|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (309)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,162)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures trade copier (1)

- Futures Trading (1,268)

- futures trading education (446)

- Gold Futures (113)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (144)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (432)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (224)

Author: Cannon Operations

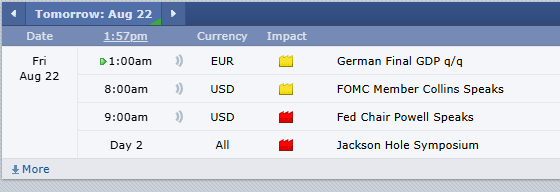

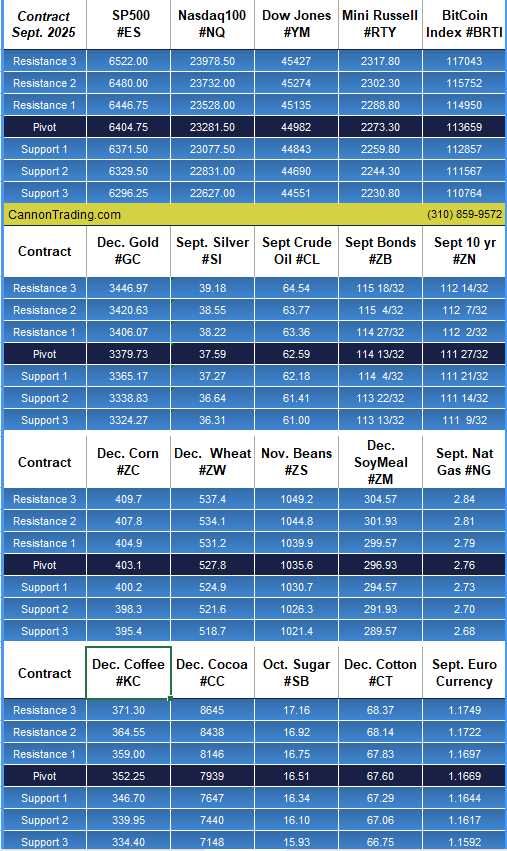

Trading Alerts – Free Trial! Plus Levels, Reports; Your 3 Crucial, Important Need-To-Knows for Trading Futures on August 22nd, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Jobless Claims, PMI, Cattle, Crude Oil, Levels, Reports; Your 6 Expert, Crucial Need-To-Knows For Trading Futures on August 21st, 2025

