Dear Futures Trader,

Get Real Time updates and more on our private FB group!

Get FRESH insight every morning BEFORE the market starts like the one below posted 3 hours before market opened this morning, on our private FB group: https://business.facebook.com/groups/1105191589938254/

XX = STOP

SCO = STOP CLOSE ONLY

MA= MOVING AVERAGE

FIBO’S = Fibonacci Retracements

11.17.21

RECAP FROM Wednesday:

THE INFLATIONARY TRADE HAS BEGUN

IN THE SOFTS:

COFFEE IS LEADING THE WAY!

H COFFEE CLOSED 234.75 +10.25!!

H SUGAR CLOSED 20.42 +0.43

H COCOA CLOSED 2568 +0.15

H COTTON CLOSED 116.92 +1.79

Z S&P

4752.00 IS THE NEXT TEST AREA.

Z S&P

4590 MUST HOLD!

CLOSE BELOW TRIGGERS 4515.00

LONG TERM

Z DOW OBJECTIVE 40,000

***

Z CRUDE COLLAPSED BELOW

KEY TRANSITIONING MA 80.07!!!

CLOSED 78.36 -2.40

BEARISH FOR S&P’S

76.26 OBJECTIVE UNTIL A CLOSE ABOVE

79.31 OCCURS.

$99.95 LONG TERM

***

Z BONDS

CLOSED 160.14 +0.14

BULLISH FOR NASDAQ

Z COPPER CLOSED

4.2660 -0.0855

BEARISH FOR S&P’S

Z YEN

CLOSED 87.64 +0.435

BEARISH FOR S&P’S

GOOD MORNING.

11.18.21 Thursday

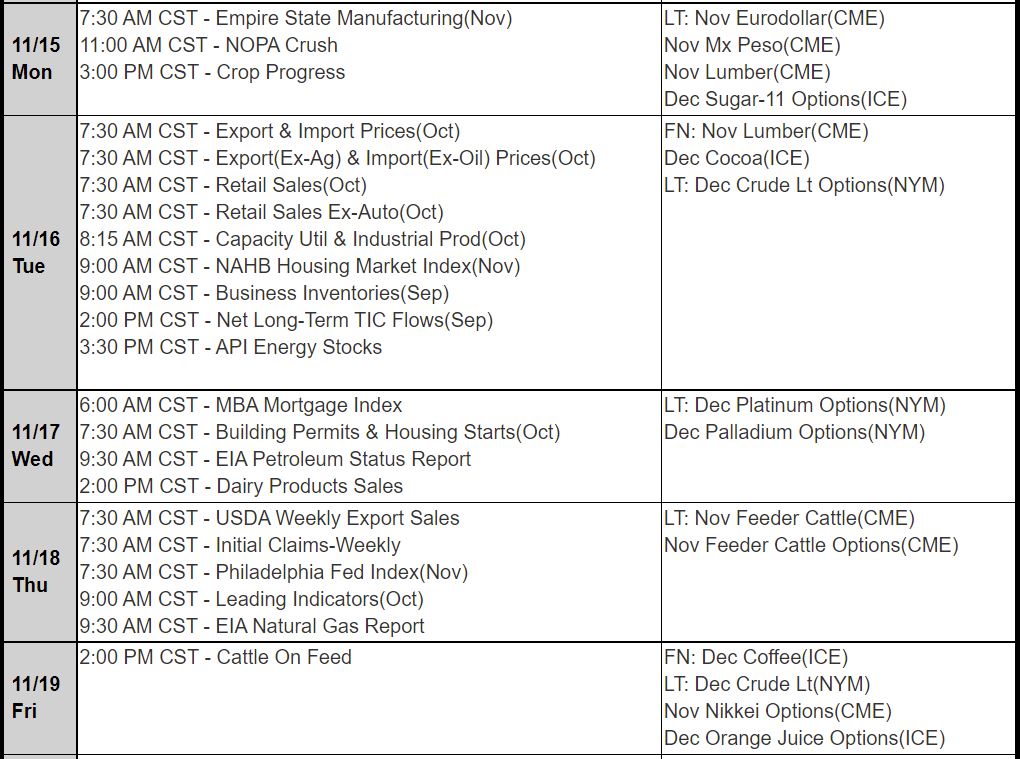

Export Sales 7:30

Jobless Claims 7:30

EIA Gas Storage 9:30

Z US$

ALGO IS LONG

Z US$ CLOSED 95.829 -0 082

ALGO SUPPORT:

95.42

95.28 Sell SCO

95.13

Z S&P:

X 5th HIGH 4,711.75

V 01st LOW 4260.00

FIBO’S:

38.2% = 4538.75

50.0% = 4485.50

61.8% = 4432.50

4630.75

KEY MA

MUST HOLD!

