|

|

Investment is a game of money of securing future money by taking a risk today. Trading therefore comes with a list of rules to play by. Commodity trading in particular offers tremendous potential for becoming a completely different asset class.

However, before investing in any kind of commodity, you must do an in depth research and also ask your broker as many questions as possible. Through this category archive we provide you as much information and valuable insights into the world of commodity trading.

We at Cannon Trading are here to help you with your commodity trading needs. You as a trader should select your commodity trading advisor only after performing a due diligence on him/her. We in fact do that for you. This way, you get only the best advice to help you with your commodity trading.

We’ve got the information that you might need at every step of commodity trading, and you’ll find it all right here in the commodity trading section of our blog. Read up, and read on to get equipped!

|

|

|

In this issue:

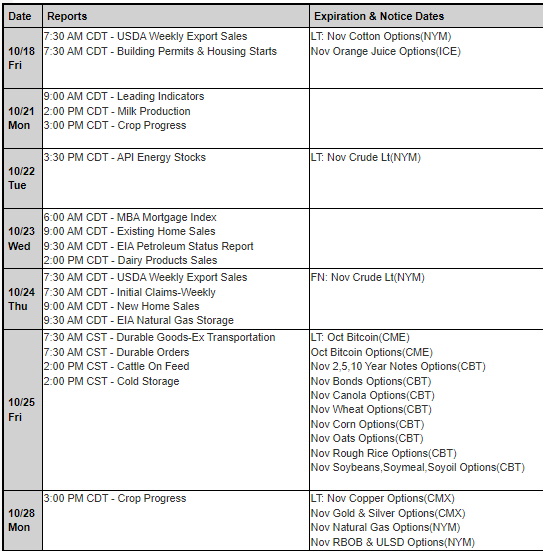

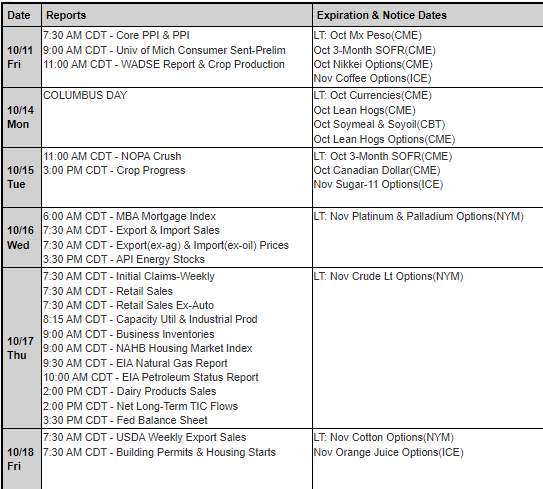

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

A fair amount of Speakers, Data and Earnings .

Just 2 ½ weeks to the U.S. Presidential Election. Nov 5th.

Economic Data:

Mon. CB Leading Indicators

Tue. Redbook, Richmond Fed

Wed. Mortgage Index

Thu. Chicago Fed Activity Index, Weekly Initial Jobless Claims, New Home Sales

Fri. Durable Goods, Michigan Consumer Sentiment.

Fed and ECB Speakers:

Mon. Logan, Kashkari, Schmid

Tue. 9A.M. Central ECB President Lagarde, Harker

Wed. Bowman, LaGarde 9 A.M. Central, Barkin

Thu. Hammack

Fri. quiet

Earnings: 608 3rd QTR. Reports this week

Prominent Companies reporting

Wed. Tesla, IBM, Coca-Cola

|

|

|

“Trading Around Key Economic Reports” FREE SHORT Course you will learn:

