|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

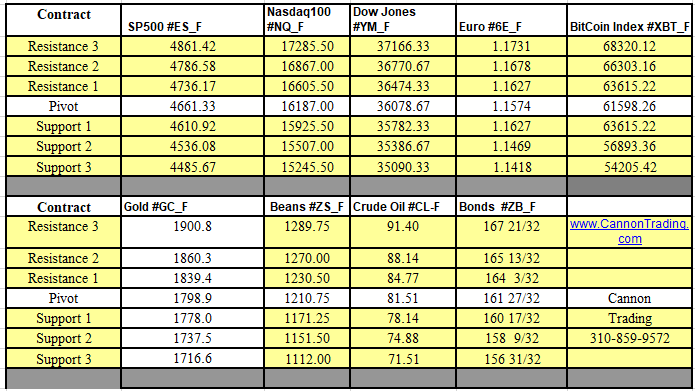

12-28-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

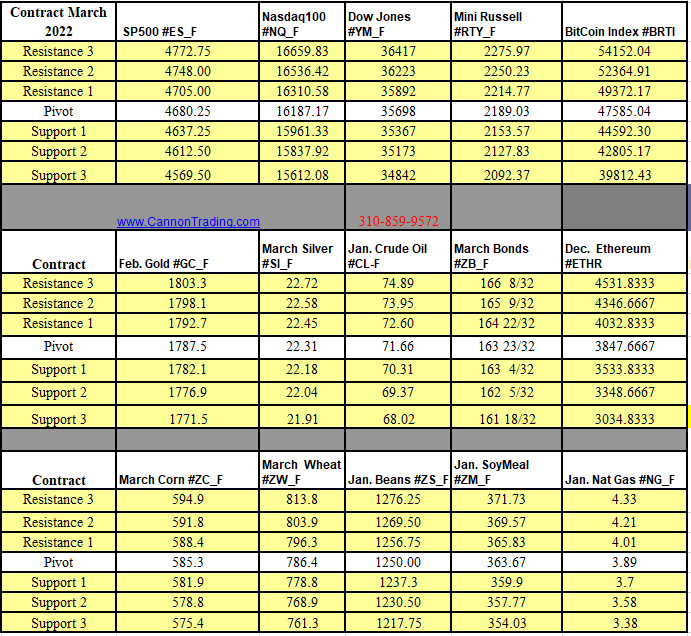

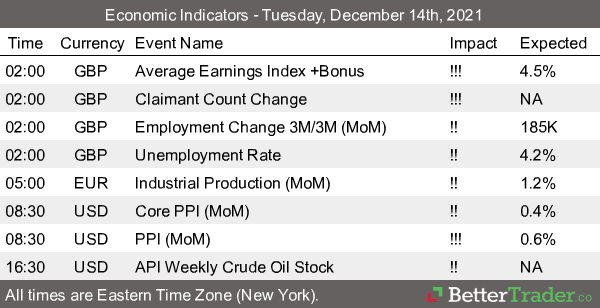

12-14-2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Dear Traders,

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

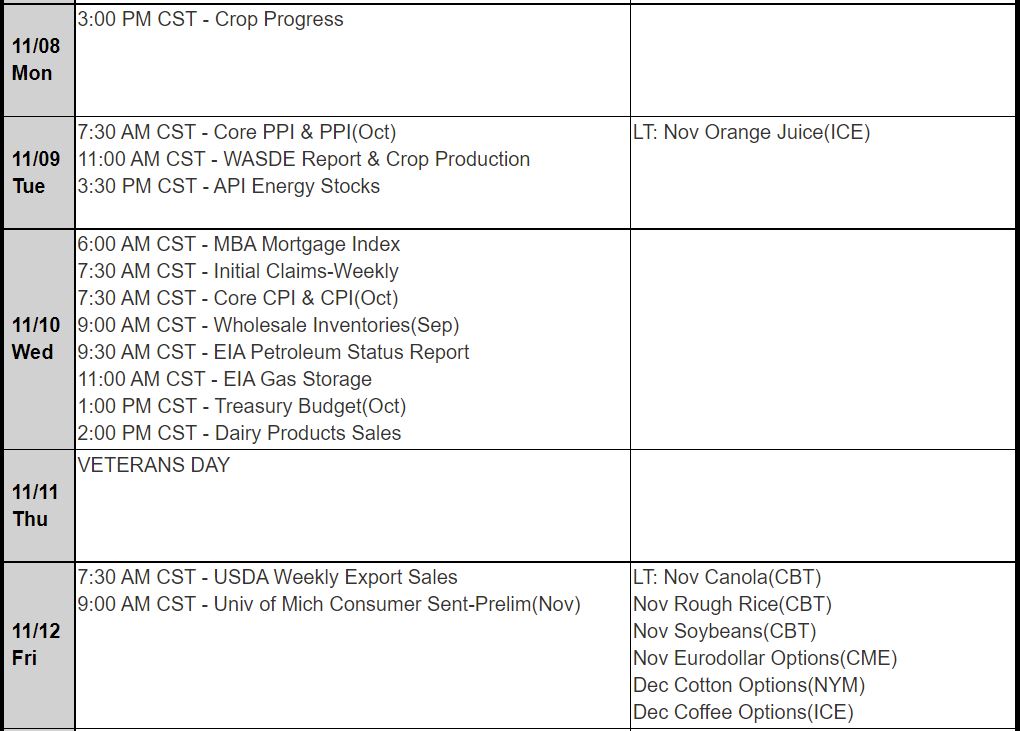

