Coffee

Movers & Shakers by John Thorpe, Senior Broker

|

|

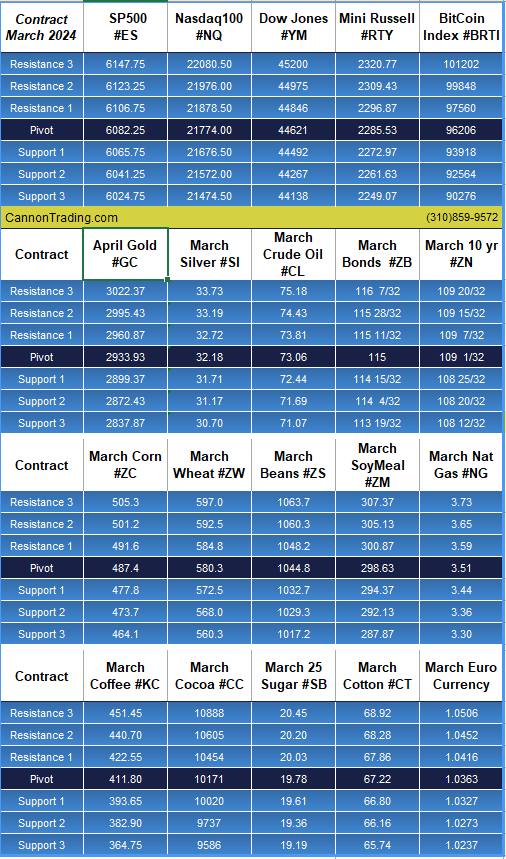

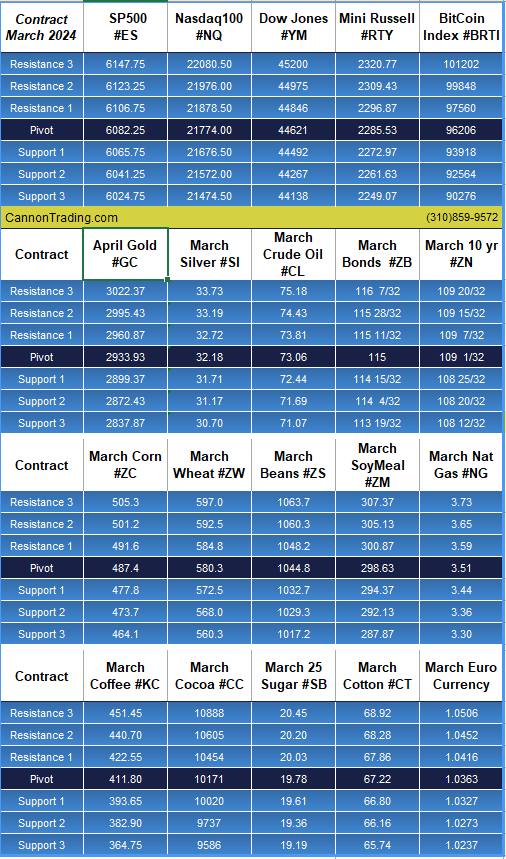

Daily Levels for February 12th, 2025

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Hello Traders,

For 2014 I would like to wish all of you discipline and patience in your trading!

Not much to share today to be honest but found this little factoid VERY interesting….

Morning MoneyBeat Daily Factoid: On this day in 1929, the blue-chip Dow Jones Industrial Average finished at 381.17. The closing level proved to be the Dow’s peak before the Crash of 1929 and the subsequent Great Depression. Stocks didn’t reclaim this level until 1954.