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

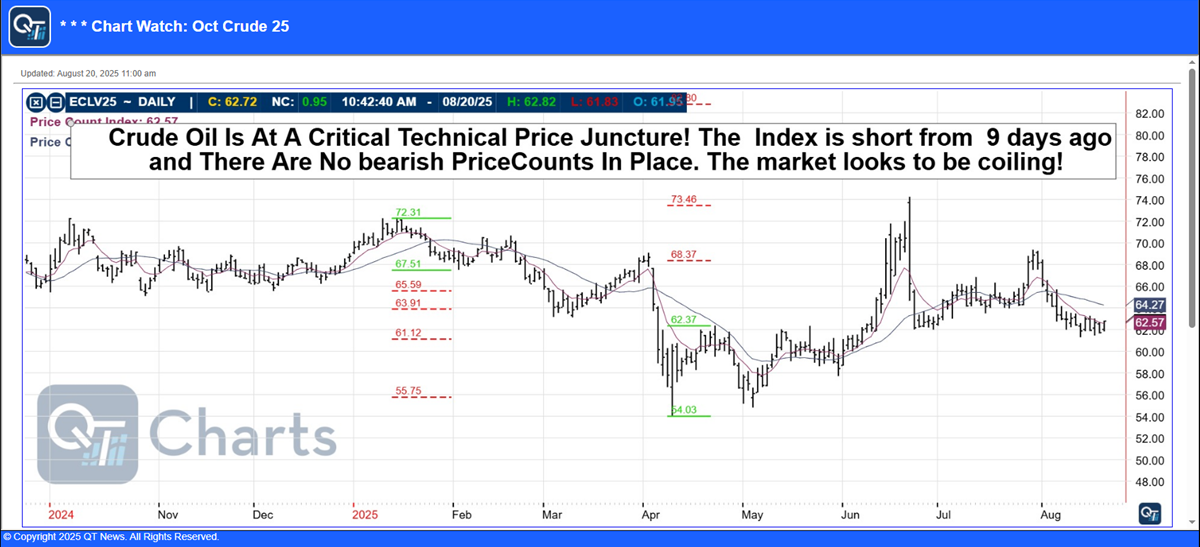

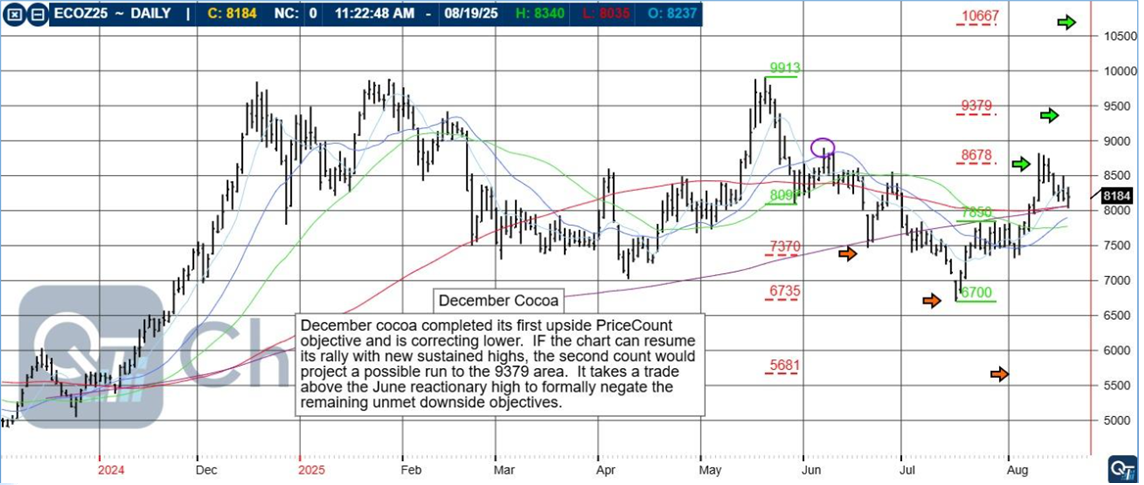

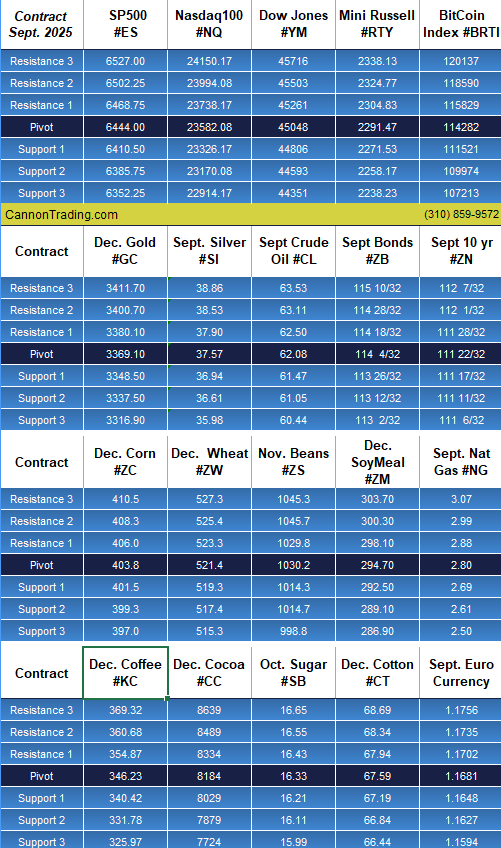

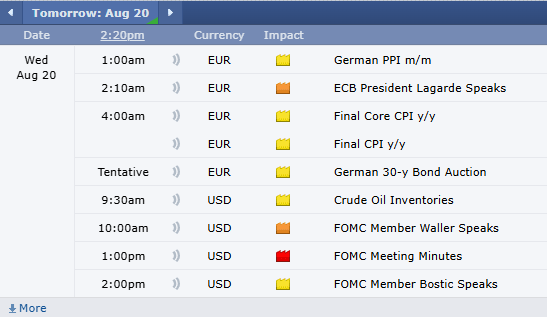

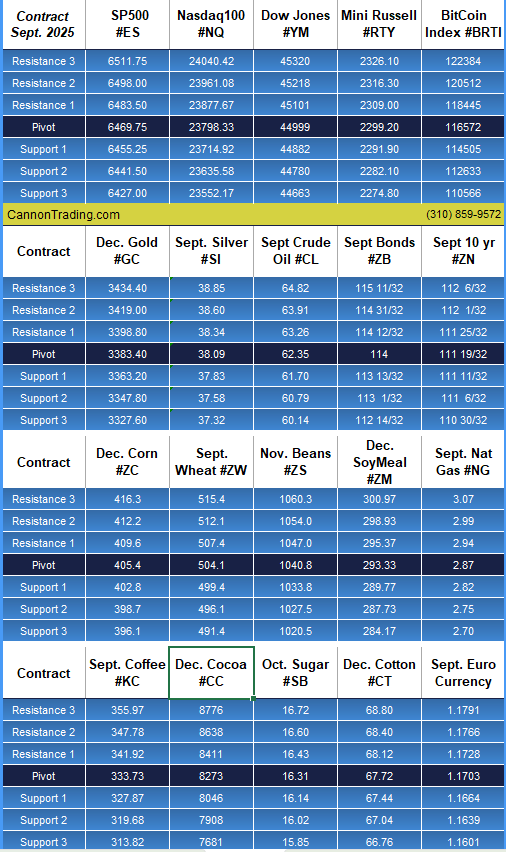

FOMC, Gold, Cocoa, Levels, Reports; Your 5 Important Need-To-Knows for Trading Futures on August 20th, 2025

|

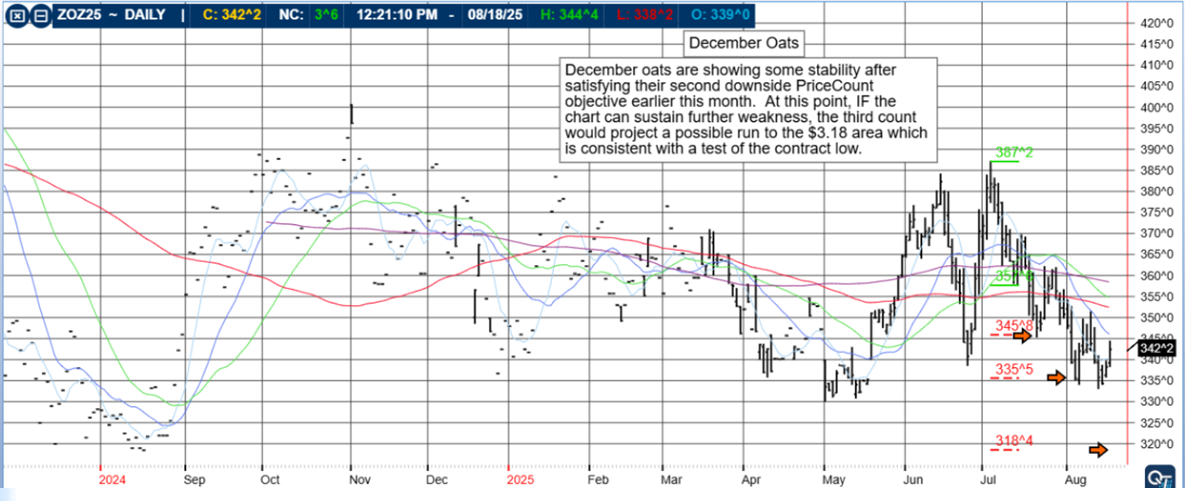

Volatility, December Oats, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on August 19th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Micro Bitcoin, September Dollar Index, Gold Swings, Levels, Reports; Your 5 Crucial Need-To-Knows for Trading Futures the Week of August 4th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

BookMap

BookMap

In the fast-evolving world of futures trading, having an edge can make the difference between profit and loss. Traders are constantly seeking tools that offer enhanced visibility, faster decision-making, and deeper insights into market behavior. Enter BookMap, one of the most innovative and powerful platforms for futures trading. Known for its real-time, visually rich market data analysis, BookMap trading enables traders to see the market with unmatched depth.