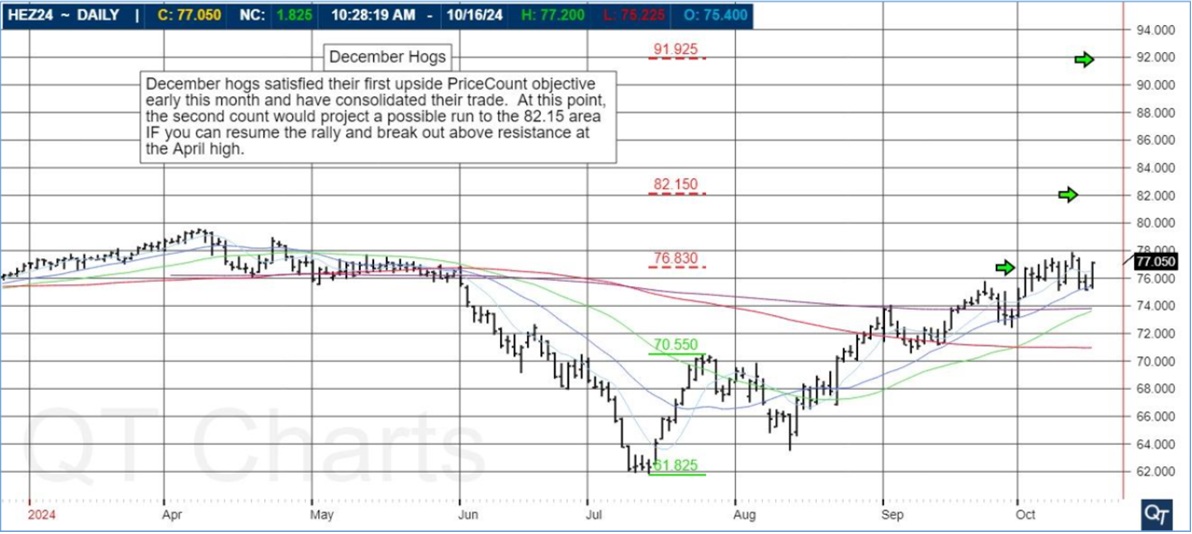

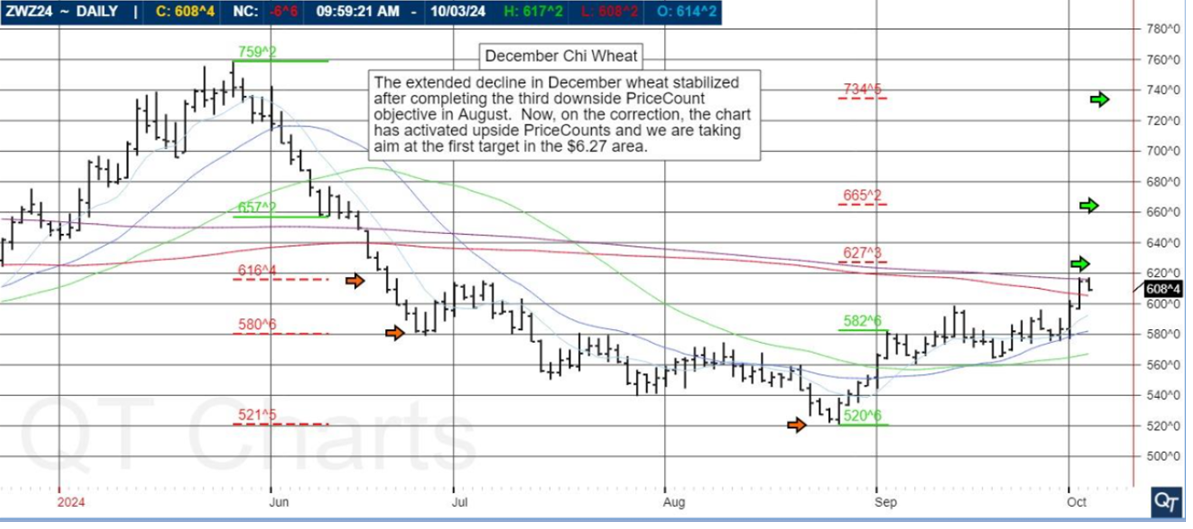

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Hogs

December hogs satisfied their first upside PriceCount objective early this month and have consolidated their trade. At this point, the second count would project a possible run to the 82.15 area IF you can resume the rally and break out above resistance at the April high.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

MVA 998 RTY 208

PRODUCT

RTY – Mini Russell 2000

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$10,000

COST

USD 80 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

|

|

|

|

One of the most profitable areas a stock market broker can get into is commodities futures and you can start trading them right now with the right research tools and trading strategy to bet on the future of the market while you’re trading stocks and growing your bank account. Any online brokerage account should have a diversified portfolio with plenty of commodity futures and options trades to go around and pad the investment accounts, whether you’re self-directed or use online brokers. Most online brokers know the importance of investment objectives and can almost always be met with the help of futures and financial advisors are always there to give you an idea of where they’ll be the time your trade goes through.

