Labor

General:

It’s that time of the month again: we’re a couple of days away from the Labor Dept.’s release of its monthly Non Farm Payrolls report – widely considered to be one of the most important and influential measures of the U.S. economy. The report is released at 7:30 A.M., Central Time on the first Friday of the month and measures the number of workers in the U.S. economy, excluding agricultural workers, and self-employed individuals.

More the usual, this month’s report looks to be a critical moment for traders and investors evaluating the Federal Reserve’s monetary policy in the coming months.

Again more than usual, attention will be on the revisions to the July non-farm payrolls data. Initial values for this year have been consistently downwardly revised, in part due to low response rates for the survey. The possibility of significant downward revisions could reveal more persistent labor market weakness than initially anticipated.

Ahead of that, tomorrow the ADP National Employment Report – jointly developed with the Stanford Digital Economy Lab – will show the latest snapshot of the private sector’s employment situation. While the ADP report has a poor record of predicting the Labor Dept.’s numbers – primarily because of each report’s differing means of collecting data – it.

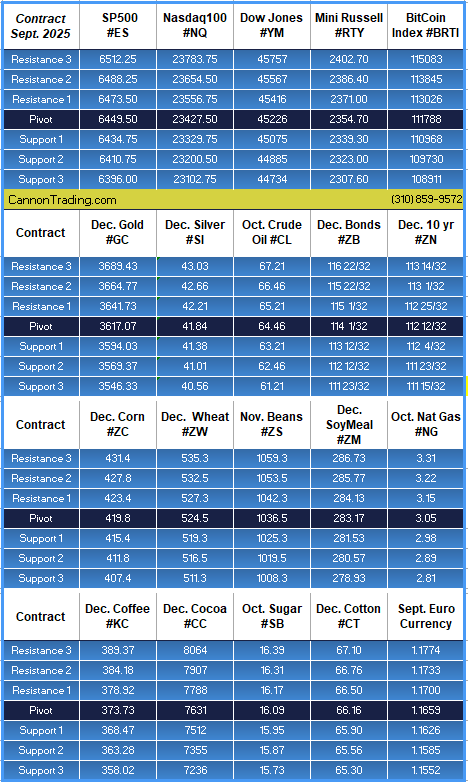

Indexes:

Get ready for the availability of a brand-new S&P 500 stock index futures contract – and corresponding options. Starting Monday, September 22, CME Group will launch S&P 500 Month-End futures and options.

Each futures and options contract is sized at 100x the S&P 500 Index (each 1-point = $100) and expires at the index close every month, providing greater efficiency and flexibility to manage S&P 500 positions.

Now scale S&P 500 exposure with fewer contracts for greater operational efficiency and simplifying your hedging.

View the CME Group’s FAQs to learn more about trading hours, specifications and more.

Metals:

December gold set its latest all-time record high closing price yesterday: $3,592.20 per ounce, after a stout ±$76 rally. Today’s new all-time intraday high near $3,640.00 per ounce – another ±$45 rally – marks a whopping ±$280 per ounce rally in 10 trading days – going back to Aug. 20, a ±$28,000 per contract move!

Likewise, December silver closed yesterday at $42.06 per ounce, setting its own new all-time record high, a ±$4.25 per ounce move over the same 2-week span, a $21,250 per contract move. |