The “Triple Lever” Stimulus and Economic Resilience from:

Historically, new Federal Reserve chairs face an early “test” from the market. Data over the last century suggests that these transitions often coincide with a market correction averaging 15%. While past performance is never a guarantee of future results, it remains a significant historical trend for investors to consider.

The Coordination of Economic Levers

Washington influences growth through three primary levers: fiscal policy (taxes and spending), monetary policy (interest rates), and credit policy (ease of borrowing). Historically, these functioned independently and were often uncoordinated:

- Fiscal policy followed congressional cycles.

- Monetary policy was the domain of an independent Fed.

- Credit policy was often the result of disjointed regulatory decisions.

This year marks a shift. All three levers are currently dialed toward stimulus, reflecting a unified focus by the administration and Congress on accelerating growth ahead of the November midterms.

Analysis from Jan Hatzius (Goldman Sachs)

On a recent Exchanges at Goldman Sachs podcast, Jan Hatzius noted several tailwinds for the U.S. economy:

- Trade: Tariffs are no longer acting as a primary drag.

- Consumer Support: Tax cuts and strong refunds are bolstering household spending.

- Business Investment: Firms can now fully depreciate equipment and plants, providing significant “physical help” to the business sector.

- Monetary Policy: Easing conditions are expected to support a steady growth pace.

Hatzius does not anticipate a meaningful tightening in the labor market. However, he cautioned that a 0.5% increase in the unemployment rate is a historically reliable (though not guaranteed) indicator of an impending recession.

Corporate Health and Sectoral Trends

While GDP remains strong, the National Income and Product Accounts (NIPA) profit report—which covers a broader range of companies than just those on the S&P 500—paints a more nuanced picture. Earnings growth there has been anemic:

- H1 2025: Growth was in negative territory.

- Q3 2025: Growth marginally turned positive.

- 2026 Outlook: Investors are waiting to see if this recovery gains momentum.

Currently, investors are rotating into cyclicals, industrials, and materials. While manufacturing has faced a “sectoral recession” (as evidenced by the ISM Manufacturing Index), the broader economy’s strength relies on a resilient labor market and robust consumer spending.

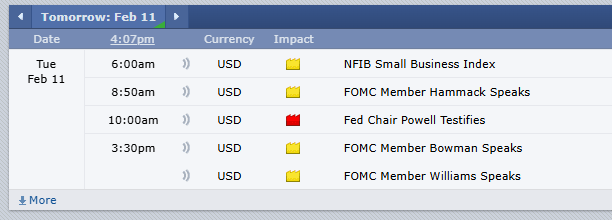

Key Indicators to Watch This Week

To gauge the trajectory of the economy and the impact of current policies, the following data points are critical:

- Jobs Report: Looking beyond the headline numbers for the “fine print” on labor participation and wage growth.

- Productivity Data: A key measure of long-term economic health.

- Import/Export Prices: Serving as a proxy for the ongoing effects of tariff policies.

- J.P. Morgan Healthcare Conference: Often a catalyst for movement in the biotech and pharma sectors.

If the cost of capital continues to decrease, we can expect a significant boost in the housing and automotive sectors, further stabilizing the current expansion.

