Cannon Futures Weekly Letter

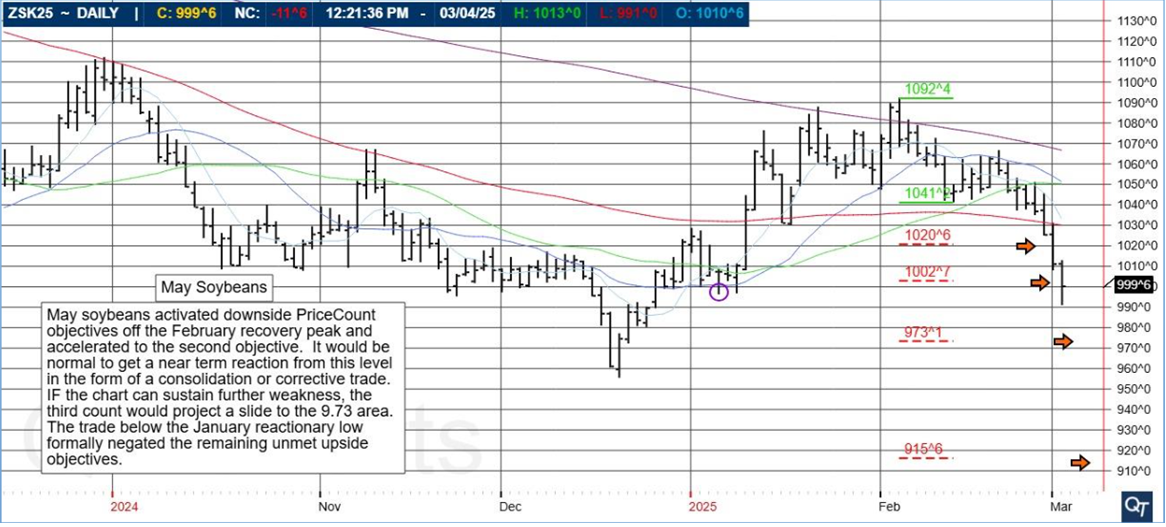

March Soybean

In Today’s Issue #1233

- Time Change

- The Week Ahead – CPI, PPI, Fed Blackout

- Futures 102 – Intro to Treasury Futures

- Hot Market of the Week – May July Beans Spread

- Broker’s Trading System of the Week – ES intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

USA Time Change!!

Final Week of Standard time in the U.S. “Spring Forward!” Begins Sunday, March 9th.

Advance your clocks 1 hour @ 2 A.M. |

|

Important Notices: The Week Ahead

By John Thorpe, Senior Broker

Final Week of Standard time in the U.S. “Spring Forward!” Begins Sunday, March 9th.

Advance your clocks 1 hour @ 2 A.M.

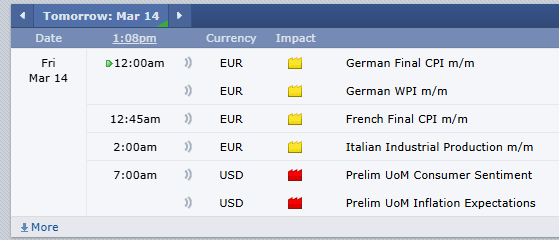

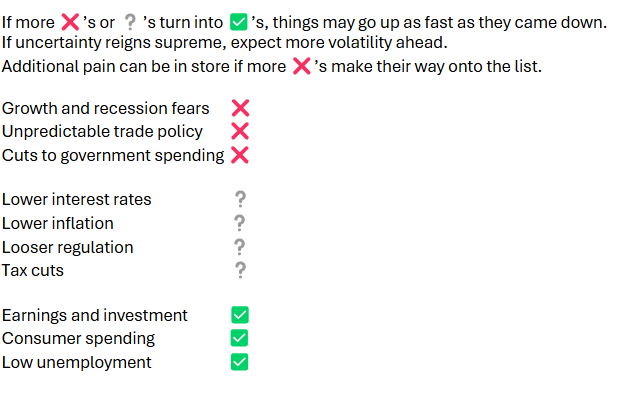

More volatility to come as next week all markets will be reacting to the potential for tariff implementations creating uncertainty in the marketplace. Therefore, increased volatility expectations.

Highlights next week will also include CPI and PPI Wednesday and Thursday respectively prior to cash market open. No fed speakers as we enter the official “BlackOut” period. The next Fed Rate decision is do out the following week.

Earnings reports continue to dwindle with 302 total reports while we are in the top of the 9th inning of earnings season, the reports will be impacting the indices much less than in past weeks.

I am including the European carmakers as a benchmark. My belief is the market will be much more interested in the earnings of these companies in future quarters as bell weathers for potential tariff effects. Finally, for Indices traders, at the end of next week, Friday, this should be the last day you will want to trade the March contract. June will become the front month. M25.

Earnings Next Week:

- Mon. Oracle post close

- Tue. Volkswagen AG

- Wed. Adobe post close, Porsche.

