Find out more about hedging with Cannon Trading Company here.

In the ever-evolving landscape of financial markets, futures trading has emerged as a powerful mechanism for risk mitigation, particularly in the realm of commodities. This strategic approach enables producers, farmers, and various entities to hedge against price volatility, ensuring stability and safeguarding their financial well-being. Through futures contracts, these market participants can navigate uncertainties while embracing the potential for gains. One shining example of a brokerage in this field is Cannon Trading Company, a renowned institution that has earned a TrustPilot ranking of 4.9 out of 5 stars, reflecting their commitment to excellence in futures trading and hedging.

Understanding Hedging

At its core, hedging is a proactive strategy designed to minimize potential losses caused by price fluctuations. It involves taking an offsetting position in a related security or contract to neutralize the impact of adverse price movements. Hedging aims to ensure price predictability, offering a protective shield against market volatility. By locking in prices through futures contracts, entities can mitigate the risk associated with fluctuating market conditions.

Evolution of Futures Trading for Risk Mitigation

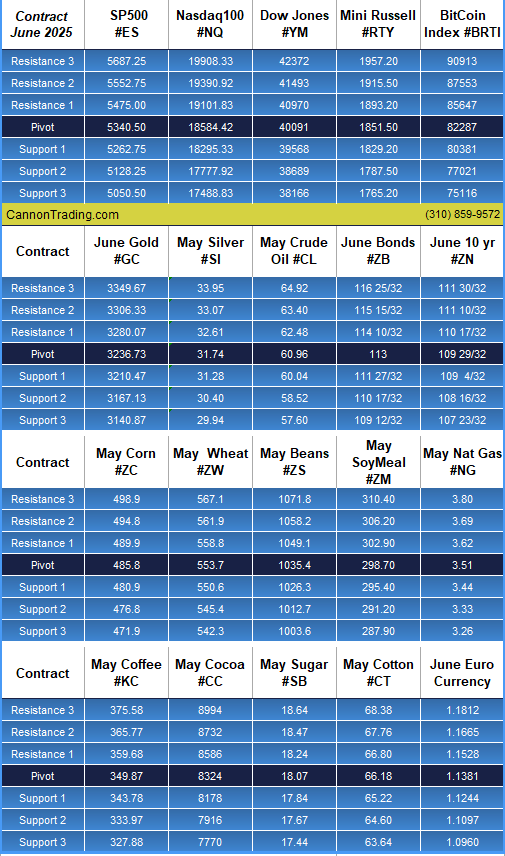

Futures trading has a rich history that dates back centuries, originating with farmers and producers seeking to secure stable prices for their products. In the context of agriculture, a farmer could plant crops with confidence, knowing that price fluctuations wouldn’t jeopardize their financial stability. This concept gradually extended to other commodities, including energy products like oil, where geopolitical events and global demand can trigger price swings.

The essence of futures trading lies in the ability to transfer risk from one party to another. For instance, an oil producer concerned about falling prices can sell futures contracts, effectively locking in a selling price. Conversely, a buyer, such as an airline company reliant on fuel, can buy oil futures contracts to hedge against rising fuel costs.

Over time, the futures market has evolved to include various asset classes beyond commodities, such as financial instruments, indices, and even cryptocurrencies. This expansion has allowed a broader range of market participants to engage in hedging and risk management.

Hedging for Farmers and Producers

Farmers and producers are among the most prominent beneficiaries of futures trading and hedging practices. The agricultural sector is inherently exposed to unpredictable variables, including weather patterns, pests, and diseases. These factors can dramatically impact crop yields and, consequently, market prices. By engaging in futures trading, farmers can secure prices for their crops well in advance, effectively locking in their profit margins regardless of how market conditions evolve.

Consider a scenario where a wheat farmer anticipates a bountiful harvest but is concerned about a potential drop in wheat prices. The farmer can enter into a futures contract to sell a specific quantity of wheat at a predetermined price. Even if prices plummet due to oversupply or other factors, the farmer is protected by the agreed-upon price in the futures contract, ensuring a steady income stream.

Cannon Trading Company: A Beacon of Excellence

Cannon Trading Company stands as a beacon of excellence in the field of futures trading and hedging. With a TrustPilot ranking of 4.9 out of 5 stars, the company’s reputation is a testament to its commitment to client satisfaction, reliable service, and effective risk management solutions.

The high ranking achieved by Cannon Trading Company on TrustPilot underscores several key factors that contribute to their success. Firstly, their transparent and client-centric approach sets the tone for building trust with their clientele. Clear communication, fair practices, and responsive customer service create an environment where clients feel valued and well-informed.

Secondly, Cannon Trading Company’s expertise in futures trading and hedging is a cornerstone of their reputation. Their seasoned professionals understand the intricacies of various markets, enabling them to provide tailored solutions that cater to each client’s unique risk profile and financial goals.

Moreover, the company’s commitment to education further distinguishes them in the industry. They empower their clients with knowledge about futures trading, risk management strategies, and market trends. This educational approach not only helps clients make informed decisions but also fosters a long-term partnership that extends beyond transactions.

In the world of financial markets, futures trading has transcended its origins to become a vital tool for managing risk and uncertainty. For producers, farmers, and market participants, it offers a means to secure stable prices in the face of volatile market conditions. Through futures contracts, these entities can hedge against adverse price movements, ensuring stability and financial well-being.

Cannon Trading Company’s remarkable TrustPilot ranking of 4.9 out of 5 stars exemplifies their dedication to excellence in futures trading and hedging. By prioritizing transparency, expertise, and education, they have positioned themselves as leaders in the industry, empowering clients to navigate the complexities of futures markets with confidence and success. As markets continue to evolve, futures trading remains a cornerstone of risk management strategies, enabling participants to embrace opportunities while safeguarding against potential losses.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.