But even the best technology must be paired with exceptional support and brokerage infrastructure to truly thrive. That’s where Cannon Trading Company, one of the best futures brokers, steps in. With decades of experience, 5-star TrustPilot reviews, regulatory excellence, and a wide selection of elite trading platforms, Cannon Trading empowers traders to leverage BookMap to its fullest potential.

This article dives deep into how BookMap enhances trading through its signal generation and analytics features and how Cannon Trading Company helps traders harness this potential.

Try a FREE Demo!

Chapter 1: What is BookMap?

BookMap is a next-generation futures trading platform that delivers superior visualization of market liquidity and order flow. It goes beyond traditional charts and indicators by offering a heatmap-style display of limit order book activity. This allows traders to see liquidity, track real-time volume, and observe the dynamics of supply and demand with unparalleled clarity.

Unlike traditional candlestick charts or DOMs (Depth of Market), BookMap reveals hidden liquidity and iceberg orders and showcases the evolution of the order book in a scrollable, interactive visual format. This gives traders the unique ability to anticipate market movement and execute trades with higher precision.

Key features of BookMap include:

- Real-time order book visualization

- Market depth heatmaps

- Volume dots and bubbles

- Customizable indicators

- Add-on modules for advanced signal generation

Whether you’re scalping, day trading, or conducting quantitative analysis, BookMap futures trading tools provide a level of detail that is rarely found elsewhere.

Chapter 2: Advanced Signal Generation with BookMap

One of the most remarkable capabilities of BookMap lies in its signal generation features, which transform visual data into actionable insights. These tools allow traders to cut through market noise and focus on high-probability trading opportunities.

2.1 Heatmap Analysis

The heatmap display uses shades of color to reflect the concentration of buy and sell orders at different price levels. The brighter the color, the higher the concentration. Traders can see where liquidity is stacking up, which helps in identifying key support and resistance levels.

These visual signals are invaluable for spotting fake-outs, market manipulation, or legitimate breakouts—crucial data for any serious futures broker or retail trader.

2.2 Volume Dots and Bubbles

Every trade executed is displayed in the form of a dot on the chart. The size and intensity of the dot indicate the size of the trade. Larger dots mean higher volume, giving a clear picture of where institutional interest is entering or exiting the market.

2.3 Imbalance Indicators

These indicators show where aggressive buying or selling is taking place in real time. By analyzing the bid-ask spread and executed volumes, traders can gauge momentum and react swiftly.

2.4 Iceberg Detection

Iceberg orders—large orders broken into smaller pieces—are hard to detect with conventional platforms. BookMap trading software can expose these hidden orders using proprietary algorithms, giving traders a window into institutional activity.

2.5 Customizable Add-ons

Advanced users can integrate add-ons such as:

- Strength Level Indicator

- Stop & Absorption Tracker

- Market Pulse

- Advanced Volume Delta

Each tool enhances the BookMap futures trading experience, making it more robust and tailored to specific trading styles and strategies.

Chapter 3: BookMap Analytics Tools

In addition to real-time signals, BookMap offers deep analytics that help traders improve performance and fine-tune strategies.

3.1 Market Replay and Recording

Traders can replay past sessions tick-by-tick to study market behavior, improve execution, or test theories. This is invaluable for education and performance optimization.

3.2 Volume Profile and Cumulative Delta

By analyzing volume distribution and the cumulative delta of buy/sell volume, traders gain insight into the market’s directional bias.

3.3 Liquidity Tracker

BookMap’s liquidity tracker identifies patterns in liquidity movement, including spoofing or pulling orders. This allows traders to avoid traps and engage the market with more confidence.

3.4 Price Action Replay

For those who want to understand the nuances of trading futures, being able to rewind and observe how price moved in correlation with liquidity changes is priceless.

Chapter 4: How Cannon Trading Company Elevates the BookMap Experience

Choosing a powerful platform is only half the battle; the other half is selecting the right futures broker. That’s where Cannon Trading Company shines as one of the best futures brokers in the business.

4.1 Decades of Experience

Cannon Trading has over 35 years of experience in the futures trading industry. This longevity signals trust, deep market knowledge, and a commitment to supporting traders through all market conditions.

