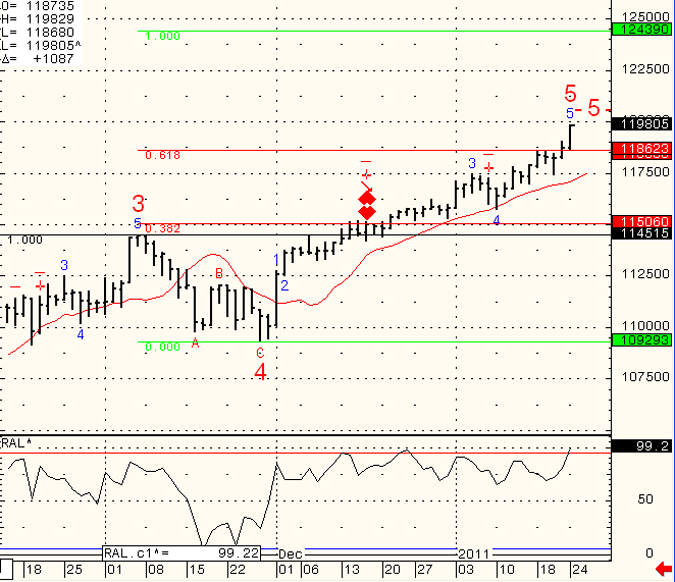

I wrote the following last Thursday as SP, NASDAQ and Russell 2000 were selling off a bit:”Last two days we saw the first meaningful price decline in more than a few good weeks.

Still we are not getting a confirmation from the Dow Jones index that this potential

I would like to see for a larger scale sell off. ”

So while I still think stock indices are over valued and due for a correction, I definitely don’t think it is wise to try and “predict tops and bottoms” and in this case it is trying to pick tops.

I rather wait for a good signal along with good risk/ reward set up.

The chart below if of the Dow Jones CASH INDEX (not the futures contract). I would take a shot at a short position if the cash can break below 11,862, otherwise it looks like the Dow may want to work its way towards the 12439. I use this technique of entering certain positions if prices break above or below certain levels as it gives me more confidence in market direction. I call it “Price Confirmation”

Past results are not necessarily indicative of future results.

The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition. Continue reading “Futures Trading Levels and Economic Reports for January 25, 2011”