|

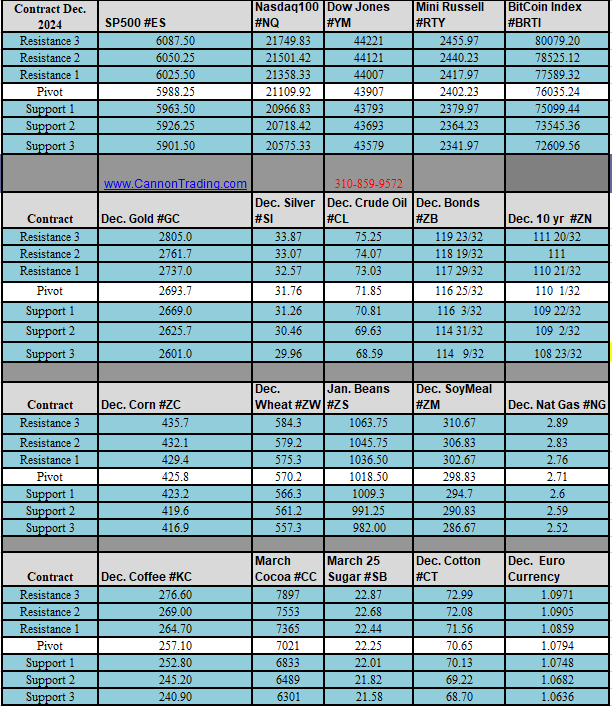

Daily Levels for November 8th 2024

Economic Reports

All times are Eastern Time ( New York)

|

Good Trading!

About: Cannon Trading is an independent futures brokerage firm established in 1988 in Los Angeles. Our mission is to provide reliable service along with the latest technological advances and choices while keeping our clients informed and educated in the field of futures and commodities trading.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Cannon Trading Company

12100 Wilshire Boulevard

Suite 1640

Los Angeles, CA 90025

(800) 454-9572

|

|

|

|