The S and P 500 futures contract, commonly referred to as SPX index futures, is one of the most popular and actively traded stock market index futures. It represents a standardized agreement to buy or sell the value of the S&P 500 Index at a future date. With a focus on the performance of 500 large-cap U.S. companies, the SPX index futures contract serves as a barometer for the broader U.S. economy and is widely used by traders and investors to hedge portfolios or speculate on market direction. In this article, we’ll delve into the significance of the U.S. Presidential election on the S&P 500 futures contract, assess the impact of Trump’s hypothetical win on these futures, and explore the advantages of using a highly rated brokerage firm, Cannon Trading Company, for trading futures.

What Does the U.S. Presidential Election Mean for the S&P 500 Futures Contract?

U.S. Presidential elections significantly impact financial markets, with the S&P 500 and SPX index futures being among the most affected instruments. This is due to the perceived influence that presidential policies can have on the broader economy, specific sectors, and individual corporations. SPX index futures, representing the S&P 500 Index, are particularly sensitive to factors like economic stimulus, corporate taxation, regulatory policies, and trade relations—policies that can shift dramatically depending on which candidate wins the White House.

When a candidate from a business-friendly background, such as Trump, wins an election, it can lead to initial optimism in the stock market and a subsequent rally in S&P 500 futures. This optimism is often fueled by expectations of corporate tax cuts, deregulation, and pro-business policies that could directly boost corporate earnings and drive stock prices higher. On the other hand, uncertainty around foreign policy and global trade dynamics can introduce volatility, impacting SPX index futures as traders try to anticipate the broader implications for multinational corporations.

Historically, a Republican victory has often led to an initial bullish outlook on the SPX index futures due to the traditional pro-business stance associated with the party. However, this impact can vary depending on the incumbent’s unique policy mix, as seen with Trump’s focus on “America First” policies. A win for Trump in the 2024 election, for instance, would likely continue influencing investor sentiment, particularly in industries like manufacturing, energy, and defense, as well as in sectors that rely on reduced regulations.

Pros and Cons of S and P 500 Futures Contracts with Trump’s Victory

Trump’s victory could bring both advantages and disadvantages for S&P 500 futures contracts, creating both opportunities and risks for traders. Here’s a closer look at some potential pros and cons.

Pros

- Potential for Corporate Tax Cuts and Deregulation: One of the most prominent benefits seen from Trump’s previous presidency was his emphasis on reducing corporate taxes and loosening regulatory requirements for businesses. A win for Trump would likely signal similar intentions, potentially boosting the profitability of U.S.-based companies. With higher earnings, stock valuations tend to rise, making SPX index futures attractive to traders who anticipate a bullish market.

- Infrastructure Spending and Job Growth: Trump’s previous initiatives often included ambitious infrastructure spending plans, which he posited would lead to job growth and increased consumer spending. If Trump returns to office, a renewed focus on infrastructure could drive demand across multiple sectors, from construction to technology. This increased economic activity might provide a strong backdrop for the S&P 500 index, pushing SPX index futures higher.

- Market Volatility and Trading Opportunities: Trump’s leadership style has historically brought volatility to financial markets. For active traders in S&P 500 futures contracts, such volatility can present a plethora of trading opportunities, as frequent market swings allow traders to capitalize on both upward and downward movements in SPX index futures.

Cons

- Potential Trade Conflicts and Global Tensions: Trump’s previous term was marked by trade tensions, particularly with China. Renewed trade wars or heightened tariffs could negatively affect multinational companies, especially in sectors like technology, manufacturing, and agriculture. This uncertainty might cause sharp swings in SPX index futures, making it more challenging for traders to accurately predict market directions.

- Uncertain Economic Policies and Fiscal Discipline: The potential for an expansionary fiscal policy focused on government spending might also increase concerns about the national debt. Increased federal spending and potential inflation concerns could contribute to volatility in the bond market, which can trickle into the S&P 500 and SPX index futures. Traders may need to exercise caution in response to fiscal policy announcements and inflation indicators.

- Social and Political Instability: A win for Trump could also bring about societal polarization and potential civil unrest, which may have repercussions in the financial markets. Uncertainty in the political landscape often translates to market volatility, which could create unexpected swings in SPX index futures, challenging risk management for traders.

Why Choose Cannon Trading Company for Trading Futures?

