Get Real Time updates and more on our private FB group!

Coming Up As We Close Q1 2022

By Mark O’Brien

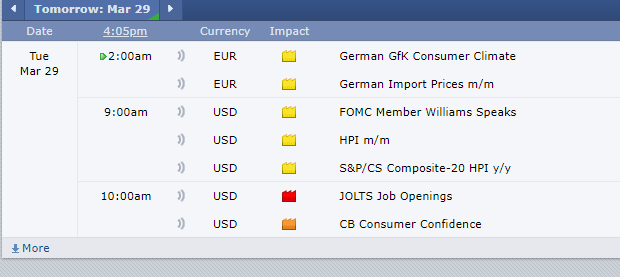

If the war in Ukraine wasn’t disruptive enough for commodity prices, keep an eye out for a few noteworthy potential market movers stacked up over these next two days.

Tomorrow the U.S. Dept. of Agriculture will release its annual Prospective Plantings report. The report establishes acreage estimates for principal crops and leading commodities including

corn,

wheat,

soybeans,

oats and

cotton for the upcoming crop year. The report is serves as a record of the planting intentions of the nation’s farmers. Acreage estimates are based on surveys conducted during the first two weeks of March. This year the survey reached 78,900 farm operators in 48 states.

Tomorrow is also the date for the 27

th OPEC and non-OPEC Ministerial Meeting. Members meet at this event to determine the output levels for production beginning in May. OPEC+, an expanded group that includes non-OPEC members like Russia and Mexico, has immense power because its members control more than 40% of

global oil production.

U.S. private employment payrolls rose by 455,000 in March, according to this morning’s ADP National Employment Report. Up next, on Friday the Bureau of Labor Statistics will publish its official nonfarm payroll report. This is one of the most important monthly economic data points on the calendar. It’s intended to represent the total number of paid workers in the U.S., minus farm employees, government employees, private household employees and employees of nonprofit organizations. Economists – polled by The Wall Street Journal – forecasted a gain of 450,000 private sector jobs in March.

