| Movers and shakers!

By John Thorpe, Senior Broker

What a reversal! After yesterday’s huge tech sell off initiated by a realization that a new AI app uses cheaper chips, The AI challenge from China shook the trading consciousness to the very roots of the U.S. AI talking points/ narrative. If true, what a breath of fresh air, think about it, the barriers to entry for innovation have been lowered 10 fold or more!, More competition in the A.I. zeitgeist is critical to reaching innovative success.

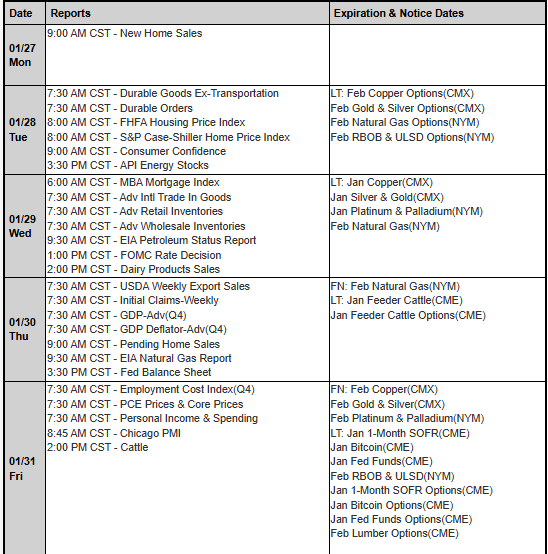

Tomorrow is FED Rate decision day, followed by Chairman Powell’s presser at 1PM CDT and 1:30 PM CDT respectively.

According to CME’s FEDWATCH tool , expectations are for no change from the current 4.25-4.50 fed funds rate, the rate charged to borrowing banks. Higher inflation, leads to higher Bond yields, Higher Yields lead to lower bond prices, and greater hesitancy by the FED to lower rates anytime soon.

Watch out for post cash close Earnings tomorrow and a number of other events.

Today’s Movers

**US December Advanced Durable Goods: -2.2%; prior -1.2%

**US December Advanced Durable Goods ex Trans: +0.3%; prior -0.1%

**US December Advanced Durable Goods ex Def: -2.4%; prior -0.3%

Redbook Weekly US Retail Sales Headline Recap

**Redbook Weekly US Retail Sales were +4.5% in the first four weeks of January 2025 vs January 2024

**Redbook Weekly US Retail Sales were +4.9% in the week ending January 25th vs yr ago wee

Case Schiller 20 US Metro-Area Home Prices Recap

**Case Schiller 20 US metro area home prices for November Y/Y: +4.3% from the year ago month

**Case Schiller 20 US metro area home prices for November M/M: +0.4% vs prior month

Richmond Fed Manufacturing Index Headline Recap

**Richmond Fed January Manufacturing Index: -4.0 ; prior -10.0

**Richmond Fed January Manufacturing Shipments Index: -9.0 ; prior -11.0

**Richmond Fed January Manufacturing New Orders: -4.0 ; prior -11.0

**Richmond Fed January Manufacturing Employees: +3.0 ; prior -8.0

**Richmond Fed January Manufacturing Prices Paid: +2.37 ; prior +2.86

**Richmond Fed January Manufacturing Prices Received: +1.21 ; prior +1.71

**Richmond Fed January Service Sector Index: +4.0 ; prior +23.0

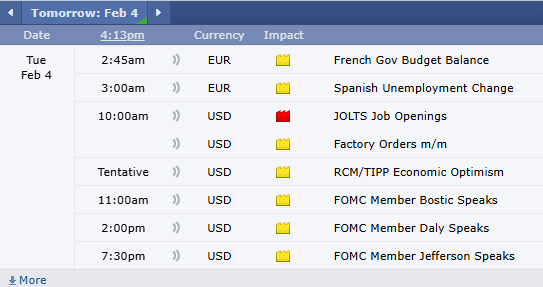

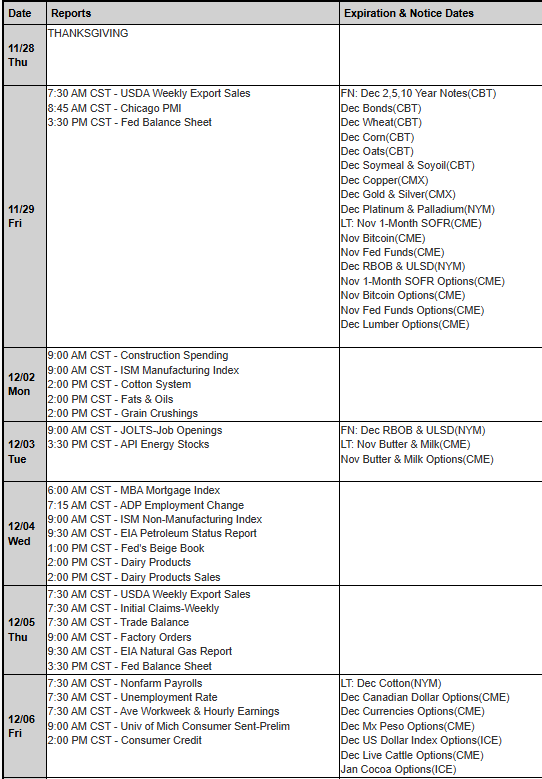

Tomorrow’s Movers and Shakers:

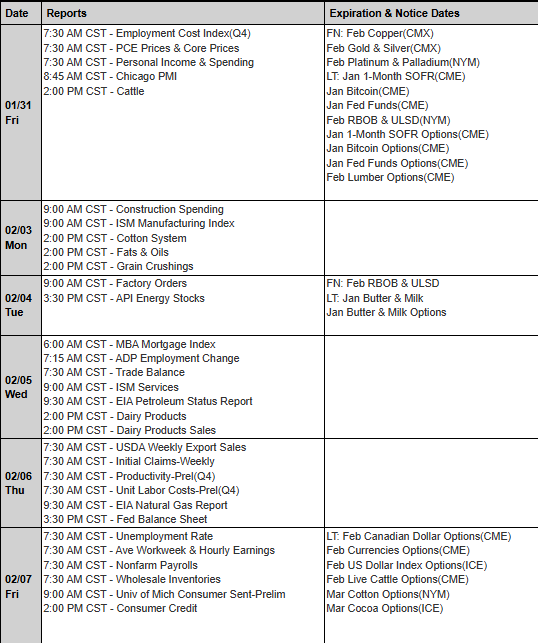

7:30 AM CST Goods Trade Balance and Retail/Wholesale inventories.

1:00 PM CDT Fed Rate Decision

1:00 PM CDT Fed Press Conference

Earnings:

(95 rpts) Pre-Open Alibaba, MSFT, META, TSLA, IBM all after the cash close.

Plan your trade and trade your plan.

|