The oil market is one of the most significant and dynamic global markets, with crude oil futures representing one of the most actively traded commodities worldwide. For both new and experienced traders, understanding how to trade oil futures is key to gaining exposure to the oil market, which is impacted by a multitude of factors, from geopolitics to technological advancements. In this guide, we’ll explore the history of crude oil futures trading, why they are so popular, and the advantages and disadvantages for various types of traders, including retail traders, institutional traders, and hedgers. We’ll conclude with an analysis of oil price forecasts for the end of the year, addressing relevant factors that may impact these predictions.

The Origins of Oil as a Tradable Commodity

Oil, often referred to as “black gold,” has been a critical resource in the global economy since its discovery as a fuel source. The journey of oil from its early use to becoming a dominant global commodity on the futures trading market is complex. Originally, oil was traded in physical markets, where buyers and sellers would negotiate contracts for delivery. However, as global energy demand grew, especially in the 20th century, oil became an essential commodity, fueling industries, economies, and transport systems worldwide.

To facilitate oil trading and address the volatility in oil prices, crude oil futures were introduced in the 1980s, allowing for price stabilization and hedging. The New York Mercantile Exchange (NYMEX) launched the first crude oil futures contract in 1983, followed by similar offerings from the Intercontinental Exchange (ICE) and other exchanges. These contracts allowed market participants to buy or sell oil at a predetermined price on a future date, bringing a significant degree of predictability and security to the volatile oil market.

Why Crude Oil Futures are Popular

Crude oil futures are among the most popular futures contracts, and there are several reasons why traders are drawn to crude oil futures trading:

- Liquidity: The oil futures market is one of the most liquid markets globally. High liquidity means that there is always a buyer or seller at any given time, making it easier for traders to enter and exit positions.

- Volatility: Oil prices are highly sensitive to changes in supply, demand, geopolitical tensions, and economic shifts. This volatility presents opportunities for traders to profit from price movements, whether they are upward or downward.

- Transparency: Unlike other markets, where information may not always be easily accessible, the oil market is relatively transparent, with data on supply, demand, inventory levels, and geopolitical developments widely available.

- Global Significance: Oil is essential for transportation, manufacturing, and energy production, making it a critical commodity globally. Consequently, oil futures are a popular contract for speculation and risk management, given the reliance of the world economy on oil.

How Trade Oil Futures

To successfully engage in crude oil futures trading, traders should familiarize themselves with the trading process, understand market terminology, and stay informed on global events. Below are key steps for how trade oil futures:

- Choosing a Brokerage: Selecting the right brokerage is the first step. Brokers that offer crude oil futures trading, such as E-Futures.com or Cannon Trading, provide platforms, tools, and guidance specifically tailored for futures traders.