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

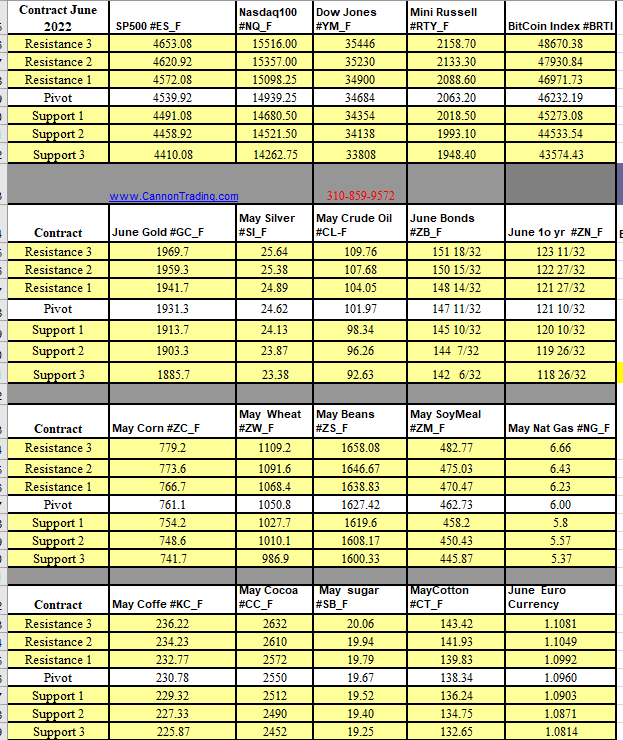

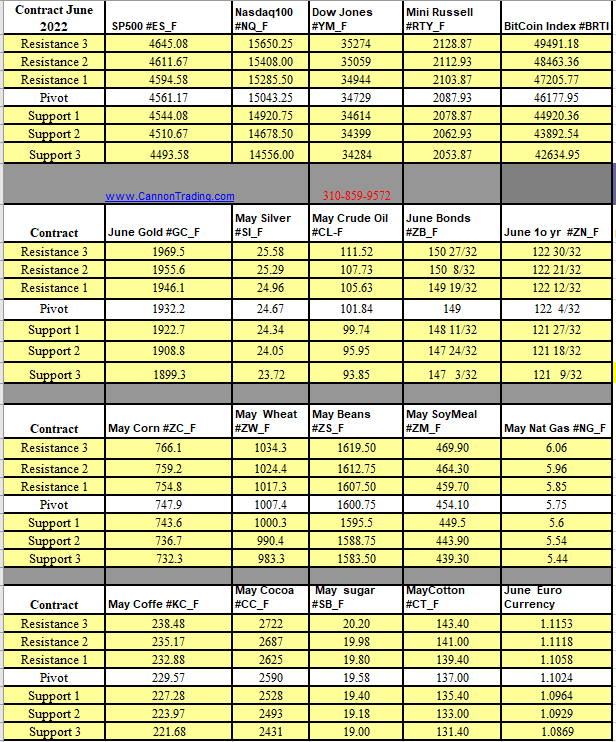

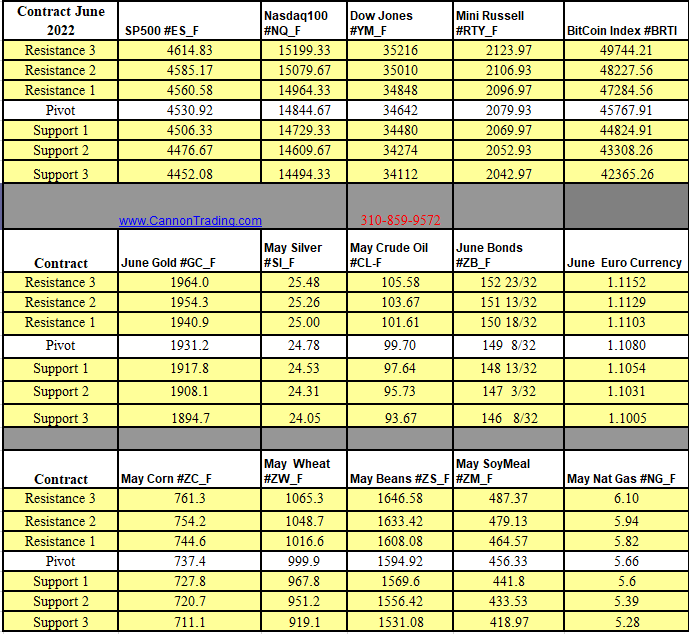

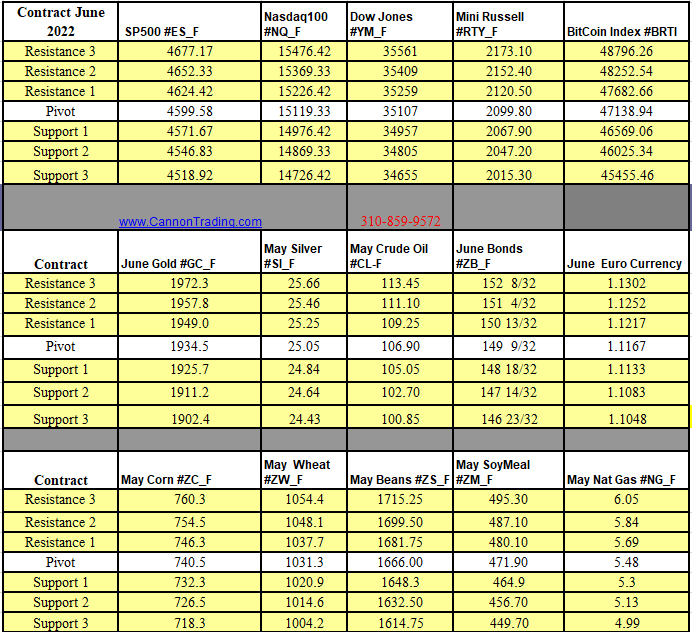

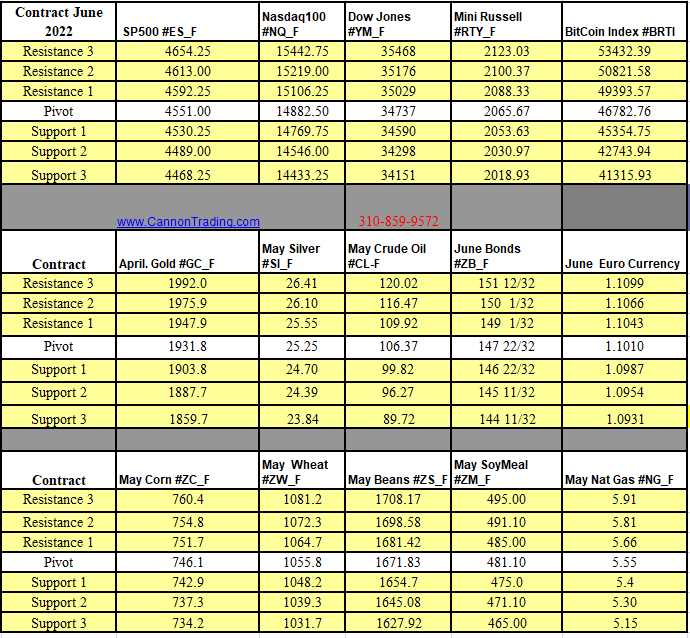