- Thu. Quiet

- Fri. BMW

FED SPEECHES:

- Mon. Fed Blackout period

- Tues. until the day after

- Wed. the next rate announcement

- Thu. On Wednesday March 19th

- Fri. 3/19/25 Chair Powell will Speak, 30 minutes after the rate decision.

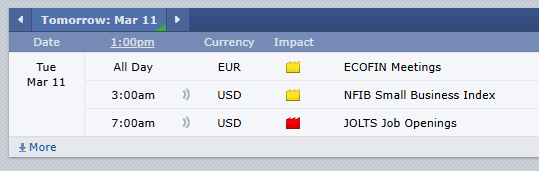

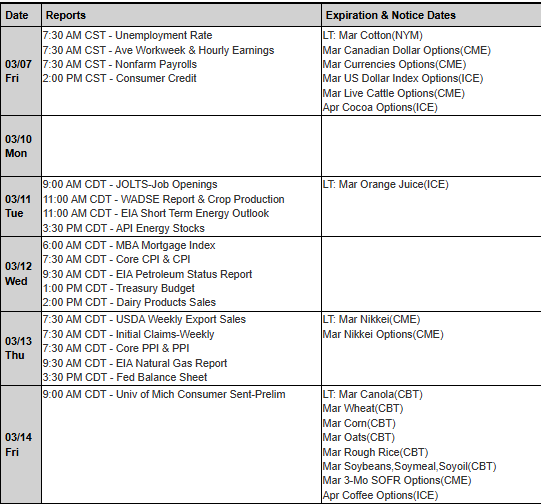

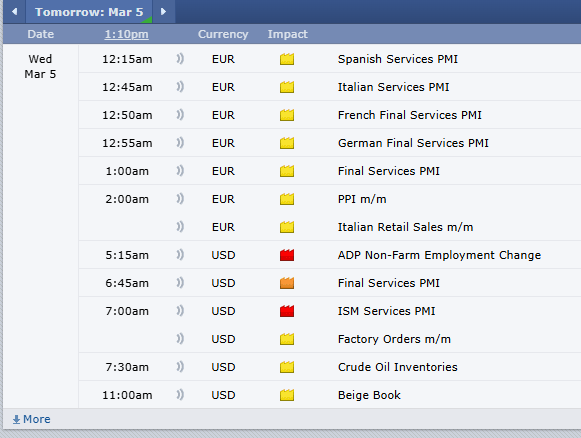

Economic Data week:

- Mon. Quiet

- Tue. Redbook, Jolts, WASDE

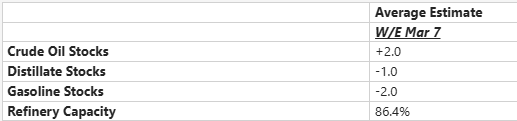

- Wed. CPI, EIA Crude Inventories, Beige Book

- Thur. PPI, Initial Jobless Claims, EIA Nat Gas

- Fri. Michigan Consumer Sentiment

|

|

Futures 102: Introduction to Treasuries

Course Overview

Central banks like the U.S. Federal Reserve help shape short- and long-term economic growth by restricting or expanding the supply of money circulating in an economy. They do this through the use of debt obligations called treasuries — such as bills, notes and bonds – in which the government borrows money from the holder for a specified period of time. Because treasuries are viewed as being among safest of all investments, they can be in high demand.

Treasury futures offer one way to gain exposure without trading the individual securities themselves. Learn the basics behind trading Treasury futures, from the delivery process, contract specifications, key concepts like basis and Cheapest to Deliver (CTD) and more. Discover the different ways these contracts are used, from price discovery to risk management to profit speculation, and how they are intertwined with other financial markets like stocks and currencies.