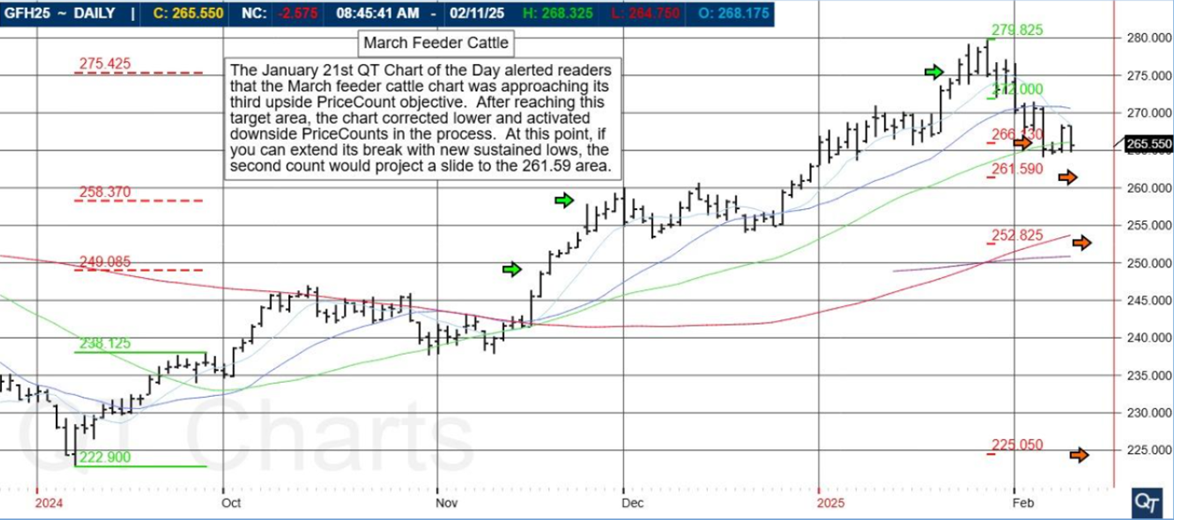

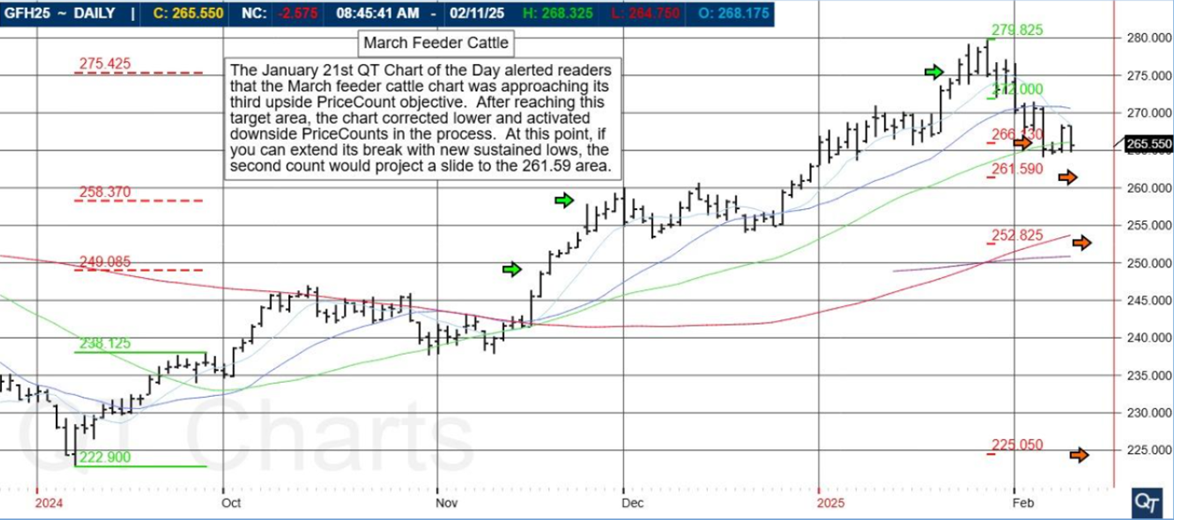

On a different note, yours truly analysis of Feeder Cattle market available at:

http://experts.forexmagnates.com/feeder-cattle-leading-meat-sector-back/

GOOD TRADING !

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time. Past performance is not indicative to future results.

If you like Our Futures Trading Daily Support and Resistance Levels, Please share!

