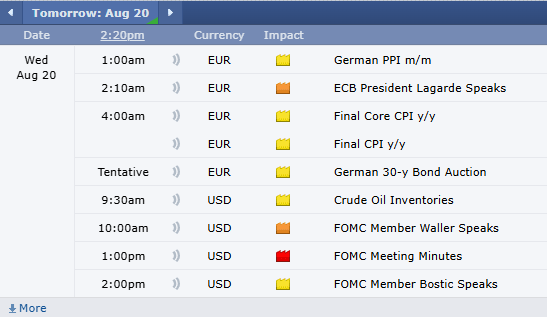

Markets have been calm so far this week (FOMC Minutes tomorrow)

What goes up must come down?

Does Newtons law of Gravity capsulized by the quote” what goes up, must come down” apply metaphorically to prices on assets? this quote reminds us of the inherent predictability and order found in nature by earths gravitational pull.

The question becomes, what pulls asset prices down? and how does the investor protect or benefit from forces pulling prices down?

Since the forces pushing prices of assets lower are much harder to determine than a simple law like gravitational pull without doubt make what goes up must come down a truest statement, that doesn’t mean we can’t protect our investments or even benefit from selloffs of commodities, equities and other assets we hold.

Gold will be a good example to explain 2 common risk management strategies since this asset has been range bound for some time now, having become comfortable in a relatively narrow price range since Memorial Day after a runup to start the year.

One report indicates that gold opened at $2,633 per ounce on January 2, 2025, and as of August 15, 2025, it was trading around $3,383 per ounce, marking a 24.9% increase,

Protecting your long gold futures contracts, GLD ETF or your personal gold stash you can use futures options as an insurance policy to cover your downside risk.

You believe the price of gold is ready to fall on a breakout to the downside. You can buy Comex Gold Puts. How Gold Puts Work:

Buying a Put

- You buy a gold put option when you expect gold prices to fall.

- The put gains value as gold declines.

- If gold drops below the strike price, you can:

- Sell the put at a profit, or

- Exercise it to take a short position in gold futures at the strike price.

Gold option premiums consist of intrinsic value and time value:

Premium=Intrinsic Value+Time Value\text{Premium} = \text{Intrinsic Value} + \text{Time Value}Premium=Intrinsic Value+Time Value

- Intrinsic Value = Max(Strike − Futures Price, 0)

- Time Value = Based on volatility, time to expiration, and interest rates

For example:

If gold = $3380.00 and your put strike = $3400.00:

- Intrinsic = $20

- If option trades at $28 → Time Value = $8

A bear put spread is an options strategy used when you expect the price of gold to decline moderately.

You buy a put option (higher strike) and sell a put option (lower strike) with the same expiration date.

- The long put gives you downside profit potential.

- The short put helps reduce the cost of the trade.

- This caps both your risk and your max profit.

Click here for the Gold Bear Put Spread Cheat Sheet.

Please click here to access the: Comex Gold Bear Put Spread Cheat Sheet. We will be happy to walk you through and answer any questions, just give us a call.

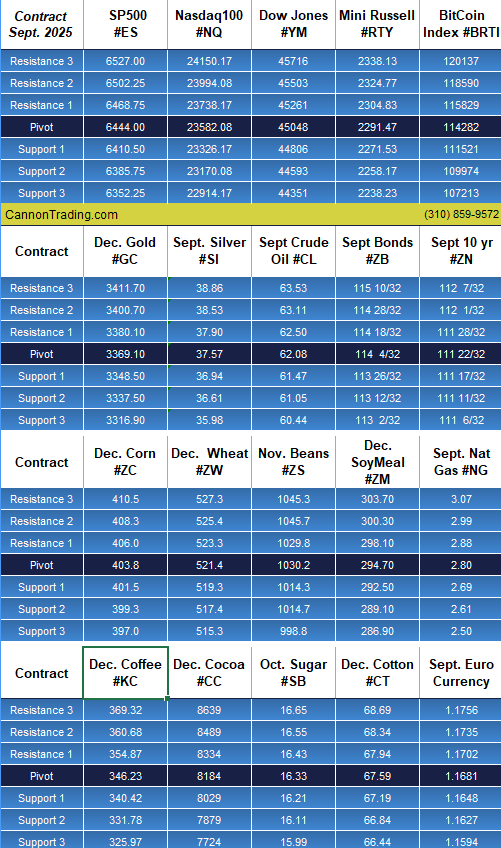

Tomorrow:

Econ Data: EIA Crude Stocks, 17-week T-Bill auction, FOMC Minutes. Jackson Hole symposium begins

FED: 2 speakers

Earnings: TJX Companies, Lowes, Analog Devices Inc. Target

Tariff news: Anything goes!

Click here for the Gold Bear Put Spread Cheat Sheet. |