Start Now

|

|

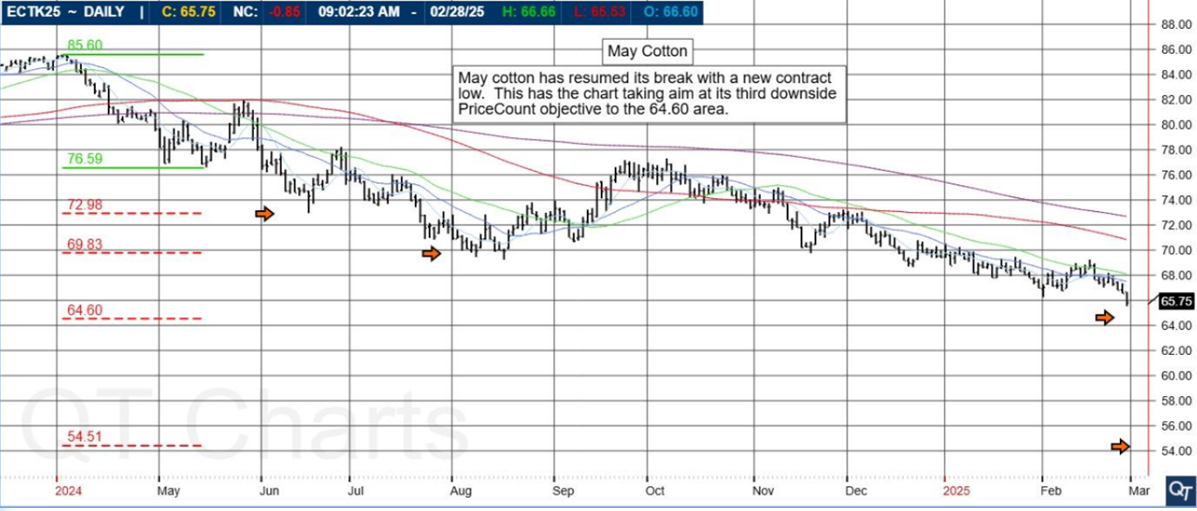

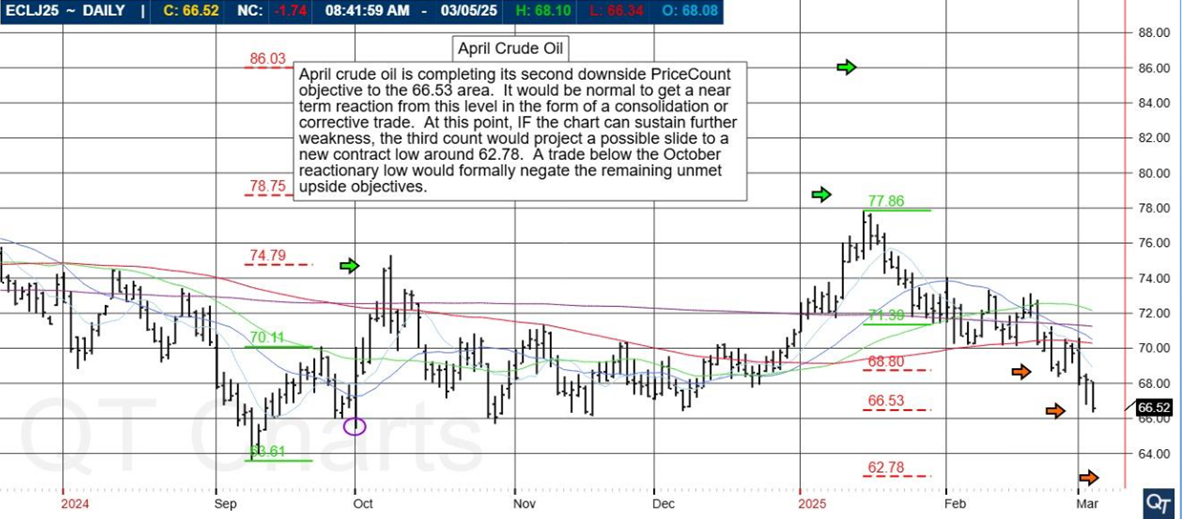

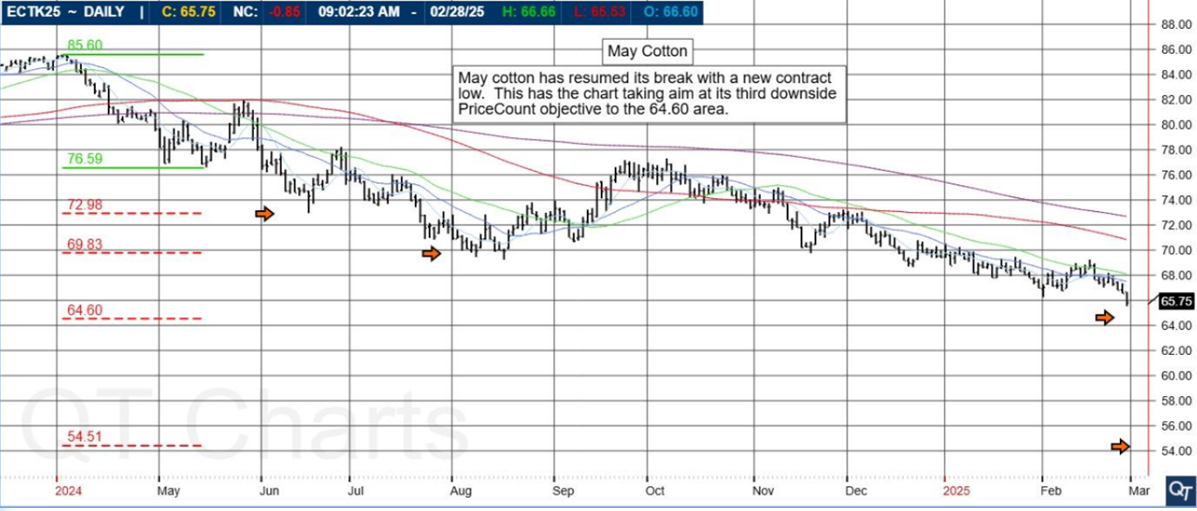

Hot Market of the Week

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

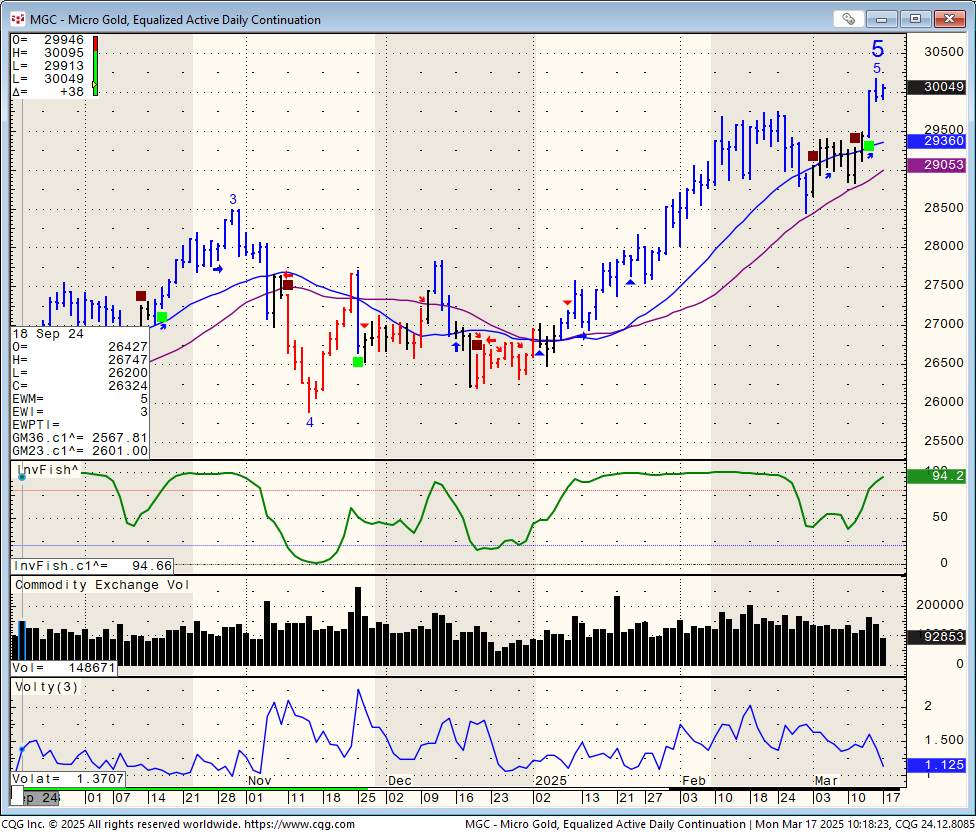

Soybean Spread

May – July

The May – July soybean spread accelerated with a gap higher where it completed its second upside PriceCount objective off the February low. The chart is correcting and closed the gap. IF you can resume the rally with new sustained highs, the third count would project a possible run to the -9 area, which would be consistent with a challenge of the January spike reversal.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

