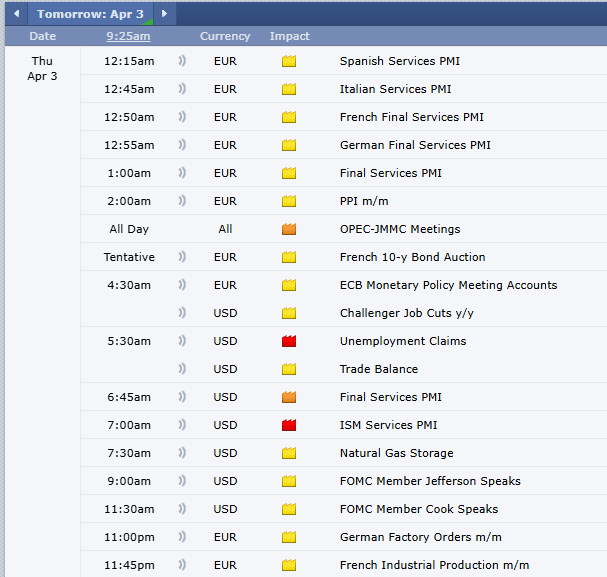

General:

Trading in CME Globex metals and natural gas futures and options markets were halted today due to technical issues impacting traders across the globe. CME Group later opened its Globex natural gas futures and options markets at 12:50 Central Time.

Metals futures reopened soon after. The exchange operator stated its support team were investigating the matter and pointed to a cooling issue at one of its data centers.

CME later said all day orders and good-till-date (GTD) orders for today would be canceled, while good-till-canceled (GTC) orders that had already been acknowledged would remain working.

More General:

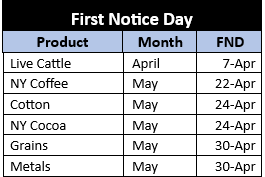

Heads up: this Friday, Feb. 27 is First Notice Day for several major March futures contracts. All long positions in these, if held through First Notice Day are contractually committing to take delivery of the underlying physical commodity. Notable among them:

→ 50,000 bushels of corn, soybeans, wheat, oats (about five semi-truck trailers full)

→ 1,000 or 5,000 ounces of silver

→ 25,000 pounds of copper (equal in wieght to two grown elephants)

→ A 2-, 5-,10-yr. treasury note, or a 30-yr. treasury bond with a face value of $100,000 at maturity.

Avoid taking delivery by liquidating long positions tomorrow. Do not risk holding any long positions overnight into Friday and risk your account receiving a delivery notice. It is a complex and costly procedure to cancel this process, called a retender.

Contact your Cannon Trading Co. broker if you have any questions regarding this or any future First Notice Day, or other important dates on the futures calendar.

Metals:

Which metals futures contracts settle with long positions obligated to receiving the actual physical commodity or short positions obligated to delivering it? Alternatively, which ones settle “in cash,” with a calculated financial settlement price offsetting both long and short positions on the final settlement date?

Below are the settlement conditions for a selection of major metals futures contracts:

|