4517.00

KEY TRANSITIONING MA

MASSIVE SUPPORT

4479.75

MASSIVE MA

KEY SUPPORT

4451.25

CRITICAL MA

4263.75

LAST MA SUPPORT

ALGO IS LONG

Z S&P Closed 4686.25 -9.75

ALGO SUPPORT:

4674.00

4666.50 Sell SCO

4658.25

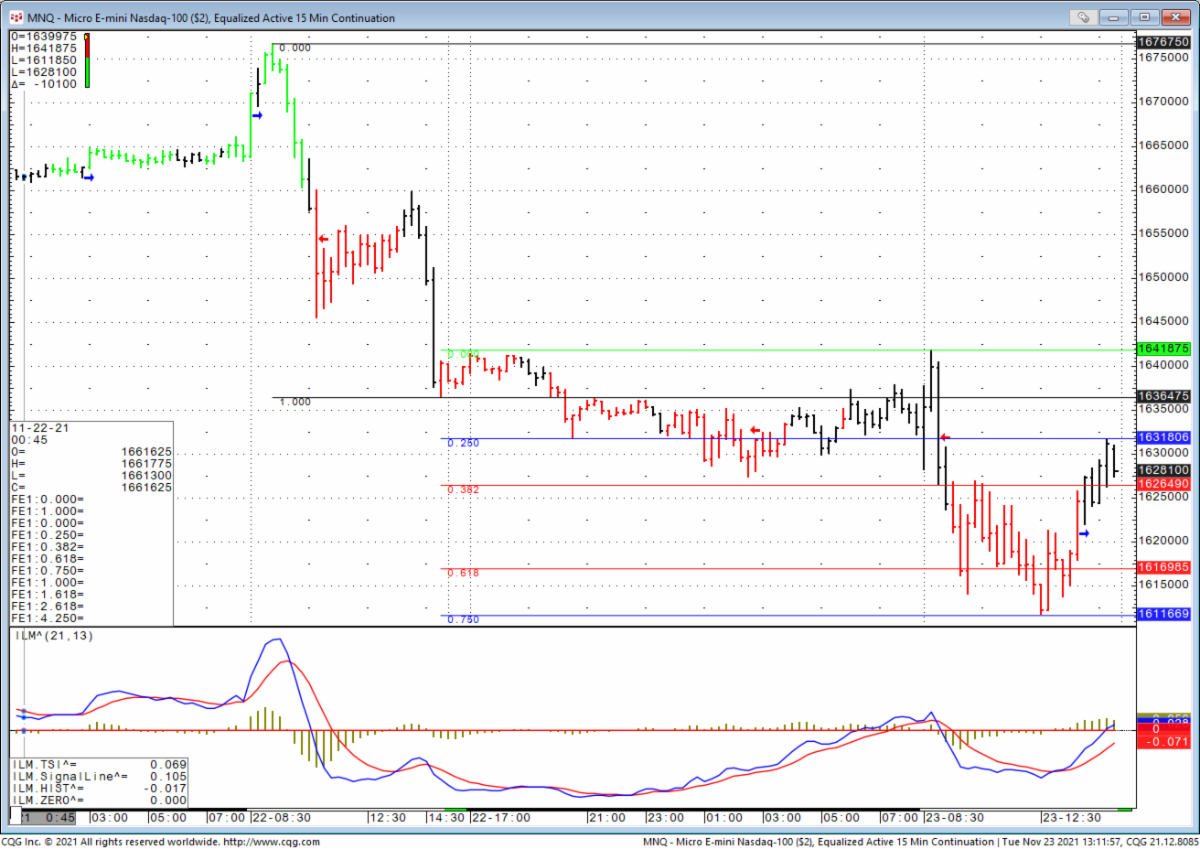

Z NASDAQ:

X 5th HIGH 16,448.50

V 04th LOW 14,367.75

FIBO’S:

38.2% = 15,651.75

50.0% = 15,406.75

61.8% = 15,161.75

15,973.50

KEY MA

MUST HOLD!