Active traders have plenty of options when it comes to stock and ETF trades and a stock market broker is going to suggest that every investment portfolio has a few things to hedge your bets and ensure you’re growing your bank account and never losing money with your stock trading. Investment holdings should always include mutual fund trades, stock ETF trades, and commodity futures and every good stock trading platform will have a mobile app that lets you make the most of them. Here’s all the information that active stock traders need to get into commodities and buy stocks that not only cover their account fees but make them money.

There are interactive brokers and online brokers that will sell stocks and mutual funds for you and take all the work of e-trade away from you so you can sit back and watch your account grow and mature over time and that might be the best option for beginner investors before they start trading. They’ll make all the investment decisions for you and they’ll make a cash bonus when exchange-traded funds get a boost, but you can choose commission-free trades by using a mobile app to do it all by yourself. Active investing takes many research tools and the best online stock brokers will have the educational resources you need to get the most out of trading platforms without using full-service brokers.

Your online brokerage account should come with investment advice and access to mutual funds trading forex trading, and alternative investments that you can look at and decide if you want to get into the same areas that advanced traders are using in their online brokerages. You can start trading right now by setting margin accounts on your online brokerage account and full-service brokers will take over from there, or you can act as your online broker and use trading platforms and brokerage firms for research. There are many financial products to choose from and the decision is yours, but you should ensure you have all the information you need to make the correct one.

There are a few things to consider when you want to find the best brokerage accounts to help with your active investing and there are financial products, such as discount brokers, to help you buy stocks with a brokerage account that makes you money and grows your bank account. The best online brokers will have options for active traders as well as access to a full-service broker to take your taxable brokerage account and do all the trading work for you. These online brokers know the stock market and are monitored by the financial industry regulatory authority to keep you and your money safe.

It’s important to consider account minimums on any mobile app you choose to use so you can be sure that your online brokerage platform is something you can comfortably afford until you start to sell stocks and make money through mutual funds and stock and ETF trades. Stock trading platforms are monitored by the Securities and Exchange Commission so your taxable brokerage account is secure and your account minimum is safe. The best online brokerage accounts keep their account fees low so you can buy stocks and make money simply by using a mobile app that supports your active investing decisions.

The best online brokerage platform will have every option available to you, from Morgan self-directed investing to online brokers who trade mutual funds, futures, and commodities for you, based on your long-term goals and the amount of money you’ve given the trading platform to use on your behalf. If you want fully commission-free trading, it’s best to act as your online broker and use the trading platform for information and educational resources that let you make the best decisions for your trades. This is great for advanced traders who know how the market works and want to use the broker’s online trading platform for support rather than a full-service broker.

No matter which type of brokerage account you get, your money will be protected by the Securities Investor Protection Corporation if the firm goes bankrupt for any reason or the stock trading platform gets shut down. The best online broker will have educational resources on a mobile app that you can access to carry out the investment decisions you’ve made. You’ll also have access to interactive brokers and online brokers to do the e-trade work for you so you don’t have to do it all on your own.

Interactive brokers are easy to find on the right trading platforms and active traders will take your goals and make e-trade decisions based on what you want from brokerage firms and all you have to do is set up an account on a mobile app. Everything from alternative investments to stock ETF trades and options trades will be available to you as soon as you get set up and you’ll have the best online brokers and interactive brokers working for you on your trading platform. Active traders and discount brokers will have your account minimum to work with and you get to watch your investment accounts grow.