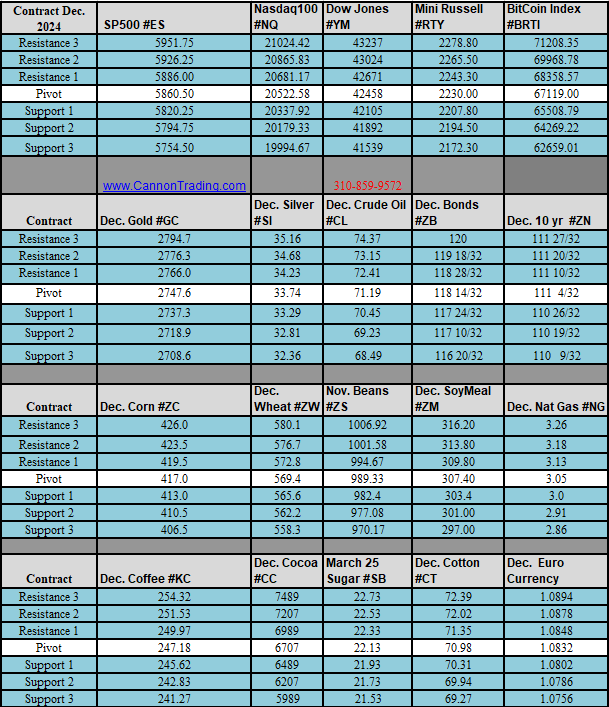

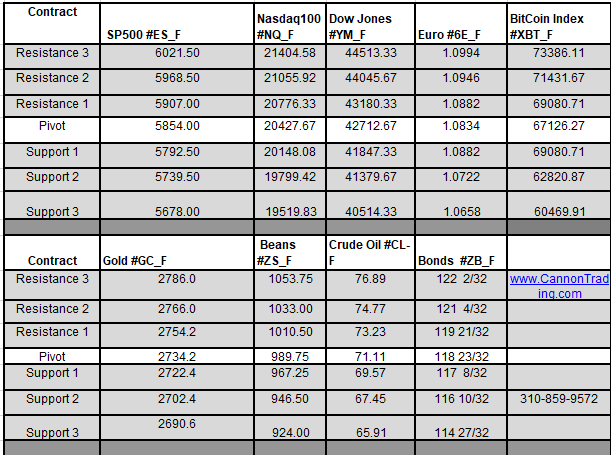

- Understanding Contracts: The most widely traded crude oil futures contracts are West Texas Intermediate (WTI) on the NYMEX and Brent crude oil on the ICE. These contracts specify the quantity (typically 1,000 barrels) and the quality of oil to be delivered, along with the future delivery date.

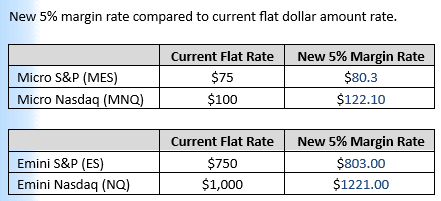

- Leverage and Margin Requirements: Oil futures are leveraged products, meaning that a trader only needs to put down a fraction of the contract’s value (margin). While leverage can amplify profits, it also increases risk, as even a slight price movement against a trader’s position can result in significant losses.

- Strategies: Some common trading strategies include day trading, swing trading, and position trading. Day trading involves capitalizing on intraday price fluctuations, while swing trading captures short-term trends over several days. Position trading, on the other hand, is suitable for those looking at long-term trends.

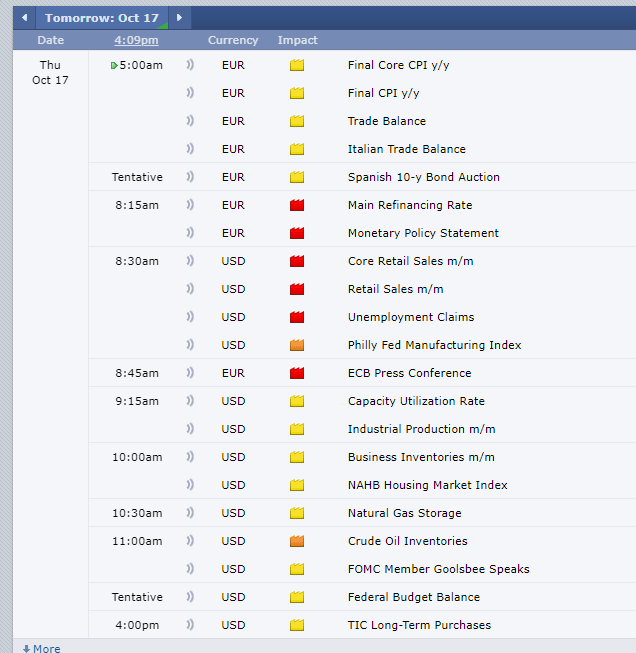

- Monitoring Influences: Global events, weather patterns, and geopolitical tensions in oil-producing regions are critical to monitor, as they have direct impacts on oil supply and demand.

- Risk Management: Setting stop-loss orders, understanding margin requirements, and using technical and fundamental analysis are essential risk management techniques in how trade oil futures effectively.

Advantages and Disadvantages of Trading Oil Futures

For Retail Traders

Advantages:

- Access to Leverage: Retail traders can control large positions with relatively small amounts of capital due to leverage, allowing for potentially high returns.

- Profit from Volatility: Retail traders often look for quick returns, and the volatility in the crude oil market can provide these opportunities.

- Diverse Strategies: From day trading to holding long-term positions, retail traders can employ a variety of trading strategies to benefit from both short and long-term price movements.

Disadvantages:

- High Risk: Leverage can be a double-edged sword. High volatility in oil prices, combined with leverage, can lead to significant losses.