15,471.50

KEY TRANSITIONING MA

15,359.50

MASSIVE MA

15,247.00

CRITICAL MA

14,392.50

LAST MA

ALGO IS LONG

Z NASDAQ

Closed 16,311.50 +10.75

ALGO SUPPORT:

16,228.75

16,187.50

16,142.00

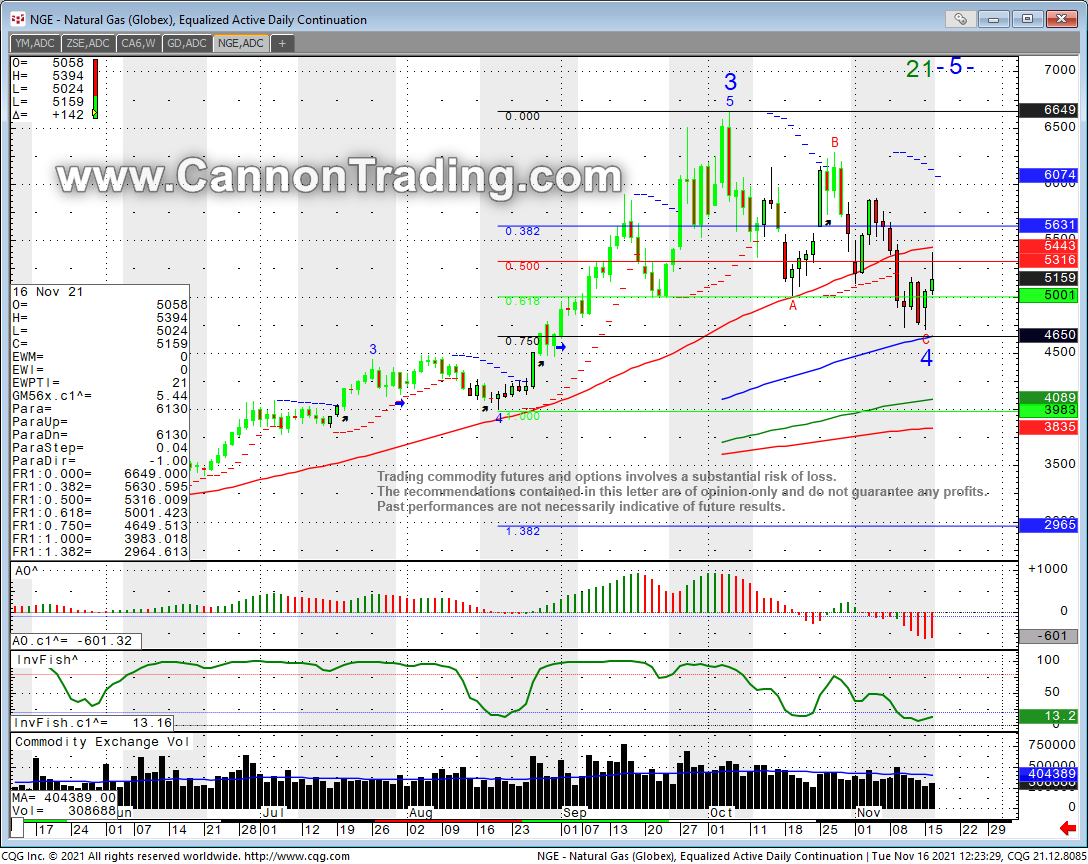

Z CRUDE:

76.26 OBJECTIVE UNTIL 79.31 CLOSE.

ALGO IS SHORT

ALGO RESISTANCE:

79.62

79.09 Buy SCO

78.60

Closed $78.36 -2.40

81.84

KEY MA

KEY RESISTANCE

80.15

KEY TRANSITIONING MA

COLLAPSED ***

KEY RESISTANCE

74.17

MASSIVE MA

73.21

CRITICAL MA

67.30

LAST MA SUPPORT

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

If you are looking for other reference material please

contact your Cannon Broker for lists of solid, informative and helpful trading tomes

