Movers and Shakers

By John Thorpe, Senior Broker

Oil took another $3 .40 nosedive when OPEC announced a smaller than expected demand growth forecast for 2025 for the Third time!

Updated: October 14, 2024 8:43 am

For the third time OPEC slashed its 2024 and 2025 worldwide crude oil demand growth rate. This year’s demand was lowered to 1.93 mln bpd, down from last month’s projection at 2.03 mln mt. Analysts noted much the downgrade came from lower expected Chinese demand. Next year’s demand growth is seen at 1.64 mln bpd down from 1.74 mln bpd previously forecast.

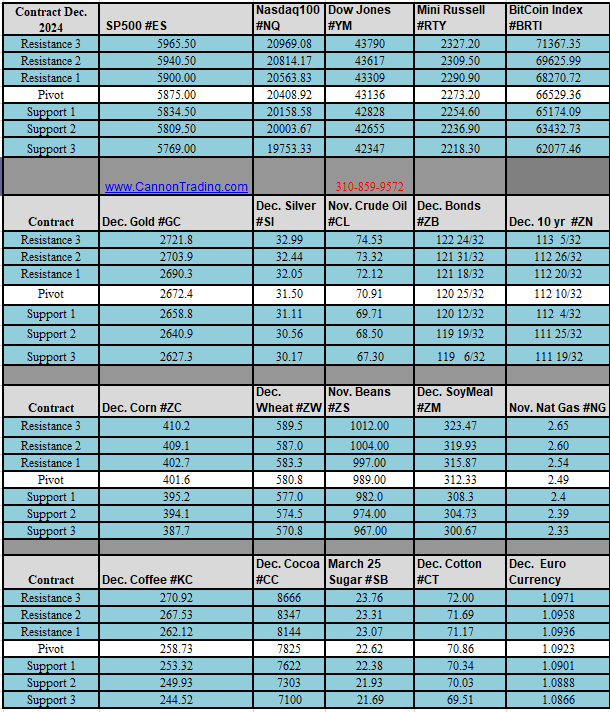

Flirting with the low end of the 25 month old range, November crude held it’s ground around $69.75/bbl level , a mere 3 dollars from the springtime 2023 lows.

Equity markets were upset by poor United healthcare Group end of year Guidance although they beat EPS estimates, Buy the rumor sell the fact? UNH shares down 48.25 per share or nearly 8%.

Metals cruised higher today with the CME FedWatch tool reflecting a solid 90% chance the FED will lower rates .25-50 in its November meeting is again fueling speculative buying in the Yellow Metal.

The All time high in the December contract is 2708.70 , are we flirting with that number?, yes, as of this writing GCZ24 is @ 2678.00 can we take that out? Stay tuned…

Sympathetic Silver is recouping it’s bullish stance, 1.80 away from it’s contract high @ 31.70 /oz +.37 for the day

Watch Tomorrow’s Movers and Shakers:

No Fed Speakers, No Economic Data, very few ,if any earnings that would make headlines. |