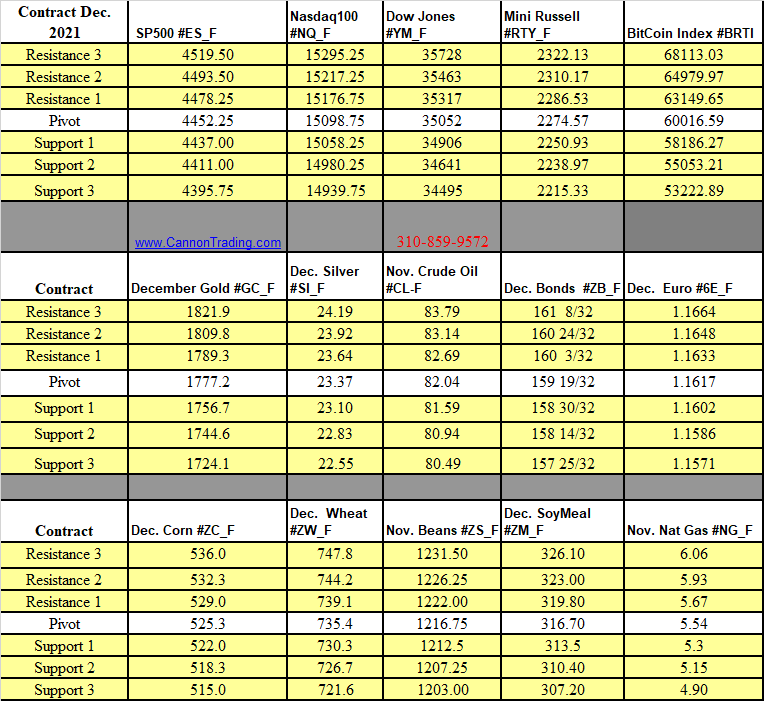

11-08.2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading

Dear Traders,

A comprehensive resource for information on options on futures

In this section you will read and learn about the following:

*Options Basics

*Options Strategies for Bullish set ups

*Options Strategies for Bearish set ups

*Options Strategies for Neutral set ups

*Selling Options Premium – an overview

And much more!