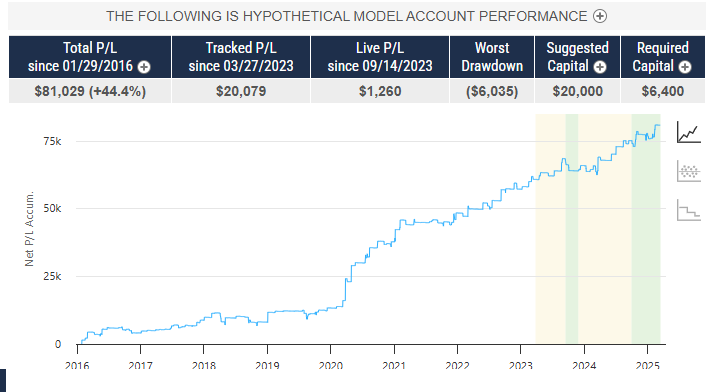

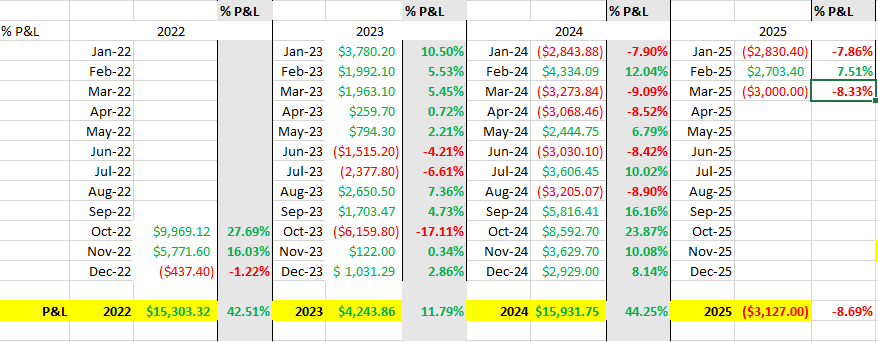

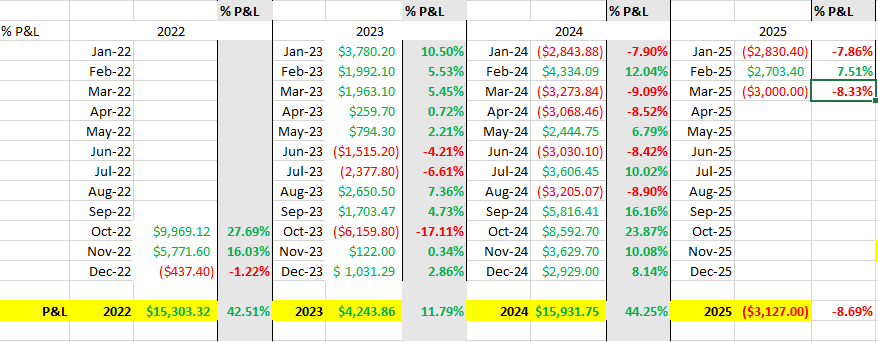

Brokers Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

ES NZL

The NZL automated trading system utilizes two main ALGOS in an attempt to identify either an early trend in the trading day and/or high percentage counter trend set ups.

The system is fully automated and runs between the hours of 4 AM central and 3:15 PM Central.

The model relies on volume charts rather than time charts.

PRODUCT

Mini SP500

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$36,000

COST

USD 199 / monthly

Get Started

Learn More

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data. Please read full disclaimer HERE.

| Would you like to get weekly updates on real-time, results of systems mentioned above? |

