|

General:

Stay alert tomorrow for Federal Reserve Board Chair Jerome Powell’s speech at the Economic Club of Chicago, when he will share his outlook for the U.S. economy. 12:30 P.M., Central Time.

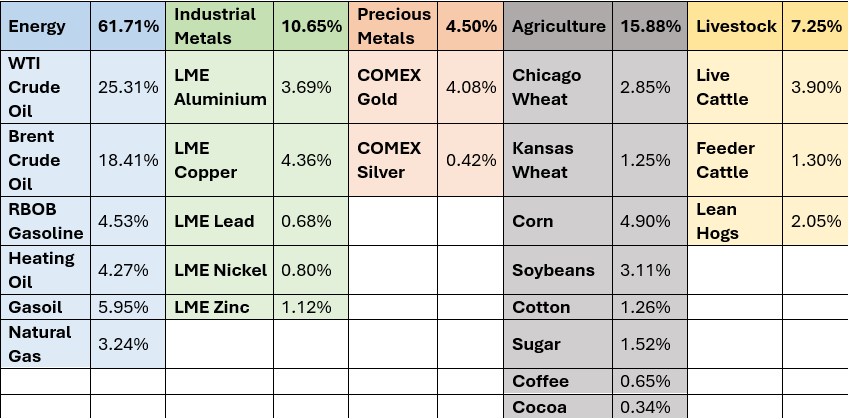

Standard and Poors GSCI

The S&P GSCI (formerly the Goldman Sachs Commodity Index) tracks global commodities across the energy, metals and agriculture sectors and serves as a benchmark for the commodity markets as a measure of commodity performance over time.

Standard and Poors

The index currently comprises 24 commodities from all commodity sectors. The diversity of the index’s component commodities along with their weighting allows the index to respond in a stable way to world economic growth and contraction.

The index is tradable on Chicago Mercantile Exchange. Each point equals $250.

It shows that prices have declined over 8% since April 2, when U.S. President Donald Trump announced a raft of “reciprocal” tariffs – even after a slight recovery in prices after the White House leader announced a tariff about face last Wednesday.

Of all the commodities in the basket, energy fell the most since April 2, declining around 12%,

Industrial metals posted the second steepest loss of around 9%, followed by soft commodities, which fell roughly 5.2%.

Expectations of further declines in commodities prices are feeding a growing chorus of U.S. recession calls. JPMorgan expects U.S. gross domestic product to contract 0.3% this year.\

Standard and Poors

GSCI Components and Dollar Weights:

|