4.2 5-Star TrustPilot Ratings

With an abundance of 5 out of 5-star TrustPilot reviews, clients frequently praise Cannon Trading for its customer service, transparency, and responsiveness—traits every trader needs in a futures broker.

4.3 Regulatory Excellence

Cannon Trading enjoys a stellar reputation with both federal and independent futures industry regulators. This includes adherence to all CFTC, NFA, and other compliance standards, giving traders peace of mind when engaging in futures trading.

4.4 Competitive BookMap Integration

Cannon Trading not only supports BookMap trading but also offers competitive data packages and customized solutions that match a trader’s volume and style. Their team is well-versed in BookMap’s technology and can assist with setup, data feeds, and strategy alignment.

4.5 Wide Platform Selection

In addition to BookMap, Cannon Trading offers a range of high-performance platforms including:

This makes Cannon a go-to futures broker for traders seeking versatility and platform compatibility.

4.6 Personalized Service

Unlike many futures brokers USA who operate on a “set it and forget it” model, Cannon Trading offers a personal touch. Their licensed professionals assist traders one-on-one—whether they are just starting or managing large portfolios.

Chapter 5: Why Traders Choose BookMap and Cannon Together

The synergy between BookMap futures trading tools and the robust brokerage support from Cannon Trading creates a powerful ecosystem for successful trading futures.

- Real-time analytics + expert support = faster learning curves.

- Advanced signals + regulatory trust = higher confidence in execution.

- Customization + platform variety = better alignment with trading goals.

Whether you are a scalper looking to capitalize on micro-movements or a swing trader aiming to analyze broader liquidity patterns, BookMap trading with Cannon provides the edge.

And in a world flooded with futures brokers, only a handful can genuinely claim to be both technologically progressive and deeply client-focused. Cannon Trading is among the few best futures brokers that consistently meets both criteria.

Future-Proof Your Trading with BookMap and Cannon

In 2025 and beyond, success in trading futures demands more than just intuition or basic charts. It requires a technology stack that exposes the undercurrents of market behavior—and a brokerage that understands and supports those needs.

BookMap delivers the visual horsepower and analytical depth. Cannon Trading Company provides the integrity, support, and platform choice necessary to maximize its utility.

If you’re ready to level up your futures trading experience, combining BookMap with the expert guidance of Cannon Trading Company is a winning formula. From signal generation to analytics, and from platform integration to regulatory assurance, this partnership is built for performance.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Futures Options Broker

Futures Options Broker

The Growing Relevance of Futures Options Brokers in Modern Trading

In today’s rapidly evolving financial landscape, the role of a futures options broker has become more critical than ever. With the explosion of algorithmic and AI-powered futures options trading platforms, more traders—from retail to institutional—are seeking experienced and technologically advanced brokerages to help navigate the complexities of commodities trading and speculative derivatives. This is where brokerage services like E-Futures.com shine, delivering unparalleled expertise, reliability, and technological edge through their top-tier platform, CannonX powered by CQG.

To understand what makes a futures broker options provider like E-Futures.com exceptional in 2025, we must first explore the historical development of futures options trading, including the pivotal moments and individuals that shaped the speculative markets we know today.

Historical Origins of Options in Speculation and Commodity Markets

Ancient Roots of Options Trading

Though futures options trading may seem like a product of modern finance, its roots stretch back thousands of years. One of the earliest known uses of options-like contracts occurred in ancient Greece. The philosopher Thales of Miletus reportedly used early options contracts to secure the rights to olive presses in advance of harvest, anticipating high demand. This speculative use of future rights demonstrated the powerful concept of leveraging predictions about future value.

The concept resurfaced in early Japanese rice markets in the 1600s. The Dojima Rice Exchange in Osaka became the world’s first formal commodity trading exchange, where merchants employed forward contracts and proto-options to hedge against price fluctuations. These mechanisms were vital in establishing confidence and liquidity in agricultural markets—principles that remain foundational to futures options trading today.

