelers Companies Inc. (TRV),

Friday, Oct. 18: Housing Starts & Building Permits. American Express (AXP), SLB (SLB) and Procter & Gamble (PG) Fifth Third Bancorp (FITB), Regions Financial Corp. (RF), Ally Financial Inc. (ALLY), Comerica Inc. (CMA),

Technical Analysis:

While the SPX and DOW made new all-time highs, the Nasdaq 100 did not. But it continued to trend higher this week and is on pace to close less than 2% below the all-time closing high of 20,675, hit back on July 10th. If Nvidia sets fresh all-time highs this could signal to markets that the AI trade is alive and well and should help the NASDAQ, but other AI plays are trading well as well, such as ORCL, AVGO, PLTR.

Small caps: the Russell is heavily weighted on regional banks and health care. The Russell 2000 was the relative outperformer Friday (+1.64%), assisted by several strong earnings reports out of the financial sector Friday. The index trading range is roughly 2,050-2,260. If the Index can notch a fresh two-year closing high this could send a bullish technical signal to the markets that small caps are finally ready to join the party.

Market breadth:closed out the week strongly, with roughly 75% of SPX components trading above their respective 200-day moving averages. No change in market breadth. On a week-over-week basis, the SPX) breadth ticked down to 75.75% from 76.35%, the CCMP ticked up to 44.66% from 44.09%, and the RTY is flat at 55.87% from 55.76%.

Overseas: rates are in the news ahead of the European Central Bank’s (ECB) decision Thursday. The ECB has cut rates twice in 2024, and analysts expect a third one next week and a fourth in December, Reuters reported.

Bonds: Economy defies gravity, sending bond yields higher. The U.S. economy continues to defy expectations by growing faster than expected. Despite all of the constraints —tightening Federal Reserve monetary policy, weak global growth, wars in the Middle East and Ukraine, and low consumer confidence. GDP growth has been running at about a 3% annualized pace over the past four quarters. The major driver behind the growth is consumer spending. Supported by steady job and income growth, consumers are spending at a pace that is keeping the economy buoyant. In the Treasury bond market, yields, which generally move inversely to prices, have rebounded on these signs of strength.

XLK, XLI, XLF, MAGS, KRE, IJR, MSFT, NVDA, ORCL, IBM, CSCO, MU, DELL, CMG, WFC, BLK, GS, EBAY, VRT, ABNB, PINS, OGN, GOOGL, NXT, MBLY, FROG, AFRM, PANW, CRWD, GXO, HD, CLF, GLW, LEVI, DD.

What stands out to me: ever since the Microsoft Constellation energy deal, I have been looking for plays in the Energy sector particularly in nuclear power plants. Listen to Brad Gerstner podcast on BG2. I welcome any insight and news on the subject from any of you.

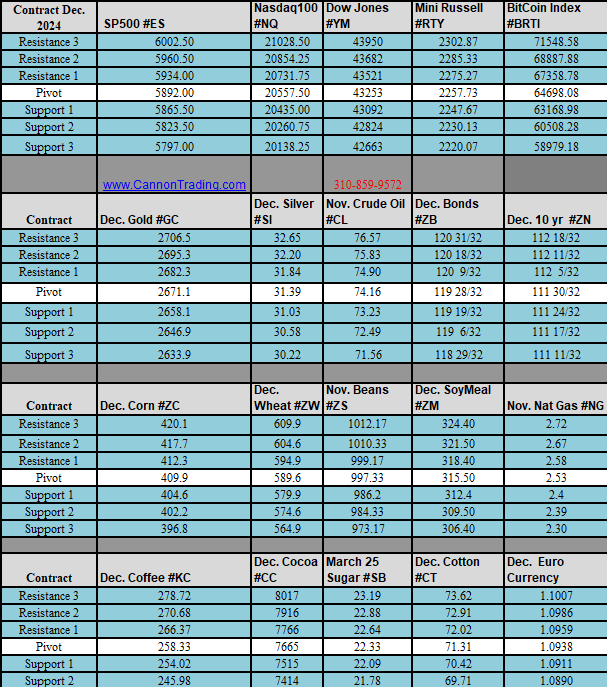

futures I am watching this week:

Have an amazing week.

The outlook contained in this article are of opinion only and do not guarantee any profits. Futures trading is risky and suitable for everyone. |