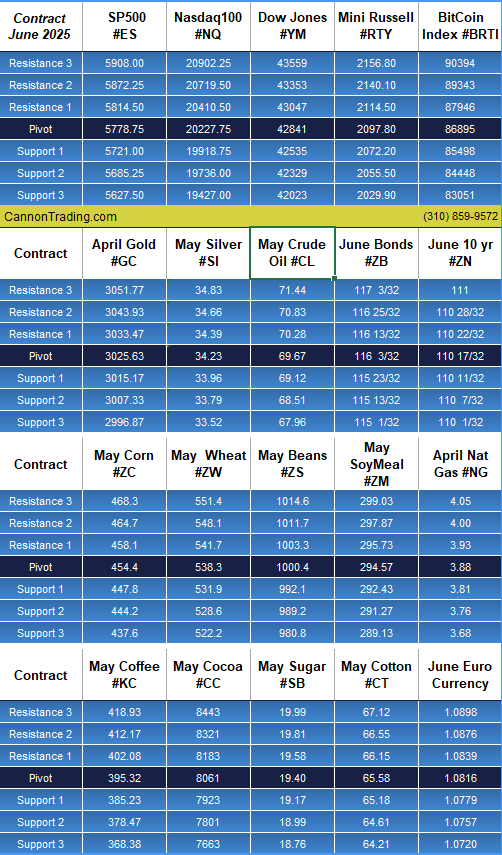

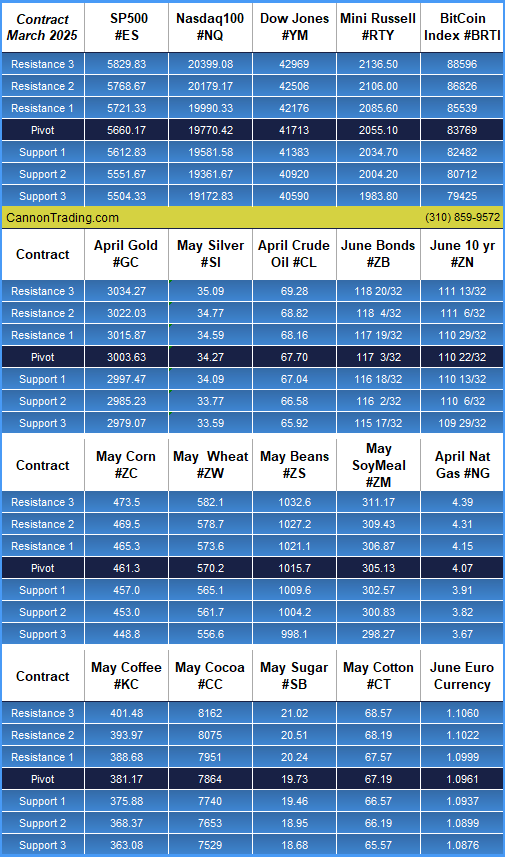

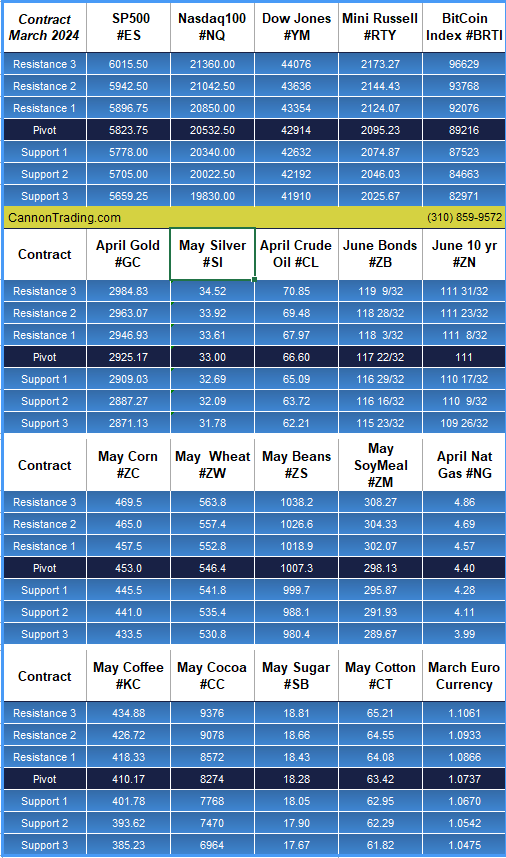

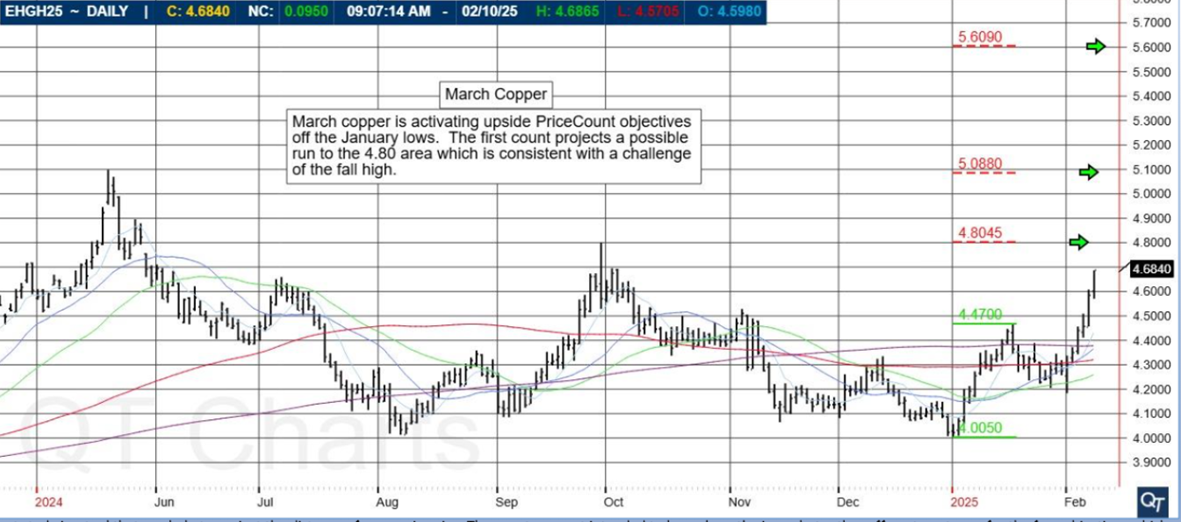

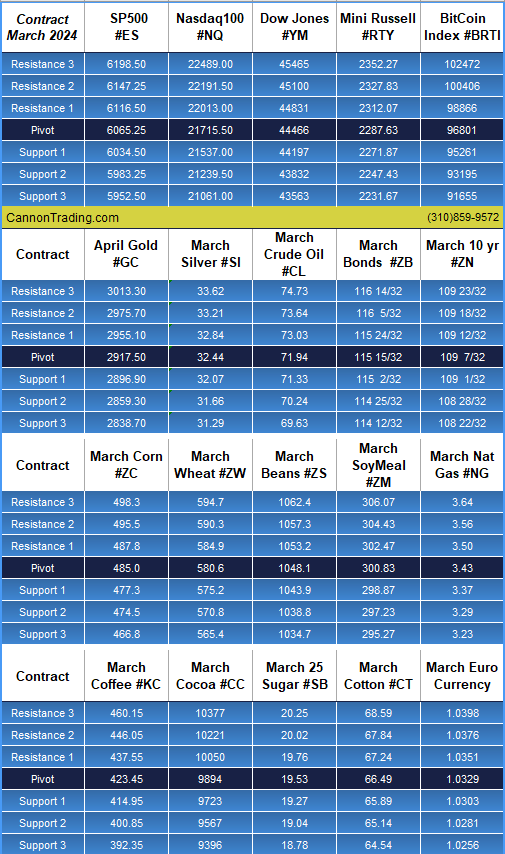

FUTURES:

1. Equity Futures: S&P 500 (ES) & Nasdaq 100 (NQ)

- Fundamental: Investors are pricing in a “perfect growth scenario” driven by the coordination of fiscal and credit stimulus. However, the NIPA profit report shows that while public tech giants are thriving, the broader economy’s earnings are anemic, creating a divergence between the “headline” and the “foundation.”

- Technical: The S&P 500 futures recently tested psychological resistance near 7,000.

- Support: Immediate support sits at 6,885. A break below 6,730 would signal a “lower low,” potentially confirming the 15% historical “New Fed Chair” correction you mentioned.

- Resistance: Bulls are pushing for a sustained break above 7,000 to extend the rally.

2. Interest Rate Futures: 10-Year Treasury Note (ZN)

- Fundamental: The “Fed Test” is most visible here. The 10-year yield has jumped to 4.29% (the highest since August), reflecting market skepticism about the Fed’s ability to cut rates further while the White House pushes for aggressive stimulus.

- Technical: Ultra 10-year futures are trading in a tight range near 114’085.

- The Play: Traders are watching the 114.75 level; a failure to hold here suggests that bond markets expect “higher for longer” rates despite political pressure for easing.

