Silver Hitting Multi Years Highs

|

|

Silver Soars

By Andy Hecht – www.cqg.com

- A bullish trend since the 2020 low

- Silver rises to the highest price in fourteen years- The 2011 and 1980 highs are the upside targets

- Fundamentals support higher silver prices

- Gold supports rising silver prices

- Expect volatility and new highs as investment and speculative demand are critical

At the turn of this century, nearby COMEX silver futures prices were $5.413 per ounce. After trading as low as $4.02 in November 2001, silver prices began a slow ascent, reaching $49.82 a decade later, in April 2011. The 2011 peak was slightly below the record 1980 high at $50.32 per ounce.

Silver corrected from the 2011 high, but the price remained above the $10 level, trading to a low of $11.64 in March 2020 as the global pandemic weighed on prices across all asset classes. Silver quickly recovered, rising to over $20 four months later in July 2020.

In September 2025, silver futures are closing in on a challenge to the 2011 and 1980 peaks, and all signs indicate that those levels could soon become technical support rather than resistance.

A bullish trend since the 2020 low

The continuous COMEX silver futures contract reached a low of $11.74 per ounce in March 2020 as the global pandemic gripped markets across all asset classes.

Contact our trading desk today to learn how we can help you integrate silver and gold into your strategies.

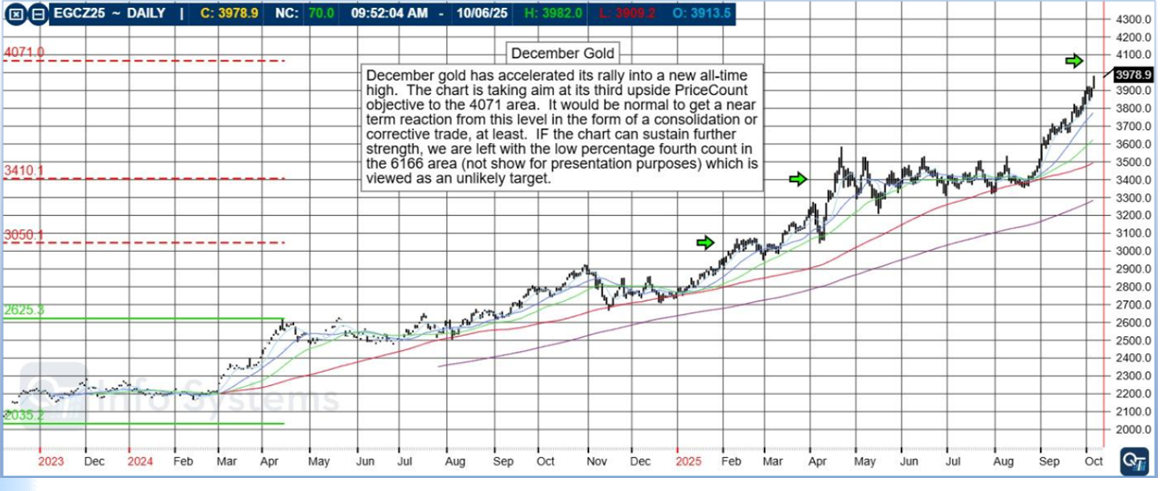

December Gold

December gold has accelerated its rally into a new all-time high. The chart is taking aim at its upside PriceCount objective the 401.7 area. It would be normal to get a near term reaction from this level in the form of a consolidation or corrective trade, at least. If the chart can sustain further strength, we are left with the low percentage fourth count in the 616 area (not shown here for presentation purposes) which is viewed as an unlikely target. |

|

|

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

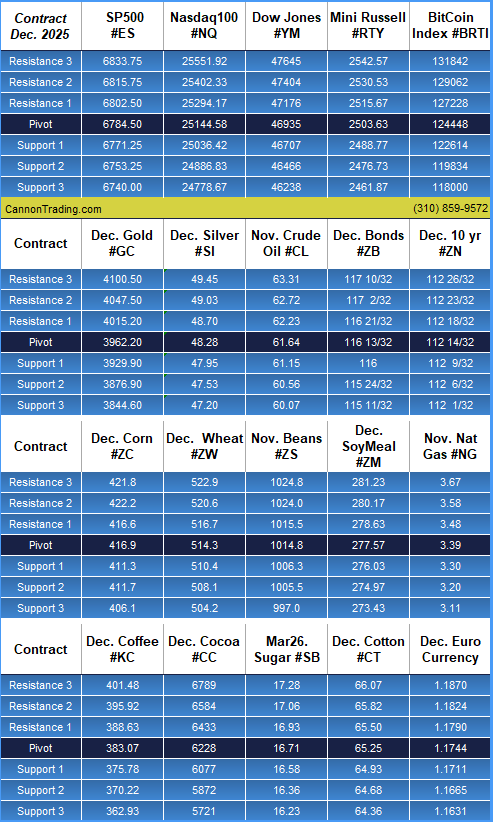

Daily Levels for Oct. 7th, 2025

|

|

Want to feature our updated trading levels on your website? Simply paste a small code, and they’ll update automatically every day!

|

|

Economic Reports

provided by: ForexFactory.com

All times are Central Time ( Chicago)

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|