Of course, you don’t have to use interactive brokers on any trading platforms if you want to act as your full-service broker and do the e-trade work on your own. Some of the best online brokers are people who do it on their own with self-directed trading platforms and it can be the best commission-free trading that you can get into. Trading stocks in commodities futures can be very lucrative, as long as you have the educational resources it takes to know what’s happening and which moves you should make.

Stock trading platforms are great for active traders because brokerage firms have done the leg work of gathering information on stock trading so you can make self-directed trades without paying online brokers to do it for you. The best online broker platform will have real-time information you can access whenever you need it before you make an e-trade and bet on the future of the commodities of your choosing. Stock and ETF trades should be easy to access and they’ll have charts that show you where a stock has been so you can make an informed decision on where it will be in the future.

Stock trading platforms will have full-service brokers to utilize, as well as self-directed e-trade options that you can choose based on your needs and how you want to go about your options trades. The right stock trading platforms will allow you to add and draw from your account for your money is never locked away from you and you’ll get the same information that brokerage firms and the best online brokers get to use. Interactive brokers will also be available to help you make e-trade decisions so your stock trading and mutual funds always turn profits, just like full-service brokers would be making for you.

Whether you go with self-directed investing or interactive brokers on a better stock trading platform, your account minimum will always be safe and your information will always be kept as secure as possible, so you can act as your online broker without worrying about it being stolen. Most online brokers and interactive brokers utilize security features on their trading platforms that encrypt your data from end to end so your stock and ETF trades stay safe from outside interference. Your banking and personal information will be secure, and your account minimum will always be there for you.

The Securities Investor Protection Corporation will also insure your money in the event your stock trading platform goes bankrupt or shuts down, just like the money in your bank is protected. It’s also overseen by the financial industry regulatory authority so everything is safe, from mutual funds trades to ETF trades and options trades. No matter what you trade, you’ll always be safe and secure when you use the best brokerage accounts you can find.

No matter what kind of brokerage account you have at your brokerage firm, your money is always insured and protected, so you don’t have to worry about it disappearing from the trading platform or your account minimum being taken. The trading platform and online broker will use high security features and everything will be overseen so you can sell stocks and deal in commodities futures with full peace of mind. Every brokerage account gets the same level of security, whether you’re using interactive brokers or simply trading with the account minimum they require you to have.

It makes it easy to choose a brokerage firm that gives you access to commodities futures trading, mutual funds, options trades, and stock ETF trading when you know your money is insured and your information is always kept secure. You can make any investment decisions you want and the best online broker you can get will have your back, no matter what happens. Keep in mind that online brokers are overseen, just like all other brokerage accounts that you can open and manage.

The best online brokers and brokerage accounts are waiting to make futures commodities trading possible right now and you can choose to go with interactive brokers or use the information they’ve collected to be your best online broker on your own, it’s completely up to you and how you want to trade. Commodities futures. stock ETF trades and options trades can be some of the most lucrative moves you can make and there’s an online broker ready to give you the chance to make lots of money off the market. You’ll get information on trends, past activity, and everything else you need to be the best online broker that you can be while you trade on your own behalf and make moves by trading stocks.

There are also active traders who can do the work for you if you don’t have the time it takes to become an expert on commodities futures and financial advisors who know the market and how to carry out the best trading strategy for you and your money. You don’t have to know everything about the stock market to start trading and making money off your investments right now. Just choose the best online broker and you’ll have all the resources you need to turn a profit and benefit from commodities futures.

|

|

In this issue:

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

A relatively Quiet Data week next week, Geopolitics may be the only driver of volatility. One Caveat: the Fed Speakers dialogue may be given much more weight by investors as there will be a lot less noise in the form of Economic Data and earnings from prominent “Magnificent Seven” stocks to drive market volatility.