3. Energy Futures: WTI Crude Oil (CL)

- Fundamental: Oil is under pressure due to a projected supply surplus of nearly 4 million barrels per day by the IEA. While geopolitical risks (like the “Venezuela Shock”) provide temporary spikes, the fundamental “glut” is the dominant narrative.

- Technical: Crude is currently in a bearish descending channel that began in late 2025.

- Key Level: It is struggling to hold the $60.00 barrier. A confirmed close below $55.00 opens the door for a slide toward $49.00, which aligns with a 160-year historical trendline.

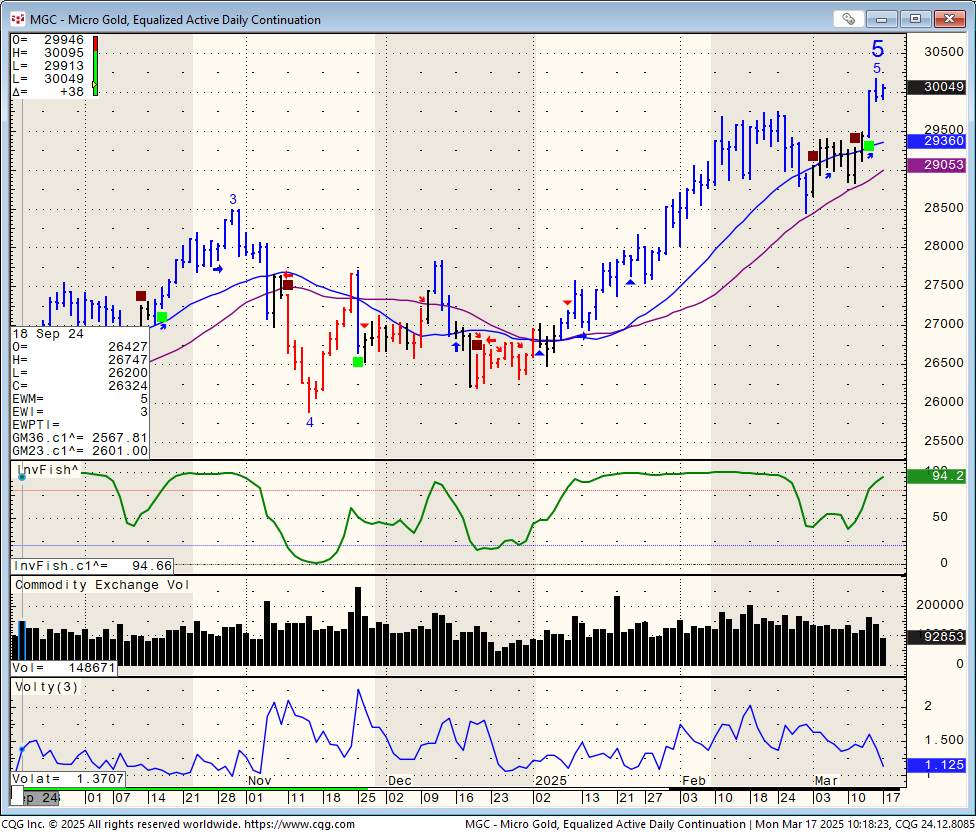

4. Metals Futures: Gold (GC)

- Fundamental: Gold is the star performer of 2026 so far, acting as a hedge against “monetary instability” and concerns over Federal Reserve independence. Central banks (China, India, Turkey) continue to be aggressive buyers.

- Technical: Gold recently smashed through the $4,550 level.

- Outlook: It is currently “overbought” but lacks bearish divergence. Analysts are targeting the 161.8% Fibonacci extension at $4,712 for the remainder of Q1.

OUTLOOK:

Fundamental: overall I think the equity market is overbought in the short term. The SPX broke the 50 DMA and closed below the average. In past corrections the 50 DMA was a buying signal, it will be interesting to see how this plays out this time around.

Europe has been lowering short term rates for a while and the long term rates have gone up, will that scenario play out in the US markets as well?

Trading commodity futures, Stocks, ETF, Bonds, Options and any other financial derivative involves a substantial risk of loss.

The information here is of opinion only and do not guarantee any profits. Past performances are not necessarily indicative of future results. |