Equities, US Elections, Iranian Threats and FOMC week

By John Thorpe, Senior Broker

Today, Equities rallied on ultra light volume.

When “volume is light and prices are up,” it indicates a situation where a price is increasing, but with a relatively low number of contracts being traded, suggesting limited investor enthusiasm or potential weakness in the price movement, as a strong trend usually coincides with higher trading volume.

The reasons for light volume could be associated with several factors. Last week investors sold off on high volume; money still sitting on the sidelines waiting for the results of the U.S. Elections. Many FCM’s have increased their day trading margins to the exchange initial requirement for overnight positions. This restricts liquidity, today’s action smells like potentially a short covering rally, more cash on the sideline. What I expect, post election for the initial strong price movement to be a head fake, the wrong move for the longer term trend and must be faded. For Risk managers during this time, caution abounds.

Not only is the world watching the U.S. Presidential election, we can’t lose sight of which party takes control of congress, Republicans are expected to win the Senate and Democrats to win the House, These winners will play an important role determining how the winner of the presidency will likely govern.

If you hadn’t heard , The Ayatollah has issued a fatwah Crushing Isreal and the US after the U.S. election.

“The enemies, both the U.S. and the Zionist regime, should know that they will definitely receive a tooth-breaking response to what they are doing against Iran and the resistance front,” Khamenei said. The chief of Iran’s Islamic Revolutionary Guard Corps, General Hossein Salami, echoed these sentiments by stating Iran “will give an unimaginable response to the enemy.”

In addition to the above, all markets have already priced in the expected .25 decrease in the fed funds rate this coming Thursday.

If you are on the sidelines, waiting for margins to resume to normal, we appreciate your patience, Hopefully, this will be a minor disruption, as will all the above with your trading plans.

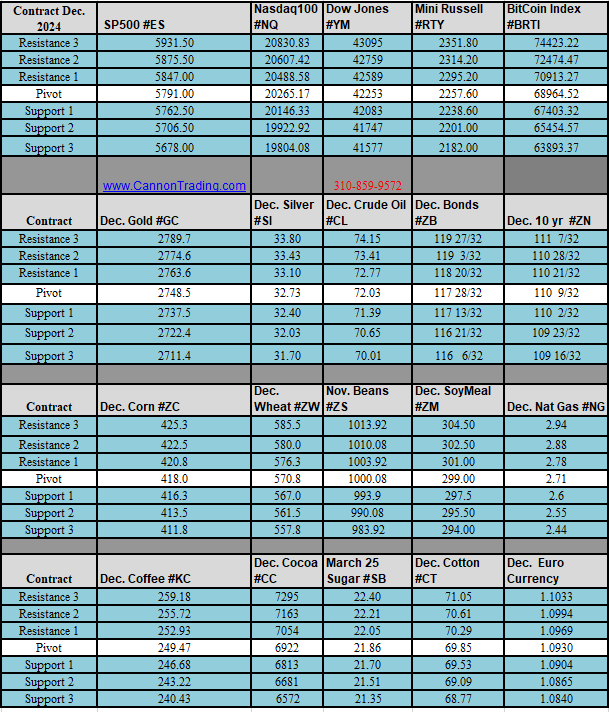

|