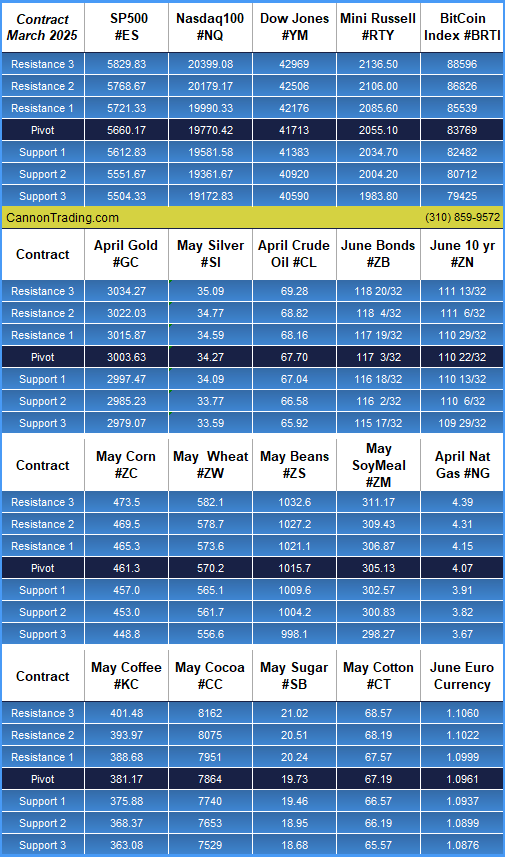

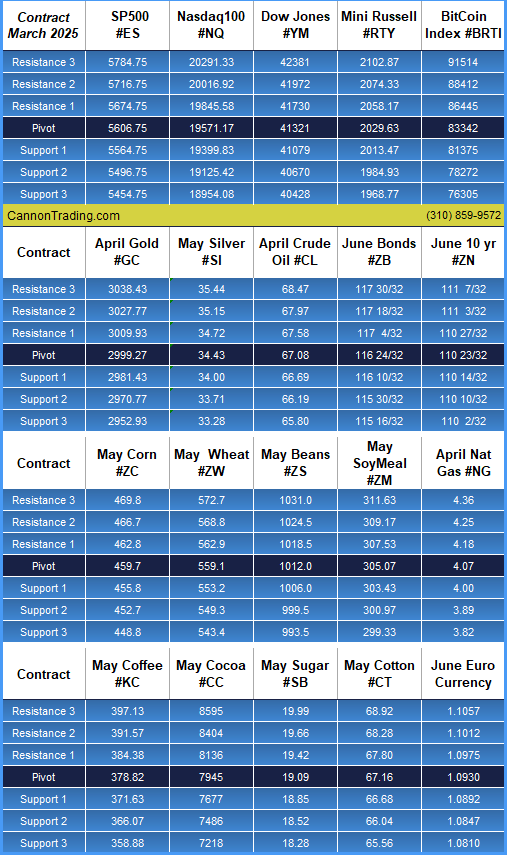

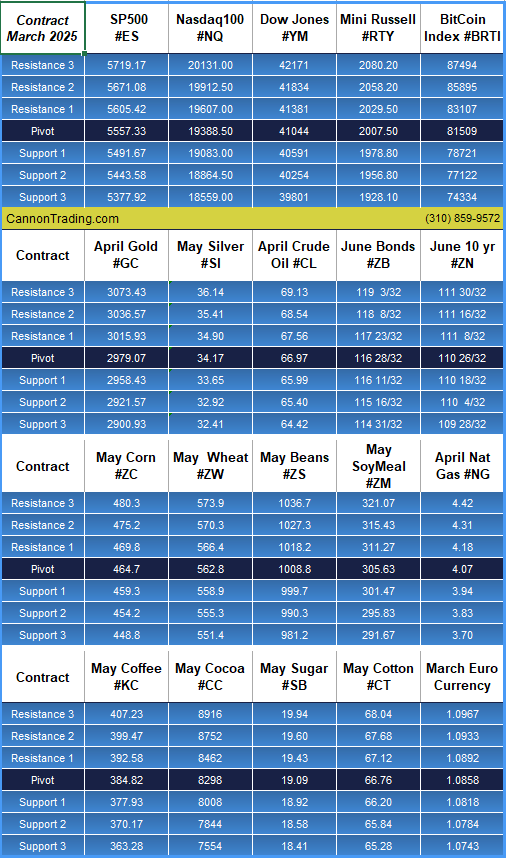

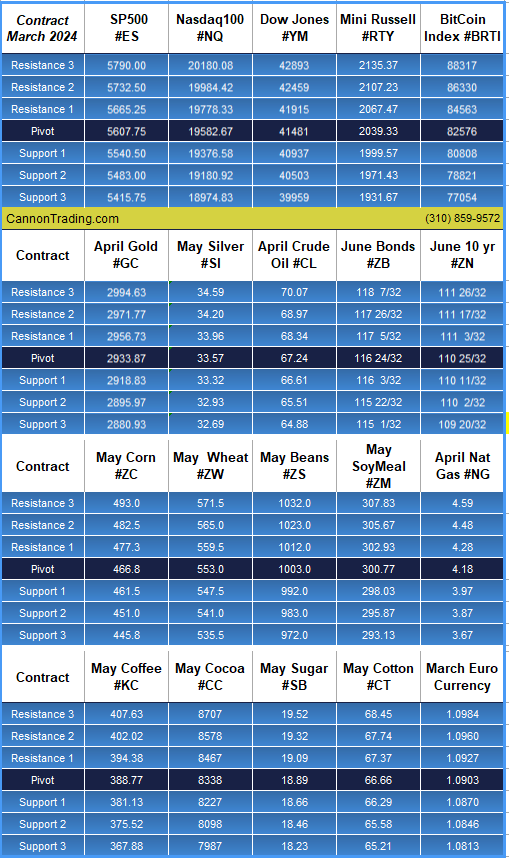

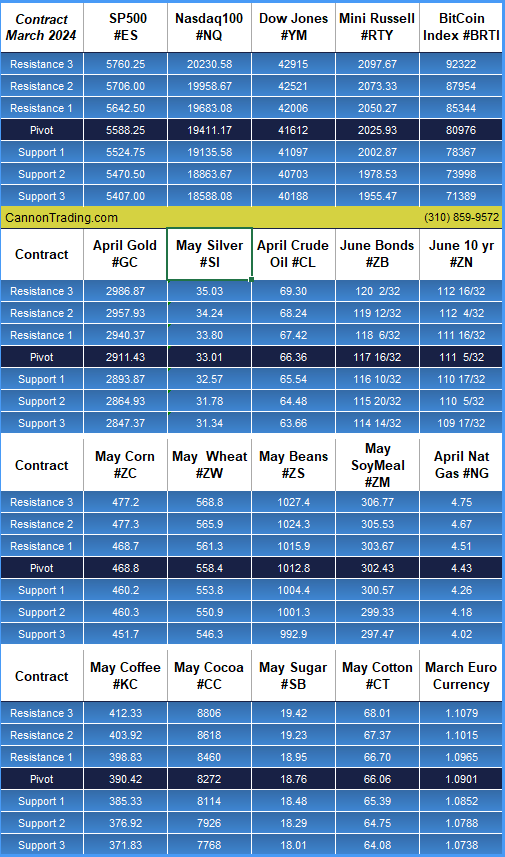

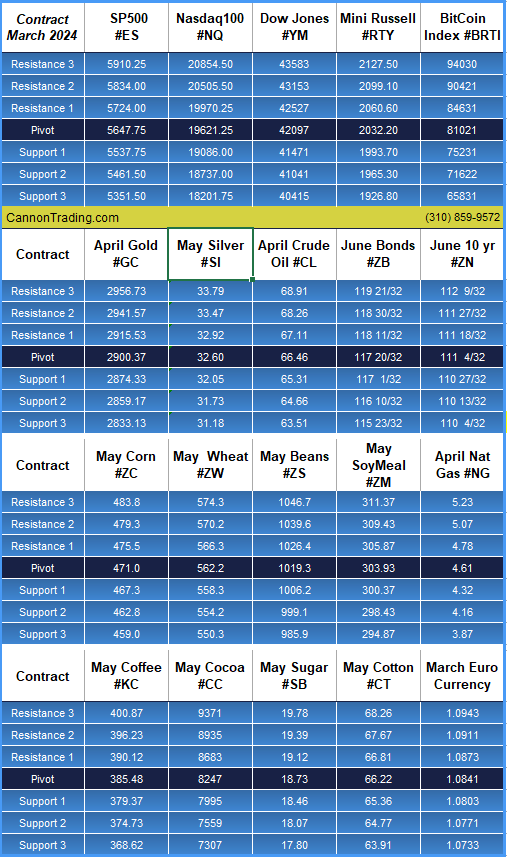

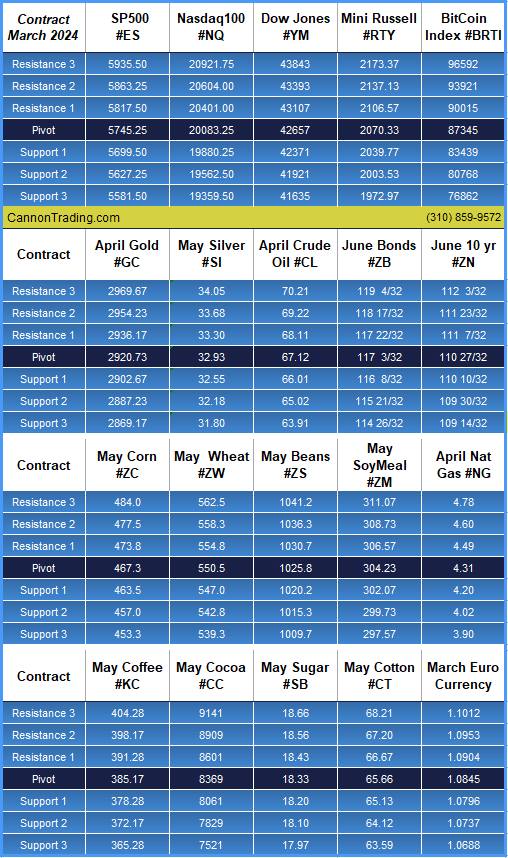

