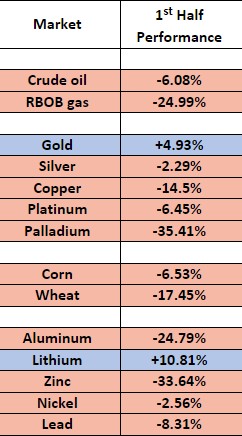

Learn more about trading crude oil futures with Cannon Trading Company here.

Trading crude oil futures is a dynamic and potentially lucrative endeavor that requires a deep understanding of the energy markets, technical analysis, risk management, and trading strategies. In this comprehensive guide, we will delve into the world of crude oil futures trading, focusing on a specific type of crude oil, discussing relevant exchanges, exploring day trading techniques for futures, and touching on techniques for trading crude oil options on futures. Additionally, we will highlight the services of Cannon Trading Company, known for their customer service excellence and high TrustPilot rating.

Understanding Crude Oil Futures Trading

Crude oil is a crucial global commodity that not only fuels economies but also presents trading opportunities for individuals and institutions. Crude oil futures contracts allow traders to speculate on the price movements of oil, whether they anticipate its price to rise (go long) or fall (go short). Futures contracts provide a standardized way to buy or sell a specific quantity of crude oil at a predetermined price on a future date.

Types of Crude Oil: When trading crude oil futures, it’s important to consider the different types of crude oil. West Texas Intermediate (WTI) and Brent crude are two of the most widely traded types. WTI is primarily produced in the United States and is known for its relatively low sulfur content. Brent crude, on the other hand, is sourced from the North Sea and is considered a global benchmark for oil prices.

Exchanges for Crude Oil Futures: Crude oil futures are traded on various exchanges around the world, with the New York Mercantile Exchange (NYMEX) and the Intercontinental Exchange (ICE) being two prominent ones. NYMEX offers WTI crude oil futures, while ICE provides Brent crude oil futures. These exchanges provide liquidity, price discovery, and a platform for traders to engage in both speculation and risk management.

Day Trading Techniques for Crude Oil Futures

Day trading involves opening and closing positions within the same trading day, capitalizing on short-term price movements. Trading crude oil futures using day trading techniques requires discipline, a solid strategy, and an understanding of market dynamics.

- Technical Analysis: Day traders often rely on technical analysis, using indicators such as moving averages, MACD, RSI, and candlestick patterns to identify entry and exit points. Price charts and patterns can provide insights into potential price movements.

- Volatility Analysis: Crude oil markets can be highly volatile, presenting both opportunities and risks. Traders can use tools like the Average True Range (ATR) to gauge volatility and adjust their position sizing and stop-loss levels accordingly.

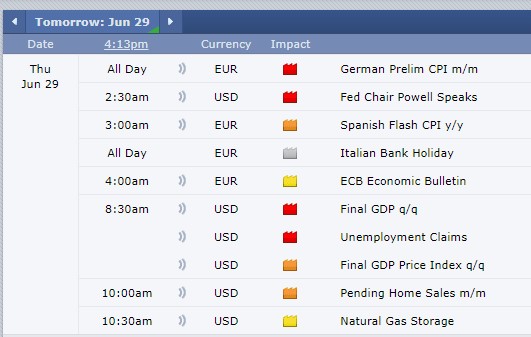

- News and Events: Economic and geopolitical news can significantly impact oil prices. Day traders should stay informed about major events, such as OPEC meetings, inventory reports, and geopolitical tensions, to anticipate potential price swings.

- Scalping and Momentum Strategies: Scalping involves making quick trades to capture small price movements, while momentum strategies capitalize on trends. These techniques require quick decision-making and a keen understanding of price momentum.

- Risk Management: Effective risk management is crucial in day trading. Setting stop-loss orders, defining maximum loss thresholds, and managing position sizes can help traders protect their capital.

Trading Crude Oil Options on Futures

Options on futures provide traders with the right, but not the obligation, to buy or sell a futures contract at a specific price (strike price) on or before a certain date (expiration date). Trading crude oil options on futures allows for more flexibility and risk management.

- Hedging Strategies: Crude oil options can be used for hedging purposes, allowing producers and consumers to protect themselves against price fluctuations. For example, a crude oil producer can purchase put options to hedge against a potential price decline.

- Directional Strategies: Traders can also use options to speculate on the future price direction of crude oil. Buying call options can provide exposure to potential price increases, while buying put options can provide exposure to potential price decreases.

- Spread Strategies: Option spreads involve trading multiple options contracts simultaneously to capitalize on price differentials. Calendar spreads and vertical spreads are common strategies that can be used to take advantage of volatility or time decay.

- Implied Volatility Considerations: Implied volatility reflects the market’s expectation of future price volatility. Traders should be aware of implied volatility levels, as it can impact option prices. High implied volatility may make options more expensive.

Cannon Trading Company: Customer Service and TrustPilot Rating

Cannon Trading Company is a brokerage firm known for its services in facilitating various types of trading, including crude oil futures and options on futures. The company’s commitment to customer service plays a crucial role in assisting traders as they navigate the complexities of the commodities markets.

Customer Service Excellence: Cannon Trading Company prides itself on providing exceptional customer service. Their experienced brokers offer personalized assistance, market insights, and trading strategies to help clients make informed decisions.

TrustPilot Rating: The company’s high TrustPilot rating of 4.9 out of 5 stars is a testament to its dedication to customer satisfaction. TrustPilot is a platform where customers can share their experiences with businesses. Such a high rating indicates that customers have found value in Cannon Trading Company’s services and have had positive interactions with their team.

Trading crude oil futures presents opportunities for both institutional and individual traders to capitalize on the volatility and price movements in the energy markets. Understanding the nuances of different crude oil types, utilizing relevant exchanges, and employing effective day trading techniques can help traders navigate this complex market. Moreover, trading options on crude oil futures offers additional strategies for risk management and speculation. As exemplified by Cannon Trading Company’s customer service and high TrustPilot rating, choosing the right brokerage partner can enhance the trading experience and provide valuable support to traders of all levels.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.