Futures Trading Levels

| Contract Sept. 2014 | SP500 | Nasdaq100 | Dow Jones | Mini Russell | Dollar Index |

| Resistance 3 | 2022.50 | 4153.92 | 17241 | 1201.57 | 83.22 |

| Resistance 2 | 2016.75 | 4133.83 | 17198 | 1194.73 | 83.15 |

| Resistance 1 | 2007.75 | 4102.67 | 17134 | 1182.27 | 83.00 |

| Pivot | 2002.00 | 4082.58 | 17091 | 1175.43 | 82.93 |

| Support 1 | 1993.00 | 4051.42 | 17027 | 1162.97 | 82.79 |

| Support 2 | 1987.25 | 4031.33 | 16984 | 1156.13 | 82.72 |

| Support 3 | 1978.25 | 4000.17 | 16920 | 1143.67 | 82.57 |

| Contract | December Gold | Dec.Silver | Oct. Crude Oil | Dec. Bonds | Sept. Euro |

| Resistance 3 | 1285.1 | 19.43 | 99.22 | 140 15/32 | 1.3205 |

| Resistance 2 | 1278.8 | 19.36 | 97.52 | 139 26/32 | 1.3183 |

| Resistance 1 | 1274.6 | 19.29 | 96.45 | 139 14/32 | 1.3167 |

| Pivot | 1268.3 | 19.21 | 94.75 | 138 25/32 | 1.3145 |

| Support 1 | 1264.1 | 19.14 | 93.68 | 138 13/32 | 1.3129 |

| Support 2 | 1257.8 | 19.07 | 91.98 | 137 24/32 | 1.3107 |

| Support 3 | 1253.6 | 19.00 | 90.91 | 137 12/32 | 1.3091 |

| Contract | Dec Corn | Dec. Wheat | Nov. Beans | Dec. SoyMeal | Dec. bean Oil |

| Resistance 3 | 366.8 | 538.8 | 1039.33 | 368.93 | 32.35 |

| Resistance 2 | 363.5 | 537.9 | 1032.67 | 363.87 | 32.22 |

| Resistance 1 | 357.8 | 536.8 | 1026.33 | 357.13 | 32.09 |

| Pivot | 354.5 | 535.9 | 1019.67 | 352.07 | 31.96 |

| Support 1 | 348.8 | 534.8 | 1013.3 | 345.3 | 31.8 |

| Support 2 | 345.5 | 533.9 | 1006.67 | 340.27 | 31.70 |

| Support 3 | 339.8 | 532.8 | 1000.33 | 333.53 | 31.57 |

| Date | 3:50pm | Currency | Impact | Detail | Actual | Forecast | Previous | Graph | |

|---|---|---|---|---|---|---|---|---|---|

| ThuSep 4 | 2:00am | EUR | German Factory Orders m/m | 1.6% | -3.2% | ||||

| 4:10am | EUR | Retail PMI | 47.6 | ||||||

| Tentative | EUR | Spanish 10-y Bond Auction | 2.69|2.1 | ||||||

| Tentative | EUR | French 10-y Bond Auction | 1.77|2.7 | ||||||

| 7:30am | USD | Challenger Job Cuts y/y | 24.4% | ||||||

| 7:45am | EUR | Minimum Bid Rate | 0.15% | 0.15% | |||||

| 8:15am | USD | ADP Non-Farm Employment Change | 218K | 218K | |||||

| 8:30am | EUR | ECB Press Conference | |||||||

| USD | Trade Balance | -42.5B | -41.5B | ||||||

| USD | Unemployment Claims | 298K | 298K | ||||||

| USD | Revised Nonfarm Productivity q/q | 2.5% | 2.5% | ||||||

| USD | Revised Unit Labor Costs q/q | 0.6% | 0.6% | ||||||

| 9:45am | USD | Final Services PMI | 58.5 | 58.5 | |||||

| 10:00am | USD | ISM Non-Manufacturing PMI | 57.3 | 58.7 | |||||

| 10:30am | USD | Natural Gas Storage | 72B | 75B | |||||

| 11:00am | USD | Crude Oil Inventories | -0.9M | -2.1M | |||||

| 12:30pm | USD | FOMC Member Mester Speaks | |||||||

| 7:00pm | USD | FOMC Member Powell Speaks | |||||||

| 8:15pm | USD | FOMC Member Fisher Speaks | |||||||

| 9:00pm | USD | FOMC Member Kocherlakota Speaks |

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading