As of this typing stock index futures and other futures contracts (but particularly index futures) have experienced single-day downward moves not seen in years:

Index Futures

→ E-mini Dow Jones: down ±1,600 points / 3.7%

→ E-mini S&P 500: down ±260 points / 4.5%

→ E-mini Nasdaq: down ±1,025 points / 5.1%

→ E-mini Russell 2000: down ±128 points / 6.2%

With tomorrow ushering in the Labor Dept.’s release of its monthly Non-farm payrolls report and the furtherance of what looks to be the beginning of a global trade war, expect no drop-off in market volatility.

Index Futures

Traders not only need to be extra cautious in making trading decisions, it’s also important to be aware of important aspects of the markets they’re trading.

Key among these are the daily price limits of the markets you’re trading. A price limit is the maximum price range permitted for a futures contract in each trading session. When markets hit the price limit, different actions occur depending on the product being traded.

Index Futures

Some markets may temporarily halt until price limits can be expanded or trading may be stopped for the day based on regulatory rules. Different futures contracts will have different price limit rules; i.e. Equity Index futures have different rules than Agricultural futures.

Price limits are re-calculated daily and remain in effect for all trading days (except in certain physically-deliverable markets, where price limits are lifted prior to expiration so that futures prices are not prevented from converging on prices for the underlying commodity).

Index Futures

Equity Indexes futures have a three level expansion: 7%, 13% and 20% to the downside, and a 7% limit up and down in overnight trading.

Follow the links below to the CME Group web site to find more information on price limits generally and specific price limits for the markets you’re trading:

Find daily price limits for CME Group Agricultural, Cryptocurrency, Energy, Equity Index, Interest Rates, and Metals products: click here.

Index Futures

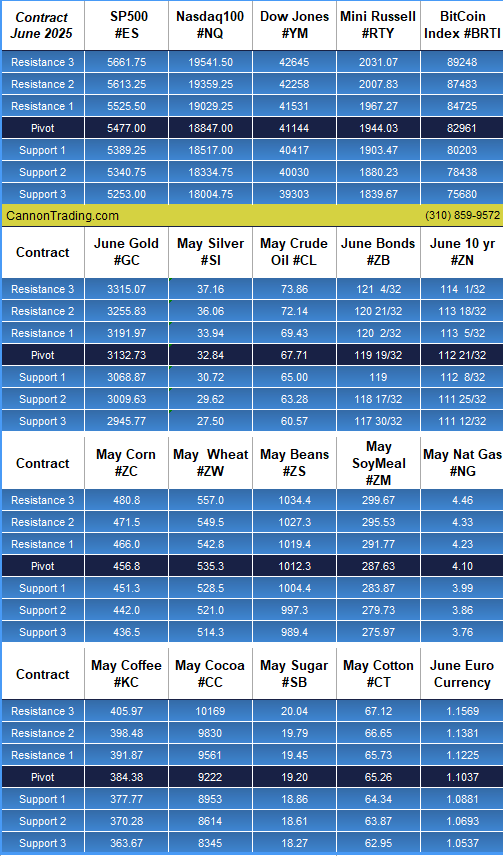

|