USDA Numbers from Today

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Today’s energy crude oil market is truly global. From West Texas Intermediate (WTI) to Brent and DME Oman, the crude oil market fuels many of the world’s leading economies and impact nearly every nation. Energy crude oil futures and options provide the tools the industry needs to manage risk.

Explore the key concepts and structure of today’s energy markets, including the factors that affect supply and demand and move prices. Learn how to use these instruments to hedge exposure and unlock opportunities.

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

The Bloomberg Commodity Index is a basket of 24 commodities spread across energy, grains, softs, livestock, industrial and precious metals. The weekly chart has developed a 2-year sideways range of trade. IF the chart can break out to the topside, there are upside PriceCount objectives in place which suggest that this index would have significant potential to run.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

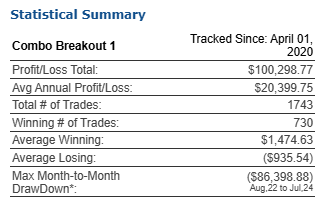

Combo Breakout 1 Trading System

Market Sector: Diversified / Multiple

Markets Traded: C , KW , S , W , CL , HO , NG , RB , KC , SB , FGBL , TU , FV , BP , EC , JY , SF , DX , FESX , GC , EMD , NQ , RTY , ES , YM ,

System Type: Swing Trading

Risk per Trade: varies

Trading Rules: Partially Disclosed

Suggested Capital: $50,000

Developer Fee per contract: $200.00 Monthly Subscription

System Description:

Portfolio Combo Breakout I consists of 5-6 daytrade and swing strategies using different symbols, timeframes, and session templates. All strategies are developed by simple, structured, and proven breakout models based on strong fundamental logics.

All strategies are fully robustness tested as well as stress tested with no position sizing, more contracts can be traded. The 5-6 strategies have very low correlations (Less than 0.1) in order to achieve smoother portfolio equity curve.

Combo Breakout I is specially designed to trade with Combo Breakout II and Combo Breakout III for their low correlations in the portfolio level.

Disclaimer: The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”.

A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position.

If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Please read full disclaimer HERE.

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|