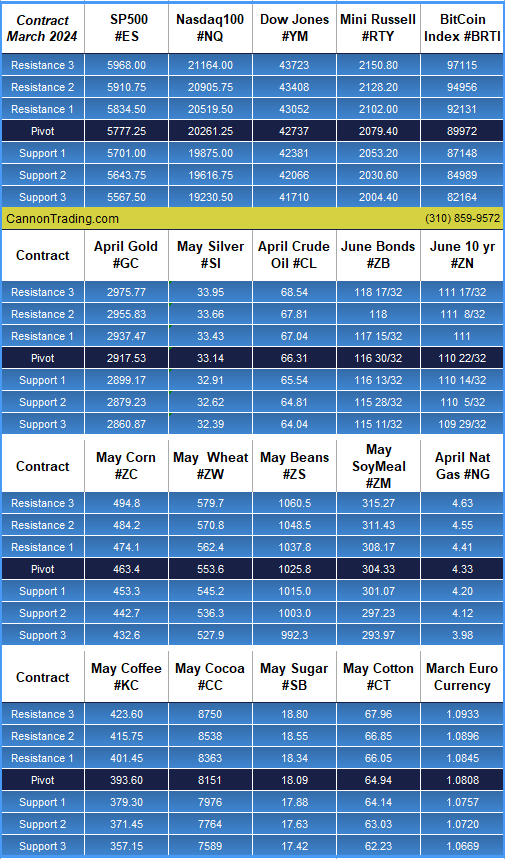

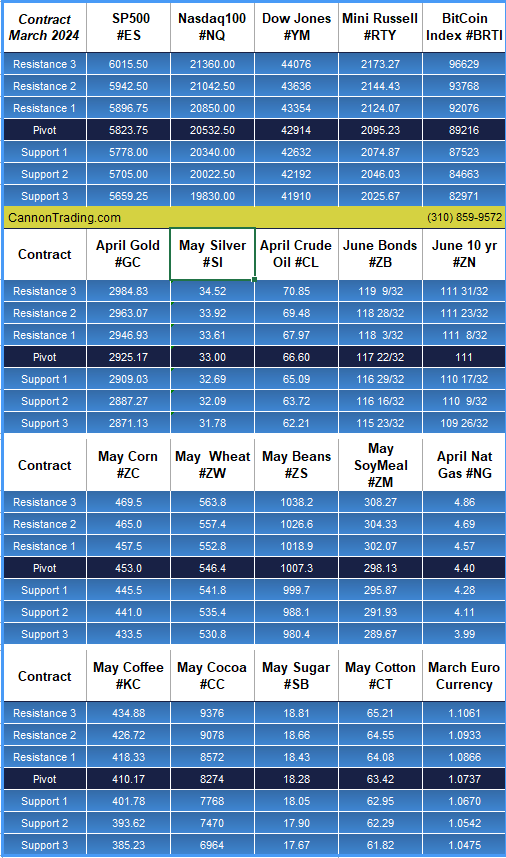

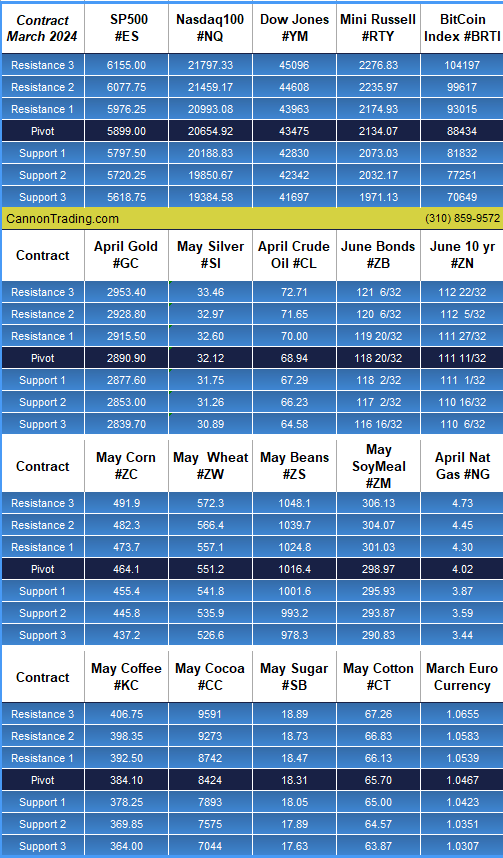

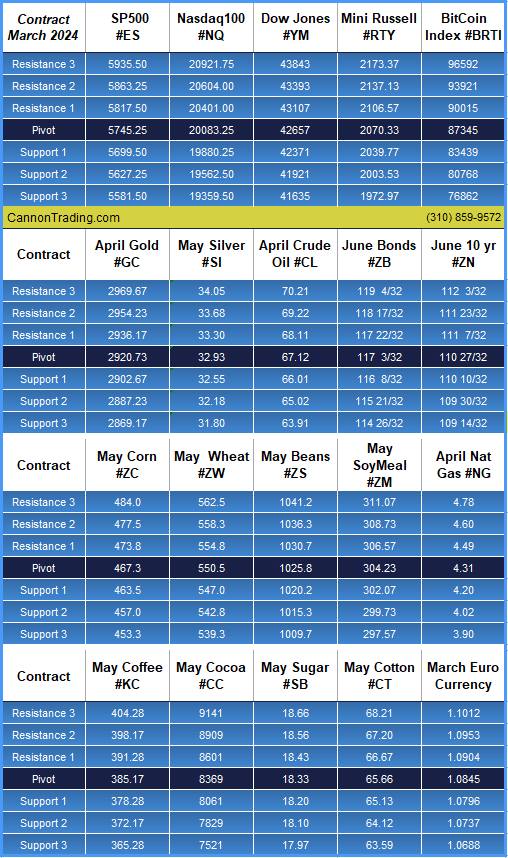

Trading Levels for Next Week

Daily Levels for March 10th, 2025