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

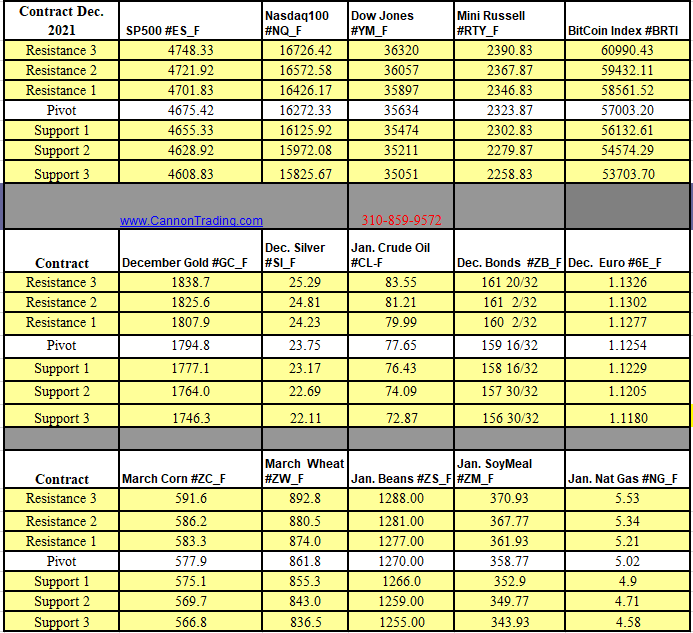

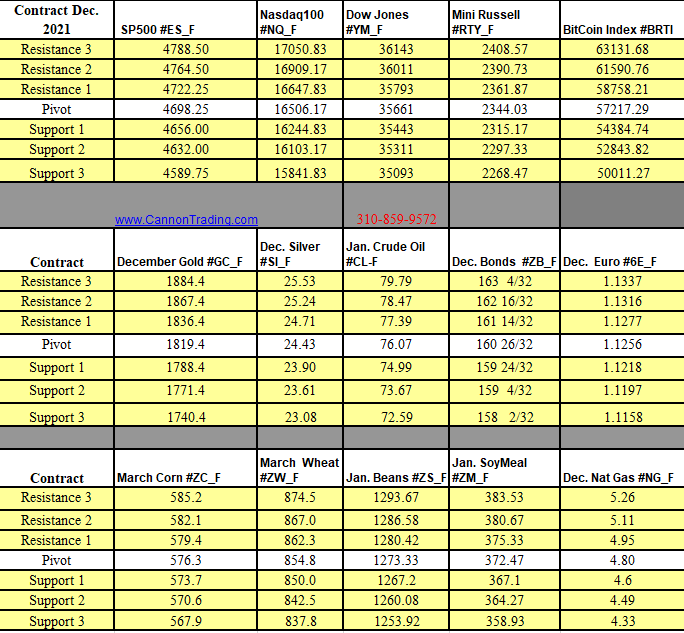

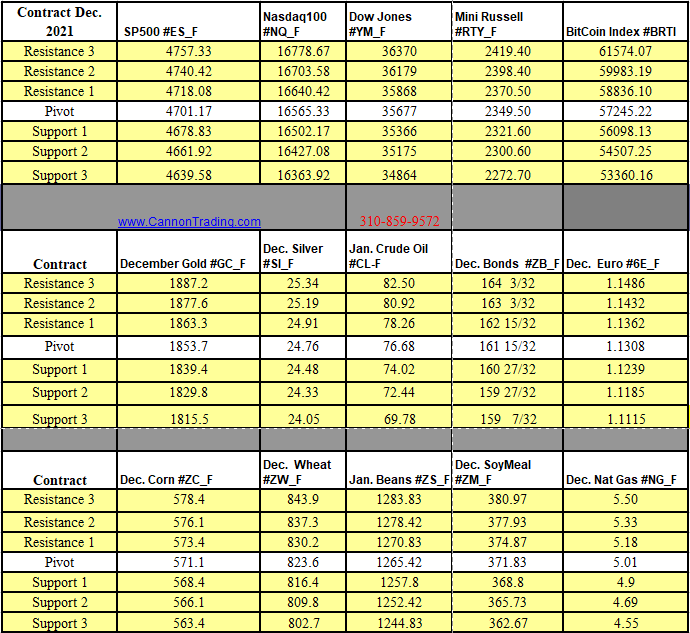