The Birth of Modern Futures and Options Markets

The modern era of commodities trading began with the founding of the Chicago Board of Trade (CBOT) in 1848. Initially focusing on agricultural futures contracts, the CBOT provided a formalized structure to a previously informal network of spot trading and forward agreements. Traders could now lock in prices for commodities like corn and wheat, reducing exposure to volatility.

By the 1970s, the CBOT and the Chicago Mercantile Exchange (CME) began introducing standardized futures options trading contracts. These contracts allowed speculators to trade options on futures contracts themselves—a significant leap in market complexity and flexibility.

The 1973 introduction of options on futures was revolutionary, enabling traders to control leveraged positions in commodities with reduced upfront capital and predefined risk. This development transformed how both hedgers and speculators approached the market.

Key Innovators Behind Futures Options Trading

Fischer Black and Myron Scholes

The creation of the Black-Scholes model in 1973 by Fischer Black and Myron Scholes—later extended by Robert Merton—provided the mathematical foundation for pricing options. Their work enabled market participants to determine fair values for options based on volatility, time to expiration, and interest rates.

This pricing model, while initially developed for stock options, was quickly adapted for futures options trading, fueling the growth of options markets globally. Their work earned Scholes and Merton a Nobel Prize in Economics (Fischer Black died before he could be awarded).

Leo Melamed and the CME

Leo Melamed, a former chairman of the Chicago Mercantile Exchange, was instrumental in transforming Chicago into the global hub of commodity trading innovation. Under his leadership, the CME launched the International Monetary Market and introduced financial futures, including options on currency and interest rate futures.

Melamed was a strong advocate for electronic trading and helped lay the groundwork for today’s high-speed futures options trading platforms. His vision of global access, market transparency, and trader education still informs how brokerages like E-Futures.com operate.

The Role of Regulation

The Commodity Futures Trading Commission (CFTC) was created in 1974 to regulate the U.S. derivatives markets, followed by the National Futures Association (NFA) in 1982. These organizations provided crucial oversight and investor protection, helping to legitimize futures broker options services and foster trust in the emerging industry.

Today’s Futures brokers USA, including E-Futures.com, operate under these regulatory bodies, ensuring that traders are protected and markets remain transparent.

Why E-Futures.com Is a Top Choice Futures Options Broker in 2025

- A Legacy of Trust and Performance

With 38 years of experience in the industry, E-Futures.com has developed a reputation for excellence among independent traders, institutional clients, and regulators alike. With multiple 5 out of 5-star ratings on TrustPilot, the brokerage’s reliability, customer service, and trading infrastructure have earned the trust of thousands of users globally.

Unlike newer entrants to the space, E-Futures.com offers a rare combination of institutional-grade infrastructure and boutique-level support.

One of the cornerstones of E-Futures.com’s success is its CannonX powered by CQG platform. Known for its speed, reliability, and precision, CannonX combines CQG’s institutional-grade backend with Cannon Trading Company’s intuitive user experience. It enables traders to execute strategies in real-time across global markets with deep liquidity and cutting-edge analytics.

For serious traders seeking a powerful, responsive interface with real-time charting and order routing capabilities, CannonX is among the top futures options trading platforms available in the market today.

Key benefits of CannonX powered by CQG:

- Lightning-fast execution

- Comprehensive options analytics

- Advanced charting tools for commodity trading

- Seamless mobile and desktop integration

- Unmatched Customer Support and Regulatory Integrity

E-Futures.com is distinguished among Futures brokers USA for its emphasis on client relationships. All clients receive one-on-one onboarding, platform training, and 24/7 support from experienced brokers—many with decades of market experience.

Regulatory compliance is a cornerstone of their operation. As an NFA-member and CFTC-regulated broker, E-Futures.com operates with full transparency and client protection protocols.

Whether you’re a retail trader new to futures options trading or a high-volume professional looking to optimize your execution strategy, E-Futures.com offers a secure and supportive environment to trade with confidence.

- Comprehensive Range of Tradable Instruments

Traders at E-Futures.com gain access to a diverse array of tradable products:

- Agricultural, energy, metals, and soft commodity trading

- Interest rate, equity index, and currency futures

- Options on futures, including calendar spreads and complex strategies

The firm’s deep understanding of both underlying commodities trading and options mechanics makes it a top-tier partner for executing sophisticated trades.