- Complex Market Factors: The oil market is influenced by numerous complex factors, including geopolitical tensions, natural disasters, and supply chain disruptions, which can be challenging for retail traders to analyze.

- Margin Calls: If the market moves against a leveraged position, the trader might receive a margin call, requiring additional funds or leading to forced liquidation of the position.

For Institutional Traders

Advantages:

- Risk Management: Institutional traders can hedge against other investments in energy or oil-dependent industries, allowing them to mitigate risks in their broader portfolios.

- Access to Superior Data: Institutional traders have access to advanced trading platforms, market data, and analysis tools, giving them a competitive advantage in crude oil futures trading.

- Liquidity and Execution: Institutional traders benefit from enhanced liquidity and can execute large trades with minimal slippage due to their established relationships with brokerages and exchanges.

Disadvantages:

- High Costs: Institutional trading often involves high costs, including transaction fees, data feeds, and sophisticated trading technology.

- Regulatory Scrutiny: Institutional traders are subject to regulatory requirements, which can restrict certain trading activities and require additional compliance.

For Hedgers

Advantages:

- Price Stabilization: Companies in oil-dependent industries use crude oil futures to lock in prices, allowing them to stabilize costs and protect against price volatility.

- Enhanced Budgeting and Planning: By locking in prices, hedgers can budget more effectively, making it easier to forecast costs and profits.

- Reduced Exposure to Geopolitical Events: Oil prices are often sensitive to global political events, and hedgers can reduce their risk of exposure to such events by securing future oil prices.

Disadvantages:

- Opportunity Costs: By locking in prices, hedgers may miss out on favorable price movements if the oil market shifts unexpectedly.

- Initial Costs and Margins: Hedgers need to meet margin requirements, which may tie up capital that could be used elsewhere.

- Complexity: Effective hedging requires a deep understanding of futures markets, as well as continuous monitoring of global oil trends.