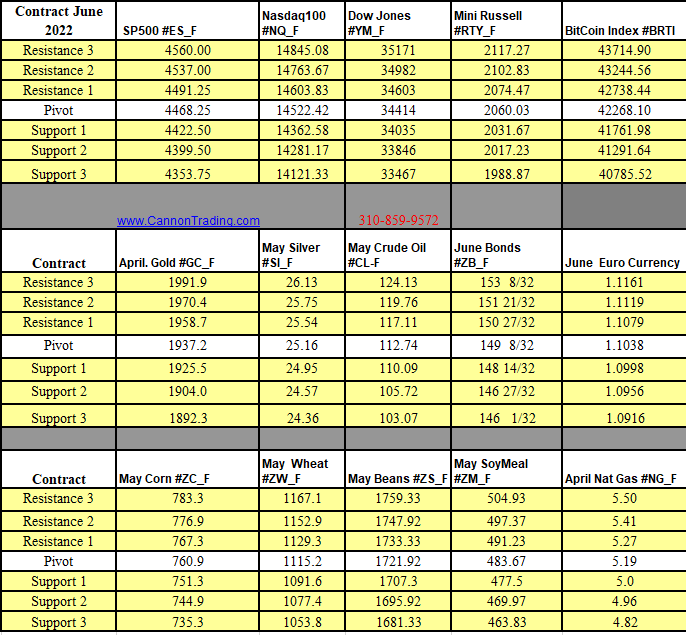

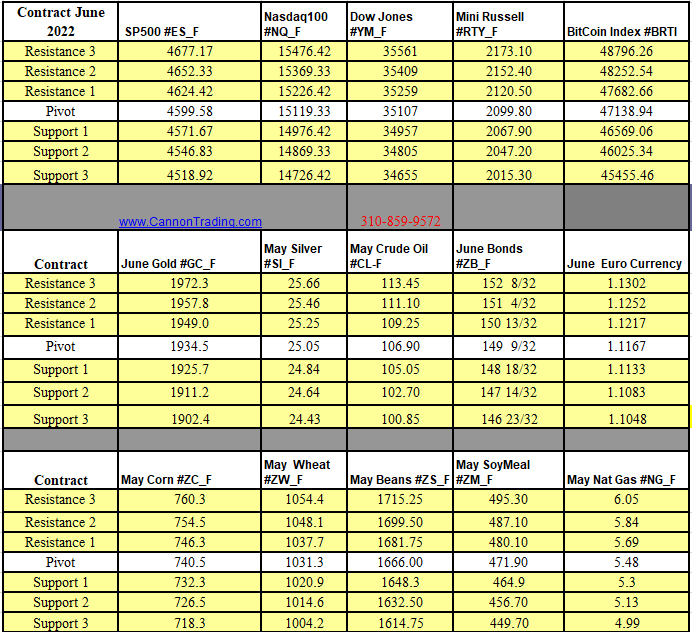

Futures Trading Levels

03-31-2022

Improve Your Trading Skills

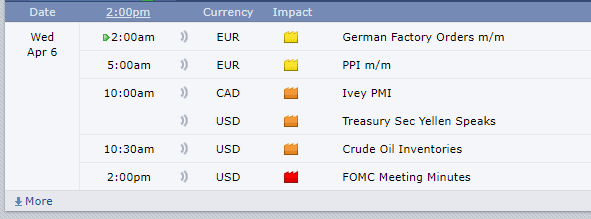

Economic Reports, Source:

http://BetterTrader.Co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.