Get Real Time updates and more by joining our Private Facebook Group!

Subscribe to our YouTube Channel

Listen to our Market Recap Podcasts on Apple Podcasts

Movers and Shakers

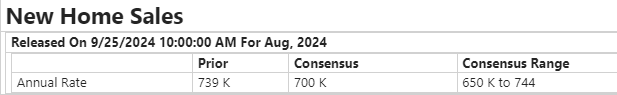

By John Thorpe, Senior Broker With Equities quietly trading in a consolidation phase, Interest rates following, the precious metals ,once again found footing and surprised many traders with their mid-day upside move, Gold higher by $36.00 @ 2689.00, Silver up $1.50 into the $32.50 /Troy OZ range.. The US Dollar @ 100.10 continuing it’s 2.5 month long slide, flirting with 14 month lows of 99.22. Metals should gain additional strength if the dollar falls below that number on a closing basis. Todays Headlines Updated: September 24, 2024 6:12 am Churning hurricane threatening US production, continued Middle East tensions, and Chinese stimulus measures have helped crude oil prices trade higher on Tuesday. Updated: September 24, 2024 7:00 am China’s central bank announced its largest stimulus measures since the pandemic. The bank will lower interest rates and additional funding. However, analysts say very week consumer and business demand for credit will have little response to lower interest rates, and the lack of fiscal stimulus measures will leave the central bank’s response to fall short of jump starting the economy and beating back deflationary environment. Updated: September 24, 2024 7:55 am Redbook Weekly US Retail Sales Headline Recap **Redbook Weekly US Retail Sales were +5.2% in the first three weeks of September 2024 vs September 2023 **Redbook Weekly US Retail Sales were +4.4% in the week ending September 21 vs yr ago week Updated: September 24, 2024 8:00 am Case Schiller 20 US Metro-Area Home Prices Recap **Case Schiller 20 US metro area home prices for July Y/Y: +5.9% from the year ago month **Case Schiller 20 US metro area home prices for July M/M: +0.01% vs prior month Updated: September 24, 2024 9:02 am Richmond Fed Manufacturing Index Headline Recap **Richmond Fed September Manufacturing Index: -21.0 ; prior -19.0 **Richmond Fed September Manufacturing Shipments Index: -18.0 ; prior -15.0 **Richmond Fed September Manufacturing New Orders: -23.0 ; prior -26.0 **Richmond Fed September Manufacturing Employees: -22.0 ; prior -15.0 **Richmond Fed September Manufacturing Prices Paid: +3.36 ; prior +2.45 **Richmond Fed September Manufacturing Prices Received: +1.57 ; prior +1.87 **Richmond Fed September Service Sector Index:-1.0 ; prior -11.0 Updated: September 24, 2024 9:09 am Conference Board Consumer Confidence, Present Situation, Expectations Index Headline Recap **Conference Board September Consumer Confidence Index: 98.7 ; prior revised to 105.6 from 103.3 ; expected 102.8 **Conference Board September Consumer Present Situation Index: 124.3 ; prior revised to 134.6 from 134.4 **Conference Board September Consumer Expectations Index: 81.7 ; prior revised to 86.3 from 82.5 Tomorrows Movers and Shakers New Home Sales Released On 9/25/2024 10:00:00 AM For Aug, 2024  US new home sales data for June will be updated Wednesday morning at 9:00 am CT. Analysts expect new home sales month-to-month at a 0.640 mln unit annualized pace, up +3.4%. The prior month’s sales were -11.3% at 0.619 mln unit annual rate. Micron Technology reports after the close

US new home sales data for June will be updated Wednesday morning at 9:00 am CT. Analysts expect new home sales month-to-month at a 0.640 mln unit annualized pace, up +3.4%. The prior month’s sales were -11.3% at 0.619 mln unit annual rate. Micron Technology reports after the close