| Would you like to receive daily support & resistance levels? |

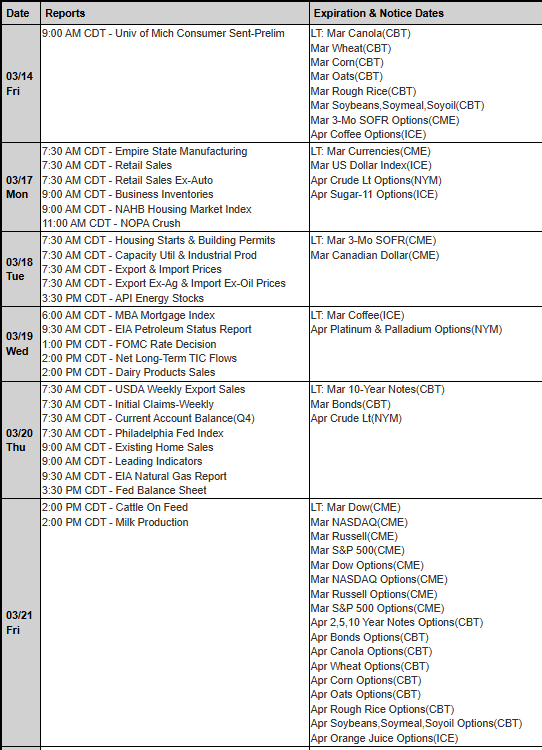

Trading Reports for Next Week

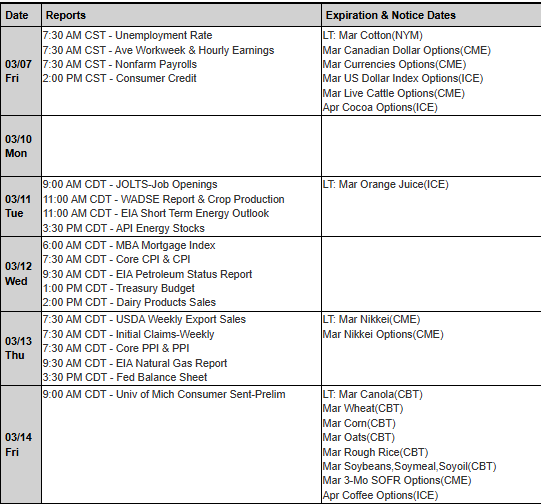

First Notice (FN), Last trading (LT) Days for the Week:

www.mrci.com

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|