The Following is analysis from Dan Hueber. You can find his analysis on Our QT Market Trading platform

Weekly Hueber Report: Now is it time to worry?

According to the Federal l Reserve Bank of New York, household debt in the United States grew by $212 billion to reach $17.5 trillion in the fourth quarter of last year. The lion’s share of this debt is wrapped up in mortgages and home equity lines of credit, which grew $112 billion during the quarter and reached $12.25 trillion. Auto loans rose $12 billion to $1.61 trillion, and student loans were flat at around $1.6 trillion, but the most significant percentage growth came via credit cards, which jumped $50 billion to $1.13 trillion.

Do keep in mind that as the overall population continues to grow, it is only natural for debt to expand along with it. Still, when you add in the fact that savings went backward during that same period, it would appear that the American consumer is increasingly relying on debt to meet day-to-day needs and wants. I should point out that savings balances have not slipped to as low as they were during the second quarter of 2022 and remain relatively consistent with the period between 2010 and 2018. However, both the amount being tucked away and the personal savings rate have been trending lower again.

There is one more telling chart that we need to throw into the mix—the delinquency rate on credit cards. While nowhere near the nearly 7% level witnessed during the Great Recession or even the averages seen throughout much of the 1990s, it has been climbing steadily for the past two years and has risen to the highest level since the second quarter of 2011.

Granted, not all of this news has been bleak, at least not if you are in the banking sector. Last year, they reported an estimated $92 billion in earnings, and this after taking into account funding costs and loan losses. This is more than double what they were earning from credit cards a decade ago. As the old proverb says, one man’s poison is another man’s pleasure. While there are a number of other elements that factor into this, it should come as no surprise that recent surveys find that 41% of Americans believe they are worse off than four years ago. In case you were wondering, 24% say they are better off, and 34% said they were about the same. That still leaves the majority of people thinking that at least they have been holding their own, but these debt trends would appear to suggest that number may shrink in the months ahead.

**The views expressed above are entirely those of the author.

DH

Plan your trade and trade your plan

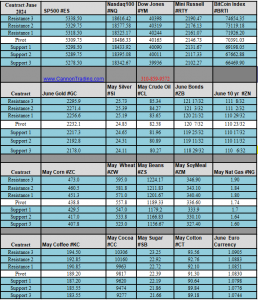

Daily Levels for March 27th, 2024

Economic Reports

All times are Eastern Time ( New York)

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.