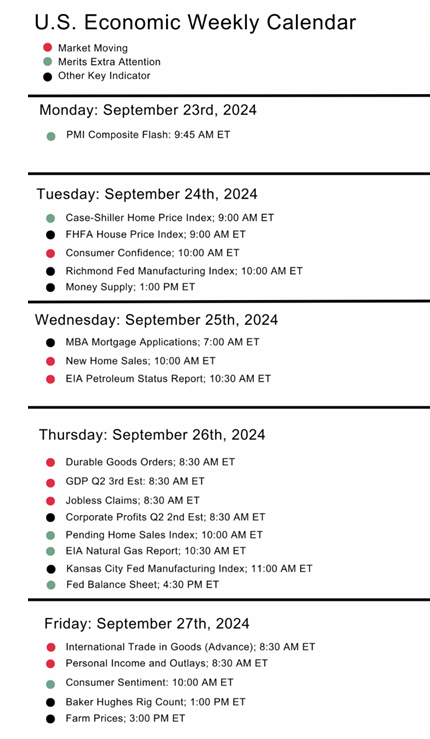

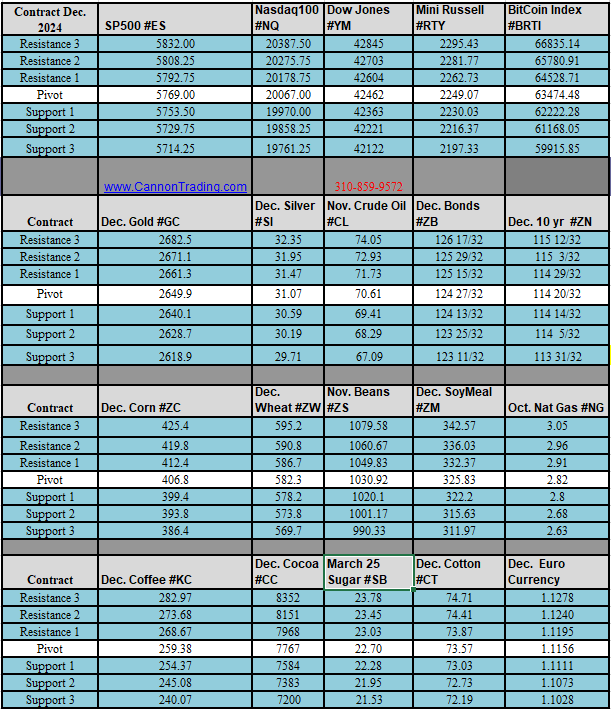

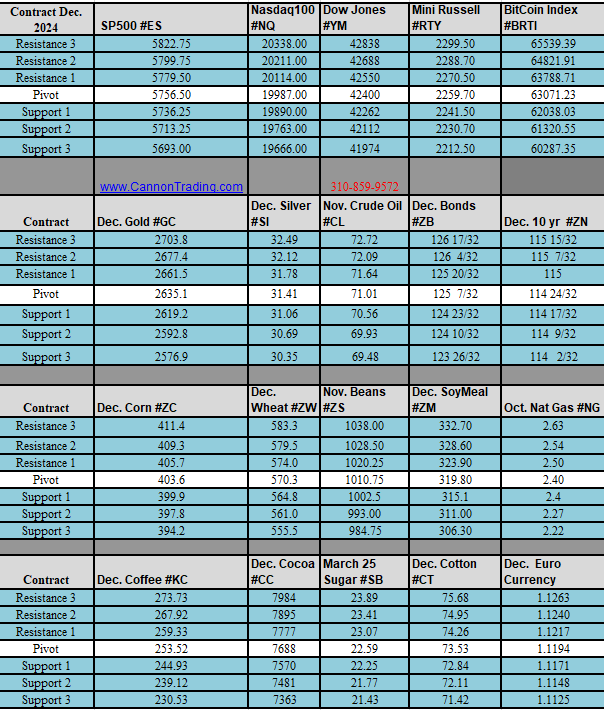

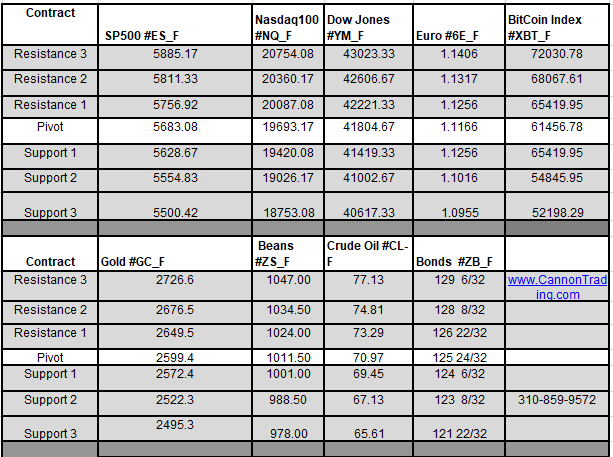

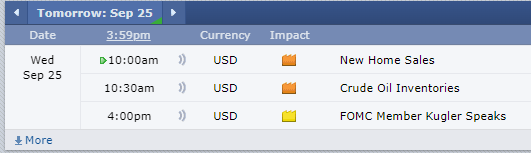

Daily Levels for September 25, 2024

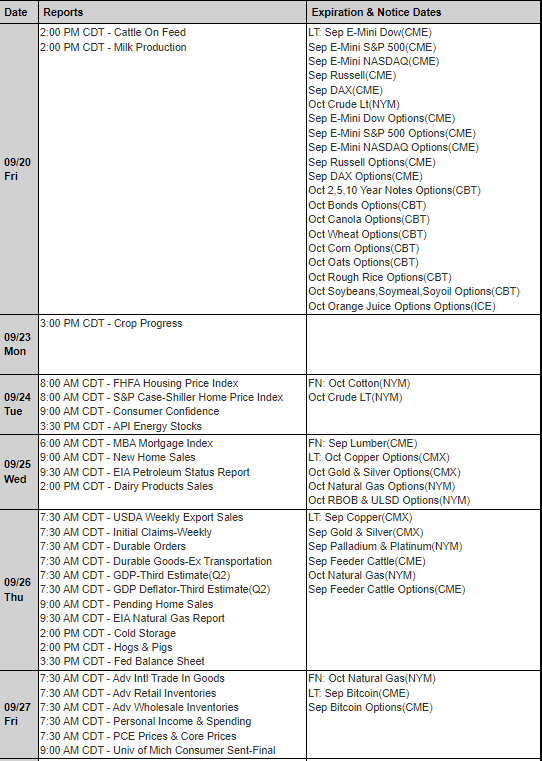

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

#Equities, #Consolidation phase, #Interest rates, #Precious metals, #Gold, #Silver, #US Dollar, #Crude oil prices, #HurricaneHelene, #Middle East tensions, #Chinese stimulus, #Redbook US Retail Sales, #Case Schiller US Metro-Area Home Prices, #Richmond Fed Manufacturing Index, #Service Sector Index, #Consumer Confidence, #New Home Sales, #Micron Technology