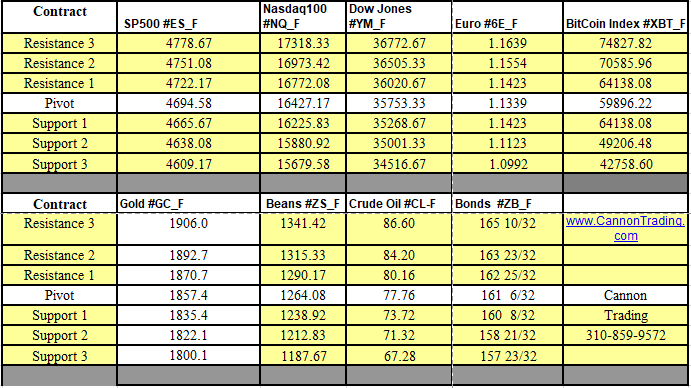

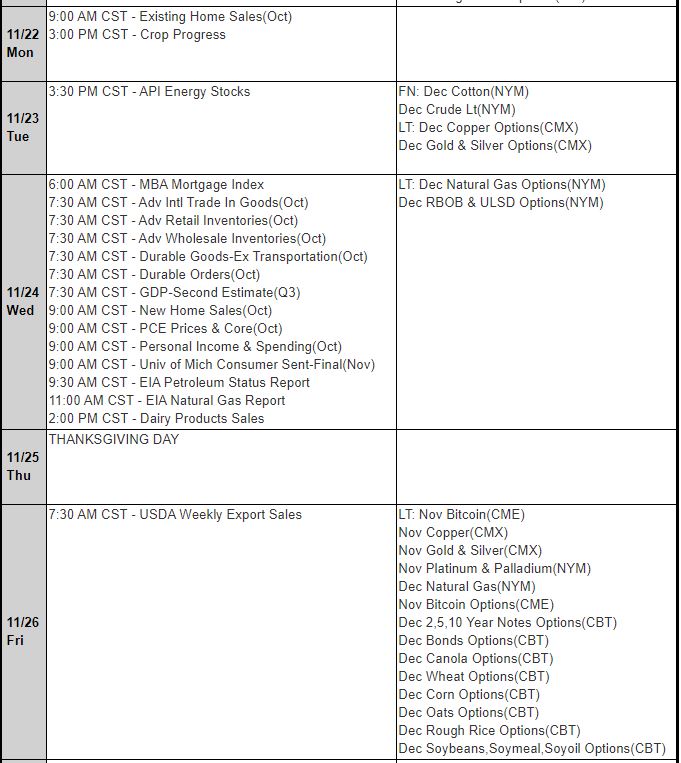

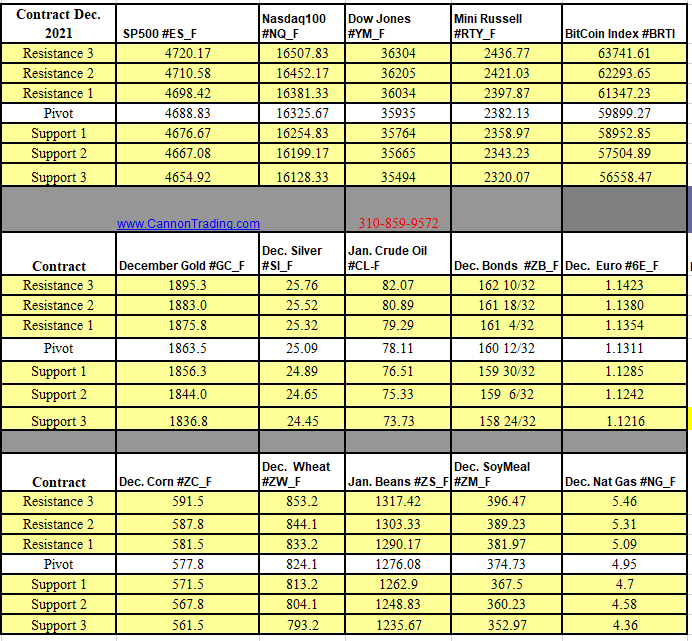

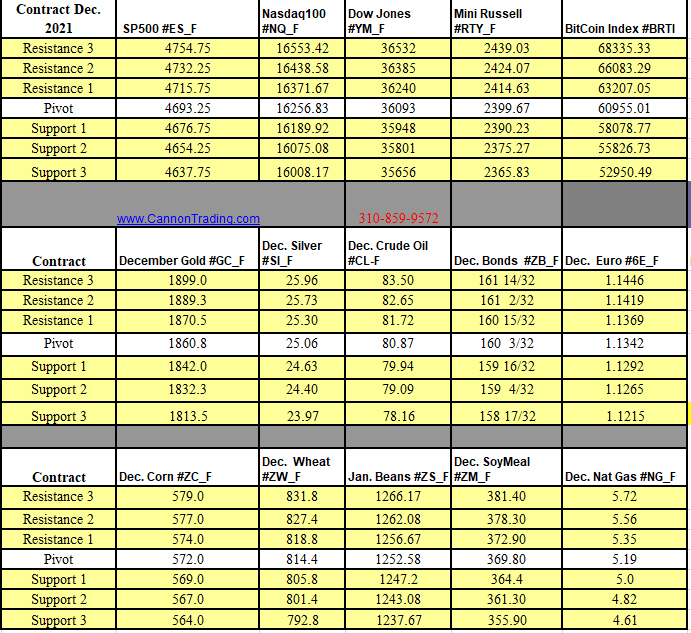

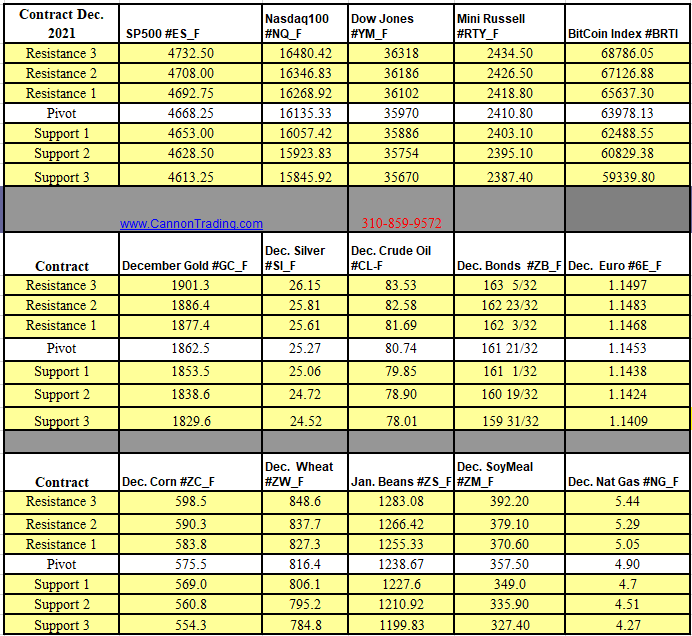