Prominent Earnings this Week:

FED SPEECHES:

Big Economic Data week:

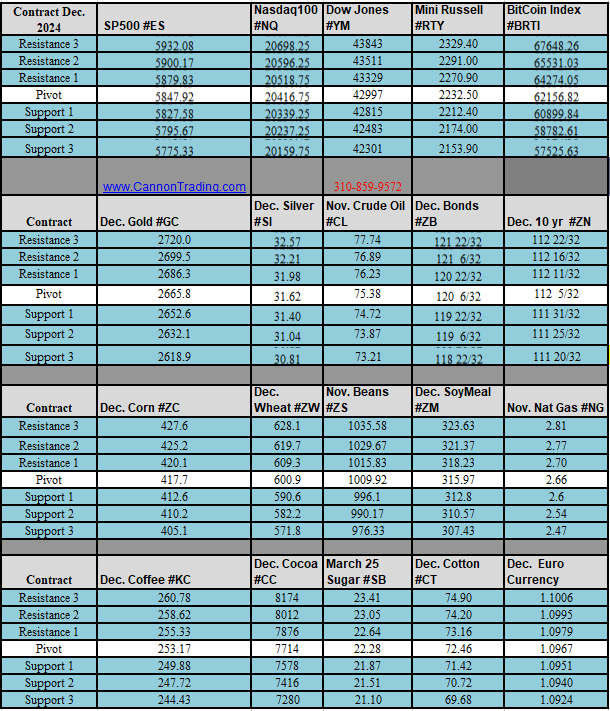

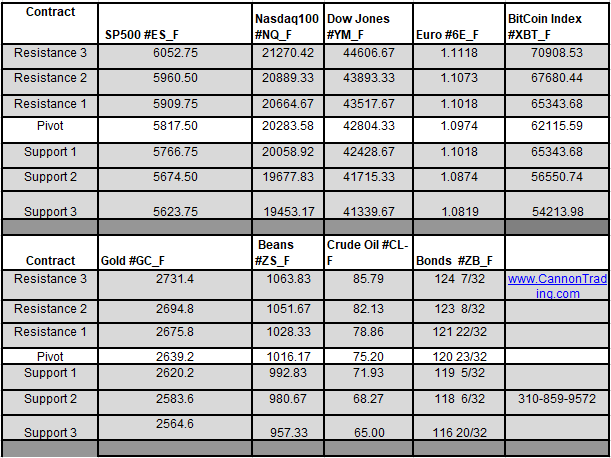

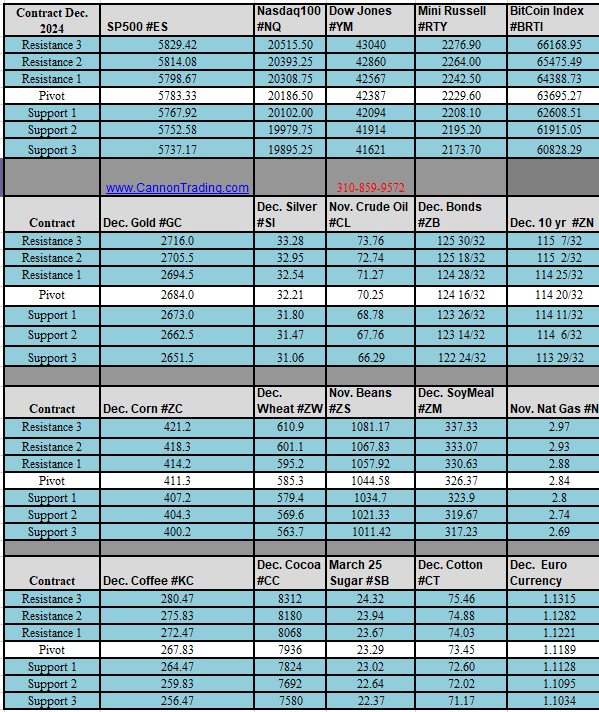

Would you like to have access to research like shown above and MORE?

Here is what you will receive DAILY:

To sign up and get two weeks FULL access, start by requesting the free trial below.

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

December Heating Oil

December heating oil Rallied to its second upside PriceCount objective before correcting. At this point if the chart can resume its rally with new sustained highs, the 3rd count would project a possible run into the 2.59 area

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

Swing61B Cont v.3 _ RBOB Gasoline

PRODUCT

RB – RBOB ( unleaded gasoline)

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$25,000

COST

USD 160 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Watch a series of short videos, where our VP, Ilan Levy-Mayer shares his personal preferences and opinions on different trading topics.

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)