Important Notices: The Week Ahead

By John Thorpe, Senior Broker

NVDIA Earnings, Fed Watch Pointing to Lower rates, Slew of Economic Data

NVDIA will report earnings next week, the star AI Chipmaker EPS estimate is 1.01 usd with Revenues @ 45.94B usd. This 4.34 trillion market cap. company’s Q2 release and future guidance will move the Equity indexes after Wednesday’s NYSE cash market close and perhaps deep into Thursday’s trading session.

A heavy dose of economic data points will be released next week providing plenty of food for thought to chew on for the fed voting members as they continue to assess whether a freeze on Fed Funds or a reduction of .25 to .50 is the best medicine for the economy when they announce a rate decision in September. (BTW, did you know there are more economists employed by the Federal Reserve Bank than there are stocks in the S&P 500?)

The last 3 Fed Rate reductions were 9/2024 when the rate of inflation as measured by CPI was 2.9 the month prior. (High) Rate moved down ½ bps. Next, 11/2024 when the prior month CPI was 2.6. (Better) Rate moved down ¼ bps. Finally, 12/2024 when the prior month CPI was 2.7. (Same as the past 2 months) Rate was reduced by the fed an additional ¼ bps.

The on again off again nature of Tariff and Russia/Ukraine war talks has created golden opportunities for breakouts in some markets, rangebound trades in others. (see gold commentary below)

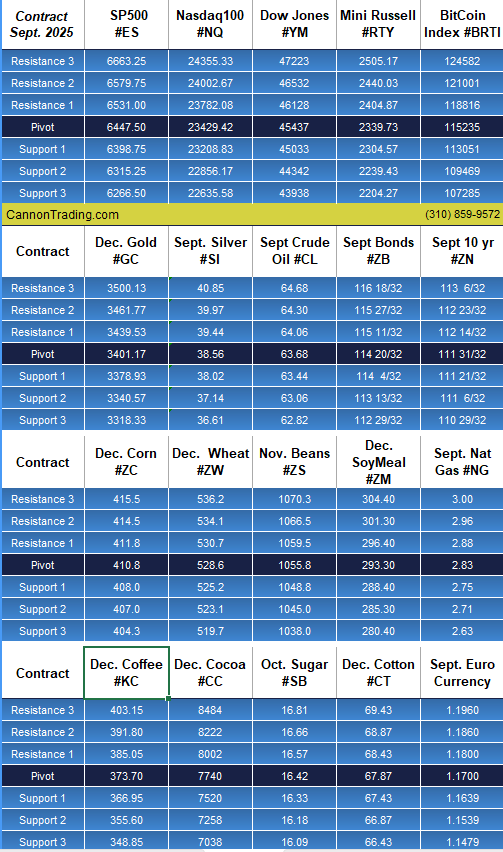

Remember to zoom out when reading your intraday time frame charts to daily and weekly time frames. December Gold is still rangebound! This week, the psychological low was challenged in the 3350.00 area basis December and bounced, as of this writing, current price is 3420.00. Three weeks ago, I wrote this: Watch for the gold market to maintain its rangebound stance, close below 3350 (basis December) or above 3500 should denote a breakout, begin trading the December(Z) contract next week.

Two weeks ago, I wrote: Dec gold traded below 3350 today and the past three days but never closed meaningfully below 3350.0 (3348.60 Thurs.) Today we have breached $3500.00 oz with a high in the $3543.00 area per oz. while currently trading @$3493.00 oz as of this writing. Look for a close above $3500.00 on successive days to again accumulate longs. This may be the break from this range we are looking for. Manage your downside risk according to your account size, risk no more than 15-20% whether with options or futures.

Today, August 15th as of this writing that 3500.00 oz did not hold, always wait for confirmation prior to taking a position, several consecutive closes above or below a range is a start. We are teasing the bottom of the range today Dec gold in the 3380’s, I see psychological support @ 3350.00

Continued volatility to come as next week all markets will be reacting to whatever comes out of U.S. Govt leadership relating to conflicts cessation and trade deals, especially with China, India, Canada and Russia. Also, remember that Mexico’s extension will end October 29.

Earnings Next Week:

- Mon. Quiet

- Tue. Quiet

- Wed. NVIDIA, Crowdstrike

- Thu. Dell

- Fri. Baba

FED SPEECHES: (all times CDT)

- Mon. Quiet

- Tues. Quiet

- Wed. 9:45 am Barkin.

- Thu. 5:00pm Waller

- Fri. Quiet

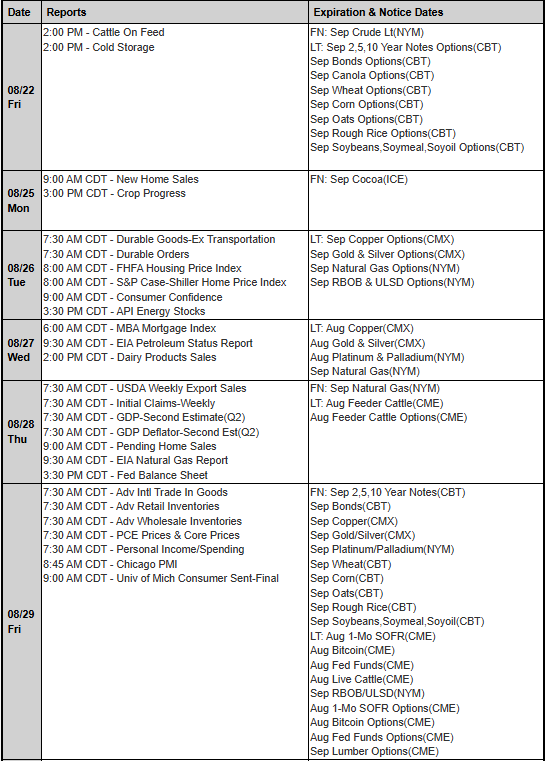

Economic Data week:

- Mon. Building Permits, Chgo Fed National Activity Index, New Home Sales, Dallas Fed Manu. Index

- Tue. Durable Goods, Redbook, Housing Px. Index, CB Consumer Confidence, Richmond Fed, Dallas Fed Svcs. Index

- Wed. EIA Crude Stocks, 17-week Bill auction,

- Thur. Jobless claims, CORE PCE, EIA NAT GAS Storage, GDP, Pending Home sales, Fed Balance sheet,

- Fri. PCE Price Index, Retail Inventories, Chgo PMI, Michigan, Consumer sentiment.

|