Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Non-Farm Payrolls

A full week ahead and as nearly always, the 1st Friday of the month brings an impactful data set to the markets. Non-Farm Payrolls (NFP).This week will also feature the last week of Fed speakers until after the FOMC Rate announcement 8 business days following this upcoming weekend, known as the blackout period. Light earnings, only 149 reporting as we are in the 9th inning of this game.

Tariffs

More volatility to come as next week all markets will be reacting to whatever comes out of the U.S. Govt leadership relating to conflicts cessation and trade deals. Therefore, increased volatility expectations with periodic choppiness as the administration Vs the Courts seem to be in the middle innings of their tariff battle.

Earnings Next Week:

- Mon. Credo

- Tue. HP, Dollar General, Crowdstrike

- Wed. Dollar Tree

- Thu. Broadcom, LuLuLemon

- Fri. ABM industries

FED SPEECHES: (all time CDT)

- Mon. Logan 9:15 am CT, Goolsbee 11:45 am CT

- Tues. Goolsbee 11:45 am CT, Logan 2:30 pm CT

- Wed. Bostic 7:30 am CT

- Thu. Harker 12:30 pm CT,

- Fri. None

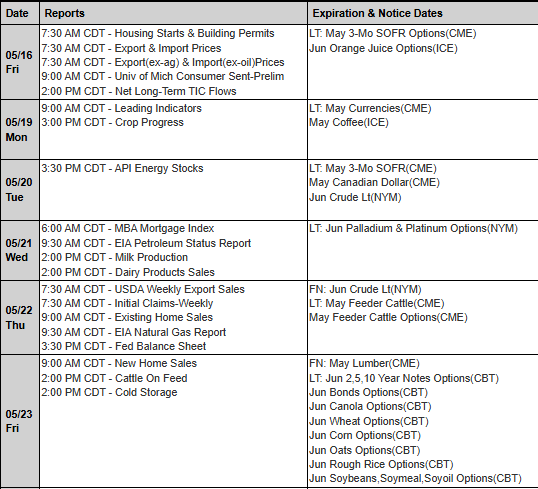

Economic Data week:

- Mon. ISM mfg. PMI

- Tue. RedBook, JOLTS, Factory Orders,RCM/TIPP Econ Optimism Index,

- Wed. ADP, PMI Final, ISM Services, EIA Crude Stocks, Beige Book,

- Thur. Challenger Job Cuts, Continuing claims, EIA Nat Gas storage

- Fri. Non-Farm Payrolls, Used Car prices.

|