- Education and Risk Management Tools

Unlike many platforms that leave traders to learn by trial and error, E-Futures.com invests heavily in trader education. Resources include:

- Live webinars and archived tutorials

- Strategy-specific guides for futures options trading

- Platform walkthroughs for CannonX and CQG

- Customized risk management templates

This dedication to education helps traders avoid common pitfalls and build sustainable, long-term trading strategies.

The 2025 Landscape: Why a Trusted Futures Options Broker Matters Now More Than Ever

Increased Volatility and Market Interconnection

The second half of 2025 is shaping up to be a period of increased volatility and global market uncertainty. With ongoing geopolitical tensions, shifting interest rate policies, and fluctuating commodity prices, traders need precision tools and reliable execution more than ever.

A brokerage that combines the experience, reputation, and platform sophistication of E-Futures.com ensures traders can stay agile, informed, and efficient.

Rise of Algorithmic and AI-Powered Trading

As more traders deploy automated strategies and AI-powered systems, the reliability and latency of a trading platform becomes paramount. Platforms like CannonX powered by CQG are specifically built for this next generation of trading strategies, offering API access, backtesting capabilities, and integrated market data.

Partnering with a futures broker options firm that understands this tech evolution is critical in maintaining a competitive edge.

Compliance and Safety

In an era of data breaches and financial fraud, regulatory compliance isn’t optional—it’s essential. Futures brokers USA like E-Futures.com that comply strictly with CFTC and NFA guidelines offer traders peace of mind that their capital and data are secure.

As the regulatory environment continues to evolve, brokers with a track record of ethical behavior and transparency will thrive. E-Futures.com is not just a technology provider, but a fiduciary partner.

Conclusion: Futures Broker Options and the Path Forward

The development of futures options trading is a story of innovation, risk management, and speculative opportunity. From ancient Greek philosophers to modern-day electronic platforms like CannonX powered by CQG, options and futures have evolved to meet the changing needs of traders and hedgers across centuries.

In this complex and ever-changing ecosystem, choosing the right brokerage partner is one of the most important decisions a trader can make. With its decades of experience, sterling reputation, regulatory compliance, and cutting-edge platform, E-Futures.com remains one of the premier Futures brokers USA for traders in 2025.

Whether you’re seeking to trade agricultural contracts, hedge geopolitical risk, or leverage volatility in metals and energy, E-Futures.com provides the technological muscle and human insight necessary to succeed.

For any serious trader or investor looking to excel in futures options trading, there’s no better partner than a brokerage that merges institutional performance with personalized service.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with E-Futures.com today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

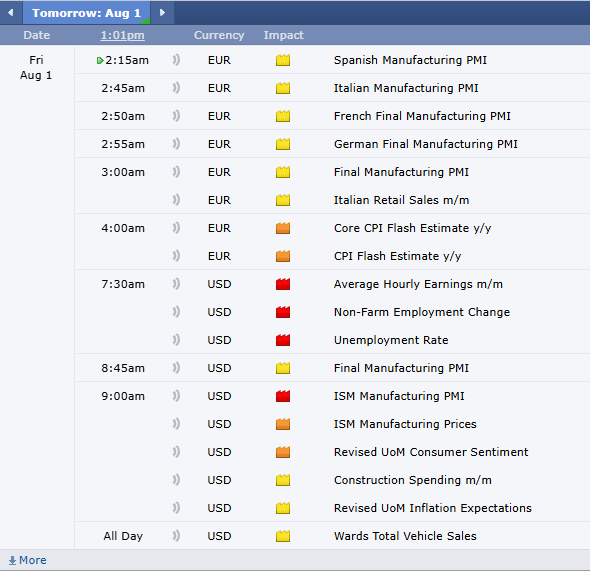

NFP Tomorrow, September Dollar Index, Levels, Reports; Your 4 Crucial Need-To-Knows for Trading Futures on August 1st, 2025

NFP Tomorrow

By Ilan Levy-Mayer, VP

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Corn, Soybean, Copper, Crude Oil; Your 4 Important Need-To-Knows for Trading Futures on July 31st, 2025

Corn

Bullet Points, Highlights, Announcements

By Mark O’ Brien, Senior Broker

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010