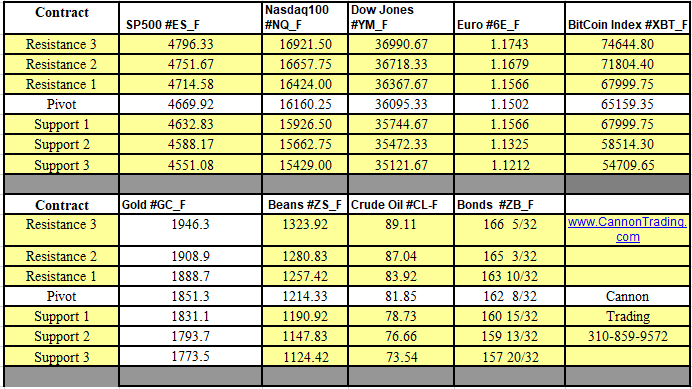

Futures Trading Levels

11-19-2021

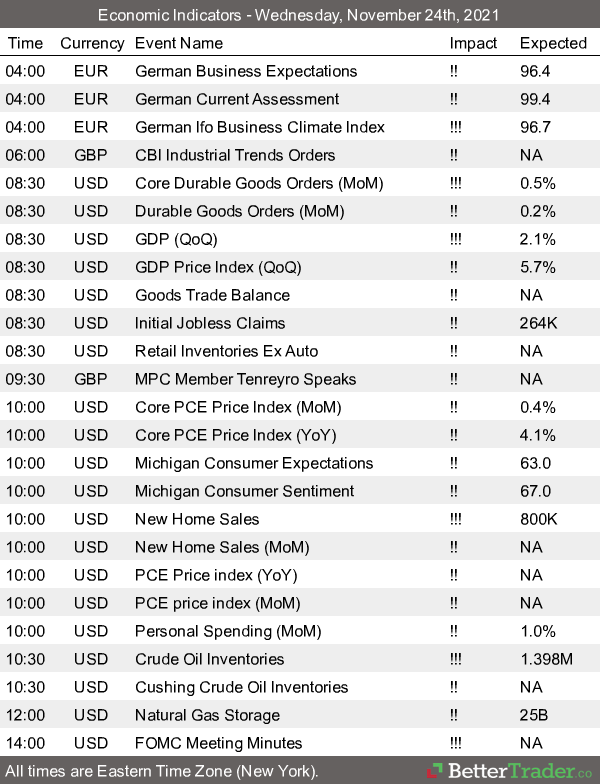

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.