Speculation on Oil Prices for the End of the Year

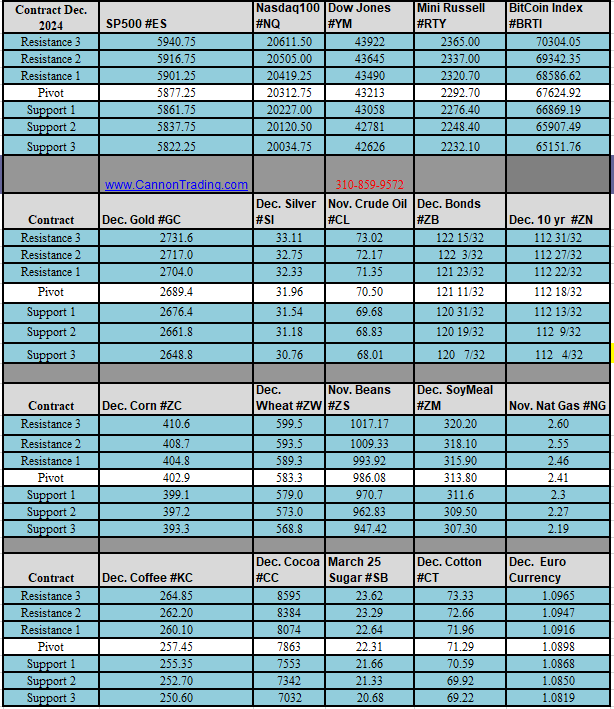

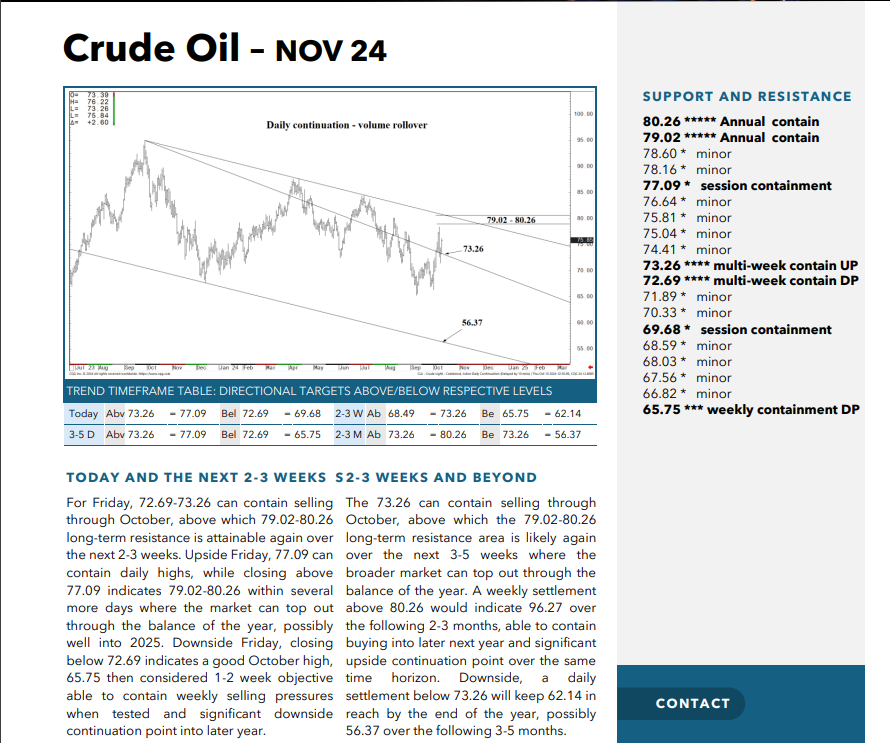

The price of crude oil futures heading into the end of the year is likely to be influenced by several critical factors, including global demand recovery, OPEC+ production decisions, and geopolitical issues.

- Global Economic Recovery: As economies recover from global events, the demand for oil is expected to rise, pushing up prices. However, any setbacks, such as renewed economic slowdowns or shifts in energy policies, could temper demand.

- OPEC+ Production Policies: OPEC+ decisions on production quotas will continue to be a key factor in crude oil futures trading. Tightening or loosening production levels could have an immediate impact on oil prices, as these decisions directly affect global supply.

- Energy Transition Policies: The ongoing shift toward renewable energy may gradually dampen long-term oil demand, but in the short term, supply constraints and increased demand for conventional energy sources could drive prices higher.

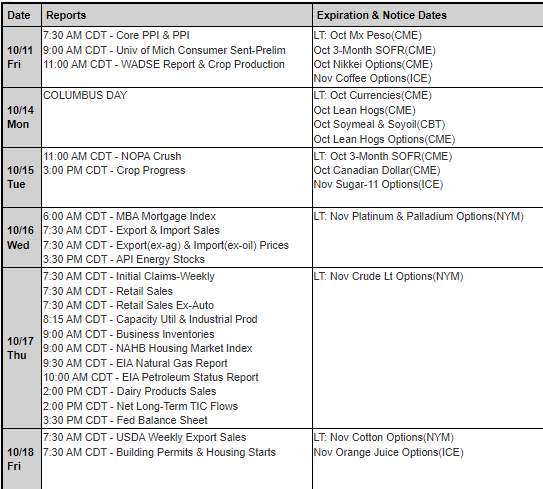

Based on current market conditions, analysts predict that oil prices could remain relatively high through the end of the year, with potential spikes if any supply disruptions occur. Crude oil futures may see increased buying pressure, but price sensitivity to unforeseen disruptions could cause fluctuations. Retail and institutional traders, as well as hedgers, should remain vigilant, monitoring relevant indicators and adjusting their strategies accordingly. Given these factors, how to trade oil futures effectively will require a close watch on economic reports, OPEC announcements, and geopolitical developments.

Understanding how to trade oil futures requires a grasp of market mechanics, key influences, and the reasons behind the popularity of crude oil futures trading. With high liquidity, volatility, and a strong influence from global factors, oil futures present unique opportunities and risks for traders of all kinds. For retail traders, the potential for high returns is met with significant risk. Institutional traders benefit from data and scale, but face regulatory challenges, while hedgers achieve price stability at the cost of flexibility.

The outlook for crude oil futures remains complex, with oil prices predicted to face various pressures that may drive prices higher or, conversely, cause corrections. As oil remains essential to the global economy, futures trading in this sector will continue to be a focal point for market participants. For anyone engaging in crude oil futures trading, maintaining a strategic approach and staying informed of global events are essential for navigating the unpredictable and profitable world of oil futures.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading