|

Weekly Outlook Ahead!By Gal Levy, Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

Weekly Outlook Ahead!By Gal Levy, Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday March 17, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

A note on Silver by my colleague, John Thorpe who has over 25 years of experience starting on the floor of the CBOT.

Silver Futures

Here is a daily chart with simple moving averages, a 25 day slow and 10 day fast, the buy signal is still intact. With the fast(red) SMA penetrating the slow (blue) from underneath. RSI in the neutral range.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday March 16, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

FRONT MONTH for STOCK INDEX is JUNE!!

The FOMC interest rate decision is due at 2:15 ET in the US tomorrow ( Wednesday, March 16th ). Also more than a few economic numbers ahead of the announcement.

FOMC days have different characteristics than other trading days. If you have traded for a while, check your trading notes from past FOMC days that may help you prepare for tomorrow.

if you are a newcomer, take a more conservative approach and make sure you understand that the news can really move the market.

The following are suggestions on trading during FOMC days:

Continue reading “FOMC Tomorrow and Managing Trading Size 3.16.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday March 10, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

I personally will start trading the June mini SP this Friday but most traders will rollover tomorrow:

Rollover Notice for Stock Index Futures

Important notice: For those of you trading any stock index futures contracts, i.e., the E-mini S&P, E-mini NASDAQ, E-mini Dow Jones, the “Big” pit-traded S&P 500, etc., it is extremely important to remember that tomorrow, Thursday, March 10th, at 8:30 am CDT Time is rollover day.

Starting March 10th, the June 2016 futures contracts will be the front month contracts. It is recommended that all new positions be placed in the June 2016 contract as of March 10th. Volume in the March 2016 contracts will begin to drop off until its expiration on Friday March 18th.

The month code for June is M6.

Traders with electronic trading software should make sure that defaults reflect the proper contract as of Thursday morning.

Please close any open March Currency positions by the close on Friday the 11th.

Should you have any further question please contact your broker.

Continue reading “Rollover Notice for Stock Index Futures 3.10.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday March 9, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

Crude Oil inventories tomorrow at 10:30 AM EST, like almost every Wednesday. On weeks when we have long weekends, the report will come out Thursday.

below you will see 1 minute chart from the last two reports, as they say, picture is worth a 1000 words….

Wednesday March 2nd 2016

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday March 2, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

I have written in the past about the importance of keeping a trading journal.

Many benefits for doing so. From the mental / emotional aspect to the bottom line of keeping notes on market behavior which you can use down the road.

A good example is trading on the last trading day of the month ( example for me is that I dont run one of my systems for bonds on the last trading day of the month). Another example is behavior of markets ( look at stock index futures) on the first trading day of the month.

I think part of the reason for the unique market action ( not always but quite often) during these two days is the activity of large traders, CTA’s who need to report monthly performance, institutions who may need to establish longer term positions on the first of the month etc.

Continue reading “Keeping A Futures Trading Journal 3.02.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Tuesday March 1, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Greetings!

So as many of you know the ICE exchange has decided to charge all users (professionals and non professional) $110 per month to receive real-time data. This is compared to the CME which charges $86 for professionals (brokers, hedge funds etc.) but a “normal amount of $5 to retail users ( i.e. large percent of the trading public). If you ask me not a bright move on the part of the ICE exchange and they may see volume drop quite a bit on certain markets.

In between, I have more than a few clients who are trading the mini Russell 2000 and like it, but are not so sure about paying $110 per month for the privilege to trade this one….While ICE also hosts coffee, sugar, dollar index and a few other markets, the mini Russell is so far the one that caught most interest.

I did some homework and while the CME does offer the mini Russell 1000, the volume on this one, so far is pathetic….(I think it traded 83 contracts on Friday). HOWEVER….the CME for the same $5 per month most users pay to trade the ES and NQ along with currencies, also has the mid cap 400. Symbol is EMD on the Transactand Shogun platforms as well as E-futures International.

Not bad volume, same tick size as mini Russell 2000 and from the quick research seems to move in similar ways. Worth exploring, perhaps using in demo mode or simply following price movement as the ICE change will go in effect April 1st.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Wednesday February 17, 2016

Hello Traders,

For 2016 I would like to wish all of you discipline and patience in your trading!

Tough day in the markets, busy day after the long weekend = no commentary…..

TRADE SMART / TRADE SYSTEMS — for the current rankings as well as actual performance of trading systems traded at Striker, click here.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

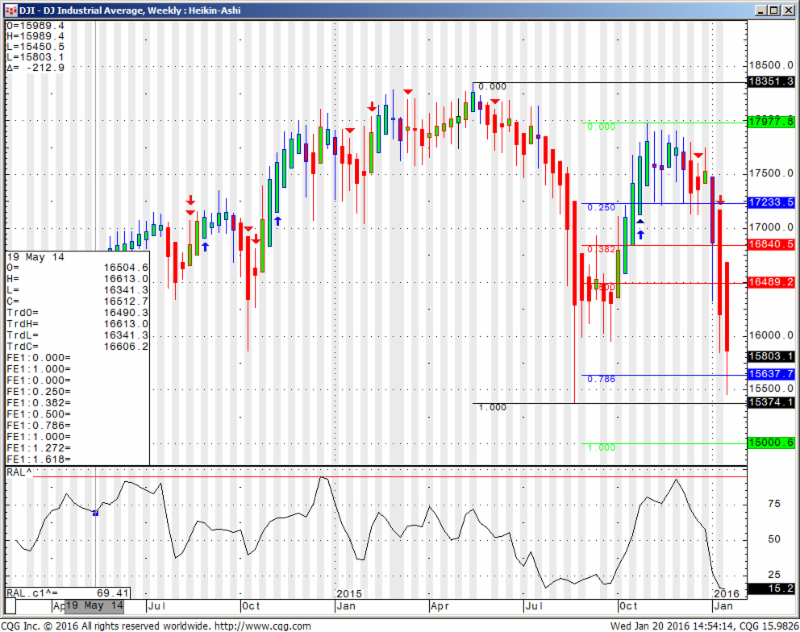

5. Futures Economic Reports for Thursday January 21, 2016

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Tremendous volatility. ADJUST AND ADAPT. These past few weeks market conditions with index futures are not even close to what we saw back in May or June of last year…..do your homework!!

Weekly chart of the CASH DOW JONES INDEX for your review below:

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

5. Futures Economic Reports for Thursday January 8, 2016

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

Voted #1 futures trading blog!

Volatility is skyrocketing. This is a completely different environment for trading than you were in 3-4 weeks ago. Markets are evolving and you must adapt your trading to changing market conditions.

This is where you find out if the gambler in you is stronger than the trader in you or vise versa…..If the trader is the strong one, you will REDUCE trading size, become extra picky in your entries , perhaps even decide not to trade at certain times….If the gambler is the dominant one…you will find yourself all over the place up huge, down huge and I am sorry to say sooner or later you will blow up…..

Think about it and try help the trader within win over the gambler that resides in the same neighborhood…..

One additional note, dont be GREEDY….set daily profit target and daily loss limit and stick to it. that can be the difference between you surviving to trade another day OR……

On a different note, please pay attention to LIMIT moves and understand what happens when the market is halting at limit levels:

http://www.cmegroup.com/trading/equity-index/price-limit-guide.html

Continue reading “Volatility Skyrockets – Futures Markets 1.08.2016”