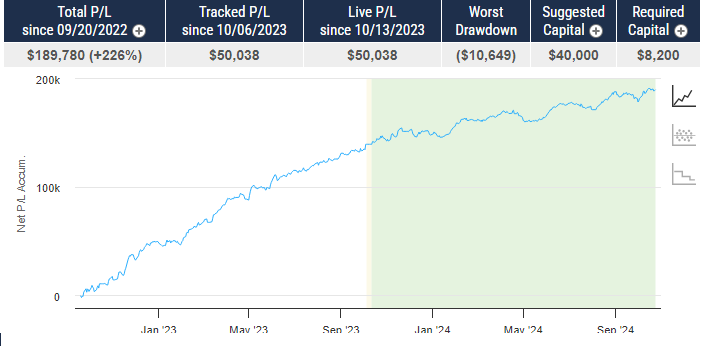

For traders looking to capitalize on SPX index futures, selecting the right brokerage is essential. Cannon Trading Company, with decades of experience in the futures market and a reputation for excellence, has become a go-to option for both novice and seasoned traders. Here are several reasons why Cannon Trading Company stands out as a top choice for trading futures, especially S&P 500 futures contracts.

- Unparalleled Expertise and Experience: Cannon Trading Company has a long-standing history in the futures market, with a team of professionals who understand the intricacies of SPX index futures and other stock market index futures. Their expertise enables them to provide valuable insights, helping traders make informed decisions based on real-time market data, technical analysis, and macroeconomic trends.

- Exceptional Customer Ratings and Trustworthiness: With a perfect 5-star rating on TrustPilot, Cannon Trading has built a solid reputation for client satisfaction. Traders appreciate the company’s transparent and ethical practices, as evidenced by its regulatory compliance record. This trustworthiness is critical for futures traders who need confidence in their broker, especially when trading high-stakes instruments like SPX index futures.

- Advanced Trading Platforms and Resources: Cannon Trading Company offers a wide array of trading platforms that cater to various trading styles and experience levels. Their platforms come equipped with sophisticated charting tools, analytical resources, and real-time data, allowing traders to stay updated on the performance of SPX index futures and other contracts. For example, their trading platforms offer advanced risk management features, allowing traders to set parameters that help protect against unexpected market swings.

- Personalized Support and Education: The brokerage’s team goes above and beyond to support its clients, offering personalized guidance tailored to each trader’s goals and risk tolerance. For traders new to SPX index futures, Cannon Trading provides educational resources and training, helping them develop strategies suited to their trading style. This level of support can make a significant difference, especially during volatile periods.

- Wide Range of Trading Instruments: Besides SPX index futures, Cannon Trading offers access to a variety of other stock market index futures, commodities, and options. This wide range enables traders to diversify their portfolios and explore different sectors, all while enjoying the convenience of trading with a single brokerage.

The Importance of SPX Index Futures for Traders

SPX index futures play a crucial role in financial markets by providing a way for traders to hedge against or speculate on the future direction of the S&P 500. These futures contracts enable traders to take advantage of market movements without needing to own individual stocks. This feature is particularly beneficial during periods of political uncertainty or economic volatility, as traders can quickly pivot their positions in response to changing market conditions.

Trading futures like the SPX index futures also offers advantages in terms of leverage, as traders only need to deposit a fraction of the contract’s value as collateral. This leverage allows traders to magnify their potential returns, though it also increases the risk, underscoring the importance of proper risk management and using a reputable brokerage like Cannon Trading Company.

The outcome of the U.S. Presidential election can have a profound impact on financial markets, especially on instruments like the S&P 500 futures contract, or SPX index futures. A Trump victory would likely bring renewed attention to pro-business policies, but it could also introduce additional volatility stemming from trade tensions, fiscal policy shifts, and political polarization. For traders, these dynamics underscore the importance of choosing a reliable and experienced brokerage.

Cannon Trading Company, with its decades of experience, high customer ratings on TrustPilot, and robust regulatory reputation, stands out as a top choice for trading futures. With personalized support, advanced trading platforms, and a commitment to transparency, Cannon Trading empowers traders to navigate the complex world of SPX index futures. For those looking to capitalize on the opportunities within the S&P 500 futures contract, a trusted brokerage like Cannon Trading can make all the difference in achieving trading success.

In a dynamic market landscape influenced by political events, having a solid foundation in SPX index futures and a supportive brokerage like Cannon Trading Company can provide traders with the tools and insights needed to make informed and strategic trades.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading