Market Highlights – NASDAQ, Copper

by Mark O’Brien, Senior Broker

Indexes – Nasdaq

Stock index futures dipped today, led lower as pressure on the tariff front mounted. The June E-mini S&P 500 Futures contract lost ±1.4%, while the E-mini Dow traded ±250 points lower, or 0.6%. The E-mini Nasdaq shed about 2%.

Stock index futures hit session lows after the White House said that President Donald Trump will unveil new tariffs on auto imports during a press conference at 4 p.m. ET. This will come ahead of a broad array of additional levies expected to be revealed next week.

Grains:

Discover new tools for planting season ahead of key reports. The upcoming Prospective Plantings report can significantly impact market prices, especially if the actual numbers differ from pre-release estimates. New Weekly options on crops such as Corn, Soybean, Soybean Meal, Soybean Oil and Chicago Wheat offer more precise risk management around the report’s release.

Micro Corn futures, Micro Wheat futures, Micro Soybean futures, Micro Soybean Meal futures and Micro Soybean Oil futures were launched on February 24, 2025, with the first weeks of trading already providing meaningful liquidity.

Financially settled Micro Agricultural futures allow customers to stay in their position closer to expiration, with no risk of physical delivery.

New Micro Agricultural futures are a tool for retail traders looking to gain exposure to commodity markets without incurring the risk of physical delivery and with less margin costs than standard Agricultural futures.

Small- to medium-size farmers can take advantage of Micro Agricultural futures to hedge parts of their expected harvest, without having to rely on standard Grains futures contracts of 5,000 bushels (according to the USDA, the average farm in the U.S. consists of 464 acres).

Metals – Copper

On December 31st, March copper futures settled at 4.0265. Today, they were trading at about 5.22; an increase of about 30% in the first three months of the year and a 5+ year high. This dramatic price action is driven by traders pricing in the possibility of hefty tariffs on the crucial industrial metal. The price gap between U.S. copper futures and the global benchmark on the London Metal Exchange has widened to record levels, creating a powerful incentive for traders to shift copper into the United States.

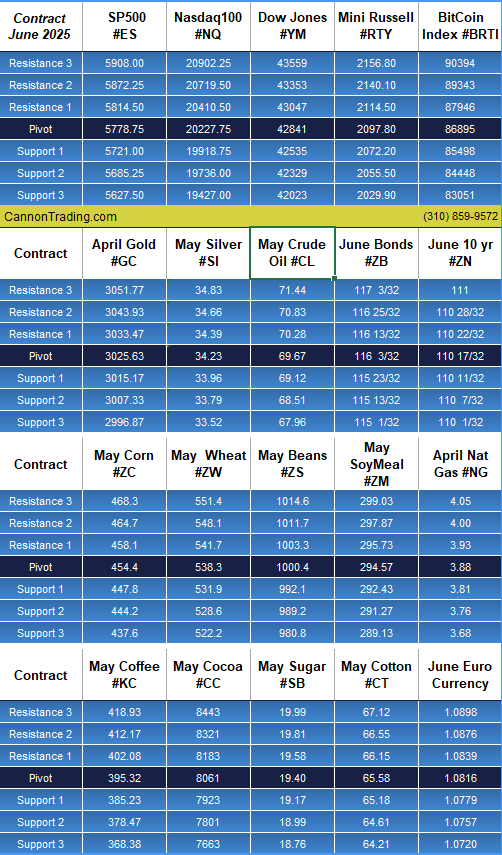

Daily Levels for March 27th, 2025

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

Click here for quick and easy instructions.

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|