|

Disclaimer The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

System Trades Disclosure:

System Description

“System Description” is based upon information obtained from specific system marketing documents, system developers and/or system vendors themselves. While the information is believed to be reliable, we cannot guarantee its completeness or accuracy.

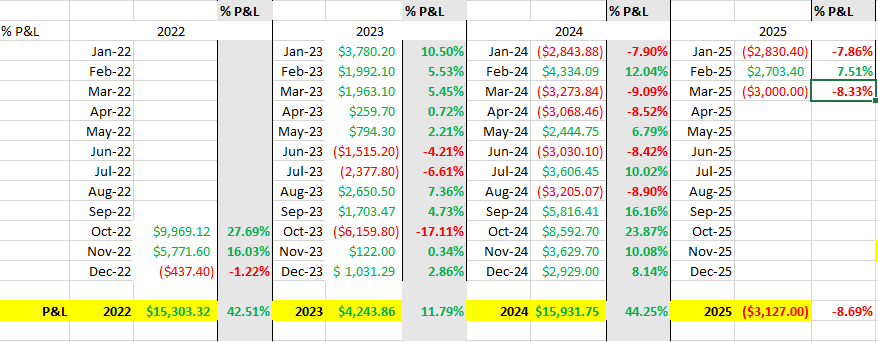

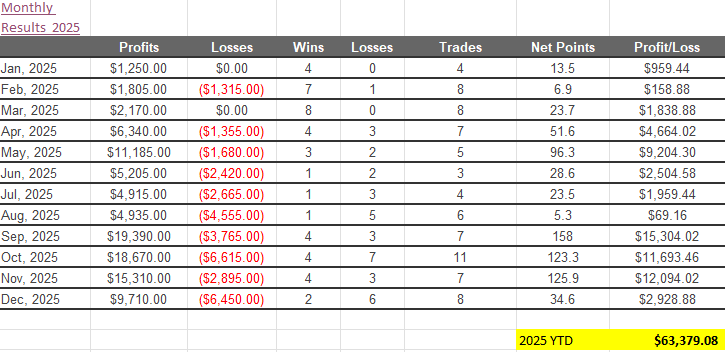

Actual Monthly Performance

The table and charts represent the monthly/quarterly/annual summation of actual trades based on system-specified contract(s) executed through Striker Securities, Inc. using the referenced trading system or system vendor for the stated time period. Commissions and monthly vendor fees are deducted from the tabulation. Results are based on 1 contract.

If a client trades 2 contracts his gain or loss is twice as displayed (and so on). This table is presented for information purposes only and is not a solicitation for the referenced system or vendor. The purpose of this information is for clients to compare their brokerage statements to what is displayed on Striker’s site. Striker as a matter of policy has no ownership with the referenced system or vendor or any other trading system or vendor. Past trade history may not be indicative of future results.

The results indicated here may or may not be typical of the performance of this system and, ALTHOUGH WE BELIEVE THIS INFORMATION TO BE ACCURATE, CANNON TRADING COMPANY MAKES NO ENDORSEMENT OF THIS OR ANY SYSTEM NOR WARRANTS ITS PERFORMANCE. This is not the only trading system that Striker executes for its clients.

Potential traders should carefully investigate, evaluate and compare trading systems before investing capital. Some or all trading systems may involve an inappropriate level of risk for potential traders. It is the nature of commodity trading that where there is the opportunity for profit, there is also the risk of loss. In opening an account through CANNON TRADING COMPANY, Customer acknowledges and agrees that he/she will rely solely upon the information that CANNON TRADING COMPANYprovides to you. Thus, all prior third-party materials provided are superseded by the information and disclosures provided by CANNON TRADING COMPANY.\

Important Information About this Trading System Analysis

Statistics, tables, charts and other information on trading system monthly performance are based on actual trading unless otherwise specified. Actual dollar and percentage gains/losses experienced by investors would depend on many factors not accounted for in these statistics, including, but not limited to, starting account balances, market behavior, developer fees, incidence of split fills and other variations in order execution, and the duration and extent of individual investor participation in the specified system.

While the information and statistics given are believed to be complete and accurate we cannot guarantee their completeness or accuracy as they results are key punched and subject to human error. Performance information is not the performance of a single account, but a compilation of several accounts over time, and is based on the physical trading ticket.

THIS INFORMATION IS PROVIDED FOR EDUCATIONAL/ INFORMATIONAL PURPOSES ONLY AND USED BY CURRENT CLIENTS TO AUDIT THEIR STATEMENTS TO STRIKER SITE. These results are not indicative of, and have no bearing on, any individual results that may be attained by the trading system in the future.

This trading system, like any other, may involve an inappropriate level of risk for prospective investors. THE RISK OF LOSS IN TRADING COMMODITY FUTURES AND OPTIONS CAN BE SUBSTANTIAL AND MAY NOT BE SUITABLE FOR ALL INVESTORS. Prior to purchasing or leasing a trading system from this or any other system vendor or investing in a trading system with a registered commodity trading representative, investors need to carefully consider whether such trading is suitable for them in light of their own specific financial condition. In some cases, futures accounts are subject to substantial charges for commission, management, incentive or advisory fees.

It may be necessary for accounts subject to these charges to make substantial trading profits to avoid depletion or exhaustion of their assets. In addition, one should carefully study the accompanying prospectus, account forms, disclosure documents and/or risk disclosure statements required by the CFTC or NFA, which are provided directly by the system vendor and/or CTA’s.

The information contained in this report is provided with the objective of “standardizing” trading systems measurements, and it is intended for educational /informational purposes only. All information is offered with the understanding that an investor considering purchasing or leasing a system must carry out his/her own research and due diligence in deciding whether to purchase or lease any trading system noted within or without this report.

This report does not constitute a solicitation to purchase or invest in any trading system which may be mentioned herein. CANNON TRADING COMPANY AND STRIKER SECURITES, INC. MAKES NO ENDORSEMENT OF THIS OR ANY OTHER TRADING SYSTEM NOR WARRANTS ITS PERFORMANCE. THIS IS NOT A SOLICITATION TO PURCHASE OR SUBSCRIBE TO ANY TRADING SYSTEM.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you. You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position.

If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position. If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

|