Sign up below and INSTANTLY get access to the online tutorial

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

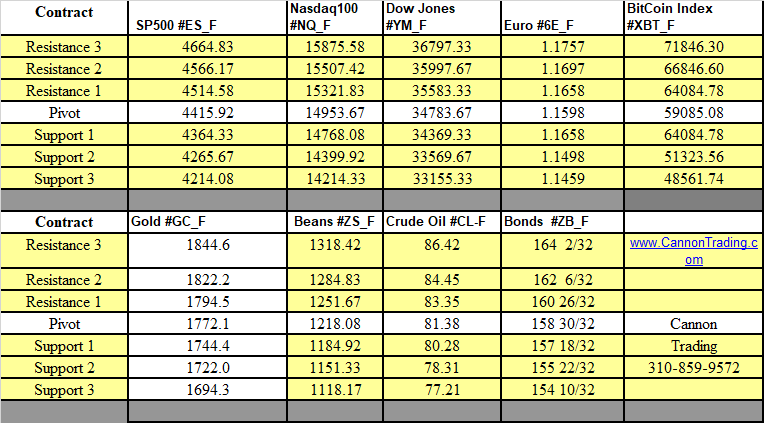

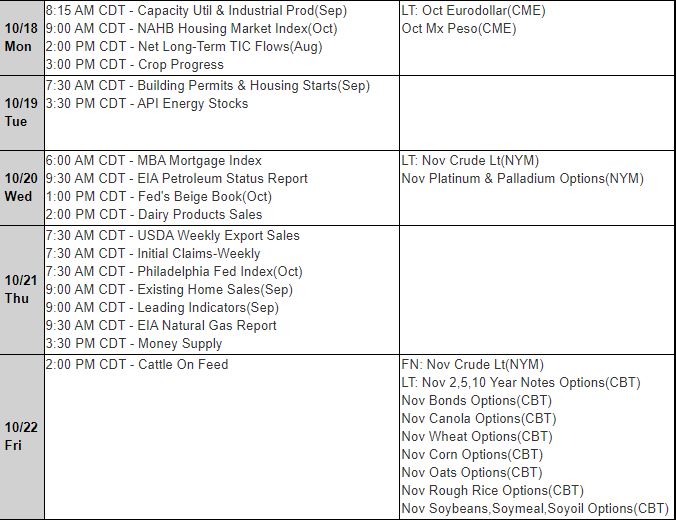

10-18.2021

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading

____________________________________________________________________

Voted #1 Blog and #1 Brokerage Services on TraderPlanet for 2016!!

____________________________________________________________________

Front month for crude oil and Natural gas is March.

Front month for gold is now April.

Wishing all of you EXCELLENT trading in February!

La Niña: Grain Options’ Implied Volatility Languishes

By Erik Norland, Senior Economist, CME Group

Video Highlights

- Corn, Soybean options’ implied volatility languishes despite La Niña

- La Niña can elevate grain volatility, has historically been bearish

Rise of non-U.S. grain producers could be limiting volatility.

Continue reading “Grain Options Volatility Video! 2.01.2018”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* 25 Proven Strategies for Trading Options

If you are currently trading options on futures or are interested in exploring them further, check out our newly updated trading guide, featuring 25 commonly used options strategies, including butterflies, straddles, strangles, backspreads and conversions. Each strategy includes an illustration demonstrating the effect of time decay on the total option premium involved in the position.

Options on futures rank among our most versatile risk management tools, and are offered on most of our products. Whether you trade options for purposes of hedging or speculating, you can limit your risk to the amount you paid up-front for the option while maintaining your exposure to beneficial price movements. Download PDF here

****

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday August 17, 2016

Hello Traders,

Greetings!

Weekly options:

In the last few years the CME group added weekly options to a variety of markets. It started with the highly liquid mini SP 500 contract and then trickled down to other markets such as crude oil, gold, bonds, grains and currencies to name a few.

So what’s the big deal you may ask as there are many different futures contacts and options contracts listed on more than a few global exchanges?

From my point of view, the weekly options are a great tool for short term traders to have in their trading arsenal for two main reasons:

If you ever day-traded futures or traded futures for short term duration ranging from hours to days you know that trading without a stop is detrimental for your physical and financial well being…yet that being said many of us got stopped out to see the market coming right back to where we thought and wanted it to move towards…. Continue reading “Have You Heard About Weekly Options? 8.17.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday July 13, 2016

Hello Traders,

Download our FREE report: Options on Futures.

Continue reading “Futures Options Information & Levels 7.13.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday June 21, 2016

Hello Traders,

A nice feature on our website that many don’t know about….a quick computerized summary of technical outlook for any market like the one below:

Start by bookmarking this page:

https://www.cannontrading.com/tools/futures-quotes-and-charts

Then select the market segment and specific market you want and finish by clicking on the E all the way to the right like in screen shot below:

Of course you can also check option prices, customize charts and much more!

Feel free to call us at 800-454-9572 with any questions.

Continue reading “Quotes & Tools on Options with Cannon Trading 6.21.2016”